Singapore Airlines is not immune to industry pressures, but remains in a strong position

Singapore Airlines (SIA) is confident that it has the right foundations in place to allow it to weather the latest wave of industry challenges - and also to take advantage of the next phases of Asia Pacific growth.

SIA's operating results are coming under the same pressures as those of most other Asian airlines - with headwinds from supply chain issues, competition, tightening yields, and geopolitical uncertainty.

While its earnings remain strong, these factors have contributed to a dip in the airline's operating profitability.

SIA has proven to be one of the most robust and consistent performers in the Asia Pacific region over many years, which inspires more confidence in its fundamental strategy than with most of its neighbouring rivals.

In a recent results briefing, the airline outlined some of the network, financial, and business model elements that underpin its strategy.

Group capacity is still expanding, although the subsidiary Scoot's growth has flattened off, due to narrowbody groundings.

The continued recovery in the mainland China market is a welcome sign for SIA.

Summary

- SIA Group’s annual net profit rose above USD2 billion, although operating profit was down 37% year-over-year.

- Singapore Airlines capacity has increased, but Scoot’s is down versus the previous year.

- More than a third of Scoot A320neo-family aircraft are inactive, CAPA - Centre for Aviation data shows.

- Group ASKs illustrate strength across many regions, although Southeast Asia still dominates seats.

- Scoot contributes dramatically to Southeast Asian network density, and is adding Embraer RJs to the mix.

- The group’s mainland China capacity has recovered to 86% of pre-pandemic levels.

Although operating profits are down, SIA is still achieving strong earnings, and has a healthy balance sheet

The SIA Group reported a net profit of SGD2.8 billion (USD2.2 billion) for the fiscal year ending 31-Mar-2025.

This was up 3.9% from last year's profit, but it was inflated by the one-off gain of SGD1.1 billion resulting from Air India's takeover of the joint venture Vistara.

Excluding this gain, the group's operating profit slid by 37.3% year-on-year, to SGD1.7 billion.

As with many other Asia Pacific airlines, yields fell as industry capacity rose - but are still at higher levels than before the COVID-19 pandemic.

This is part of the continuing process of settling to the new industry normal.

The other broader industry trend is record revenues, but also higher costs as flying increases and supply chain headaches bite.

Despite SIA's recent dip in profits, it still justifiably claims to have one of the strongest balance sheets in the industry.

The group reported healthy liquidity as of 31-Mar-2025, with a SGD8.3 billion cash balance, SGD1.8 billion in fixed deposits, and SGD3.3 billion in committed lines of undrawn credit.

This represents a key buffer against any potential industry shocks, and gives it flexibility in its reaction to dynamic global trade shifts.

Group year-on-year capacity growth has been moderating, particularly for Scoot

The Group's capacity - as measured in ASKs - was up by 8.2% for the full fiscal year, and 5.7% for the fiscal second half. The airline's latest monthly report shows ASKs were up by 4% year-on-year for the month of Apr-2025.

So the year-on-year comparisons are progressively narrowing.

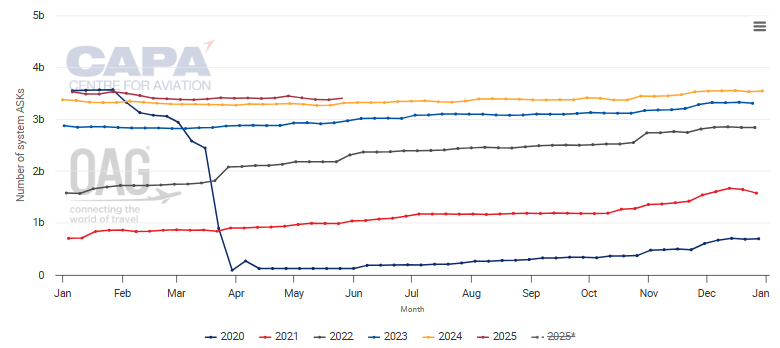

The chart below, using weekly ASK data from CAPA - Centre for Aviation and OAG, shows a steady rise of capacity for the SIA Group.

For the week of 19-May-2025, ASKs were up 3.2% year-on-year, and seats were up by 3.9%.

SIA Group: capacity, as measured in ASKs, from 2020

Source: CAPA - Centre for Aviation and OAG.

Within the group numbers, there is considerable difference in growth between the full service carrier SIA and the LCC Scoot.

For the full fiscal year, SIA's capacity was up by 10.6% year-on-year, and Scoot's was essentially flat.

In Apr-2025 SIA's monthly ASKs were up by 5.8% year-on-year, whereas Scoot's were actually down by 2.2%.

