Aircraft Interiors – industry development summary: Mar/Apr-2025

This regular CAPA - Centre for Aviation report provides a summary of major developments in the aircraft interiors sector, supported by data from the CAPA - Centre for Aviation Aircraft Interiors Database and CAPA - Centre for Aviation News.

This edition covers Mar-2025 and Apr-2025 and features:

A review of the 2025 Aircraft Interiors Expo;

Business plus a rising focus for seat manufacturers;

LEO secures position as the leader of IFC;

Latest global interior updates.

Summary

- This regular CAPA - Centre for Aviation report provides a summary of major developments in the aircraft interiors sector, supported by data from the CAPA - Centre for Aviation Aircraft Interiors Database and CAPA - Centre for Aviation News.

- This edition covers Mar-2025 and Apr-2025.

- A review of the 2025 Aircraft Interiors Expo.

- Business plus a rising focus for seat manufacturers.

- LEO secures position as the leader of IFC.

- Latest global interior updates.

2025 AIX in Review

The 2025 Aircraft Interiors Expo (AIX) was held in Hamburg from 14-Apr-2025 to 16-Apr-2025.

During the event, seat manufacturers continued to double down on the 'business plus' concept, with new announcements from RECARO Aircraft Seating, Thompson Aero Seating and STELIA Aerospace.

Attention focused on the in flight connectivity (IFC) space, with the sector holding much of the spotlight at AIX. Amazon made its official debut in the IFC market, while incumbents, including Viasat and Intelsat focused on reinforcing their market positions in response to Starlink's accelerating momentum.

In this issue of CAPA - Centre for Aviation's Aircraft Interiors spotlight we highlight these two major trends that stood out at the 2025 AIX.

Business plus rising as a focus for seat manufacturers

AIX 2025 saw various announcements from seat manufacturers for business plus, a concept covered by CAPA - Centre for Aviation numerous times in the past.

Conceived by Thompson Aero Seating, the original version of business plus debuted on Malaysia Airlines' Airbus A350 fleet in 2017.

The brilliance of the concept lies in its efficient use of cabin real estate. The seat overlaps with the footwell of the business class row behind, while the unused space at the front of the first row is re-purposed for additional features such as companion seats, larger screens and more spacious foot space.

In most cases, the seat shares mechanisms with other business class seats.

Described by Thompson as 'first class for free', business plus proved popular. Industry heavyweights such as Safran and Collins Aerospace soon followed suit with their own versions.

The concept was even extended to narrowbodies, as evidenced by the JetBlue Mint Studio. By reimagining what is effectively row one of business class, this concept provided airlines with a lower cost option to differentiate the cabin and retain premium guests.

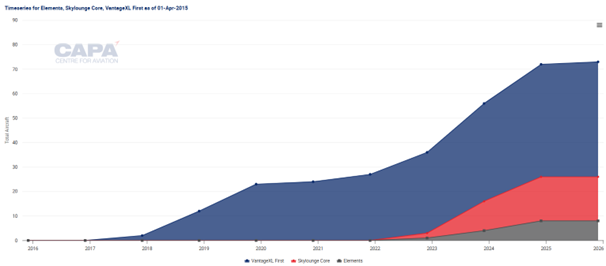

Timeline of in-service aircraft with business plus over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

At AIX 2025, Thompson added two versions of business plus:

- VantageXL+ First: The VantageXL+ line, a newly announced evolution of the VantageXL platform, is specifically optimised for the A350 and Boeing 787 and will be offered with a business plus option. China Southern Airlines is the global launch customer of VantageXL+ and will install four VantageXL+ First suites for row one of the 24 seat cabin.

- VantageNOVA First: In Sep-2024, Thompson entered the revenue herringbone space with its VantageNOVA line. At the time, the company teased a forthcoming business plus variant but provided few details. At AIX 2025, the concept, named 'VantageNOVA First', was fully unveiled. VantageNOVA is expected to enter service in 2026.

Meanwhile, AIX 2025 saw two legacy manufacturers enter the business plus space.

RECARO showcased a Business Class Plus front row suite for its R7 line, while STELIA Aerospace turned the first row of its OPERA SA into Business Class +.

Soon after AIX 2025, Air New Zealand and American Airlines both received their first aircraft with business plus seats.

Air New Zealand's first of 14 787s to be modified returned from Singapore after six months of retrofit work. Row one of Business Premier will feature 'Business Premier Luxe', which are otherwise standard Safran Visa seats with added sliding doors, companion seats and additional space.

American Airlines joined the cohort in late-Apr-2025 when Boeing delivered the first two of American's new 789P subfleet. In row one will be what American is touting as a "distinguished front row experience". Four 'Flagship Suite Preferred' seats will offer a different colour palette, additional space, more storage, and exclusive amenities.

