Air Canada's network diversification efforts create a buffer against falling US demand

Air Canada has been working to broaden its global network for more than a decade, and those efforts paid off during the first quarter as US tariff threats and other geopolitical uncertainty affected transborder leisure demand.

But the airline's sixth freedom traffic, which Air Canada has also steadily built over the last 10 years, remained robust, and the company sees opportunities to broaden its sixth freedom reach from Mexico.

It was an impressive reallocation of capacity on such short notice, and Air Canada remains confident that its network diversification will continue to serve as a buffer against future uncertainty, reflected by its decision to make a push into Latin America in 4Q2025.

Summary

- Air Canada quickly pivots capacity from US leisure routes as demand falls.

- The airline's US Sixth Freedom routes are performing well amidst trade whiplash.

- Air Canada's network diversification efforts come to fruition as demand on certain US routes slumps.

- The airline is not waiting for a US reset, and aims to mature redeployed capacity.

Air Canada quickly pivots capacity from US leisure routes as demand falls

An escalation in trade tensions between the US and nearly every major market in the world spurred weakness in demand in country's domestic economy leisure passenger segment, and on Canadian transborder leisure routes.

Air Canada executives recently told analysts and investors that it was experiencing booking declines on point-to-point transborder routes in the low teens, on average, for the next six months.

Canada's largest airline, and others, moved quickly to reallocate capacity out of US transborder leisure markets.

Air Canada's capacity measured by available seat miles is falling between 8%-10% year-over-year, depending on the month, its executives explained, with those decreases continuing into 3Q2025, and possibly into 4Q2025.

Air Canada's transborder traffic fell 7% year-over-year in 1Q2025, but yields actually increased by 2.6% and unit revenues were essentially flat.

The airline has reallocated capacity into the domestic market, and also to sun destinations in the Caribbean and Mexico.

Its fleet has also allowed Air Canada to launch more creative routes - evidenced by its plans to place a Boeing 737 MAX narrowbody on a Montreal-Edinburgh pairing in the North America summer season.

