World airline outlook: IATA trims profit forecast. Tariffs bite; returns stay below cost of capital

On 2-Jun-2024 International Air Transport Association (IATA) trimmed its forecast of airline industry profit in 2025. The dramatic hike in US import tariffs has led to weaker global economic growth forecasts and lower expected demand for both passenger and cargo air travel.

IATA notes that the previous, more robust, economic outlook "has been thwarted by US trade policy that brings protectionism to a level not seen in decades".

However, the lower revenue outlook is very nearly matched by a lower forecast of costs (not least because of lower oil prices, themselves a result of the weaker economic backdrop).

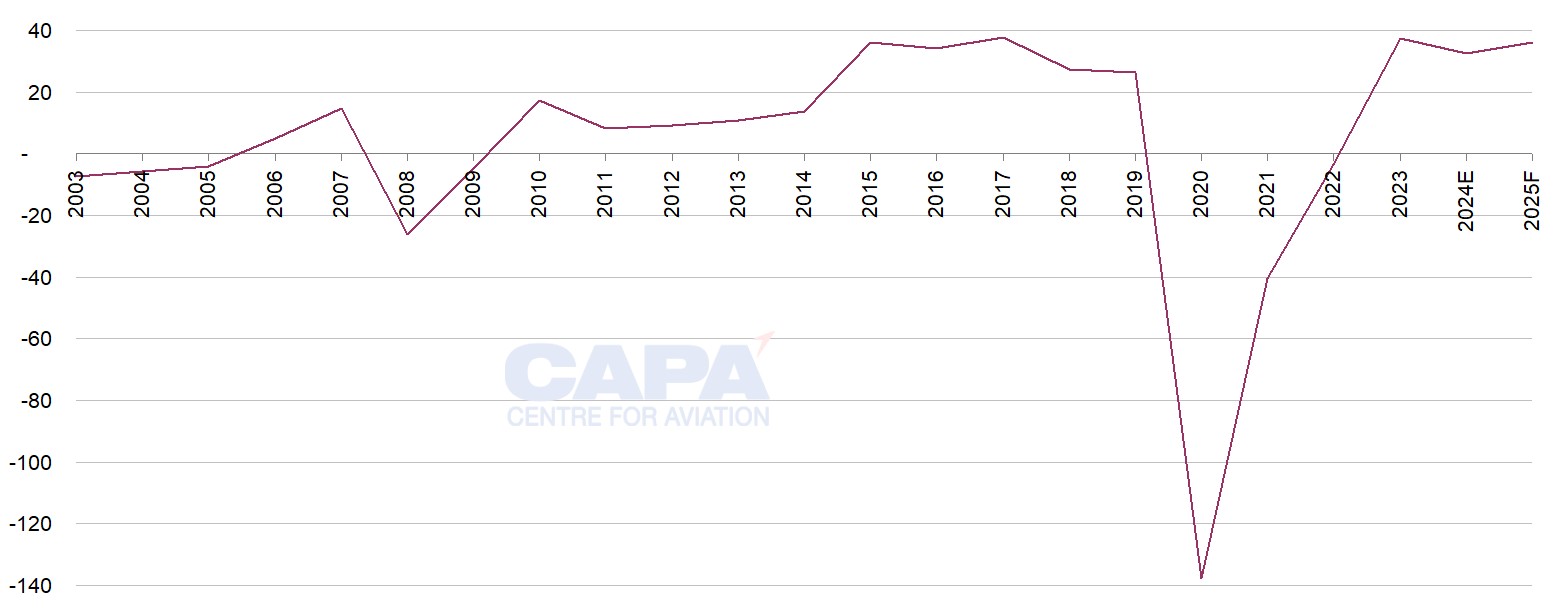

The overall impact is that IATA expects a net profit forecast of USD36.0 billion, which is only slightly below its previous forecast of USD36.6 billion.

However, this continues to translate into a return on capital that is below the cost of capital. Moreover, the gap is widening.

As CAPA - Centre for Aviation has frequently argued, this shortfall to the cost of capital is evidence of an industry in need of further consolidation.

Summary

- IATA has trimmed its 2025 net profit forecast from USD36.6 billion to USD36.0 billion.

