Oakland Airport's name change – juggling geography and personalities: part one

What’s in a name? Several CAPA - Centre for Aviation reports have considered that question when authorities have opted to change the name of an airport. The names of politicians, entertainers, sportspeople and religious personalities tend to prevail. Occasionally the name of one politician will change in favour of another, as dictated by the social zeitgeist – as happened a couple of years ago at Las Vegas. There may well be more of those to come. This is part one of a two-part report.

Summary

- Oakland Airport (OAK) considers a name change, but won’t ditch 'Oakland' from the title.

- It seeks a broader recognition of its position in Northern California’s Bay Area.

- Domestic airline support is strong enough at the airport, but it is weak in the international environment.

- OAK’s charging regime does give it an edge when courting those airlines for which cost is a key element in their airport choice.

Oakland considers new name for its airport

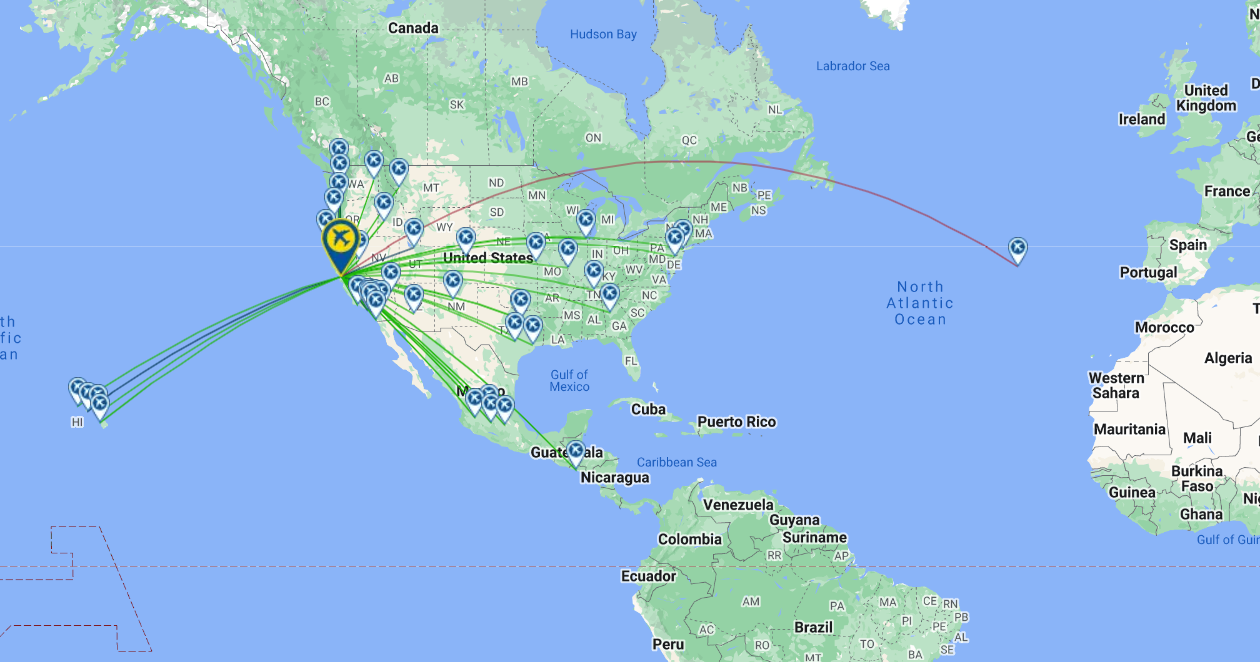

The dilemma facing Oakland International Airport (OAK) in Northern California, one of three serving the (San Francisco) Bay Area, is how to tell the world it is representing a larger, better known area while not diminishing itself by removing Oakland from its title.