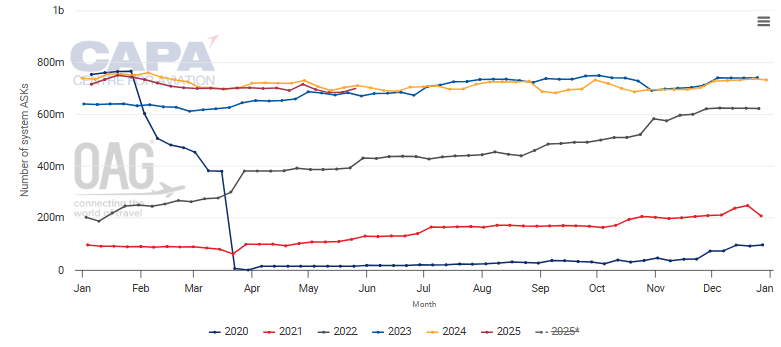

The chart below, from CAPA - Centre for Aviation and OAG data, shows Scoot's ASKs hovering just below 2024 levels for most of the early part of 2025.

ASKs were down 2.6% year-on-year for the week of 19-May-2025.

Scoot: capacity, as measured in weekly ASKs, from 2020

Source: CAPA - Centre for Aviation and OAG.

Scoot's engine-related groundings and delays to group deliveries have disrupted fleet planning, but new arrivals will help

The major reason for Scoot's lack of capacity growth has been aircraft grounded due to the global maintenance backlog for Pratt & Whitney engines on A320neos and A321neos.

The CAPA - Centre for Aviation Fleet Database lists five of Scoot's seven A320neos as inactive, and one of its 10 A321neos. It also has two A320ceos inactive.

Scoot has a fleet of 30 Airbus narrowbodies, five Embraer 190-E2s, and 22 Boeing 787s.

While it did take delivery of additional aircraft during the 2024/2025 fiscal year, phasing out older aircraft and the grounded capacity offset the gains.

Delivery delays have also been a factor for the group. SIA's major widebody order is for 31 Boeing 777-9s, but this programme has seen repeated manufacturer delays.

SIA CEO Goh Choon Phong noted the airline has multiple levers it can pull to mitigate the effects of delays on its fleet plans, such as extending leases and prolonging the operation of some owned aircraft.

The Group expects to take delivery of 22 aircraft in the 2025/26 fiscal year, while phasing out nine.

SIA is scheduled to receive two 787-10s and six 737-8s, while removing four 737-800s in preparation for lease returns.

Scoot is due to take delivery of one 787-8, one 787-9, five A320neos, three A321neos and four E190-E2s.

Five A320ceos will be returned to lessors.

SIA Group's broad global footprint gives it flexibility to adapt to demand

Mr Goh stresses that with the current macroeconomic volatility, SIA's diversified network is an advantage, allowing it to adjust to shifts in global passenger flows.

The share split for group ASKs for FY2024/25 was 25% for North Asia, 20% Southwest Pacific, 19% Europe, 12% Southeast Asia, 12% West Asia and Africa, and 12% the Americas, according to information presented by the airline.

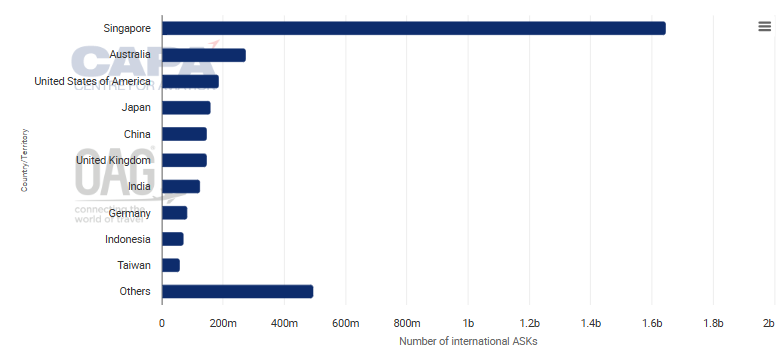

Data from CAPA - Centre for Aviation and OAG showing the group's leading country markets emphasises the geographical diversity - at least in terms of ASKs.

Singapore Airlines Group: top markets by country, as measured in ASKs for the week of 19-May-2025

Source: CAPA - Centre for Aviation and OAG.

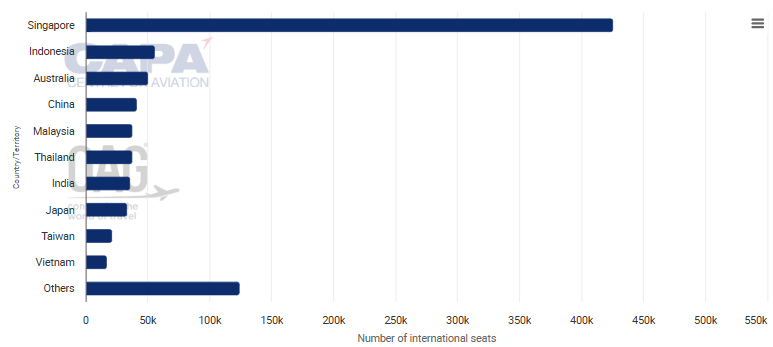

When measured in weekly seats, the list looks a lot different, as the shorter-haul Asian markets gain more prominence.