- Forecasts of both revenue and cost have been lowered due to weaker economic growth.

- Passenger revenue is forecast to grow by 1.6%, and cargo revenue is forecast to fall by 4.7%, but cargo’s share of total revenue is still higher than in 2019.

- A small forecast increase in total cost hides an expected fall in fuel cost as crude oil prices are lower.

- The balance between lower fuel costs and a weaker economy is key to industry profits.

- Key financial measures are ahead of 2019, including return on invested capital (ROIC), but the shortfall between ROIC and the cost of capital is widening.

IATA has trimmed its 2025 net profit forecast from USD36.6 billion to USD36.0 billion

IATA forecasts a net profit for the world airline industry of USD36.0 billion in 2025, which is up from USD32.4 billion in 2024. However, this is below the 2023 peak of USD37.3 billion.

In its last industry outlook, published in Dec-2024, IATA forecast USD36.6 billion for 2025, so its latest projection represents a small downward revision.

Forecasts for both revenue and cost have been reduced, reflecting a weaker outlook for economic growth.

See related report: Aviation and the Trump tariffs: clouds are darkening

IATA now models global GDP growth at 2.5% in 2025 - significantly slower than its previous forecast of 3.2%.

The cut to the revenue forecast is slightly greater than on the cost side.

World airline net profit (USD billion), 2003 to 2025F

Source: IATA Economics, CAPA - Centre for Aviation.

