OAG’s Megahubs – Heathrow best connected, Kuala Lumpur makes appearance, Dubai is missing

There are many statistical means by which to measure the impact and influence of airports, and especially hub airports, as the air transport business continues to make a recovery from the COVID-19 pandemic. Just as the ASK or ASM measure gives an extra dimension when assessing an airline’s impact, by combining the available seats on aircraft by the number of kilometres (miles) flown, the connectivity measure for airports reveals those offering the greatest number of flights and connections between them – a combination of volume and frequency. A recent OAG report says that so far in 2023 London Heathrow has reclaimed its number 1 spot for international travel connectivity. The fast growing Istanbul Airport also makes the global top 10, but Dubai International, despite being the leader in the Middle East, does not. Meanwhile Kuala Lumpur makes an unanticipated entry at number 4. And in a separate report published at the same time, IATA says that in 2022 the US (which is not well represented in the international top 10) accounted for 41% of global connecting traffic, with US airports hosting a wide spectrum of hub operations.

Summary

- The top 10 airports for international connectivity so far in 2023 are revealed in an OAG report, the so-called Megahubs.

- London Heathrow reclaims the top spot; Kuala Lumpur makes a surprise entry at number 4.

- Only two US airports in the top 10, but several more are in the top 20, and the US accounts for 41% of global connecting traffic in domestic and international segments, according to a separate report.

- Dubai heads the international table in the Middle East, but is a lowly 16th globally.

- Demographic shifts suggest the centre of gravity will continue to move towards Asia-Pacific.

OAG ‘Megahubs’ report identifies the top 10 international airports for connectivity

Air connectivity is broadly defined as the ability and ease with which passengers and freight can reach destinations by air.

OAG, the air travel intelligence company, has published a 2023 'Megahubs' report, ranking the most internationally connected passenger airports – i.e. those offering the greatest number of flights and connections between them. It is released as global capacity rebounds to approximately 98% of pre-pandemic levels.

The OAG Megahubs Index 2023 reveals the 50 most internationally connected airports in the world, and also the 25 most domestically connected airports in the US. The index is generated by comparing the number of scheduled connections to and from international flights with the number of destinations served from the airport.

London Heathrow reclaims the number 1 spot

Topping the list is London Heathrow Airport, which reclaimed the position of the most internationally connected airport.

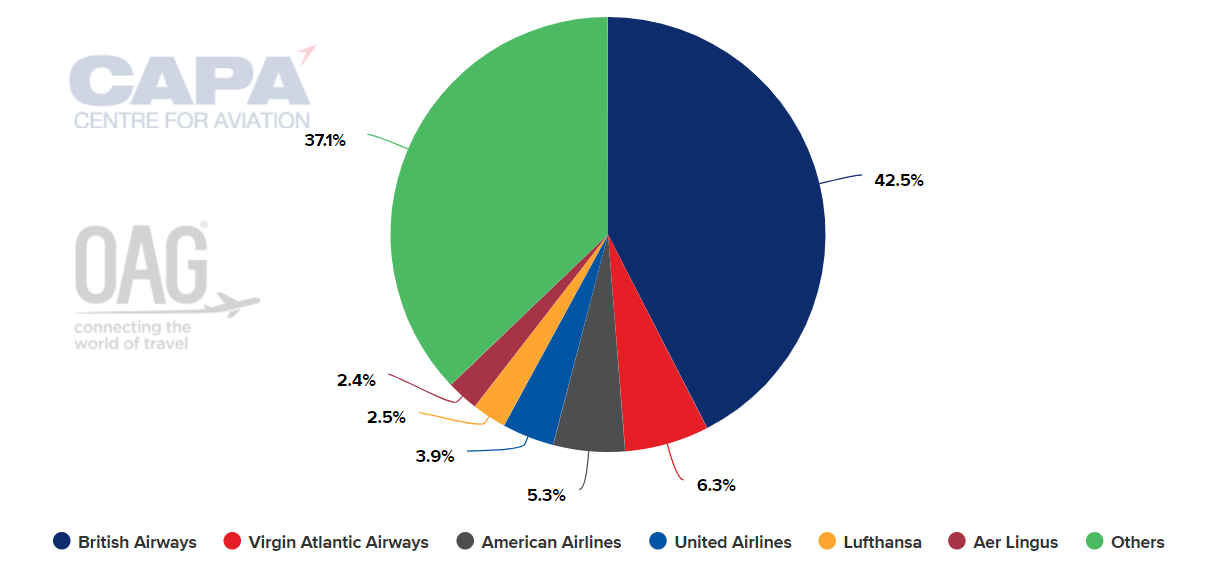

British Airways remains the airport's dominant airline, with a 49.9% share of flights (movements) and a 45.4% share of system capacity (42.5% of international capacity) in the week commencing 09-Oct-2023.