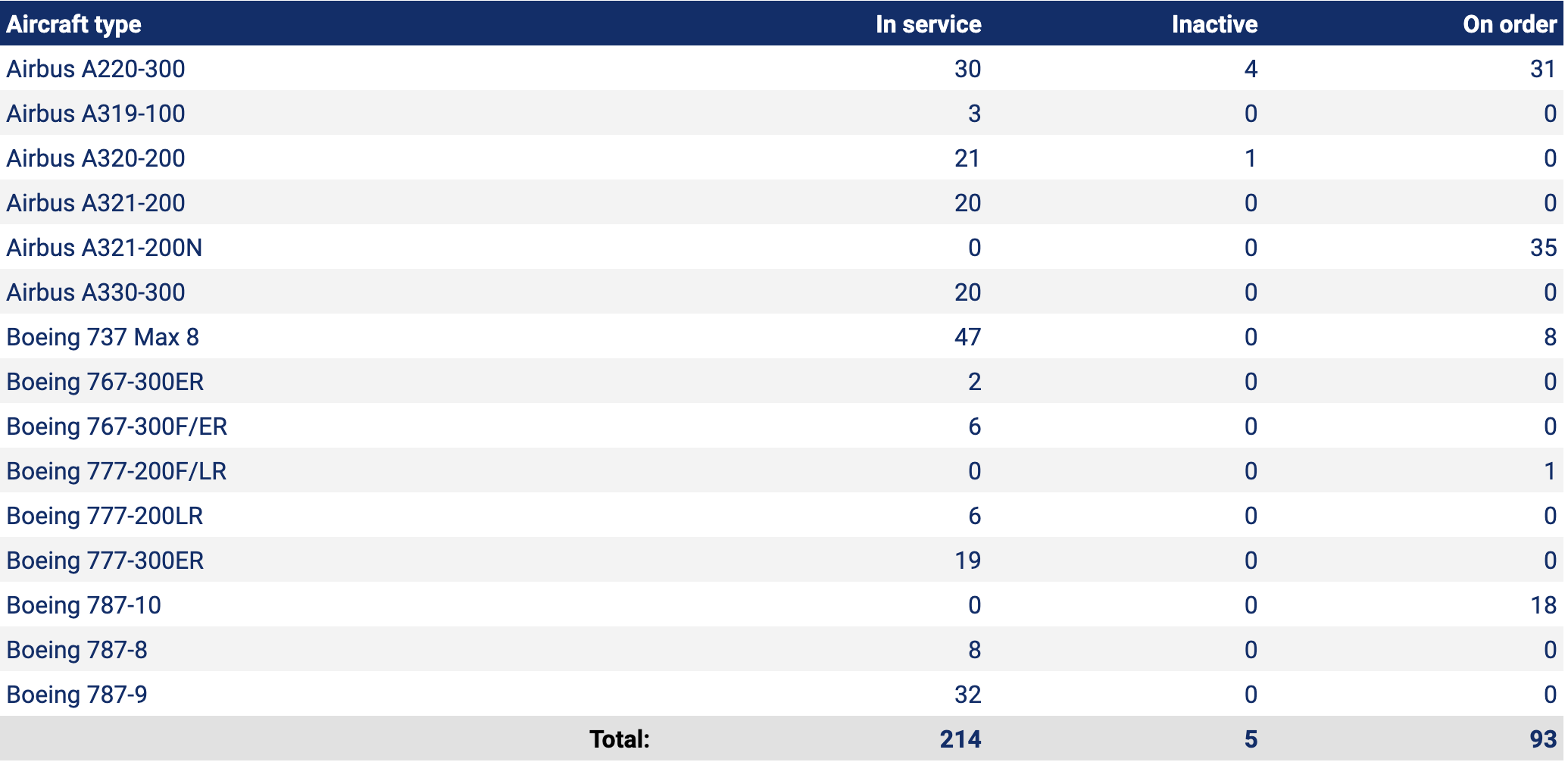

Air Canada: fleet summary, as of mid-May-2025

Source: CAPA - Centre for Aviation Fleet Database.

The airline's management said that results were solid in Mexico and the Caribbean, as Canadians sought alternative destinations.

A huge push is planned into Latin America by Air Canada in the northern winter period, with 16% capacity growth, four new destinations, and 13 new routes.

It's an interesting pivot for Air Canada, and perhaps shows that the airline is working to further shield itself from falling point of sale on Canada to US, if uncertainty lingers throughout the rest of 2025.

The airline's US Sixth Freedom routes are performing well amid trade whiplash

Air Canada's US sixth freedom traffic withstood uncertainty during Q12025; executives explained that bookings in that customer segment are well ahead of last year 2024, and its initial expectations for 2025.

The airline's sixth freedom revenues grew 12% year-over-year in 1Q2025, and Air Canada executives explained that the company had not adjusted any of its flights from the US that connect into international banks at its major hubs in Toronto, Montreal and Vancouver.

Instead, the airline has increased capacity at those specific bank times to promote as much sixth freedom traffic as possible, and early results are promising, said the airline's Chief Commercial Officer Mark Galardo.

He explained that at this point Air Canada had not cut any key business routes, including Toronto-New York and Toronto-Chicago.

As it continues to build out its intercontinental network, Air Canada also sees opportunities for growth in six freedom traffic from Mexico.

One of the new routes it is launching for the northern winter period is Toronto-Guadalajara, "...which we're very excited about, not only for the local traffic," Mr Galardo said; but the route is also timed extremely well for "...our international network, and we think we can have a decent proposition in the Sixth Freedom play between Europe and Mexico."

He also said that Air Canada was restoring service in another promising market, from Toronto to Monterrey (which was suspended last northern winter due to fleet challenges).

"Overall, we like the Mexico market, but we also like the counter-seasonality of that market and the potential Sixth Freedom contribution", that traffic could make to Air Canada's network, Mr Galardo added.

As of mid-May 2025, Air Canada's Mexico offerings comprised service to Cancún, Mexico City and Puerto Vallarta, CAPA - Centre for Aviation and OAG data show.