Forecasts of both revenue and cost have been lowered

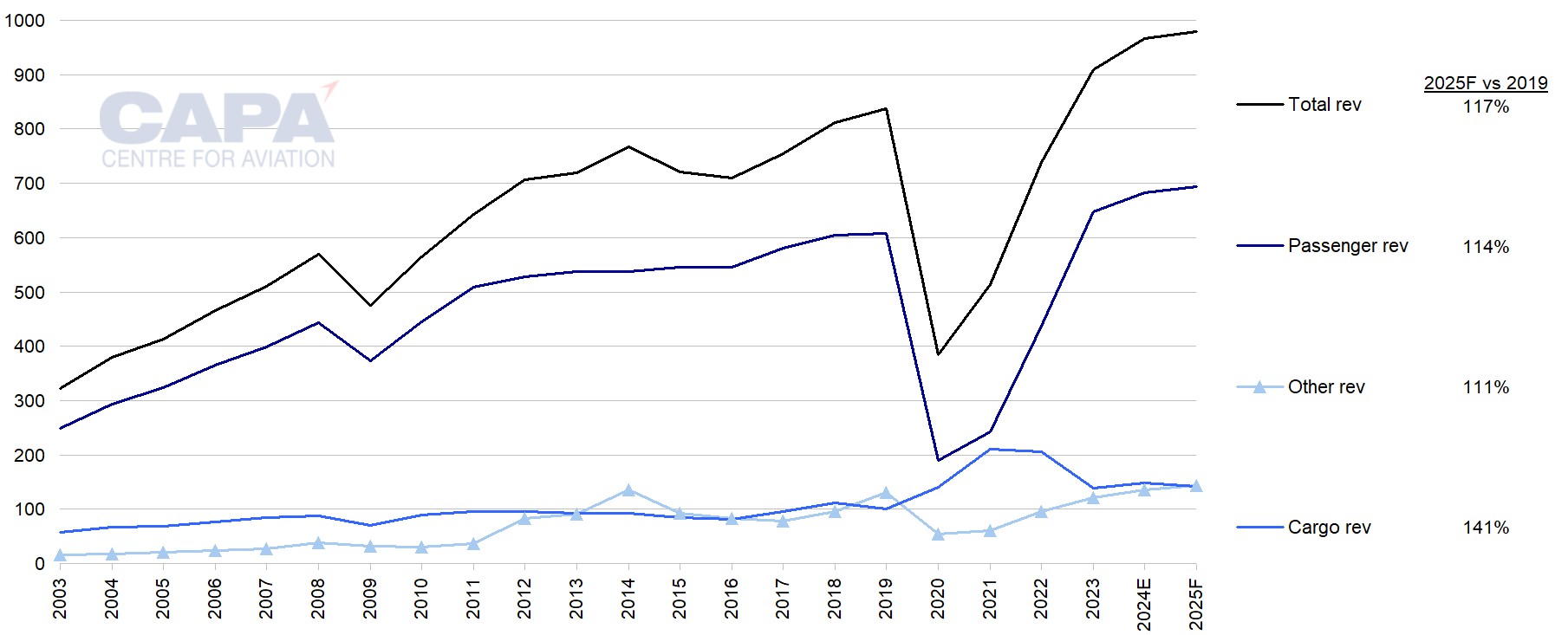

IATA expects 2025 industry revenue to grow by only 1.3%, to USD979 billion, which is less than its Dec-2024 forecast of 4.4% growth to USD1,007 billion.

It forecasts costs to grow by 1.0%, to USD913 billion (below its previous forecast 4.4% growth to USD940 billion).

Passenger revenue is forecast to grow by 1.6%...

Passenger revenue is forecast to grow by 1.6%, to USD693 billion, in 2025. This compares with grow of 5.2% in passenger revenue in 2024.

Scheduled segment passenger numbers are forecast to be almost 5.0 billion in 2025, an increase of 4.4% year-on-year.

However this is 4.5% lower than the 5.2 billion forecast by IATA in Dec-2024 for 2025. Moreover, it is slower than the 8.0% growth in passenger numbers achieved in 2024.

RPK growth for 2025 is now forecast to be 5.8% - down from 8.0% previously.