London Heathrow Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Heathrow has had to claw its way back to the number 1 position, having faced a heavier impact from pandemic-related travel restrictions than most other airports of its size.

New routes aid JFK’s claim to the number 2 position

New York John F Kennedy International Airport (JFK) is ranked second – up 16 places from 2019 and representative of how travel was better supported in the US during the pandemic.

Moreover, American Airlines and Delta Air Lines have added new destinations out of New York recently, along with Air Senegal, Air New Zealand and other airlines that have launched or reopened previously served routes.

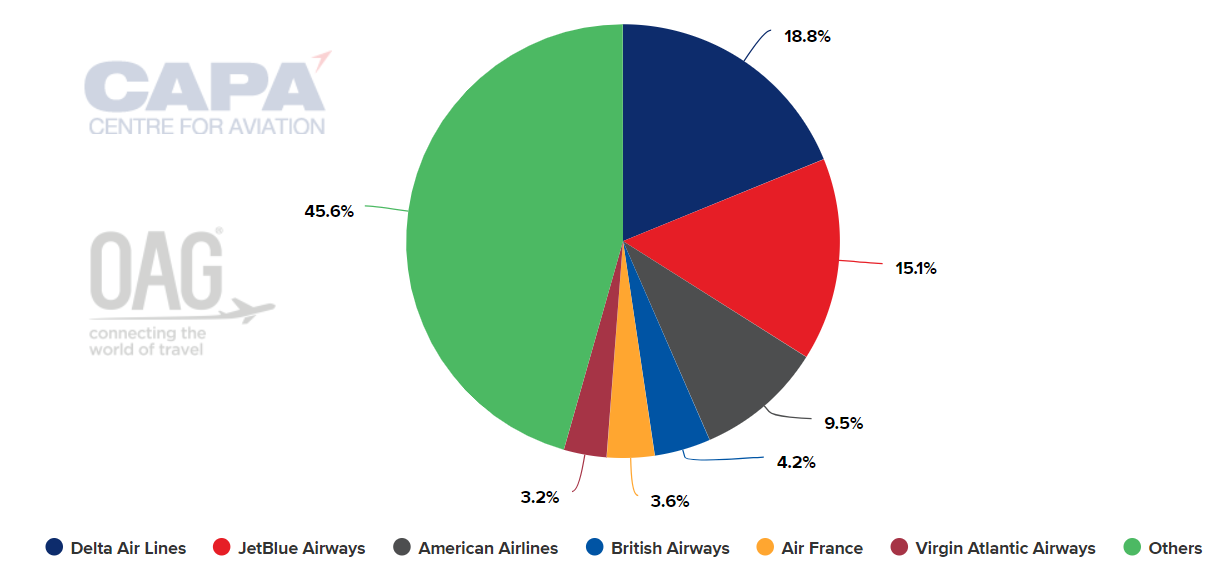

Presently there is no single dominant airline at JFK with Delta Air Lines, JetBlue Airways and American Airlines the three leading airlines by international seat capacity, followed by European-based airlines – British Airways, Air France and Virgin Atlantic.

New York JF Kennedy International Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Schiphol in third place – but flight capacity restrictions will impact on that

