The global pilot shortage is a challenge to the world's airlines

The world's airlines have to recruit significant numbers of new pilots annually, according to forecasts from Boeing, Airbus and the flight training provider CAE. CAPA - Centre for Aviation analysis of these forecasts suggests that the annual intake of new pilots needs to be around 7% to 9% of the existing active pilot population. Asia Pacific is expected to need the most new pilots, but typically it recruits significant numbers from other parts of the world. North America's pilot shortfall is expected to remain significant due to an aging pilot population, departures during the pandemic, and supply constraints. Increasing the diversity of the pilot recruitment pool, lowering the financial barriers to pilot training, and the use of new technology are some of the ways to ease the problem. However, a global pilot shortage is set to remain a challenge to the world's airlines.

Summary

- Forecast demand for new pilots is high compared with existing pilot numbers. New pilots are needed both for growth and for replacement.

- CAE (flight training and aviation company) forecasts growth in global pilot numbers of 4.1% p.a. from 2023 to 2032. US pilot numbers grew at only 1.4% p.a. in the 10 years to 2022.

- North America's pilot shortfall is expected to remain significant due to an ageing pilot population, departures during the pandemic, and supply constraints.

- Asia Pacific is expected to need the highest number of new pilots.

Forecast demand for new pilots is high compared with existing pilot numbers

Boeing forecasts demand for 649,000 new commercial airline pilots over the next 20 years (2023 to 2042).

The most recent forecast of Boeing's rival airframe manufacturer Airbus is for 585,000 new pilots in the 20-year period 2022 to 2041.

Boeing's higher forecast is broadly consistent with its higher forecast of the number of new aircraft deliveries over the next 20 years. Boeing forecasts 42,595 deliveries between 2023 and 2042, while Airbus forecasts 40,850.

These forecasts imply a significant number of new pilots by comparison with today's active pilot population.

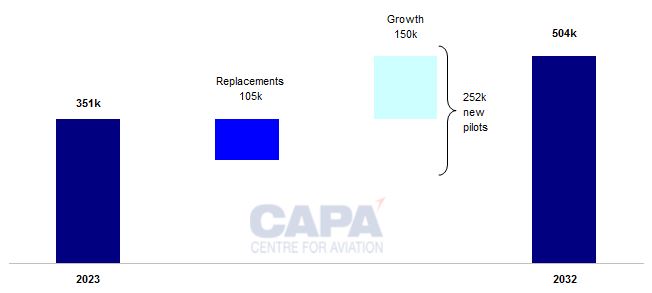

According to CAE, a leading supplier of flight training services, the global population of active commercial airline pilots is 351,000 in 2023.

In Jun-2023 CAE published its own forecast of pilot demand of the next 10 years, which projected a need for 252,000 new commercial pilots by 2032.

CAE's global forecast implies an average of just over 25,000 new pilots p.a. will be needed over the next decade from 2023. This compares with implied averages over a longer 20-year period of more than 32,000 p.a. under the Boeing forecast, and over 29,000 p.a. under the Airbus forecast.

New pilots are needed both for growth and for replacement

Demand for new pilots is driven both by industry growth and by the need to replace pilots retiring from the profession.

CAE's forecast of 252,000 new pilots over 10 years is split between 153,000 required for growth and a further 99,000 as replacements.

CAE forecasts growth in global pilot numbers of 4.1% p.a. from 2023 to 2032

The 2032 active pilot population is forecast at 504,000 pilots, compared with 351,000 in 2023, implying an average annual growth rate of 4.1% p.a.

Forecast growth in pilot numbers, CAE Aviation Talent Forecast (Jun-2023)

Source: CAE Aviation Talent Forecast (Jun-2023) and CAPA - Centre for Aviation.

US pilot numbers grew at only 1.4% p.a. in the 10 years to 2022

Data on historic rates of growth in commercial pilot numbers are hard to establish on a global basis.

However, CAPA analysis of data for the US suggests that the required annual growth rate of 4.1% p.a. is high compared with recent history.

FAA data show that airline pilot numbers in the US grew at an average annual rate of only 1.4% p.a. in the 10 years to 2022.

North America's pilot shortfall is expected to remain significant…

Aviation in the US is more mature than in much of the rest of the world and so, growth rates in traffic demand are slower, implying also that pilot numbers do not need to grow as quickly as elsewhere.