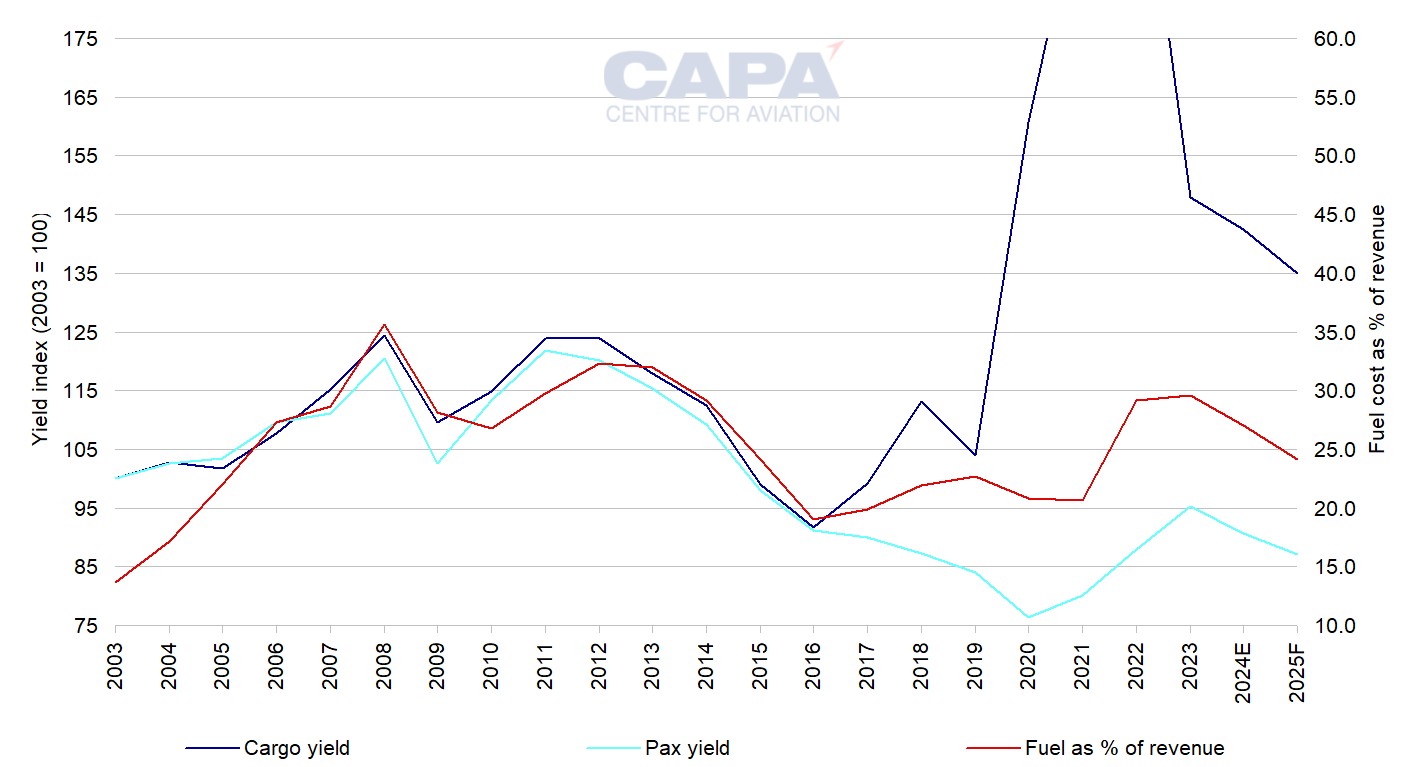

IATA has slightly adjusted its expectation of passenger yield growth in 2025 to -3.2% from -3.7%.

…and cargo revenue is forecast to fall by 4.7%...

Cargo revenue is forecast to fall by 4.7% this year, after an increase of 7.2% last year. This reflects a weaker outlook for world trade as a result of increased tariffs on US imports.

Cargo traffic volume growth is forecast to slow from 11.3% in 2024, to just 0.7% in 2025, compared with the previous forecast of 6.0%.

Cargo yield is forecast to fall by -5.2% (-0.7% previously).

World airline revenue (USD billion), 2003 to 2025F

Source: IATA Economics, CAPA - Centre for Aviation.