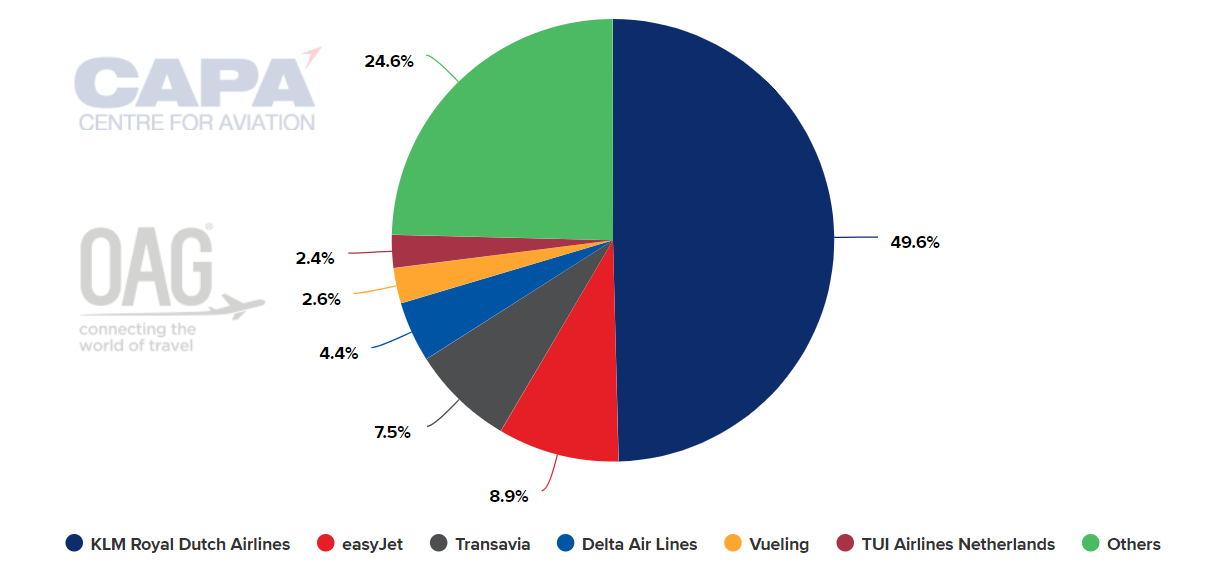

Amsterdam Schiphol Airport was ranked third, where KLM Royal Dutch Airlines accounts for 53.3% of flights and 49.6% of international seat capacity.

KLM is Schiphol’s raison d'être; second-placed easyJet has less than 9% of capacity and it will be interesting to see what the situation will be in a year’s time and thereafter as capacity is forcibly reduced by the Netherlands government.

Schiphol has recently published its capacity declaration for summer 2024, with “highlights” including a maximum of 280,645 aircraft movements (12,400 fewer than in summer 2023) and 87 aircraft types banned owing to noise concerns.

The Dutch Appeal Court has overturned a court decision which found the outgoing Netherlands government's experimental regulation to reduce capacity at Schiphol to be in violation of its obligations under the ‘Balanced Approach’. The government had previously proposed an aircraft movement limit of 440,000 per annum, effective Nov-2023.

Amsterdam Schiphol Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Kuala Lumpur a surprising fourth place

Fourth on the list – and perhaps surprisingly – is Kuala Lumpur International Airport (KLIA), which is also ranked as the most connected airport in Asia-Pacific.