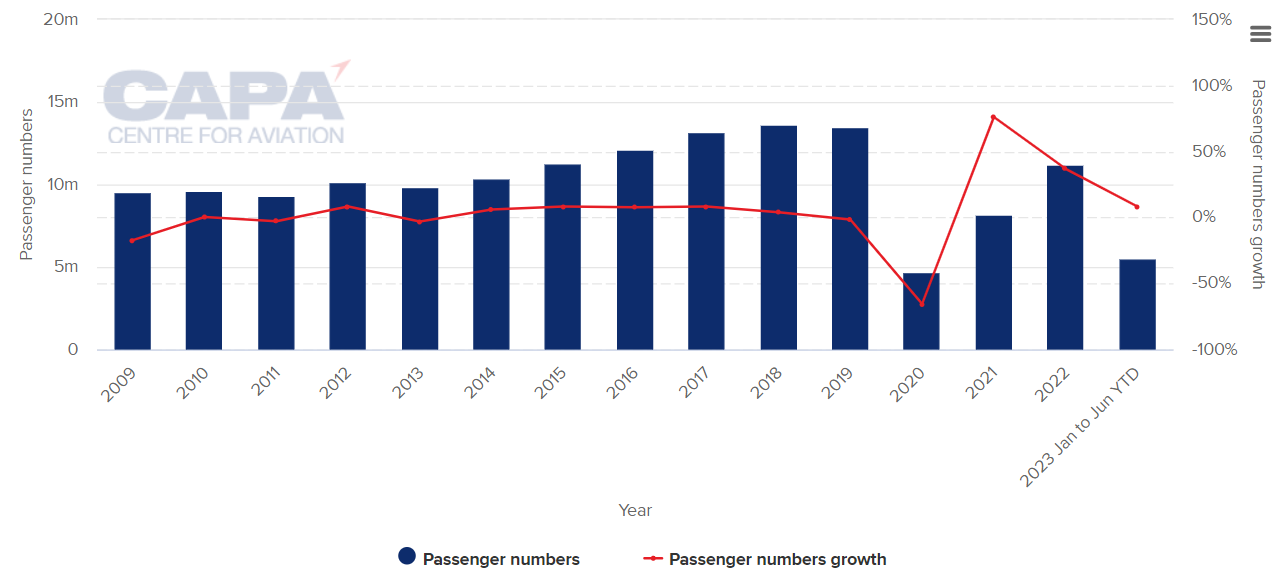

Static traffic growth during the past decade

From the aviation perspective, Oakland International Airport’s (OAK) trajectory might not be into a trough, but it has been at best static for a while now.