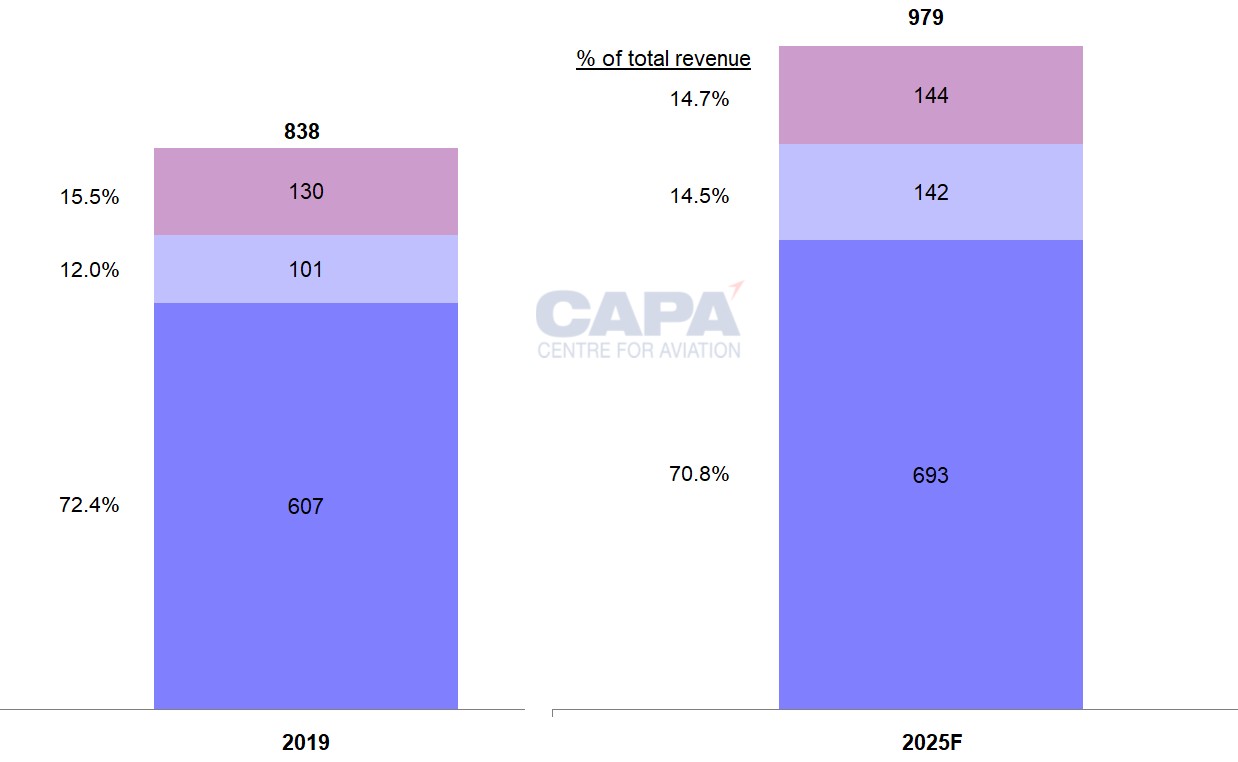

…but cargo's share of total revenue is still higher than in 2019

Revenue is forecast to be above pre-pandemic levels for the third successive year in 2025, reaching 117% of 2019 levels. However, the mix of revenue has changed since the COVID-19 crisis.

Passenger revenue is expected to be at 114% of 2019 levels this year 2025, with cargo revenue at 141%, and other revenue at 111%.

Passenger revenue is forecast to be 70.8% of total revenue in 2025, below the 72.4% share it had in 2019. The share of other revenue is forecast to be 14.7% versus 15.5% in 2019.

In 2019 cargo revenue was 12.0% of industry revenue, but its share is forecast to rise grow to 14.7% in 2025.

However, this is below its 2024 share (15.4%) and its COVID-era peak of 40.9% in 2021 (when passenger traffic was at very low levels, but air cargo was boosted by the transport of medical supplies).

World airline revenue (USD billion), 2019 and 2025F

Source: IATA Economics, CAPA - Centre for Aviation.

A small forecast increase in total cost hides an expected fall in fuel cost

IATA's forecast of a 1.0% year-on-year increase in total cost in 2025 comprises a 5.3% increase in non-fuel cost, but a 9.6% drop in fuel cost from 2024.

Fuel cost is forecast to fall from 27.0% of revenue in 2024 to 24.1% in 2025 (it was as high as 29%-30% in 2022 and 2023).

This reflects Brent crude oil now modelled at USD69 per barrel in 2025, compared with USD75 in IATA's previous forecast (and USD81 in 2024).

Lower fuel costs versus weaker economy is key to industry profits

A key issue for industry profitability is the balance between lower oil prices, which reduce costs, and weaker economic growth, which reduces revenues.

Historically, air traffic growth has been closely linked to economic growth, and so, cuts to world GDP forecasts mean lower demand for air travel.

A weaker economy often also means lower demand for crude oil, which reduces prices for this commodity and its derivatives (including jet fuel).

Moreover, both passenger and cargo yield have shown a close historical relationship with fuel cost as a percentage of revenue in the airline industry.

Airlines typically look to pass on higher fuel costs through higher fares, while lower fuel costs can mean lower fares (which can help to boost demand).

Potentially offsetting downward pressure on fares, capacity constraints resulting from supply chain challenges may continue to be beneficial for airline unit revenue.

World airline industry: cargo and passenger yield (indexed to 2003 = 100) and fuel cost as a percentage of revenue, 2003 to 2025F

Source: IATA Economics, CAPA - Centre for Aviation.

The airline industry is set to stay ahead of 2019 on key financial measures…

For the second successive year, IATA forecasts that the world airline industry will be ahead of 2019 levels on a number of key metrics in 2025 (in addition to revenue, as already noted).

It can be calculated from IATA's forecasts and historic data that scheduled passenger numbers are set to be up by 9% compared with 2019, RPKs up by 10%, and cargo volume up by 8%.

Passenger yield is forecast to be 4% above 2019, and cargo yield to be 30% higher.

Net profit is forecast to be 36% higher than in 2019. The net margin is forecast to be 3.7%, which is 0.6ppts higher than in 2019.

IATA forecasts that the industry's operating profit margin will be 6.7%, 0.6ppts above 2019.

A further measure favoured by IATA is net profit per departing passenger. This is forecast at USD7.2 in 2025, which is 25% higher than in 2019.