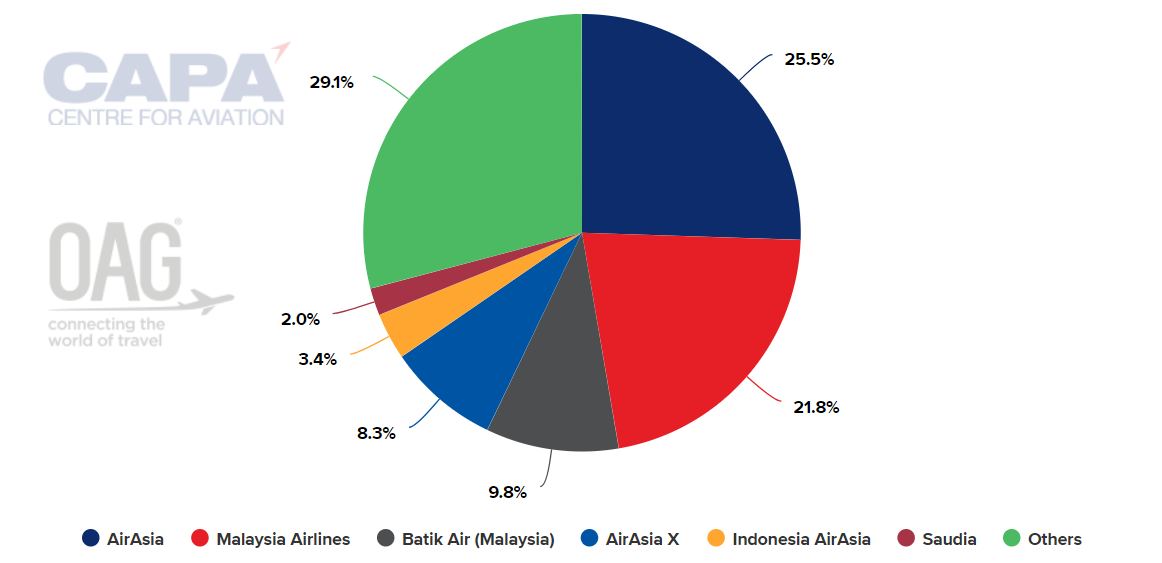

There is a greater degree of equality at Kuala Lumpur between the full service Malaysia Airlines (21.8% of international seats) and the region’s leading LCC, AirAsia (25.5%), which is the main driver behind this degree of international connectivity.

Although the secondary Sultan Abdul Aziz Shah, or Subang, airport is being restored and expanded – as analysed in MAHB proposes redevelopment of Kuala Lumpur’s second airport as a complete aerospace ecosystem – it is unlikely to make much impact on KLIA.

Kuala Lumpur International Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Tokyo Haneda is one end of the third busiest airport corridor in the world

Another airport particularly impacted by the pandemic, Tokyo Haneda, ranked fifth internationally, which was up from 22nd in 2019, and also claimed the number 2 spot in Southeast Asia rankings.

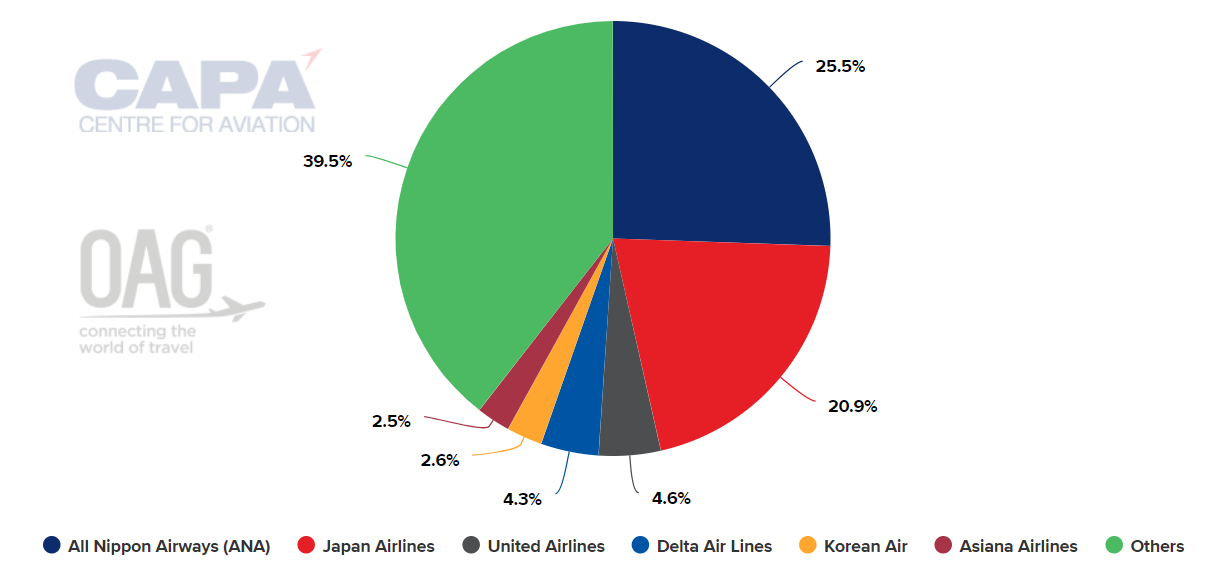

All Nippon Airways (ANA) and Japan Airlines (JAL) account for 46.4% of international capacity between them (and over 70% systemically).

The resurgence of Asia-Pacific airports generally reflects their key position as hubs for some of the world’s busiest routes – such as the air corridor between Fukuoka and Tokyo Haneda, which has become the third busiest in the world.

