Speculative watchers should slow down and let United and JetBlue test the partnership waters

United Airlines and JetBlue Airways set the US aviation abuzz after reports surfaced that the two airlines were plotting a partnership, with some speculation bandied about that eventually a merger could ensue.

It could be a defining moment if that speculation materialises into another Chapter of M&A in the country's aviation sector; but the reality is - in the short term, the arrangement will mirror typical airline partnerships that are a mainstay of the sector.

Recent messaging by United indicates that the airline sees advantages with JetBlue; yet, on the surface, committing to a complex merger integration to regain lost ground at New York JFK doesn't appear to be a major priority for the airline.

But - in the evolving US market, sometimes priorities could shift quickly.

Summary

- United Airlines and JetBlue Airways appear to be on the verge of announcing a new partnership.

- Merger speculation has also surfaced, yet United’s CEO remains somewhat coy on a potential tie-up.

- If the partnership deepens to that level, how would regulators assess the New York market?

- The odds of a merger are tough to predict, but intrigue over United-JetBlue ensues.

A typical business relationship between United and JetBlue seems imminent. What's next?

In a strange turn of events, the Italian news outlet Corriere della Sera reported that United aimed to use a potential partnership with JetBlue to obtain 20 slot pairs and two gates at New York JFK.

The airline pulled out of JFK in 2015 to focus on its hub in nearby Newark Liberty International airport. It regained some slots in 2021, but opted to end service again from JFK in late 2022 due to an inability to build scale by gaining additional slots at the airport.

The Corriere della Sera report also stated that the final phase of the partnership would culminate in United acquiring JetBlue.

It's not clear if the relationship would progress to that final stage, but the establishment of an alliance to provide greater connectivity and the earning and burning of frequent flyer miles, as reported by Reuters, seems imminent.

JetBlue executives recently stated that the company expected to announce a new domestic partner in 2Q2025. American Airlines and JetBlue recently ended partnership talks, and given how much JetBlue and Delta Air Lines compete in JFK and Boston - it leaves United as the most logical choice.

United needs to decide if it is worth the 'brain damage' to acquire JetBlue

As speculation grows regarding the end-game for United and JetBlue, United's CEO Scott Kirby offered insight into further consolidation in the US aviation sector during an investor conference in Mar-2025.

Responding to a question about whether more consolidation is necessary and if United would play a role, Mr Kirby said that additional M&A would be possible, but that there would be challenges in combining two airlines.

From United's perspective, "We have a great plan that is working," and "...mergers are so hard, they're disruptive[;] your technology team spends two years on the sidelines just integrating." He said that United would be rolling out "some super cool stuff" for customers this year 2025, and "that stuff just gets harder and harder to do during a merger integration".

Citing United's favourable execution of its own business plan, he added: "The hurdle to go do a deal gets a whole lot higher."

But having said that, "At least at United I would like to have a bigger presence on the other side of the river at JFK," Mr Kirby stated.

United's Newark hub is located in New Jersey, across the Hudson River. However, he also said: "...all the brain damage of buying a whole airline to get that, that's a lot to do".

If United decides a JetBlue acquisition is worth the brain damage, the regulatory response will be unpredictable.

The Administration of President Trump appears generally more supportive of M&A; however, the Department of Justice has formed a task force "to evaluate competition, and some of their language I think was unfavourable towards the idea of antitrust immunity," said Airlines For America SVP Legislative and Regulatory Policy Sharon Pinkerton at the recent CAPA Americas Airline Leader Summit.

Still, she believes that "we're going to have very fierce advocates for airlines in the administration".

How would regulators view the New York market if United and JetBlue move beyond the initial phase of their partnership?

Any approval of a merger, which again, is anyone's guess, would depend on how regulators view New York.