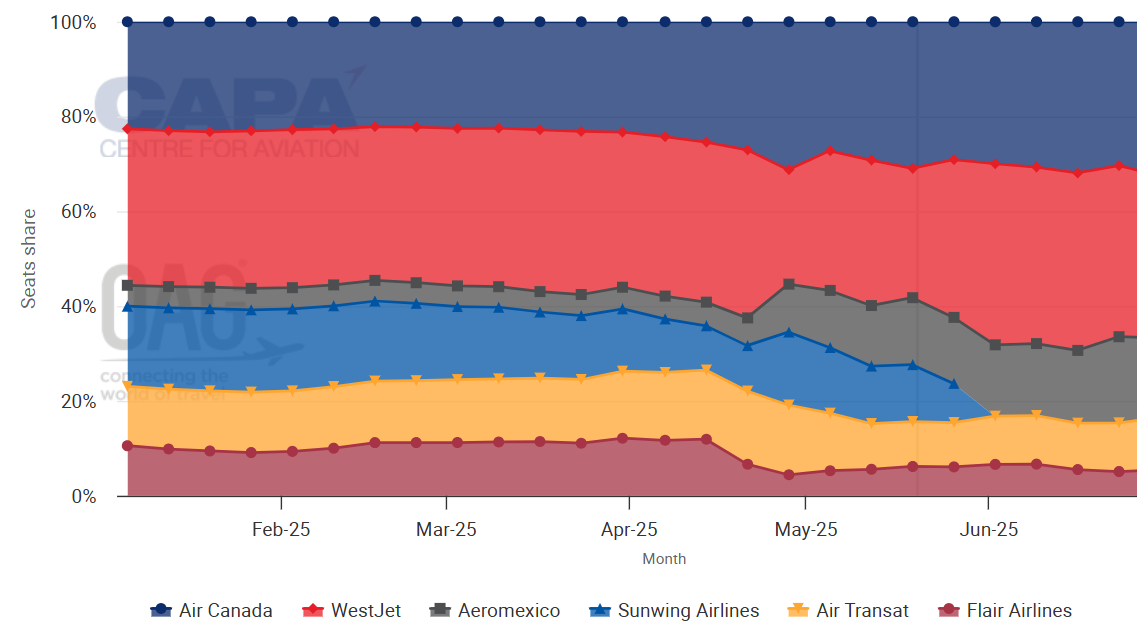

Canada - Mexico, two-way seat capacity, Jan-2025 - Jun-2025

Source: CAPA - Centre for Aviation and OAG.

Air Canada's two-way seat share from Canada to Mexico in the week commencing 19-May-2025 was 30.9% just ahead of WestJet's share of 27.3%.

Aeromexico had a 14.1% share, followed by Sunwing Airlines at 12.0% and Air Transat at 9.5%, to round out the top five operators in the market.

Air Canada's network diversification efforts come to fruition as demand on certain US routes slumps

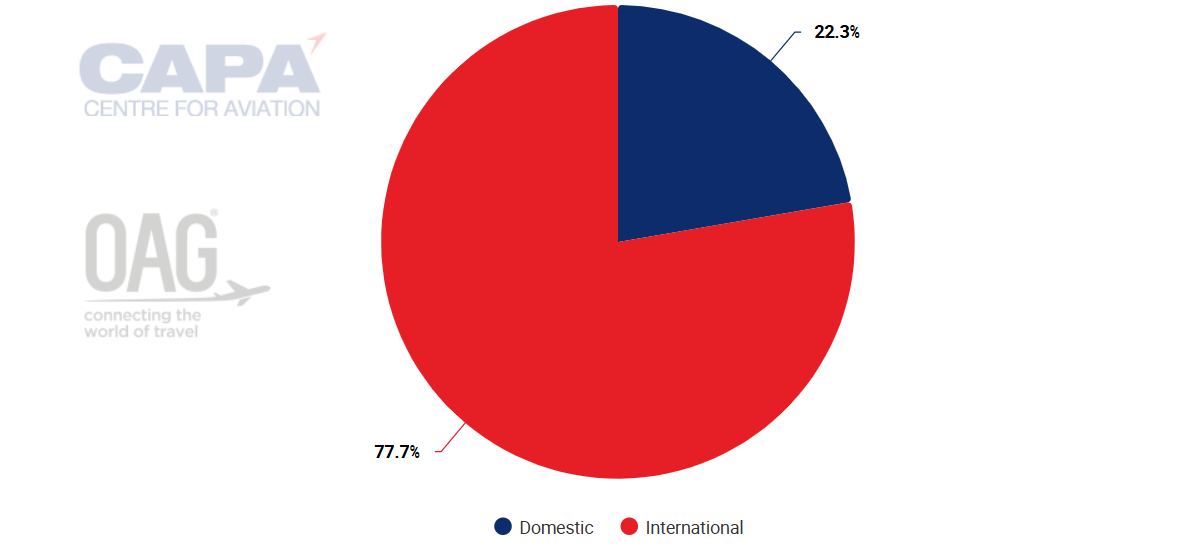

Realising that there are only so many opportunities in the Americas, Air Canada has worked to build global scale over the years, and as at mid-May-2025 more than three quarters of its ASMs were deployed into international markets.

Air Canada: international vs domestic ASMs, as of mid-May-2025

Source: CAPA - Centre for Aviation and OAG.

And although the US still accounts for a sizeable portion of Air Canada's departing ASMs, its network for 2Q2025 and 3Q2025 is weighted towards international long haul routes, which continue to show encouraging demand strength, said Mr Galardo.

"We do see favorable demand shift to Europe, domestic Canada and certain Asia Pacific markets like Japan, Thailand and Australia", he added.

"Overall, booking trends remain stable, reflecting the diversification and resiliency of our network," said Air Canada's CEO Michael Rousseau.

He also believes that Air Canada has acted quickly to "...reallocate capacity, moving to markets where demand was greater and de-risking our profile. Our established global footprint and fleet allowed us to adapt to travel trends and capitalise on them".

The airline is not waiting for a US reset, and aims to mature redeployed capacity

Air Canada obviously faces the same challenges as other airlines, given geopolitics changes at a dizzying pace. But the speed at which it pivoted capacity from one of its most important markets without major disruption is arguably a testament to the network diversification it has worked to achieve.

Additionally, the airline isn't resting on its laurels to determine if a reset will occur on certain US routes. Instead, it is looking to further diversify to feed its international engine.

"As we go forward, we'll mature into the capacity that we've reallocated elsewhere. And for [20]26 right now, it's a bit too early to speculate exactly what the market will look like," Mr. Galardo said.