Tokyo Haneda Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Lufthansa Group accounts for two thirds of Frankfurt’s capacity

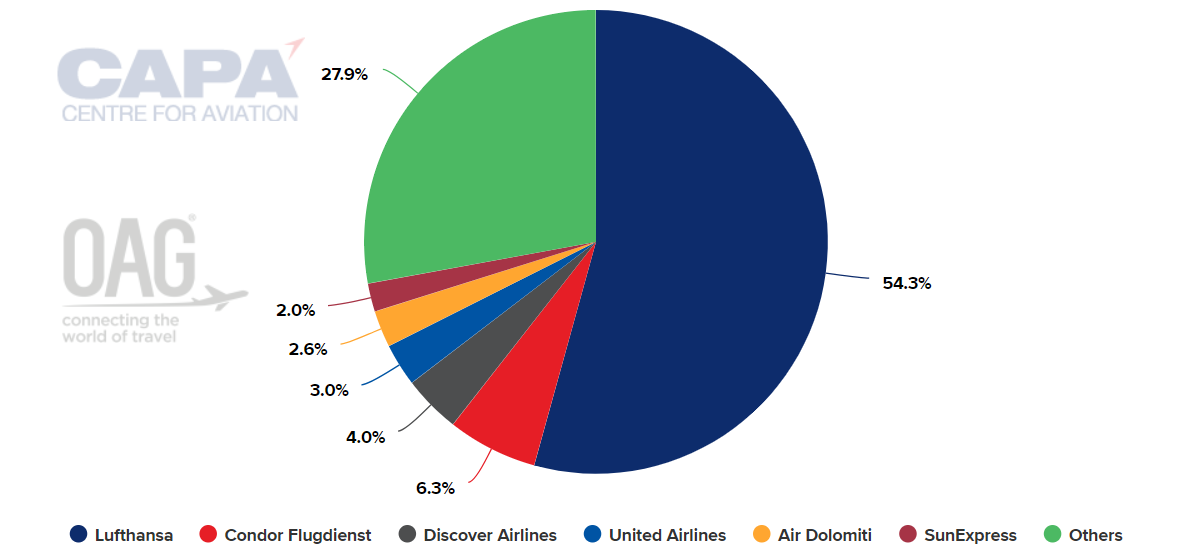

Returning to Europe: Frankfurt Airport, the main home of the Lufthansa Group, was ranked sixth for international capacity.

Together with the group subsidiaries Discover Airlines, Air Dolomiti, Austrian Airlines and Sun Express, Lufthansa presently accounts for close to two thirds of that capacity and continues to route international travel by way of that airport where it can. This is at the expense even of the capital, Berlin, but with the exception of Munich, where it also has a large base.

Frankfurt Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Istanbul Airport benefits from business and leisure demand and from Turkish Airlines’ sixth freedom routes

