The year 1997 was a vintage one for aviation-themed films, including the likes of Con Air – with Nicolas Cage, John Cusack and John Malkovich taking acting (and a toy bunny) to new highs and clearly enjoying their roles.

Meanwhile, we witnessed Harrison Ford flex not only his acting skills but also his muscles as he took on Gary Oldman in the political action-thriller Air Force One.

This article first appeared in Routes News, issue 3 2017.

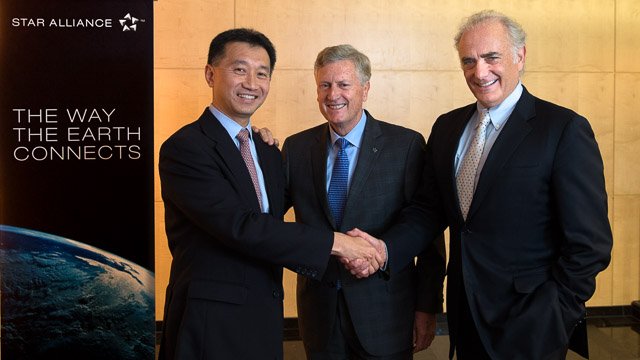

But on May 14 in the same year, five airlines (Air Canada, Lufthansa, SAS, Thai Airways International and United Airlines) launched Star Alliance. Speaking at the 20th anniversary celebrations in Frankfurt in May, the group’s chief executive board chairman and Copa Airlines CEO Pedro Heilbron said there were certain industry critics who thought those involved had lost the plot too.

He adds: “Some experts and sceptics thought this isn’t going to work out; for one it had never been done before and [they said] we know that airlines are very fierce competitors.

“History has proven right the founding airlines as we now have 28 members after 20 years, and are still the largest global alliance. The trend that Star Alliance started is now something that’s pretty much expected by travellers.”

And Heilbron is right. Star Alliance is performing well, with members generating total annual revenue of $173.94 billion from 689.98 million passengers on more than 18,450 daily departures, as of November 2016.

He believes much of the success came from the alliance’s target to be “the leading global alliance for the high-value traveller” and which was built on three initial aims, “network reach, worldwide recognition and seamless service”.

He adds: “In those early years the focus was clearly on growing the network and inviting other carriers that would join the alliance and be the ones that would complement the five original members.”

Star Alliance’s 28 members:

Star Alliance’s 28 members:

Adria Airways, Aegean Airlines, Air Canada, Air China, Air India, Air New Zealand, ANA, Asiana Airlines, Austrian Airlines, Avianca, Avianca Brasil, Brussels Airlines, Copa Airlines, Croatia Airlines, EGYPTAIR, Ethiopian Airlines, EVA Air, LOT Polish Airlines,Lufthansa, Scandinavian Airlines, Shenzhen Airlines, Singapore Airlines, South African Airways, SWISS, TAP Portugal, Turkish Airlines, THAI and United Airlines.

Although the strategy might be evolving today with a focus on improving the customer experience via digital channels, those in the world of aviation route development will be interested to discover that Star CEO Jeffrey Goh does not have the same drive to sign up new member airlines as some of his predecessors did.

He says: “When we were pursuing membership in those early days it was because we needed to build our network. Today I would say it is very good. There are very few areas in the world where none of our members fly but occasionally there are exceptions. The difference between then and now is we have a global, comprehensive and full network.”

Door policy

Drilling down into certain regions, Goh gives the example of Africa as to why Star Alliance feels the continent is well served, not just by its three African members, EGYPTAIR, Ethiopian Airlines and South African Airways, but by others.

He says: “We don’t have any immediate plans [for new recruits in the continent]. We are very well covered in Africa by members that are based there and also by those members that are serving Africa.”

Heilbron agrees that while the alliance has not closed its doors to new members, they are going to have to make some pretty impressive arguments if they are to be allowed entry, as Star can now afford to pick and choose its members.

He adds: “It is never closed, it is not closed right now, it is open. But given the size of Star today, other competing alliances and the fact that an airline that joins has to complement the rest of our members, there aren’t too many airlines out there that are interested in joining or Star is interested in attracting.”

Goh also pointed out that by taking a fairly relaxed attitude to its members’ business practices, they were able to colour in any white spots that might appear in their own network programmes and which cannot be filled by their Star partners.

He adds: “From time to time we have members that will seek opportunities with airlines outside the alliance that could meet their needs. Perhaps it is a very local market that might not make sense for us as a global alliance to let in as members. Our members are still individual companies and have their own strategies.”

Respecting differences

Heilbron agrees and cites the experience of his own airline Copa, which flies to four destinations in Mexico which, despite being the second largest market in Latin America, does not have a local Star Alliance member. Instead it has been left to Copa to make its own arrangements to find a strong local partner to help it drive its business in the market.

He adds: “It is an exception that makes us strong, it doesn’t affect the rest of Star Alliance and because of it we have a happy member who is even more keen to work with us. We have exceptions like this all over the world.”

Similarly, Goh is relaxed about members forming Joint Ventures (JVs), which he believes not only “stimulate” Star’s business but also “creates a great value proposition at an alliance level”. He adds: “If you look at the JVs that have been developed, a lot have come out of being in the alliance.”

However, even as JVs become increasingly common as airlines around the world seek to circumvent ownership and control rules, Heilbron argues it is unlikely they will ever challenge the traditional alliance model.

He says: “It would probably be hard to imagine a group that could grow to a size that would get close to our global alliance. If that was to happen it would be like having a fourth alliance... and it would not really make a big difference. More competition makes us all better and gives us an even greater reason to work together. It would not change the game that much and it would be hard to achieve with the regulations and laws and obstacles that we know are out there.”

Regarding threats to Star Alliance’s future, both Goh and Heilbron have got one eye on the world’s low-cost carriers (LCCs) whose growth remains pretty much unabated globally. In order to take advantage of both them and hybrid airlines and the routes and airlift they offer, the alliance announced the creation of the Connecting Partner model at the end of 2015. This allows LCCs to connect with Star members and while the programme may have appeared to be on ice, Juneyao Airlines signed up last year as the first official partner.

Goh adds: “To the extent there are white spots that are local or rather regional to us, we are using our Connecting Partner strategy to focus on that.”

Goh also used the celebrations to pledge to continue working with airports as they build new facilities or upgrade old ones. Most importantly, he said the decision to move all the alliance’s airlines under one roof in London Heathrow’s Terminal 2 has proven how effective a shared facility can be.

United operated the first flight out of the redeveloped terminal in June 2014 and the move was finally completed when Air India joined fellow Star members in January this year.

He adds: “Things are going well in London. When you have a connection between our members you don’t have to run a mile between them.”

With this in mind, Goh says the alliance has been in talks with the Thai authorities over the construction of the new domestic terminal at Suvarnabhumi Airport and which will be capable of handling 20 million passengers a year once completed.

He adds: “We are working with the airport to make sure they take into account connections and seamless travel for passengers. If you put domestic flights in a terminal two kilometres away from the international terminal then it doesn’t help our customers.

“When we see new airports or terminals being constructed or developed we get our hands in as early as possible. We believe we have a lot of experience and case studies that we can share with the airports and help them get better.”

As the largest airline union in the world celebrates its 20th anniversary Star Alliance is clearly a modern day blockbuster. But as in all good movies the plot thickens, and the aviation world is no exception. How Goh, Heilbron and the alliance’s team of 50 staff play out the next two decades will make for captivating viewing.