Brisbane Airport looks to drive further international recovery

Brisbane Airport has achieved some notable gains recently in its efforts to rebuild international capacity, although the airport still has more ground to make up to complete its recovery. Many of Brisbane Airport’s airlines and overseas markets have returned strongly since the COVID-19 pandemic. But there are also some that continue to lag, and the airport is looking to boost services to regain the momentum it was experiencing before the pandemic. The rapid economic and population growth occurring in South East Queensland is spurring demand for air travel, said Ryan Both, Brisbane Airport Corporation’s executive general manager for aviation. Another longer term catalyst for air services will be the Olympic and Paralympic Games scheduled to be held in Brisbane in 2032.

Summary

- Brisbane Airport’s system capacity has reached 84% of pre-pandemic levels after nearly doubling over the past 12 months.

- Domestic recovery is at 91% of 2019 levels, while international is at 75%, according to airport.

- New agreement with Jetstar will spur increases in international volumes.

- China Southern to resume Guangzhou connection from Nov-2023; before the pandemic, China was the leading source of tourism spending for Queensland.

- Upswing in Australia-North America travel continues in post-pandemic environment.

- Opportunities to grow regional and intercontinental connectivity; Virgin Australia a particular target.

Domestic leads recovery, but international capacity return is building momentum

Brisbane Airport’s system capacity has reached 84% of pre-pandemic levels after nearly doubling over the past 12 months. The main driver has been domestic operations, with capacity at 91% of 2019 levels.

International capacity averaged 64% recovery rate in the financial year ending 30-Jun-2023, and is now at 75%, said Mr Both (Brisbane Airport Corporation’s EGM for aviation).

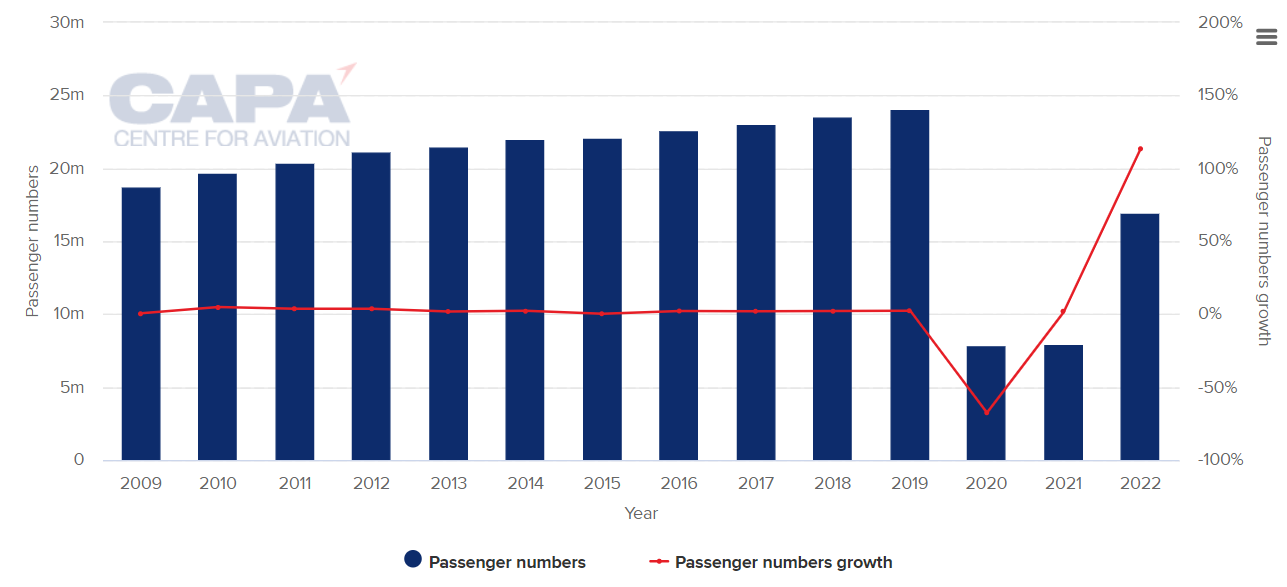

Brisbane Airport: passenger numbers/growth (2009-2022)

Source: CAPA - Centre for Aviation and Australian Bureau of Infrastructure, Transport and Regional Economics

While Brisbane’s international operations have been building steadily, progress there has still been slower than at the other main east coast hubs of Sydney and Melbourne.

“We’re recovering about one season behind” the other two airports, said Mr Both.

New agreement with Jetstar will spur increases in international volumes

A new agreement with the low cost carrier Jetstar will help spur further increases in international volumes. The airline announced on 19-Jun-2023 that it would make a significant increase in international capacity out of Brisbane, with new routes and additional frequencies.

In Oct-2023 Jetstar will switch its Tokyo flight from Gold Coast to Brisbane, and it will launch routes from Brisbane to Osaka and Seoul in Feb-2024. There will be a significant increase in frequencies on the Brisbane-Auckland route in Oct-2023, and on Brisbane-Bali in Feb-2024.

The Jetstar moves represent a shift in the airline’s international network strategy as it consolidates many of its services to Brisbane. The announcement is also very significant for the airport’s international offering, Mr Both said.

These new flights will lift Brisbane from Jetstar’s sixth largest airport to its third largest.