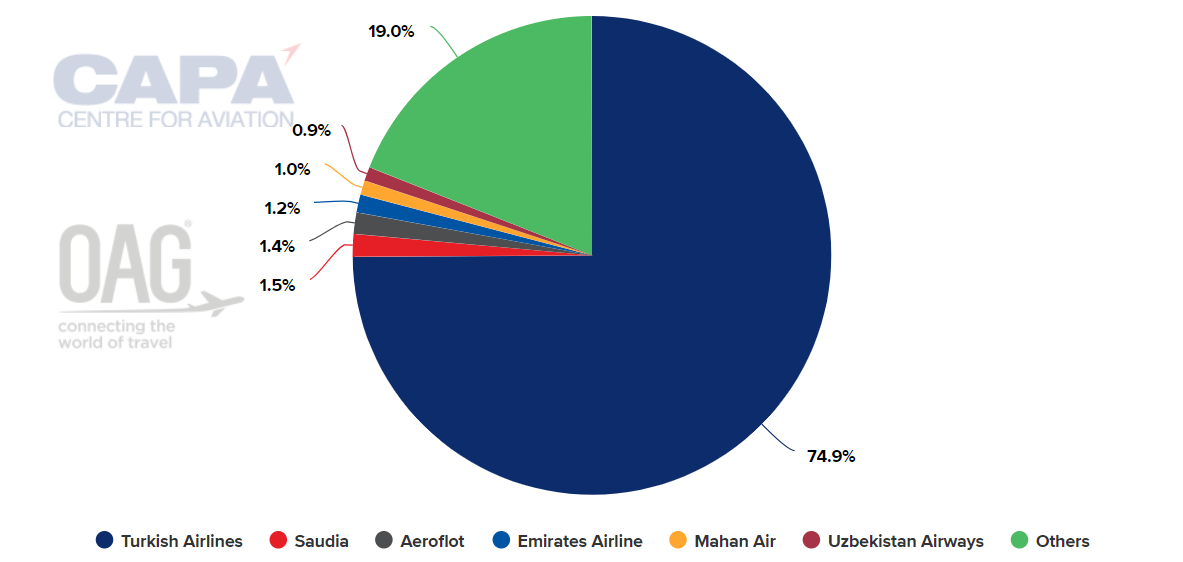

The relatively new Istanbul Airport, which opened in 2018, before the start of the COVID-19 pandemic, joined the top 10 table at seventh.

Turkish Airlines is the airport's dominant airline, with a 79.3% share of flights and 74.9% of international capacity, as of the week commencing 09-Oct-2023.

Istanbul Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Unlike some of the listed airports here, Istanbul does have a rival and sizeable airport, Sabiha Gökçen, under separate ownership – one that is not as reliant on Turkish Airlines, which has only a 21.2% international capacity share. The collective capacity at Istanbul is down to the city’s reputation as a business and leisure destination, allied to the sixth freedom operations of Turkish Airlines.

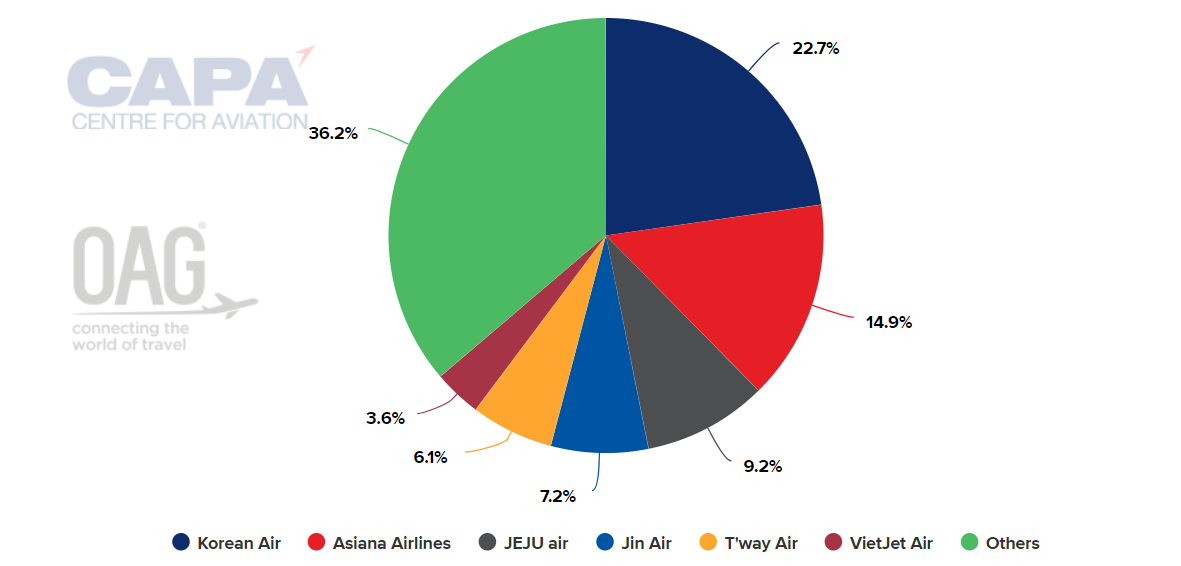

Seoul Incheon Airport still playing catch-up after severe pandemic impact

Coming in at eighth is Seoul Incheon International Airport; there is also a secondary airport, Gimpo, but one that is dedicated to domestic travel, leaving Incheon to handle the international traffic.

Again, South Korea felt the full force of the pandemic and is playing catch-up in the connectivity stakes.

At Seoul Incheon, national carrier Korean Air is not so dominant in capacity, with 22.7% of international seats, ahead of Asiana Airlines and with JEJU Air, Jin Air and T’Way Air all playing a significant role.

