What do falling oil prices mean for the airline industry?

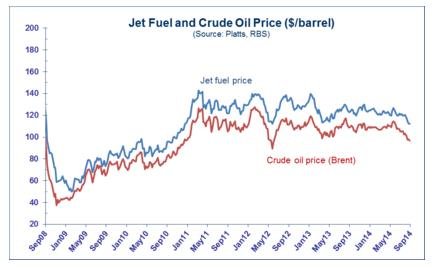

Falling oil prices have been receiving lots of coverage recently. Over the last three or four years oil prices have been relatively stable, averaging around the $110 per barrel mark. Recently the global price of oil fell to $85 per barrel.

Falling oil prices have been receiving lots of coverage recently. Over the last three or four years oil prices have been relatively stable, averaging around the $110 per barrel mark. This week [this blog was first published on Friday 31 October 2014], the global price of oil fell to $85 per barrel.

Contributing factors are the slowdown taking place in some of the world’s biggest economies, combined with excess world oil supply. So what might this mean for the airline industry? Data from OAG’s DOT Analyser shows that the US majors spent over $30 billion on fuel in 2013 and consumed over 10 billion gallons of fuel. Fuel costs for these carriers typically represents around 27% of their operating costs, whilst for LCCs like Southwest and Jetblue, with their lower cost base, fuel costs are higher, at 34% and 38% respectively.

A report last year suggested that for the big four US carriers, every 1% change in the price of jet fuel resulted in an increase or decrease of nearly $138m in operating expenses. So any shift in oil prices, and ultimately the price of jet fuel, would be expected to show a significant impact on airlines’ financial performance.

- See more at: http://www.oag.com/OAG-Blog/what-do-falling-oil-prices-mean-airline-industry#sthash.jThjnRXR.dpuf