Singapore Airlines Group: top markets by country, as measured in departing seats for the week of 19-May-2025

Source: CAPA - Centre for Aviation and OAG.

The group has enhanced its geographic reach through its list of codeshare partners and strategic alliances.

One of the most important is its shareholding in Air India, which gives SIA Group a foothold in one of the fastest growing international markets.

Asian markets are still the main focus for capacity - and that's where the greatest potential lies

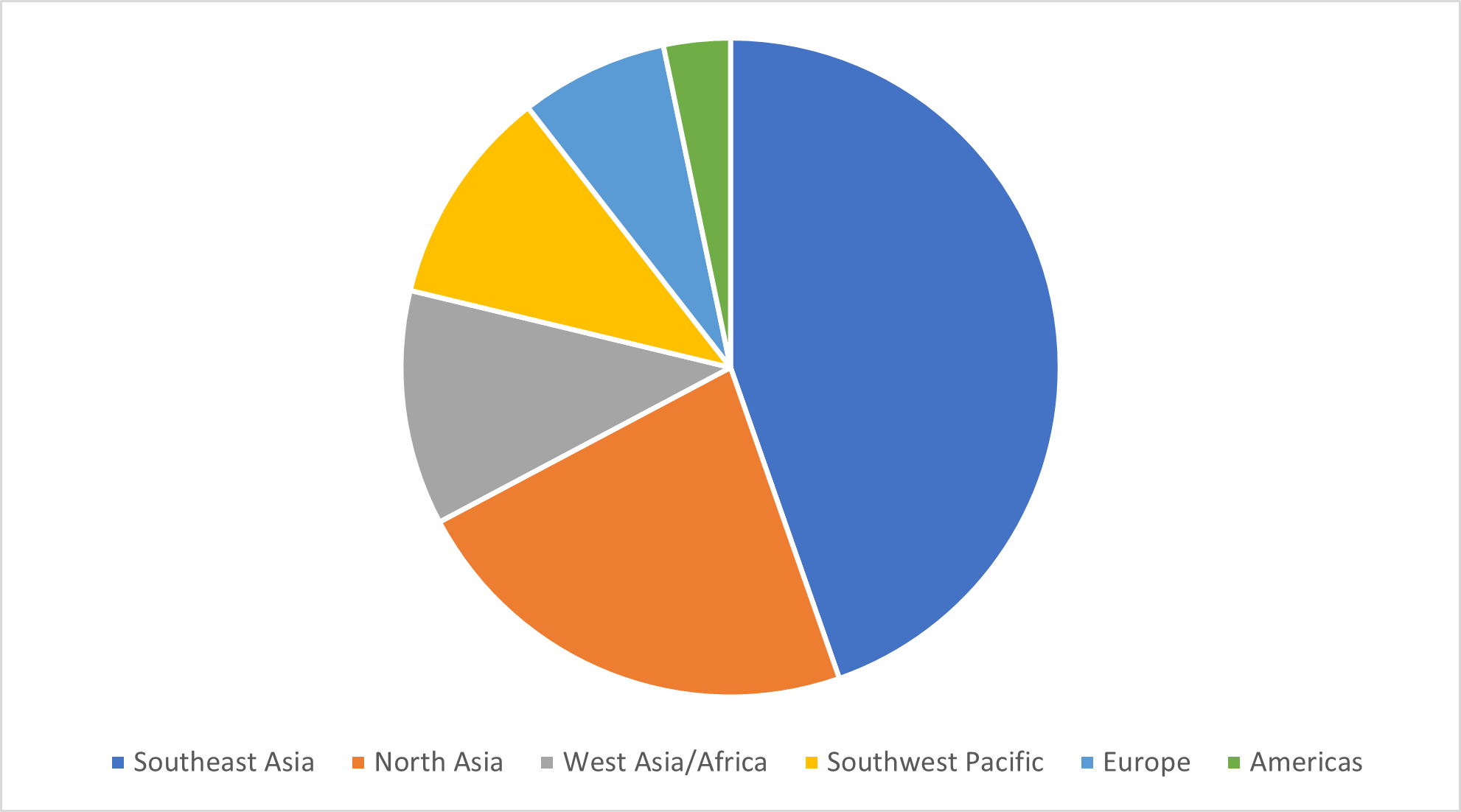

Although the group has a strong presence in many regions, particularly in terms of ASKs, the Southeast Asian region is clearly dominant in terms of weekly seats and frequencies.