Seoul Incheon Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Paris’ Charles de Gaulle not yet significantly affected by French commitment to reduce air travel in favour of rail

Back in Europe: Paris’ Charles De Gaulle Airport (CDG), which in 2019 was the second busiest airport in Europe and breathing down the neck of London Heathrow, is now ranked a lowly ninth for connectivity.

Part of that reason is again traceable to quite draconian travel restrictions during the pandemic, which means that CDG is currently (Jan-Aug-2023) 15% behind Heathrow in terms of actual passenger traffic.

There seems to be a greater commitment in France than in any other European country to reduce air travel in favour of rail travel, but so far that really applies far more domestically and so, it does not affect international connectivity.

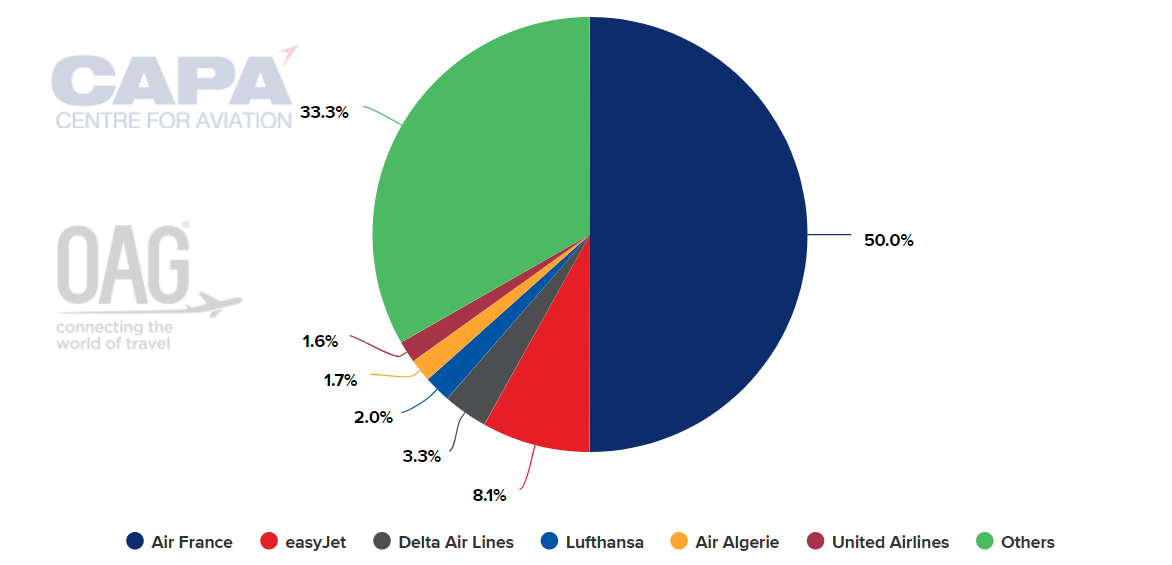

Air France enjoys a similar degree of capacity at CDG as does British Airways at Heathrow, with 50% of international seats.

Paris Charles de Gaulle Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Chicago O’Hare cements its place as the second US airport for international connectivity

Completing the Top 10 table is the second US airport, Chicago O’Hare, which has long since been regarded as one of the top two US hubs, along with Hartsfield–Jackson Atlanta International Airport.

The airport was also ranked first in the US for domestic connectivity.