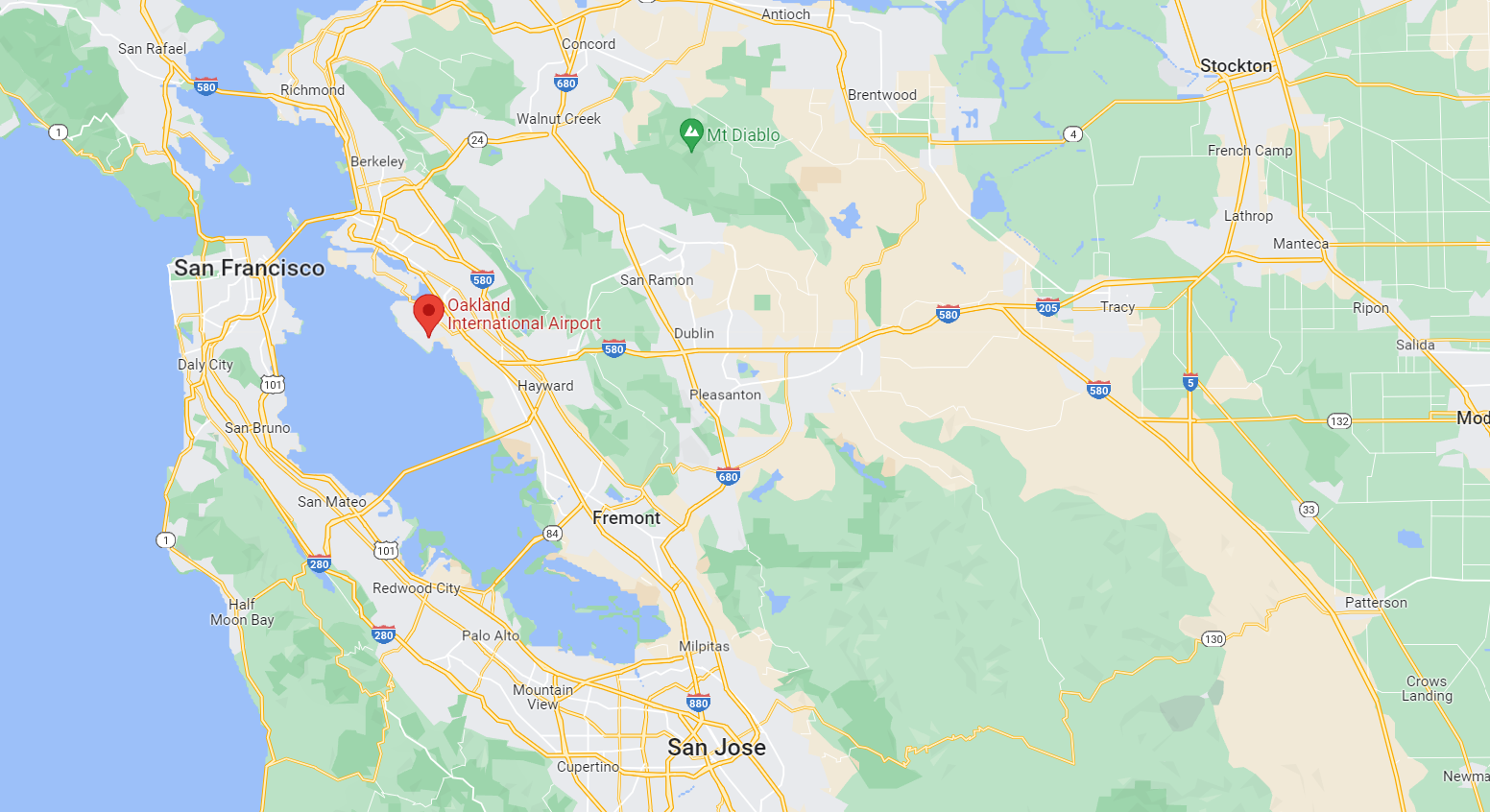

The airport, one of three serving the Bay Area along with San Francisco International and San José, is located 10 miles (16 km) south of Downtown Oakland, putting it some way (20+ miles) from San Francisco.

Oakland International Airport: location with respect to San Francisco and San José, California, US

Source: Google Maps.

Passenger traffic did, in fact, increase in the period 2009-2019 (11 years), but only marginally: by 1.7% overall, although a large part of that is accounted for by a 17% reduction in 2009 during the financial crisis.

Oakland International Airport: annual traffic, passenger numbers/growth, 2009-2023

Source: CAPA - Centre for Aviation and Oakland International Airport reports.

OAK’s pandemic recovery, in line with that of many other US facilities, suggests that it might record the 2019 level of passengers again in 2023.

By comparison San Francisco International’s growth in the same period, 2009-2019, was 4%; and San José Norman Y Mineta International Airport’s was the same.

The loss of Norwegian would have happened anyway, but failure to land Norse Atlantic is a blow

Just before the COVID-19 pandemic CAPA - Centre for Aviation published Norwegian Air’s exodus not a body blow to Oakland Airport, a report which centred on the decision by Norwegian to consolidate all of its routes in the Bay Area, from Oakland International Airport to San Francisco International Airport and questioned what implications that decision would have for OAK.