Nevertheless, this slow growth in pilot numbers has led to a shortage of cockpit crew.

The consultancy company Oliver Wyman estimates that the shortfall in pilots in North America is approximately 17,000 in 2023. It expects this gap to grow to 24,000 in 2026, before narrowing back to 17,000 in 2032.

The forecast shortfall in 2032 is smaller than a previous Oliver Wyman forecast of almost 30,000.

The consultancy suggests that rising salaries, faster career paths, and greater awareness of the need for pilots have helped to increase the number of pilot candidates.

In addition, growth in demand for pilot numbers has been dampened by reduced levels of flying – in turn, a reflection of supply chain constraints (including labour shortages).

Nevertheless, the shortfall of pilots in North America is expected to remain at significant levels over at least the next 10 years.

…due to an ageing pilot population…

To a large extent, the problem reflects an ageing pilot cohort in North America, with significant numbers reaching retirement. According to FAA data, the average age of US airline pilots in 2021 was 51 years.

In turn, this is the legacy of the industry expansion resulting from US deregulation in the 1980s and 1990s, which led to increased pilot recruits at that time, followed by more recent slower growth and consolidation.

…departures during the pandemic…

This was compounded by the departure of large number of pilots during the COVID-19 pandemic.

Airlines offered larger numbers of early retirement packages, while other pilots left the industry for other careers.

…and supply constraints

The supply of new airline pilots has also dwindled, partly as a result of fewer trained pilots from the military (due to growth in the use of drones and missiles).

In addition, a 2013 regulatory change requiring US commercial airline pilots to have at least 1,500 flight hours (versus 250 previously) has constrained the supply of younger pilots over the past decade.

Asia Pacific is expected to need the highest number of new pilots

In other parts of the world outside North America the mix of issues is different, but demand for pilots outstrips supply more or less everywhere.

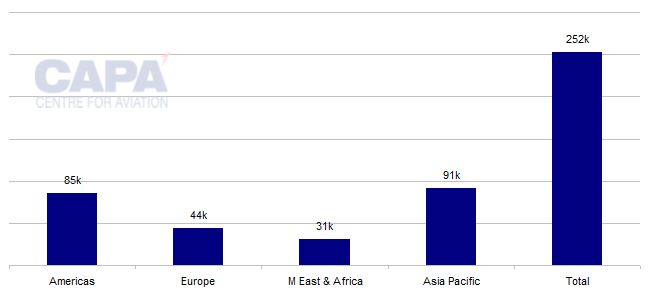

Demand for new pilots is expected to be greatest in Asia Pacific.

CAE's global forecast of 252,000 new pilots for the next decade includes 91,000 for Asia Pacific, 85,000 for the Americas (63,000 for North America and 22,000 for South America), 44,000 for Europe, 28,000 for the Middle East and 3,000 for Africa.

In the faster growing aviation regions of Asia Pacific and the Middle East the supply of local experienced pilots is constrained.

In 2018 CAE estimated that nearly 10% of pilots in these regions came from other parts of the world, whereas some Middle East airlines took more than half of their pilots from other regions.

Forecast of demand for new airline pilots by region, 2023-2032

Source: CAE Aviation Talent Forecast (Jun-2023) and CAPA - Centre for Aviation.

There are ways to ease the problem, but a global pilot shortfall is set to remain

One way to ease to the pilot shortage problem is to increase the diversity of the recruitment pool.

For example, as noted in a recent CAPA - Centre for Aviation analysis (Women airline pilots: numbers are growing, but still a pitiful percentage), only 4% to 6% of the world's airline pilots are female.

Another way to tackle the problem is to reduce the financial barriers to pilot training.

Qualification costs upwards of USD100,000, with most students funding themselves. Increased availability of scholarships, grants and airline cadetships would help to lower the financial barriers.

The use of new technologies and artificial intelligence can also help by creating more efficient methods of training pilots. In addition, new technology can help to develop more efficient scheduling tools to optimise the deployment of cockpit crew, thereby easing some of the pressure on recruiting.

In the longer term, technological advances may lead to single pilot cockpits – or even pilot-less cockpits.

This would reduce pilot demand (while also saving billions in crew costs and improving schedule flexibility). However, union and customer resistance to this is likely to delay such developments.

A pilot shortfall seems likely to remain a challenge facing the world's airlines for some time to come.