SIA Group had 763 flights per week to Southeast Asia as of 1-May-2025, the airline's figures show.

Next highest was North Asia with 386 flights per week, West Asia (including India) and Africa with 197, Southwest Pacific with 183, Europe with 124, and the Americas with 56.

The chart below illustrates the frequencies breakdown.

SIA Group: weekly frequencies by region, as of 1-May-2025

Source: SIA data.

Mr Goh noted that Southeast Asia, and the Asian region more broadly, are expected to have the highest global demand growth in coming years.

SIA has the advantage of being well located to take advantage of this trend, with an extensive network across Asia.

Scoot plays a major role in the group's approach to the Southeast Asia market

The group's multi-model approach has been particularly helpful in expanding Southeast Asian services.

LCC Scoot has allowed the group to "densify its network" in Asia, and has given it greater flexibility in matching aircraft sizes to markets, Mr Goh said.

This is now even more true since Scoot began introducing the E190-E2s in 2024. It now operates five of these regional jets.

Scoot adds 47% more weekly frequencies to those of the full service SIA across its network as of 1-May-2025, SIA said.

This number is much higher in the Southeast Asia market, where Scoot adds 80% more frequencies to those operated by SIA.

Scoot adds 51% more frequencies in North Asia, 21% in Southwest Pacific, 27% in West Asia and Africa, and 3% in Europe.

This highlights that the greatest contribution of Scoot is in the closer Asian markets, which is to be expected, given that it has a far higher narrowbody mix than the full service carrier.

Scoot has 21 Boeing 787s and 32 Airbus and Embraer narrowbodies, while SIA has 125 passenger widebodies and just 20 narrowbodies.

Most of Scoot's 787s are deployed within the Asia Pacific region, with the exception of routes to Jeddah and Athens.

SIA Group's mainland China capacity is moving closer to pre-pandemic levels

The China market is important to the SIA Group, and is third on the group's list of country markets in terms of weekly seats.

Outbound travel from mainland China has still not yet recovered to pre-pandemic levels, Mr Goh said.

However, the SIA Group has seen "a surge in inbound travel" into China over the past six months or so.

This has resulted in load factors on mainland China flights rising into the 80s this year, compared to load factors in the 70s last year.

For the full service carrier, capacity to mainland China has largely recovered to pre-pandemic levels, Mr Goh said.

SIA has been able to operate regular services to some secondary cities that had previously been restricted, while capacity to the main centres of Beijing, Shanghai and Guangzhou has been restored to pre-COVID levels.

Meanwhile, Scoot's capacity to mainland China has recovered to about 80% of pre-pandemic levels. The airline is operating to 15 mainland destinations.

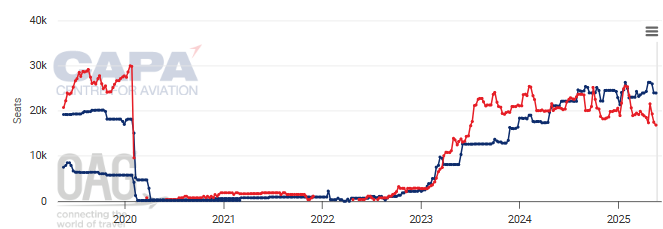

The chart below shows capacity in the Singapore-mainland China market operated by the SIA Group airlines: the red line represents Scoot, the middle blue line Singapore Airlines, and the darker blue line at the bottom is SilkAir, which ceased operations in May-2021.

SIA Group capacity between Singapore and mainland China by airline, as measured in one-way weekly seats (from 2020)

Source: CAPA - Centre for Aviation and OAG.

The data from this chart confirms that Scoot is operating 81.1% of its 2019 capacity level in the week of 19-May-2025.

Singapore Airlines is operating 24.8% more capacity than the same week in 2019, but that is mainly because it absorbed most of SilkAir's operations.

Overall, the SIA Group airlines have reached about 86% of the capacity they operated to mainland China.

SIA is well placed to confront short term and long term industry challenges

SIA's major strategic and financial building blocks have been put in place over many years.

Although they are very much aimed at the long term, these factors will still help the airline navigate the current industry challenges better than others.

Engine availability issues are stalling Scoot's growth. And delivery delays are causing planning complications for SIA.

These headaches will likely continue to put pressure on year-on-year capacity comparisons.

However, the group's robust financial health is an enviable asset. During the post-pandemic period the airline has often said that this allows it to look beyond short term concerns and target new opportunities arising from industry challenges.

The Group's broad network is another advantage, and its multi-model approach is a useful tool in serving growing Asian markets.

It is true that SIA benefits from one of the world's best-known hub airports, and support from a government that understands the value of air travel to the economy.

However, the airline has also proven over the years that it is extremely well managed, which may well be its true strategic advantage.