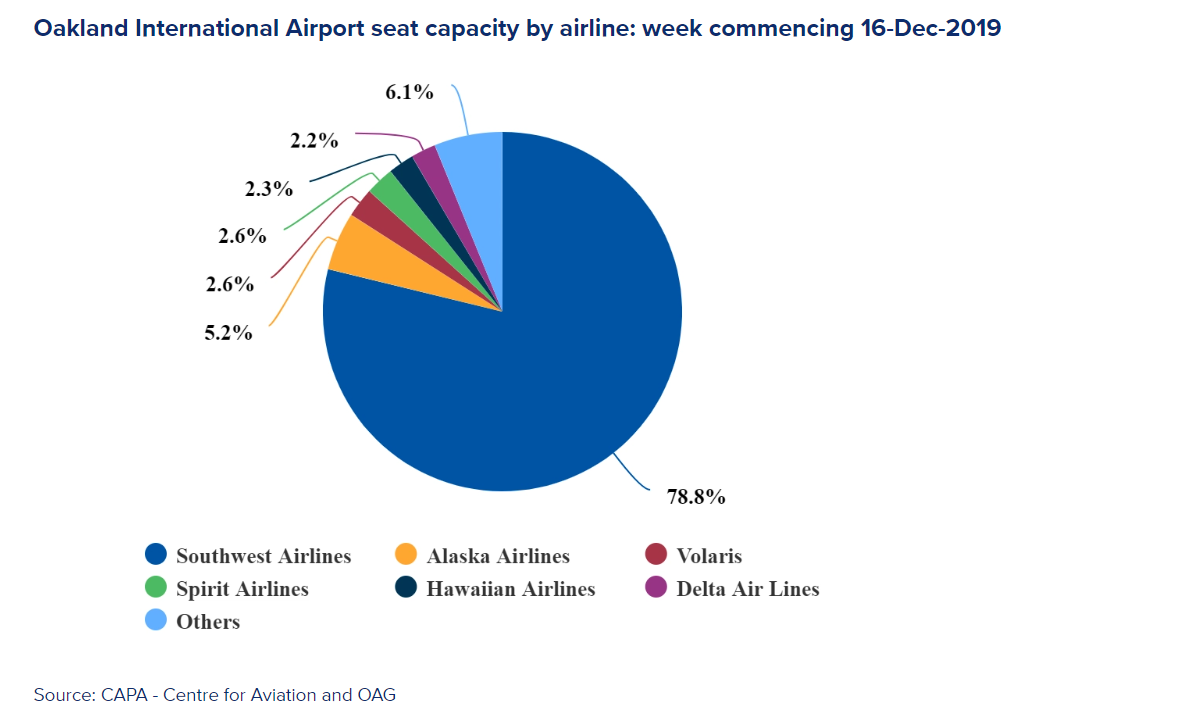

At the time OAK was identified as the ‘most low cost’ airport of significance in California. In the week commencing 16-Dec-2019 the ratio of low cost seat capacity there was 87.7%, compared to 11% at San Francisco and 58.2% at San José.

Even taking into account the Los Angeles region airports, as well as those in the Chicago area and those serving New York, OAK still had the highest budget airline capacity nationally, with the single exception of the Chicago-Rockford airport, which is now mainly a freight facility.

The conclusion was that while the stalwart that was Southwest Airlines remained, Norwegian’s move would not adversely impact too greatly on OAK – that it wasn’t a body blow.

The chart below represents the seat capacity position when that 2019 report was published.

Oakland International Airport: seat capacity, as highlighted in the CAPA - Centre for Aviation report from Dec-2019

Source: CAPA - Centre for Aviation report: Norwegian Air’s exodus not a body blow to Oakland Airport

In any case, Norwegian soon began to exit transatlantic operations, retrenching to Europe.

