2015 Trends - 18 Months On

In December 2014, OAG published its 2015 Trends report. At the time the world was focused on ebola, the hunt for Malaysia Airlines’ missing flight MH783 and falling oil prices. We made some predictions about what impacts these issues might have and 18 months on, we’re taking a look back to see how good our crystal ball was and whether these issues are still at the forefront of the aviation industry today.

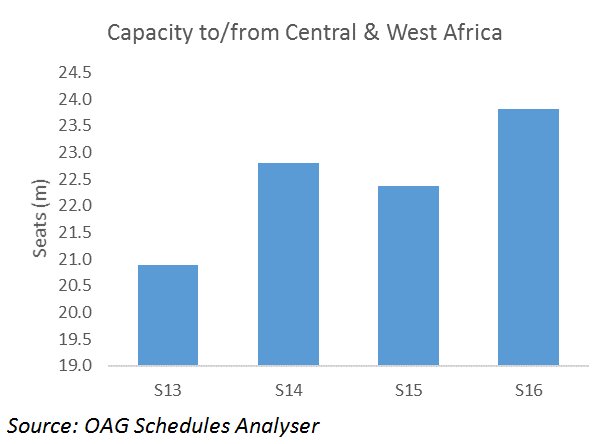

Sadly, the hunt for Malaysia Airlines missing plane continues and the Ebola crisis has been replaced with fears over the Zika virus becoming the next global pandemic. Thankfully, history shows us that the global aviation industry is resilient and that’s what we’ve observed yet again. Capacity to and from Central and West Africa is bouncing back in Summer 2016.

We said that African capacity would continue to grow and grow it has, with just under 1 million more seats to and from Africa this Summer vs. Summer 2015. Routes between Africa and the Middle East feature heavily, with strong growth to Saudi Arabia, Qatar, the UAE and Kuwait, predominantly into North Africa.

Just as there was an impact on traffic following the loss of the Malaysia Airlines plane, the last 18 months have seen testing times for Europe’s aviation industry. First there was the terrorist attack leading to the crash of a Russian registered aircraft shortly after take off from Sharm El Sheikh in October 2015 and then the terrorist bombing of Brussels Airport in March 2016. Scheduled seats to and from Egypt from Western Europe are down by nearly 30% this summer which translates to 700,000 fewer seats, mostly from Germany and the UK. Carriers operating between Turkey and four of its largest country markets – the UK, Germany, France and the Netherlands – will operate almost 900,000 fewer seats this summer compared to last year – which is to 17% of Turkey’s European capacity.

On the positive side, consumers still want to travel and appear to be happy to switch from one destination to another. As a consequence, scheduled capacity has shifted west and there are 5 million more seats operating this summer from these four countries to Spain. This is a capacity increase of 17%, and marks a distinct upward turn after the 1% increase seen in the previous year.

In the trends report we also commented on the launch of the A350 XWB aircraft.A look in OAG Schedules Analyser at current schedules shows us that there are now 5 carriers operating the A350-900 on routes to 25 destinations(1). Qatar Airways, the launch customer, operates most with 106 weekly flights on their 8 A350-900’s aircraft and they have a further 72 of these planes on order. Finnair are the next biggest operator of the A350 with 5 currently in the fleet operating 66 weekly flights and the carrier has a further 14 on order(2).

(1) Based on weekly schedules data for 30 May – 5 June 2016

(2) In accordance with CAPA

Whilst orders for new aircraft continue apace – there are nearly 4,000 aircraft on order in Asia in the next 10 years according to CAPA’s Fleet Database – the current low oil price has meant operating older aircraft has become more economic for some carriers.

Whilst 10 years ago carriers might have been retiring aircraft in the 12-15 year age bracket, with oil prices below $50 per barrel, keeping older, less fuel efficient aircraft operating for longer makes sense. Both Iberia and British Airways have recently commented that they will be retaining their respective fleets of 17 A340-600s and 18 B747-400s(3) for longer.

When oil prices fell dramatically in the second half of 2014 we questioned whether we might see weakening air travel demand as a consequence of global economic slowdown. Perhaps surpringly, looking at global year-on-year capacity for the 12 months to September 2016 shows no clear indication of this as yet.

However, we are seeing some instability in currencies:looking at the USD/EUR rate over the last 18 months shows a considerable fluctuation with a high point of 1.20 USD per Euro in January 2015, dropping to 1.05 USD at it’s lowest points.

(3) http://airwaysnews.com/blog/2015/09/16/british-airways-stays-loyal-to-its-boeing-747-400s

This impacts demand and cost. So the question we should now be asking is are we at the peak of the current cycle, or have we passed it? We know that the threat of further consolidation in Europe persists, with Lufthansa’s Eurowings subsidiary actively seeking partners.

At the end of May, IATA reported that demand was slowing and airlines, despite benefitting from lower oil prices, were being impacted by weakening economies and falling ticket prices.

IATA also reported that the first quarter of 2016 saw a decline in global trade and had led to the first annual decline in trade volumes since 2009, which makes for a challenging year for the air cargo industry. Whilst we know that global cargo demand often acts as the bellweather for passenger demand, we also know that the aviation industry is resilient and relentlessly looking to the future with optimism – not least those carriers in Asia which collectively have over 4,000 aircraft on order. Aircraft manufacturers continue to push boundaries with Boeing’s 737 MAX aircraft and the Airbus A320neo starting to bring greater fuel efficiency and new technology to the short-haul market.

The threat of oil price increases, continued dampening fares, economic slowdown and potential consolidation will not only provide the latest set of challenges but act as a stimulus for an industry that continues to defy gravity (in every sense) and grow.