Spain seeks more direct flights to Japan, Iberia the sole operator currently

The government of Spain is seeking to expand direct air services with Japan. It held meetings on 15-May-2025 with the Japanese government, and with representatives of Japan Airlines (JAL) and All Nippon Airways (ANA).

Currently the only direct Spain-Japan flights are a three times weekly service between Madrid and Tokyo Narita, operated by Iberia. The Spanish airline codeshares on the route with its oneworld partner JAL, and is part of the joint venture with JAL, British Airways and Finnair on routes between Europe and Japan.

Spain has much less direct capacity to Japan than other leading European markets, but tourism between Spain and Japan is growing rapidly.

The potential for increased nonstop capacity is significant.

Summary

- Iberia operates Madrid-Tokyo Narita – the only Spain-Japan nonstop service. It deploys Airbus A350-900s on a round-the-world return routing.

- Tokyo is the only Asia Pacific destination for Iberia, whose long haul network is focused on Latin America.

- British Airways is IAG's main Asia Pacific operator.

- IAG has much less Asia Pacific capacity than its major European rivals; Turkish Airlines is the biggest operator by Europe-Asia Pacific ASKs.

- Spain has much less direct capacity to Japan than other leading European markets.

- Tourism between Spain and Japan is growing rapidly, but is mainly served by indirect flights.

Iberia operates Madrid-Narita - the only Spain-Japan nonstop

In Oct-2016 Iberia launched the only nonstop Spain to Japan service, Madrid to Tokyo Narita.

The three weekly frequencies increased to five times in Oct-2018, but Iberia withdrew in Mar-2020 at the start of the COVID-19 crisis.

The service was restored on 27-Oct-2024 as a three times weekly operation.

It deploys A350-900s on a round the world return routing

Iberia deploys A350-900 aircraft, with 352 seats in a three cabin configuration (293 in economy, 28 in premium economy, and 31 in business class).

The outbound flight is 14 hours and the return is 16 hours. Both flights travel east, so the aircraft completes a circumnavigation of the world, due to the closure of Russian airspace and the direction of winds.

This requires a doubling of the flight crew to four pilots and 10 cabin crew (including at least three Japanese).

Tokyo is the only Asia Pacific destination for Iberia…

Tokyo is Iberia's only destination in Asia Pacific (it has not resumed the Shanghai Pudong service that it operated from Jun-2016 to Mar-2020).

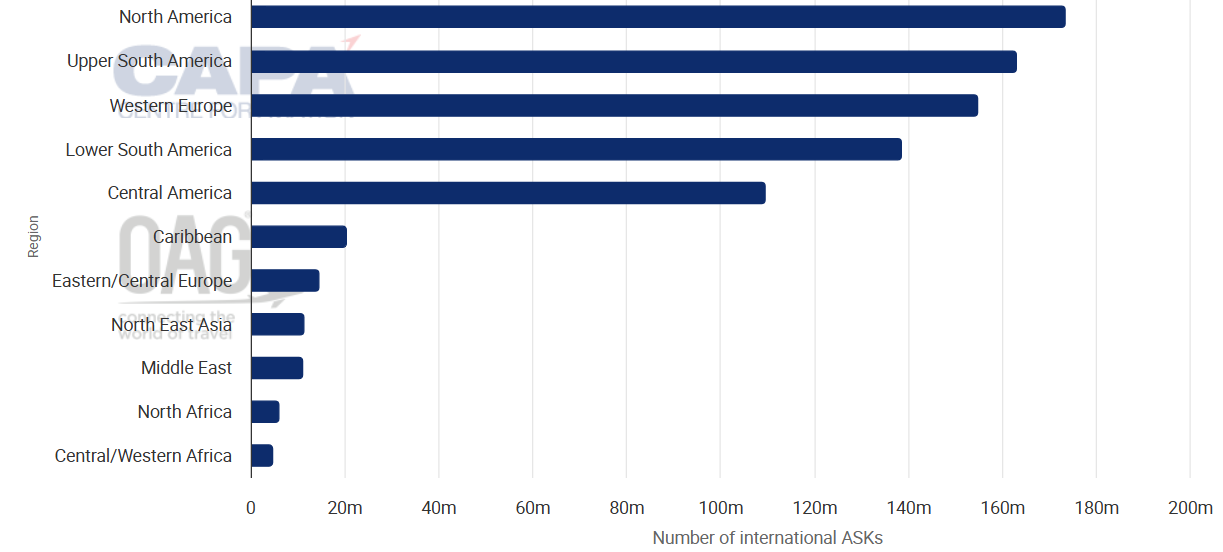

Iberia international: ASKs by region, week of 19-May-2025

Source: CAPA - Centre for Aviation and OAG.