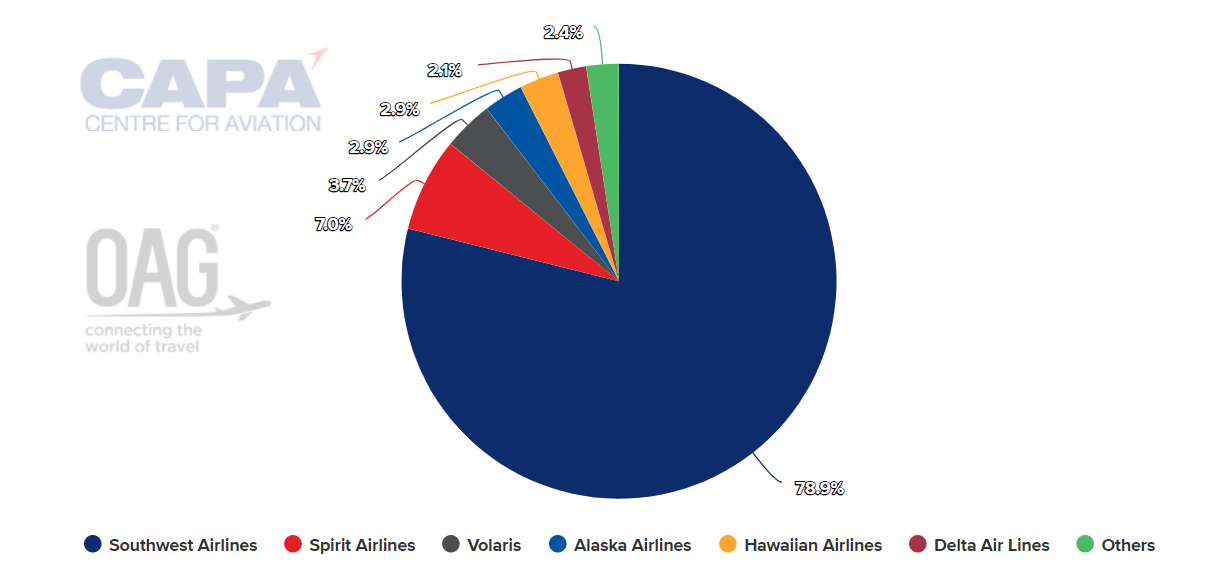

The situation now, though, is that while Southwest remains the principal airline, with almost identical capacity share (while low cost in general accounts for 91% of capacity), OAK has not replaced Norwegian’s long haul flights.

International capacity overall has reduced to only 4.6% of the total.

Oakland International Airport: seat capacity by airline, week commencing 14-Aug-2023

Source: CAPA - Centre for Aviation and OAG

There is no indication of any intention by Norwegian’s natural successor in this particular market, Norse Atlantic Airlines, to begin services to OAK. The Oslo-based airline launched a thrice-weekly London Gatwick-San Francisco service in Jul-2023, so that route is already spoken for.

And in any case, Norse Atlantic is still feeling its way into this transatlantic market, cancelling or suspending as many services as it opens new ones.

The only hope for OAK is that Norse Atlantic identifies that airport now as worth investigating, before the airline settles into an operational routine elsewhere.

International services are limited

Otherwise, international services at Oakland are limited to a handful of Mexican routes, and single ones to Canada, to San Salvador and to the Azores, from where some onward connections to mainland Europe are possible.

Oakland International Airport: network map for the week commencing 14-Aug-2023

Source: CAPA - Centre for Aviation and OAG

Retaining Southwest and building on its network is the priority, and Spirit’s expansion holds some promise

Domestically, as long as OAK can retain Southwest as that airline’s northern California operating base (of 11 nationally), it should thrive.

That 79% of capacity accruing to Southwest at OAK is not replicated at San Francisco, where it is a lowly 4.4% (and just 10.7% at Los Angeles International). It stands comparison with other established Southwest bases nationally, such as Chicago Midway (88%), Dallas Love Field (93.6%) and Baltimore-Washington (70%).

Another airline that is spreading its roots at OAK is Spirit, which has launched Oakland to Dallas, New York and Philadelphia in 2023.