Riyadh Air and Etihad Airways released renderings of their business plus plans.

Riyadh Air selected the Safran Unity platform for the Boeing 787-9 with Unity Elite in row one of the cabin.

Etihad became launch customer of STELIA Aerospace's OPERA SA Business Class +, selecting it for the Airbus A321LR First Suites.

Meanwhile, some airlines are still betting on completely differentiated experiences for first class guests.

In Apr-2025, Air France put the latest version of its La Premiere first class into service. The airline retained the signature curtain of the previous La Premiere design while adding a separate bed.

Across the channel, British Airways announced new designs for its first class cabins in late 2024. The airline plans to install the new seats on retrofitted A380s and future 777-9s from 2026.

Airbus believes a market still exists for dedicated first class, sharing a conceptual A350-1000 first class cabin at AIX 2025. The concept includes a massive master suite with its own lavatory, with the added space enabled by a revised layout near door one.

While first class may be here to stay, the share of aircraft offering either first class or business plus has been on a downward trend.

In Mar-2025, Korean Air announced a plan to retrofit its 777-300ERs by removing the first class cabin and installing a premium economy cabin.

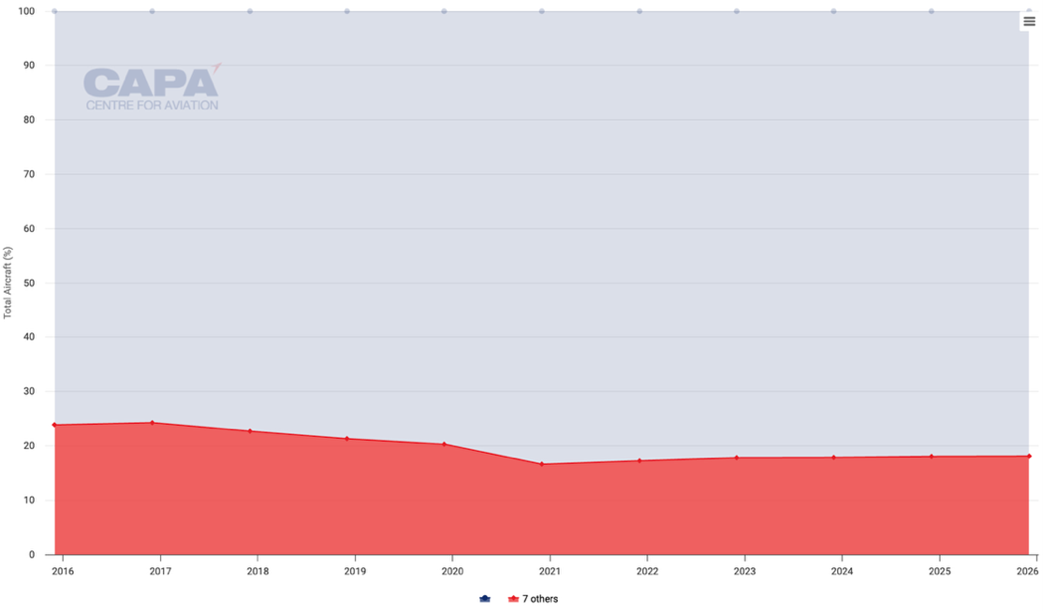

Share of in-service widebody passenger aircraft with first class or business plus over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

According to the CAPA - Centre for Aviation Aircraft Interiors Database, 23% of widebody passenger aircraft were equipped with first class or business plus in Apr-2015.

This number declined steadily pre-COVID but has since plateaued at around 18%. It remains to be seen if expanded OEM offering of Business plus options will reverse this trend.

LEO secures position as the leader of the IFC space

There has been no shortage of industry developments regarding low-earth orbit (LEO), and AIX 2025 was no exception.

Airbus added two new partners, Amazon and Hughes, to its HBCplus catalogue. Both partnerships emphasise LEO, with Amazon's Project Kuiper fully consisting of LEO offerings and Hughes leveraging Telesat's LEO network.

This marks Amazon's debut in the commercial IFC space, as it aims to tackle Starlink. Amazon and Hughes join five existing Airbus HBCplus managed service providers.

Noticeably absent is Viasat.

Viasat originally had its ex-Inmarsat GX solution as part of the HBCplus catalogue. This was possible as both GX and HBCplus utilise the Thinkom Ka2517 antenna.

As Viasat confirmed its post-integration strategy of exclusively allowing its in-house GM-40 kit to access the latest Viasat-3 network, this effectively confirmed Thinkom Ka2517 as not part of Viasat's future strategy. This may have also played a major role in the end of Viasat's HBCplus participation.

Viasat created headlines of its own. The OEM formalised a partnership with Telesat to access LEO capacity. Viasat also introduced Amara, the new IFC solution with multi-orbit capability, alongside Aera, an electronically steered antenna terminal slated for entry-into-service in 2028.