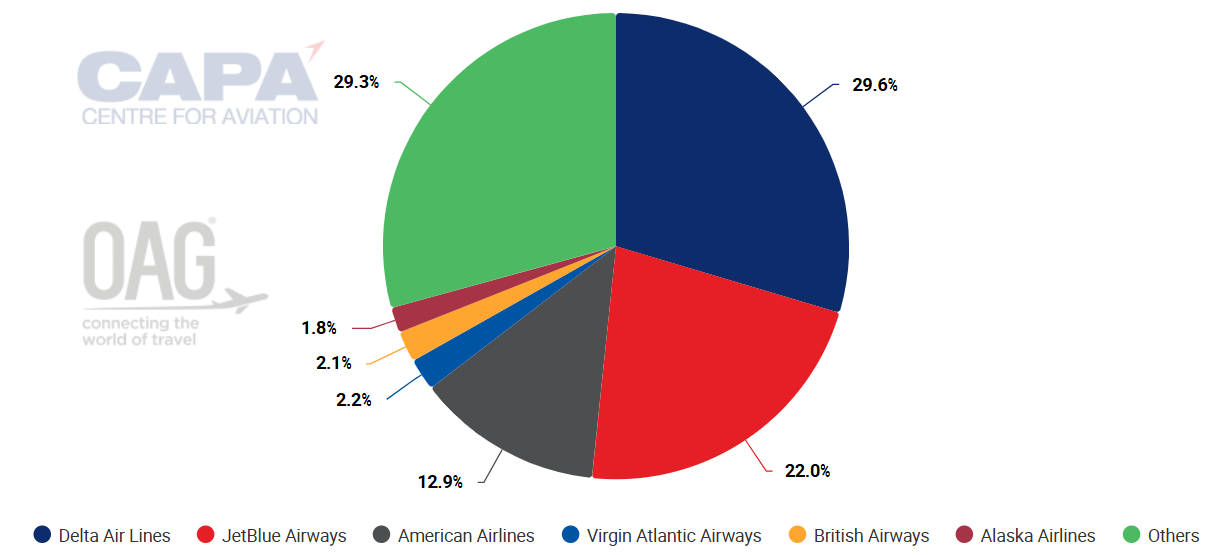

Data from CAPA - Centre for Aviation and OAG show that Delta represents 24.7% of two-way seats globally from New York, followed by United at 23.1%, American at 12.8%, and JetBlue's 12.0% share.

Based on that data, United and JetBlue's combined seat share would be 35%.

System seat share at New York JFK International, as of early May-2025

Source: CAPA - Centre for Aviation and OAG.

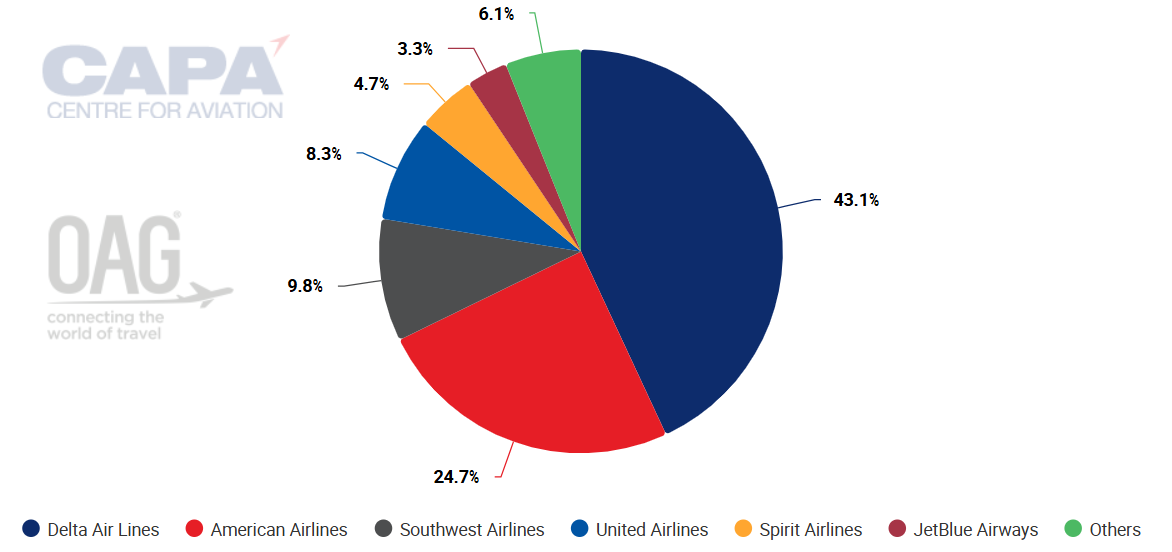

Factoring out Newark, and examining departing seats at New York JFK and LaGuardia -JetBlue has a 22% share at JFK, while at LaGuardia JetBlue and United's combined seat share is 11.6%.