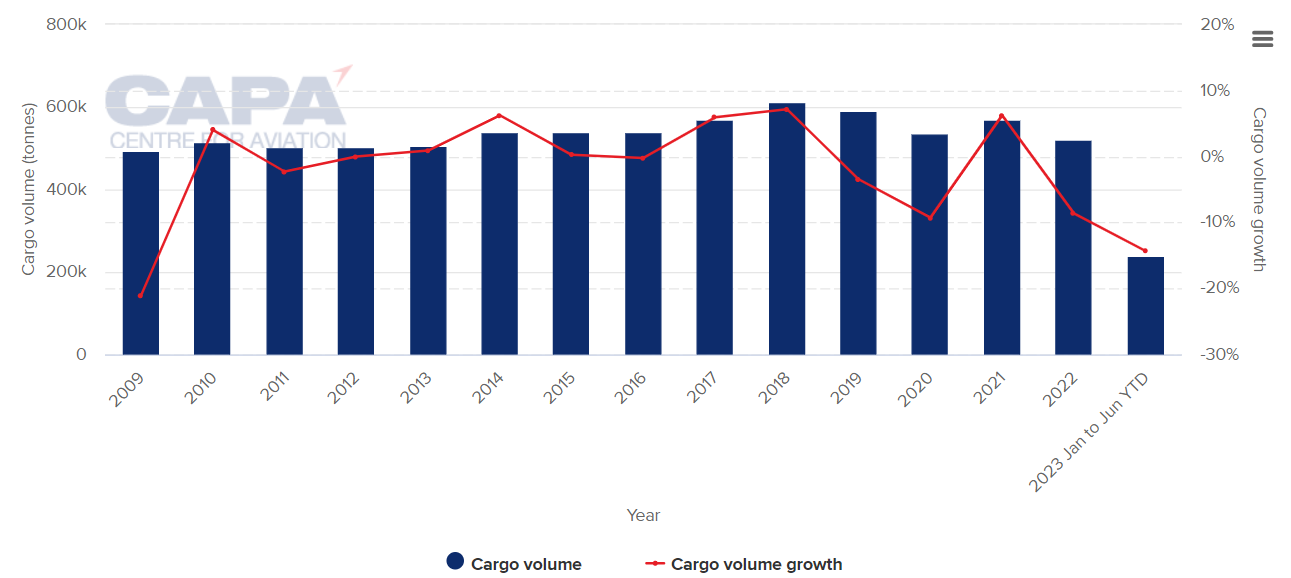

Cargo services remained resilient throughout the pandemic

On the cargo side, volume has remained static over the past decade, peaking at 610,000 tonnes in 2018.

Oakland International Airport: annual traffic, cargo volume/growth, 2009-2023

Source: CAPA - Centre for Aviation and Oakland International Airport reports

As the chart shows, and in common with many airports, that volume did not decrease greatly during the main two COVID-19 pandemic years, and capacity in 2023 is already close to 2019 levels.

OAK has handled freight-only services to and from Asia, but right now the airport is mainly a base for domestic parcel services by Fed Ex and UPS.