Riyadh Air will be among the first to activate Viasat's multi-orbit service, signing an agreement for its 787 fleet in Apr-2025.

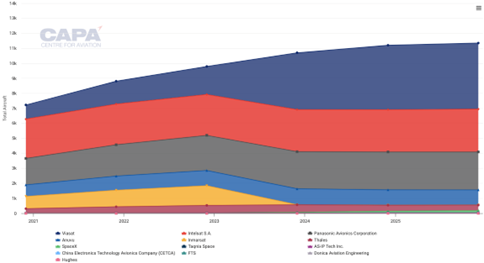

As of today, Viasat remains the IFC market leader. The acquisition of Inmarsat allowed the company to gain a sizeable lead ahead of any other IFC providers.

IFC market share over the past 10 years by number of in-service passenger aircraft

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

At AIX 2025, Panasonic Avionics announced Lufthansa subsidiary Discover Airlines as a client for Panasonic's multi-orbit IFC. This is the first publicly known client for the solution. Panasonic will leverage LEO capacity from the Eutelset OneWeb network.

Meanwhile, Intelsat secured line-fit offerability for its ESA kit on Embraer E2 aircraft. This comes as Intelsat's ESA solution achieves critical mass, passing 130 aircraft installed across Air Canada Express and American Eagle, while adding a new customer, Skymark Airlines.

Industry newcomer Neo Space Group (NSG), leveraging the SES Open Orbits solution, expanded its partnership with Thai Airways to 80 aircraft while adding Uzbekistan Airways as its latest client.

While Starlink didn't make any headlines during AIX, its threat to legacy players solidified with major recent developments.

In early Mar-2025, United Airlines finished the first installation of Starlink kits on one United Express (operated by SkyWest Airlines) Embraer E175. This marks the start of a mammoth fleet-wide installation effort covering over 1,000 aircraft.

WestJet also activated Starlink in Mar-2025. The CAPA - Centre for Aviation Aircraft Interiors Database tracks more than 20 737s already upgraded from Panasonic eXConnect to SpaceX Starlink IFC.

Meanwhile, Qatar Airways is close to completion with its 777 installation and will soon move on to its A350 fleet. This will mark the first time Starlink has been installed on an A350.

As mentioned in CAPA - Centre for Aviation's 'Aircraft Interiors - industry development summary: Jan/Feb-2025', Starlink's massive backlog is expected to help the SpaceX subsidiary dramatically increase its market share from 1% to over 20%, easily placing it in the top three.

Other latest global interior news

OEM

- Airbus and Panasonic Avionics to co-develop the future Connected Aircraft platform.

- Expliseat launches new economy seat, Ti Seat 2 X.

- IdeaNova introduces Inplsay Multicast wireless IFE solution.

- Mirus Aircraft Seating launches Falcon long range economy seat and Osprey premium economy seat.

- RECARO introduces R2 SPRINT seat and eVTOL seating solution.

- Thales launches 360Stream, industry-first live event-based IFE solution.

The Americas

- American Airlines to provide complimentary inflight WiFi, sponsored by AT&T.

- Azul selects RECARO to outfit its new A330 fleet.

- Caribbean Airlines expands deployment of Bluebox's wireless IFE to its ATR fleet.

- LATAM Airlines commences operation of Boeing 787 aircraft with renovated interiors.

Asia Pacific

- Air India picks Panasonic Astrova for 34 on-order widebody aircraft.

- All Nippon Airways to install RECARO R3 and R4 seats on Boeing 787-9 fleet.

- China Southern Airlines appoints Tangerine to design cabins for future A321neos and A350-900s.

- Malaysia Airlines to offer 1-1 Adient Aerospace Ascent suites on Boeing 737-10s.

- Thai Airways unveils A321neo cabin with seats from Thompson and RECARO.

- Thai Airways to retrofit A350 fleet from 2028.

- SriLankan Airlines selects Inflight Dublin's Everhub for W-IFE.

- Qantas Airways begins phased rollout of free international WiFi, starting with Southeast Asia.

Europe, the Middle East and Africa

- Air Côte D'Ivoire selects Bluebox wireless IFE for Airbus fleet.

- Ethiopian Airlines chooses Safran Z400 for 777-9 economy class.

- Israir Airlines to introduce WiFi entertainment system from 2025.

- flyadeal signs agreements with Geven, Astronics Corporation and Lantal Textiles for A320neos and A321neos, covering seating, in-seat power and furnishings.

- flynas to equip 60 new A320neos with Safran Z200 seating.

- TAAG Angola Airlines and Wamos Air to become launch customers of Unum One.

- TUI deploys Immfly platform across Boeing 737 fleet.

- Turkish Airlines selects Geven Essenza SE for A320ceos and A321ceos.