Aircraft leasing and management company Safair has been granted approval by South Africa’s Air Service Licensing Council to launch their own domestic scheduled operation in the country under the brand FlySafair. The start-up carrier will offer up to ten daily flights between Johannesburg and Cape Town using two Boeing 737-400s from the final quarter of this year, with a formal start date, schedule information due to be confirmed later this month when reservations are due to open.

“We are extremely excited about this new chapter in Safair’s history and we look forward to further being of service to South Africa’s flying public,” said Dave Andrew, chief executive officer, Safair. “Having close to 50 years of aviation experience, along with our proven track record of excellence within the aviation industry, the launch of FlySafair represents a natural evolution of our business.”

Safair is considered to be one of Africa's foremost leading aviation service providers with an established history of enabling airlines and operators to successfully navigate their business in an ever-changing business climate. The company has expertise and experience in providing aircraft leasing, maintenance, special operations, chartering and training services and is majority controlled by South African interests, with the remaining 25 per cent shareholding owned by the Irish ASL Aviation Group.

Since the early eighties, Safair has also been working with international aid partners such as the International Committee of the Red Cross, World Food Program and the United Nations, providing flights and carrying goods and supplies into the rest of Africa, and in fact the world, as part of their commitment to corporate social investment. However, it does have commercial aviation experience.

Few people realise Safair has been in the South African aviation sector over the last few years, having served as a commercial support partner for most other local airlines. This involves Safair being contracted as an ACMI provider to operate the other airlines’ schedules whenever they have an aircraft out of service due to technical reasons or crew shortages.

In these instances, Safair provides their own unbranded aircraft and crew, and operates under the company name of the airline it is assisting. Due to this support service, Safair can already boast a history of flying a large number of the South African general public. With this experience the company’s management believes it is well placed to enter the low-cost airline market in South Africa.

“Although many people have commented that the airline industry is an unfavourable environment for new entrants at the moment, we would like to remind the public that we have been flying commercially for almost half a century already and we have no doubt that FlySafair will only serve to further grow the domestic market,” said Andrew. “Owing to our reputation of success, we assert that our new carrier will operate proficiently, and offer the highest standards of excellence and service to our customers.”

The Johannesburg – Cape Town route is the busiest in the South African domestic market and accounted for 29.8 per cent of the total internal O&D passenger demand last year. Over three million passengers a year fly directly between the two cities on the multitude of domestic flights already offered by the likes of South African Airways, Comair, low-cost entities Kalula and Mango and up until last year, 1Time Airline.

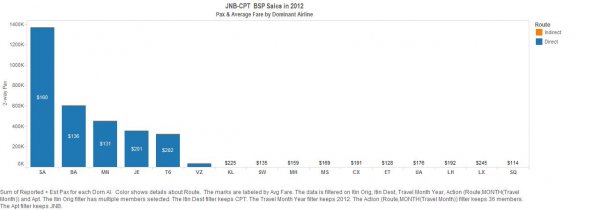

As the graphic above, extracted from the excellent new Meetings Essentials by ASM analysis, shows, South African Airways currently dominates this market with a 43 per cent share of the O&D demand in 2012, followed by Comair (19 per cent), Kalula (14 per cent) and Mango (eleven per cent). 1time Airline had a ten per cent share and FlySafair will hope to fill this void ahead of the likely entry of pan-African low-cost carrier fastJet into the domestic South African market next year.

In our analysis below we look at bi-directional O&D passenger demand between Johannesburg OR Tambo International and Cape Town International airports over the past eight years and how average air fares have fluctuated during this same period due to changes in demand and airline schedules on the route.

|

Year |

Estimated O&D passengers |

% Change |

Average One-Way Fare |

% Change |

|---|---|---|---|---|

|

2012 |

3,147,605 |

(-8.1) % |

$160 |

(-7.5) % |

|

2011 |

3,424,713 |

8.4 % |

$173 |

0.6 % |

|

2010 |

3,160,007 |

0.2 % |

$172 |

27.4 % |

|

2009 |

3,154,934 |

(-16.7) % |

$135 |

(-8.2) % |

|

2008 |

3,787,593 |

5.6 % |

$147 |

2.1 % |

|

2007 |

3,586,641 |

23.8 % |

$144 |

(-2.0) % |

|

2006 |

2,897,275 |

8.7 % |

$147 |

(-4.5) % |

|

2005 |

2,665,909 |

- |

$154 |

- |