System seat share at New York LaGuardia, as of early May-2025

Source: CAPA - Centre for Aviation and OAG.

Any party involved, either regulators or merger partners, can manipulate data to support their respective positions.

Slot allocations and potential divestment almost always factor into the regulatory processing of mergers. Delta accounts for the most pairs at JFK and LaGuardia, whereas United represents the majority at Newark.

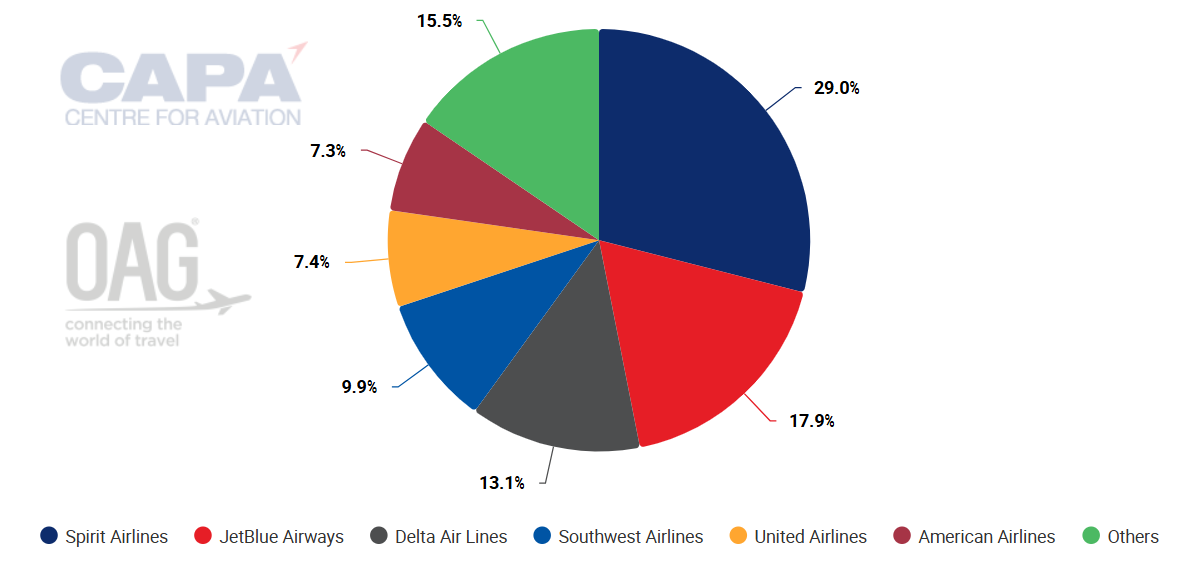

The story is a bit different in South Florida, where American has a 61% share of system departing seats.

JetBlue and United have seats shares of 17.9% and 7.4%, respectively, at Fort Lauderdale International airport. A possible merger would definitely improve United's stature in South Florida.

System seat share at Fort Lauderdale International Airport, as of early May-2025

Source: CAPA - Centre for Aviation and OAG.

Again, at this point it seems as if a merger is a distant possibility, and arguably industry conditions would have to improve for a deal to crystallise.

At the moment, many US airlines have pulled their full-year financial guidance, as economic policy has weakened domestic leisure demand. Although trends appear to be stabilising, consumer sentiment continues to fall, and discretionary spend could suffer later in the year.

United is also dealing with forced reductions of service at its Newark hub due to air traffic controller staffing and other issues, so it's not clear how much time executives have to devote to merger evaluations.

United-JetBlue merger fodder feeds an eager group of speculators

Obviously, airlines have to balance facing near-term headwinds, while mapping out a strategy to grow and thrive over the longer term.

United and JetBlue appear to be taking a minor step in that direction.

Still, the industry loves new mergers to speculate about, and this potential tie-up provides ample levels of intrigue.