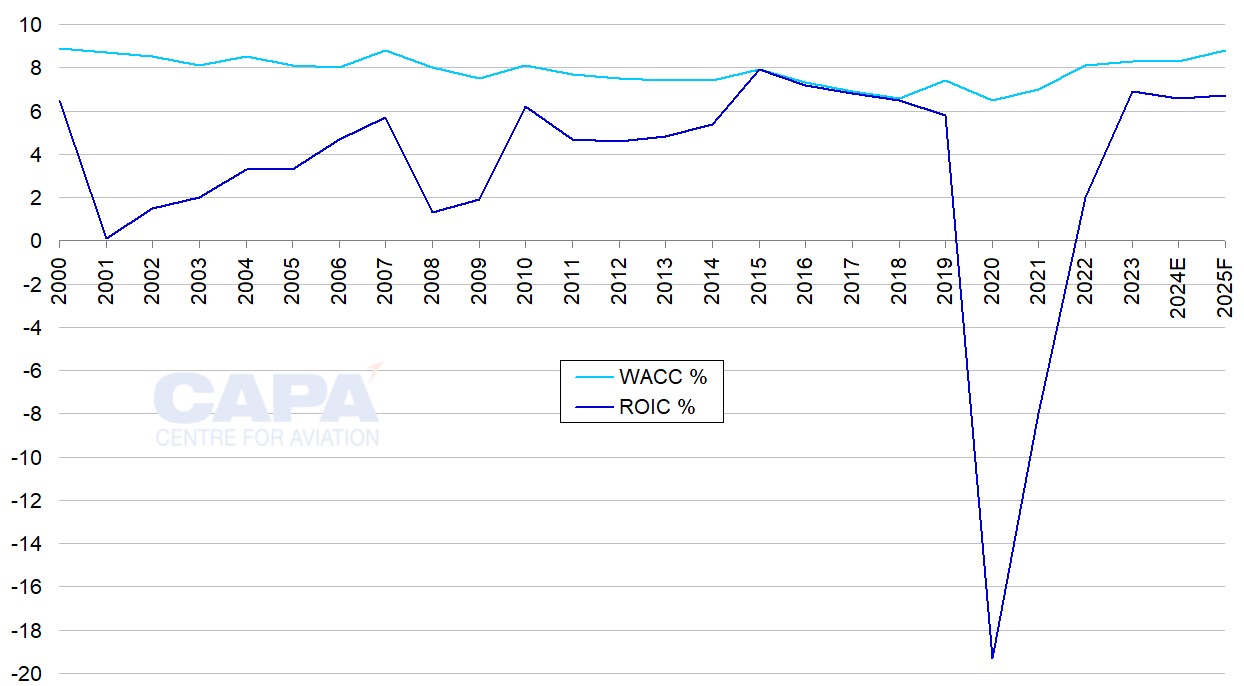

…including return on invested capital (ROIC)…

Even return on invested capital (ROIC) is expected to be above 2019 levels, for the third successive year.

ROIC was 5.8% in 2019 and reached 6.9% in 2023, before slipping down to 6.6% in 2024.

IATA forecasts the industry's ROIC at 6.7% in 2025, which is a little below the 2023 level, but 0.9ppts above the 2019 figure.

…but the shortfall between ROIC and the cost of capital is widening

However, in spite of improvements compared with 2019 in almost every measure of traffic, revenue, profit, the 2025 forecast of ROIC is below the weighted average cost of capital (WACC).

The shortfall between ROIC and WACC is forecast to be 2.1ppts in 2025, which is more than the 1.6ppt gap reported in 2019.

Moreover, this shortfall has also widened in each of the past two years.

Since the COVID-19 pandemic the cost of debt has risen, and this has contributed to an increase in the WACC, which factors in both equity and debt capital and the risk of investing in the sector.

The WACC is the minimum ROIC demanded by investors, so investors may put their capital elsewhere if investing in the airline industry fails to meet this required return.

World airline industry: return on invested capital and weighted average cost of capital, 2003 to 2025F

Source: IATA Economics, CAPA - Centre for Aviation.

Aviation needs less fragmentation to allow better returns

The imperative to attract capital to finance aviation's transition to a sustainable future is growing.

This requires a less fragmented industry structure, in which returns in line with the cost of capital are possible. Governments and regulators will need to facilitate this.

See related report: Barriers to exit must come down to raise airline returns, attract investors