…whose long haul network is focused on Latin America

Its long haul network is strongly focused on Latin America, where it has twice the seat capacity that it offers to other long haul regions.

According to data from CAPA - Centre for Aviation and OAG, Latin America accounts for 53% of Iberia's international departing ASKs in the week of 19-May-2025.

British Airways is IAG's main Asia Pacific operator

British Airways is the main operator to Asia Pacific for IAG, which owns Iberia and British Airways.

The UK airline has 13 destinations in the region, which accounts for 15% of its international ASKs in the week of 19-May-2025.

However, British Airways' most important region by ASKs is North America, which represents 40% of its international ASKs. By contrast with Iberia, Latin America accounts for only 8% of British Airways' international ASKs (half of this to the Caribbean).

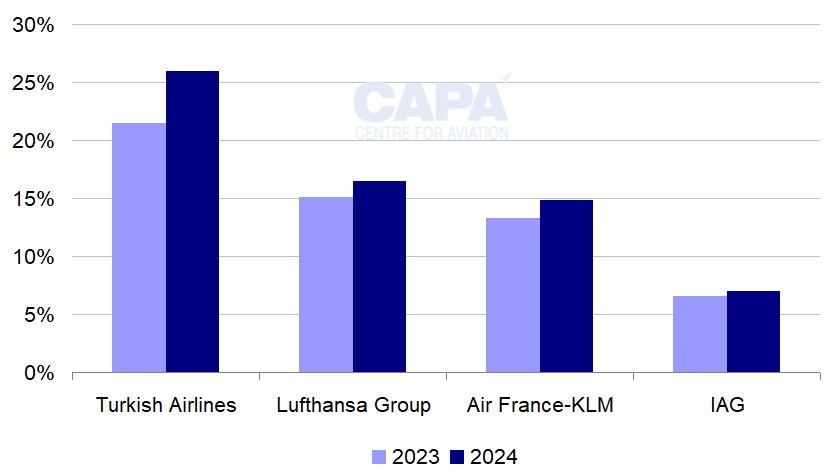

IAG has much less Asia Pacific capacity than its major European rivals

Compared with its leading European rival airline groups, Lufthansa Group and Air France-KLM, IAG is less exposed to Asia Pacific.

According to CAPA - Centre for Aviation/OAG, Asia Pacific accounted for only 7.0% of IAG's total scheduled ASKs in 2024.

The region accounted for 14.8% of Air France-KLM's ASKs in 2024, and 16.4% of Lufthansa Group's.

In absolute terms, IAG's total ASKs to Asia Pacific were only a little more than half the level of its two major European rival groups in 2024 (data source: CAPA - Centre for Aviation/OAG).

Leading European airline groups: share of their annual ASKs on routes to Asia Pacific, 2023 and 2024

Source: CAPA - Centre for Aviation and OAG.

Turkish Airlines is the biggest operator by Europe-Asia Pacific ASKs

All three of Lufthansa Group, Air France-KLM, and IAG rank behind Turkish Airlines, which is the biggest group by ASKs on Europe-Asia Pacific.

The region accounted for 25.9% of Turkish Airlines' 2024 scheduled ASKs, according to data from CAPA - Centre for Aviation/OAG.

In the ranking of all groups between Europe and Asia Pacific by ASKs scheduled for the first 10 months of 2025, Lufthansa Group and Air France-KLM are second and third respectively, and IAG is down in 9th place.

Air China, Singapore Airlines, China Eastern, Aeroflot and Thai Airways also rank above IAG.

