Asia-Pacific LCCs broaden network options with widebodies and long haul narrowbodies – part two

The concept of LCCs operating widebody aircraft has taken hold most strongly in the Asia-Pacific region, and this has become even more true since the COVID-19 pandemic. While some airlines – most notably AirAsia X – have taken a step back with their widebody fleets during the pandemic, others have been adding more aircraft. Some LCCs have also decided the time is right to enter the widebody arena. Part one of this analysis considered Asia-Pacific LCCs that are new to the widebody model since the pandemic – either start-ups, or those that previously only operated narrowbodies. The second part will discuss the airlines that were already operating widebodies before the pandemic – and one large LCC in India that is interested in joining them. Widebodies are not the only vehicle for LCCs to extend their range. Many of these airlines are also turning to longer-range narrowbodies, and this trend appears likely to increase.

Summary:

- Cebu Pacific and Lion Air are both boosting their widebody fleets with A330neos.

- IndiGo is believed to be considering a major widebody order, and is already operating 777s.

- AirAsia X is now operating about half the number of widebodies that it was before the pandemic.

- Jetstar and IndiGo are among the LCCs operating A321LRs with A321XLRs on order.

Narrowbody heavyweights see value in operating widebody fleets too

Some of the largest LCCs in the Asia-Pacific region have added widebodies to already extensive narrowbody fleets: experience has shown that widebody LCC services work best when matched with a feeder narrowbody network.

Cebu Pacific has been taking delivery of A330neos to replace its older A330s and has 11 more of the A330ceos on order to grow its widebody operation. Lion Air has been receiving A330neos since mid-2019, and has now boosted its widebody fleet to eight A330neos and six A330-300s.

Other Asia-Pacific LCCs that operated widebodies both before, and since, the pandemic include Jetstar and Scoot. Both of these are also narrowbody operators, and are subsidiaries of major legacy airline groups.

In India, the market-leading LCC IndiGo has introduced two Boeing 777s to its fleet. The aircraft, wet leased from Turkish Airlines, are used on IndiGo’s flights to Istanbul. IndiGo is also believed to be considering a significant order for widebody aircraft.

AirAsia X is one of the few widebody-only LCCs and has had to cut back its fleet

While multiple LCCs in the region have been growing their widebody fleets versus pre-pandemic levels, there have also been some notable cuts.

NokScoot, a joint venture which operated Boeing 777s, was closed down early in Jun-2020.

The major reduction has come from AirAsia X, which was one of Asia’s pioneers in long haul LCC operations.

AirAsia X was on the brink of collapse during the COVID-19 pandemic and had to shrink its fleet of A330s drastically. However, it is now attempting to build up its fleet numbers again.

The airline operated about 25 A330s before the pandemic. It cut this fleet down to 11 aircraft during a restructuring process in 2021, and most of these remained parked for a long period.

AirAsia X has been progressively activating its remaining widebodies since resuming scheduled passenger operations in Feb-2022. It has also leased more A330s as international demand surged back, and is now operating 11 of its total fleet of 15 A330s.

It also has 14 A330neos on order, after cutting back its commitment for 78 of these aircraft.