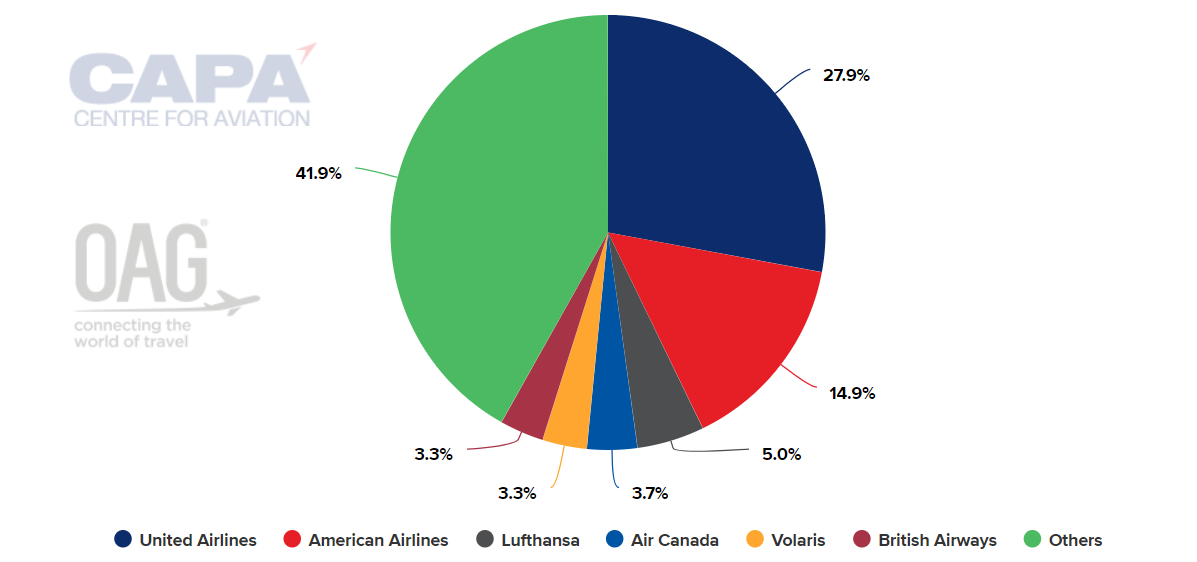

United Airlines and American Airlines share much of the capacity between them. United accounts for 47% of flights at the airport and presently 27.9% of international seat capacity. American has 14.9% of such capacity.

Interestingly, Lufthansa places third, with 5% of capacity, which is about half of its total capacity at Berlin Brandenburg Airport, where it has zero international capacity.

Chicago O’Hare International Airport: international seats, all airlines and business models, week commencing 09-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Dubai is ranked number 1 in the Middle East, but well down the list globally

Dubai International Airport (DXB) is the top ranked airport in the Middle East and Africa, at 16th in the global table.

It may seem a little strange that DXB is placed well down the global table while being ranked number 1 in the Middle East (a status that was confirmed by ACI Asia-Pacific and Middle East in a report of its own). It has 239 international destinations, according to CAPA - Centre for Aviation/OAG data, compared to 251 for Istanbul and 192 for London Heathrow, for example.

But connectivity is based as much on frequencies as on destinations, and that is where other airports score over it on account of more comprehensive frequencies on short routes.

A broad spread of regional locations for the Top 20 airports

Looking at the statistics beyond the top 10, seven of the top 20 airports are in Asia-Pacific, six are in Europe, the Middle East and Africa, and six are in North America.

And those global Top 20 hubs include six in North America, with Chicago (ORD), Atlanta (ATL), and Denver (DEN) among the top US domestic hubs.

Chicago O’Hare, Atlanta and Los Angeles International are the three leading airports for US domestic connectivity

Chicago O’Hare International Airport (ORD) continues to reign as number 1 in the US for domestic connectivity, as well as finishing at number 10 among global hubs (as above).

Atlanta Hartsfield-Jackson International Airport (ATL) maintains its place as number 2 among US hubs for domestic connectivity and finishes number 14 globally.

Los Angeles International Airport (LAX) climbed 15 spots from 2019 to number 7 in the US.

United Airlines and Delta Air Lines dominate the share of flights at the top three US airports.

IATA report identifies the US as accounting for 41% of global connecting traffic – well ahead of Europe and Asia-Pacific

In a separate report also published in Sep-2023 IATA reported the following on connecting passenger traffic by hub airports in 1Q2023:

- The US accounted for 41% of global connecting traffic, with US airports hosting a wide spectrum of hub operations, ranging from those with lighter transfer traffic shares to those with a strong mix;

- Los Angeles International Airport recorded 15% connecting traffic and Charlotte Douglas International Airport reported 72%;

- Europe contributed 24% of the world's connecting passengers and Asia 11%;

- Middle Eastern airports captured 11% of global connecting traffic, with Doha Hamad International Airport serving approximately 75% of its total passengers through international transfer flights.

Demographic shifts mean that the centre of gravity will move towards Asia-Pacific

IATA said that geographic positioning played a critical role in determining hub locations, with globally central hubs offering considerable advantages for linking passengers between various regions.

IATA also said that demographic shifts were expected to gradually move the aviation industry's centre of gravity toward Asia "in the coming decades".