Europe to Asia Pacific: top 9 airline groups by ASKs, 10M2024 and 10M2025

|

Rank |

Airline Group |

10M2024 |

10M2025 |

Growth |

|---|---|---|---|---|

|

1 |

26,272,496,097 |

27,843,058,496 |

6.0% |

|

|

2 |

23,203,370,354 |

22,646,933,638 |

-2.4% |

|

|

3 |

20,731,086,398 |

21,137,108,183 |

2.0% |

|

|

4 |

18,225,415,052 |

20,372,428,729 |

11.8% |

|

|

5 |

15,295,434,614 |

16,250,168,051 |

6.2% |

|

|

6 |

10,698,793,190 |

13,210,984,626 |

23.5% |

|

|

7 |

11,665,793,219 |

11,971,694,483 |

2.6% |

|

|

8 |

10,135,130,924 |

11,932,082,449 |

17.7% |

|

|

9 |

10,833,731,891 |

11,298,161,756 |

4.3% |

Source: CAPA - Centre for Aviation and OAG.

Spain has much less direct capacity to Japan than other leading European markets

The very low number of direct connections between Spain and Japan - only one route and three weekly frequencies - is noticeable.

Spain is Europe's second largest international aviation market by seats (after the UK), and Japan is Asia Pacific's second largest (after China).

In the week of 19-May-2025 there are four routes and 47 weekly departing frequencies between Germany and Japan.

There are two routes and 33 departing frequencies between France and Japan.

Between the UK and Japan, while there is only one route, there are 35 weekly frequencies.

Italy-Japan has two routes and 14 frequencies.

Tourism between Spain and Japan is growing rapidly, but is mainly served by indirect flights...

According to Spain's Minister of Industry and Tourism, the number of visitors from Japan to Spain increased by 32% year-on-year in 2024, to reach more than 410,000.

Moreover, according to data from the Japan National Tourism Organisation, there were 182,000 visitors from Spain to Japan in 2024 - this was 57% more than in 2023, and 40% more than in 2019.

Iberia's Madrid-Tokyo service - 352 seats, three times weekly, and assuming a load factor of 85% - carries only around 15,500 passengers annually.

This is only a small fraction of the numbers travelling between the two countries, indicating that a large majority are making connecting flights via other hubs in Europe, Middle East and Asia.

...with the Gulf hubs the main transit points

According to routes' analysis of Sabre Market Intelligence data, O&D traffic between Spain and Japan totalled nearly 590,000 two-way passengers in 2024 - a 45% increase year-on-year. However, only around 19% of travellers flew nonstop, with the bulk of passengers indeed connecting through intermediate hubs.

Dubai ranked as the largest one-stop market, followed closely by Gulf gateways in Abu Dhabi and Doha. Beijing Capital, Istanbul, Frankfurt, Paris, Helsinki, Amsterdam, and Hong Kong rounded out the top 10 connecting points.

Interestingly, Barcelona-Tokyo ranked as the top city pair between the two countries in 2024, despite the absence of nonstop service, accounting for 30% of total O&D traffic. Madrid-Tokyo followed with a 27.2% share, while Barcelona-Osaka ranked third at 11.4%.

However, overall Spain-Japan traffic remains about 14% below pre-pandemic levels, when Iberia operated up to five weekly flights on its Madrid-Tokyo route and provided approximately 2,800 two-way seats per week - approximately 25% more capacity than is available today.

The potential for more direct Spain-Japan capacity is huge

This suggests significant potential for increasing the number of direct flights between Spain and Japan.

When Iberia resumed Madrid-Tokyo in Oct-2024 it planned to increase the frequency from three to five times weekly during the course of 2025. This has not yet happened, nor is it currently scheduled to happen in 2025.

However, this might reasonably be expected to be a minimum response to support from both governments for growing the market in direct flights.

The Spanish government's press release does not directly refer to the possibility of increased Iberia services between Spain and Japan; rather, it mentions meetings with JAL and ANA.

From Iberia's perspective, and that of IAG, it would be preferable if its partner JAL provided any additional capacity.

Nevertheless, the magnitude of the market between the two countries, most of which is served with connecting flights, suggests that there is very significant scope for new nonstop capacity by any, or all, of JAL, ANA and Iberia.