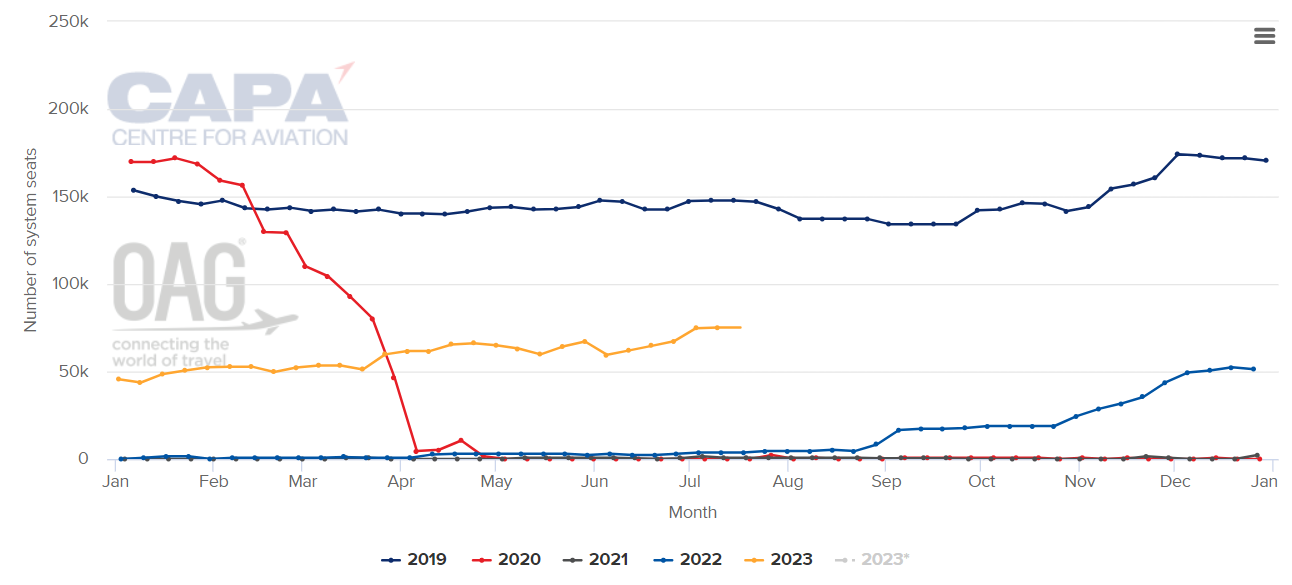

The chart below shows AirAsia X’s slow build-up through most of 2022, before picking up in late 2022 and early 2023. As of the week of 3-Jul-2023, the airline was operating 50.7% of its 2019 capacity level.

AirAsia X: international capacity, as measured in weekly seats, 2019-2023

Source: CAPA - Centre for Aviation and OAG

Before the pandemic AirAsia X had often discussed its intention to serve true long haul routes, such as Kuala Lumpur-London. Since the restructuring the airline has stressed that it will focus on medium haul routes to core Asia-Pacific markets, although it has also mentioned plans to start flights to Istanbul.

Longer-range narrowbodies are becoming more popular with Asia-Pacific LCCs

While widebodies are useful for many Asia-Pacific LCCs in certain situations, these airlines are increasingly turning to long-range narrowbody aircraft. Some already operate A321LRs, and others have this type on order. The forthcoming XLR version of the A321 offers even greater range with a narrowbody.

Jetstar is a prime example. The airline, which operates both widebodies and narrowbodies, has eight A321LRs in its fleet, with another 11 on order. The airline also has 20 A321XLRs on order, with deliveries expected to begin in the second half of 2024.

Jetstar has said that the XLRs will be able to replace its 787s on certain routes, freeing up some 787s to be used elsewhere – the XLRs will likely also be used to open new markets.

The Indian LCC IndiGo is another that has been inducting A321LRs into its fleet to help expand internationally. The airline has 70 XLRs on order and has not disclosed how many more will be added to that total as part of a massive new narrowbody order announced in Jun-2023. IndiGo has said that the XLRs will enable it to extend its reach across Europe and Asia.

AirAsia X has 20 A321XLRs on order, after reducing its backlog by 10 aircraft during restructuring. VietJet has 20 XLRs on order.

LCCs have a range of aircraft options for achieving their optimal network strategies

The main value of having widebodies in LCC fleets is flexibility – it gives these airlines more options in serving routes in terms of capacity and range. This is also one of the reasons widebody LCCs work best alongside narrowbodies.

The growing popularity of longer-range narrowbodies takes this flexibility advantage a step further – now LCCs have yet another size and range option to play with. Such aircraft can make new routes more viable.

Of course, as LCCs push into longer-range routes, they start to enter the arena where full service carriers have more advantages. Passenger experience differences become more apparent the longer the flight.

The challenge for LCCs is to address these differences without eroding their cost advantages.

In many ways, LCC widebodies are best suited to medium haul routes, where their size rather than their range can sometimes improve operating economics.