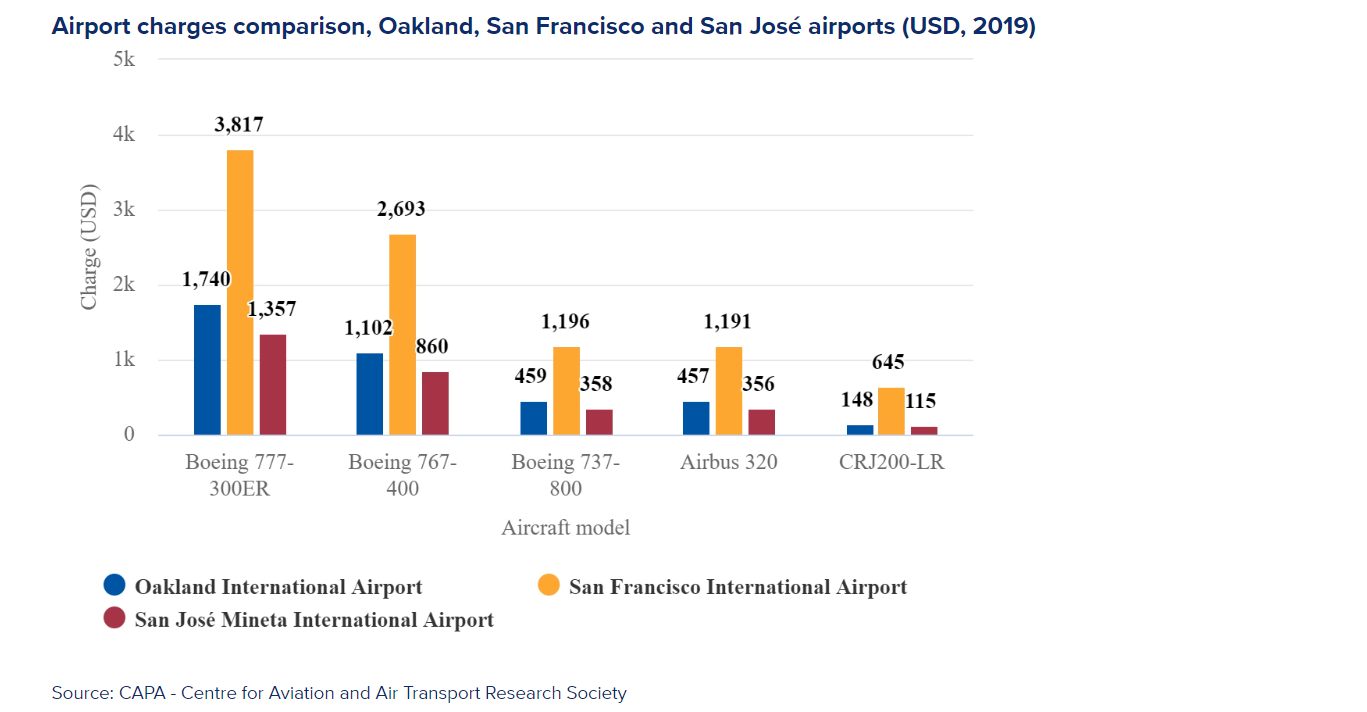

OAK’s airport charges are considerably lower than those of its rivals

Airport charges are, of course, an important consideration in attempting to attract business.

In the 2019 CAPA report OAK’s charges (aircraft landing fees) across the board were considerably less (around 40% of) than those at San Francisco, but they were a little higher than those at San José.

Airport charges comparison for Oakland, San Francisco and San José airports, as highlighted in CAPA - Centre for Aviation report from Dec-2019

Source: CAPA - Centre for Aviation report: Norwegian Air’s exodus not a body blow to Oakland Airport

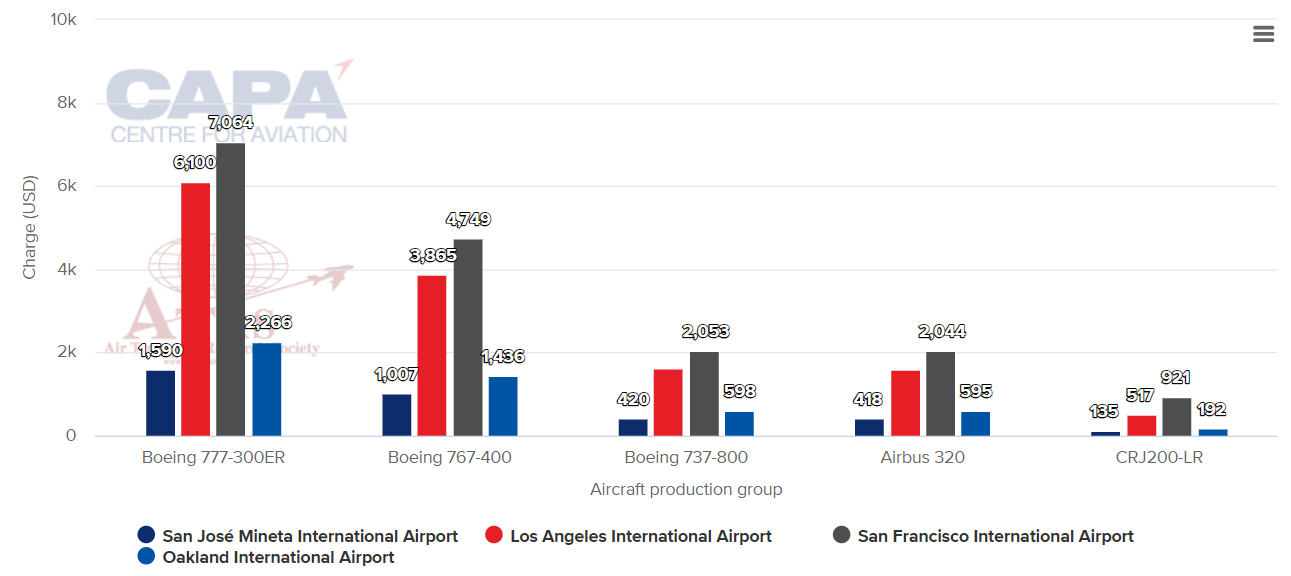

A more recent chart, which adds in Los Angeles International Airport for comparison purposes, shows that the gap has widened, with OAK’s landing charges being as little as one quarter of those at San Francisco’s in some categories.

Airport charges comparison for Oakland, San Francisco, San José and Los Angeles International airports, 2021 (USD)

Source: CAPA - Centre for Aviation and Air Transport Research Society

A charging regime of that order must offer OAK an advantage, but not only ‘low cost’ is a bargaining factor. It must also raise the question of what motivated Norse Atlantic to select San Francisco over OAK.

In part two of this report CAPA - Centre for Aviation will look more closely at the city of Oakland and examine just some of the options for the airport's potential renaming.