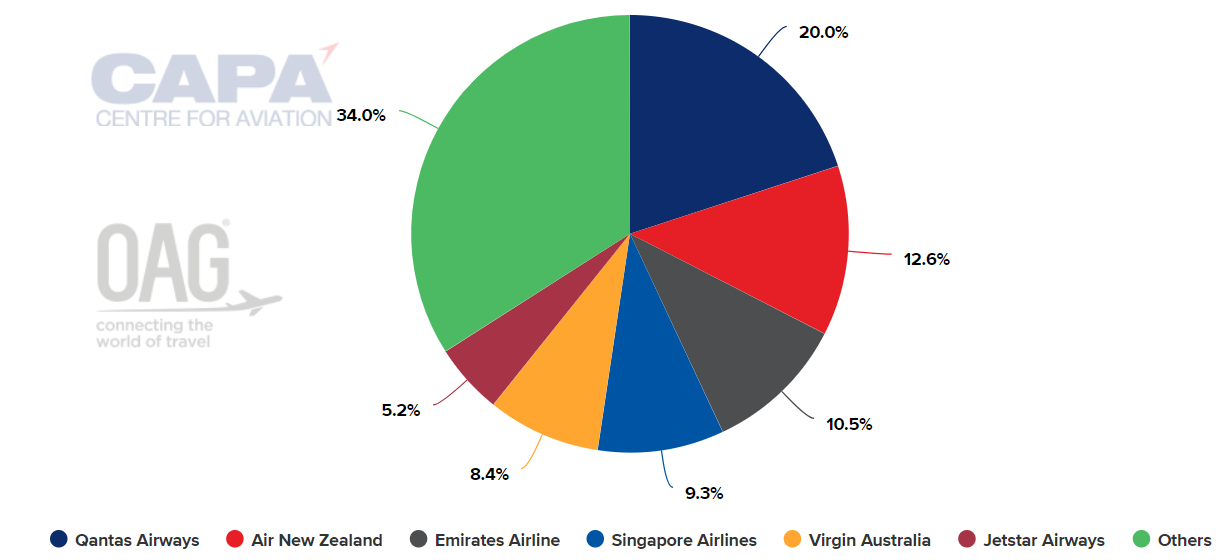

From Brisbane Airport’s perspective, Jetstar will rise from its seventh largest international airline to its second largest.

Brisbane Airport: international seats by airlines (week commencing 04-Sep-2023)

Source: CAPA - Centre for Aviation and OAG

China Southern to resume Guangzhou connection from Nov-2023

Another important development for Brisbane Airport was the 13-Aug-2023 announcement that China Southern is planning to resume its Brisbane-Guangzhou flight from 17-Nov-2023. This marks the return of direct scheduled service between Brisbane and mainland China, which has been a post-pandemic priority for the airport, Mr Both said.

Before the pandemic, China was the leading source of tourism spending for Queensland.

North Asia markets have been generally slower to recover after the pandemic, as they were among the last to reopen borders for travel. However, some of these markets are now picking up very well, Mr Both said.

Japan and South Korea markets experiencing strong demand at Brisbane

There is good demand in both directions on Japanese flights – although the outbound traffic from Australia to Japan recovered earlier than inbound.

It has helped that now Qantas and Jetstar are both flying to Japan.

Demand has also rebounded well in the South Korean market. Korean Air has returned to similar levels of year-round frequencies as before the pandemic, although high-season frequencies are not quite at that point yet.

Upswing in Australia-North America travel continues in post-pandemic environment

There has been a lot of activity in the Australasia-North America market, and Brisbane is among the airports benefitting as multiple airlines plan capacity increases.

United Airlines launched a three times weekly Brisbane-San Francisco route in Oct-2022, and intends to increase it to daily on 28-Oct-2023. It will also launch a Brisbane-Los Angeles route on 29-Nov-2023, starting with three flights per week.

Air Canada plans to ugauge its Vancouver-Brisbane flight to a larger aircraft, meaning it will be well ahead of pre-pandemic capacity levels on this route, Mr Both said.

Demand for North America-Australia travel was already on the upswing before the pandemic, Mr Both said. Airlines on these routes are experiencing a wider range of one-stop demand from secondary cities than before the pandemic.

One of the aims of the Australian travel industry is to get more Americans to look beyond the Caribbean for holiday destinations, said Mr Both.

Outbound leisure, student travel and cargo imports supporting new Vietnam link

Elsewhere, a new market has opened for Australians with the introduction of Brisbane-Ho Chi Minh City flights by Vietjet in Jun-2023, marking Queensland’s first direct service to Vietnam. This route is selling very well, as Australians look to holiday destinations beyond Bali, Mr Both said.

The demand is mainly leisure outbound from Australia, but there is also significant inbound student traffic and cargo import demand.

The Bali market is at its capacity limit under a bilateral air services agreement, although full recovery has been more elusive in other Southeast Asian markets.

Opportunities to grow regional and intercontinental connectivity

Malaysia Airlines and Thai Airways are yet to resume flights to Brisbane.

Singapore Airlines is continuing to grow its capacity, but it is not back to its pre-pandemic levels in the Brisbane market.

However, the major missing piece of the international recovery for Brisbane Airport is Virgin Australia.

During its restructuring in 2020 Virgin Australia decided to phase out its widebody fleet, which it used for medium and long haul international routes, in order to focus more exclusively on the domestic market.

The airline has also not yet resumed most of its New Zealand network. It only operates flights to Queenstown in New Zealand, including one route from Brisbane. Virgin Australia’s other international route from Brisbane is to Bali.

Brisbane Airport “would love to see [Virgin Australia] back” on long haul routes to destinations such as Los Angeles and short haul routes like Auckland and Christchurch, Mr Both said. “They were an important part of our international carrier mix” before the pandemic, he added.

Mr Both noted that with its expanded slate of partner airlines, the viability of additional international routes would be even greater than before the pandemic for Virgin Australia.

Mr Both said that the airline could do a lot internationally even with its narrowbodies – particularly with the Boeing 737 MAX in its fleet. These aircraft could fly Southeast Asian routes, as well as more Tasman services, although Virgin Australia has many domestic priorities for them.