US airport privatisation: Can airports in the US be assessed by their ownership criteria?

In the US, and as is well recognised now, the original Airport Privatisation Pilot Programme produced no discernible result - with only one small airport leased, and that quickly returned to public sector control.

Until 2013 that is, when Puerto Rico's main airport - one in which "changing a light bulb required four workers, sometimes five if there was a light bulb available" - was leased to a consortium, one that is now 100% foreign-owned. It is now unrecognisable from what it then was; it can be considered a success story and an exemplar.

That should send a clear message to government, but despite an easing of leasing conditions in 2018, there has been no further take-up. Although there has been a considerable increase in public-private co-operation for construction projects.

Other airports are coming under scrutiny, including Honolulu, the premier gateway and hub in Hawaii. Honolulu is an airport that regularly receives visitors from Asia Pacific countries, where high standards of infrastructure and service are in evidence, often at fully, or partly, privatised airports.

Also Newark Liberty, one that may enter into public-private agreements for new and refurbished terminals.

But not all the better US airports are privatised - they cannot be, because there is only one of them.

Intriguingly though, one of those better examples is Ontario International in California, which has come on in leaps and bounds since 2016. That was the year that it was divorced from Los Angeles World Airports, and came within the purview of municipal authorities that take a corporatised approach to running it.

In the meantime, the US awaits a specific set of new airport policies from the president, but they firmly remain at the back of a very long 'to do' list.

Summary

- Full US airport leasing continues to be replaced by P3s.

- San Juan’s Luis Muñoz Marín International Airport is the one clear success arising out of the original 1996 Airport Pilot Privatisation Programme.

- Passenger traffic growth there is now higher than the US average.

- Hawaii’s main air gateway is facing similar issues to those at San Juan.

- “Good enough for government work” - the aspiration and the reality are two different things.

- Minimal service standards are the expectation at US transport interchanges.

- The contrast with airports in Asia Pacific must be stark.

- Foreign interest in US airports remains strong.

- A P3 is needed urgently at Newark Airport.

- The ‘worst airports’ according to popular sentiment have no private sector involvement…

- ...but then again, neither have some of the best.

- The ball is in the US president’s court.

Full US airport leasing continues to be replaced by P3s

Until quite recently it could be argued that the US airport privatisation movement, dating back to 1996, had failed to deliver the goods.

Even the easing of restrictions that took place in 2018, since when all US commercial airports can be long-term leased under a new Airport Investment Partnership Programme (AIPP), failed to make an impact, and the only airport of substance that was made available for lease since that revision - St Louis Lambert - was withdrawn from the market in 2019, when the deal lost the support of the city mayor.

However, the increasing importance of the public-private partnership (PPP or P3) - a 'lease-lite' version in which the private sector provides financing and often management of specific facilities, usually a terminal although it could be a cargo facility or a centralised car hire building - has redressed the balance somewhat, with numerous projects completed (or in progress) across the US, and especially at two of the New York airports.

(Note that the interpretation of 'P3' is different in the US, where it usually is taken to mean any sort of lease transaction, from full-blown to a specific construction project).

What's more, a leased airport, and one where there is a P3 project now remains eligible for federal Airport Improvement Programme (AIP) grants. They no longer have to be paid back. And in most such leases, the entire 50-year (or whatever term) lease amount is paid up-front. And under AIP, the proceeds can be used for any public purpose, including other needed infrastructure or debt reduction.

Putting aside the solid argument that lessee monies should always go entirely towards airport-related needs, there are greater incentives than ever for municipal airport owners to put their trust in the private sector.

This report looks at a selection of airports across the US - focusing on one in particular, where privatisation has been a success by most measures, and then on some where it might benefit operations.

San Juan's Luis Muñoz Marín Airport is the one clear success arising out of the original 1996 Airport Pilot Privatisation Programme

Luis Muñoz Marín International Airport (LMMIA) serves Puerto Rico's capital and largest city, San Juan, and is the primary gateway to the island. It is also the busiest airport in the Caribbean.

The facility is owned by the Puerto Rico Ports Authority and operated by Aerostar Airport Holdings under a 40-year concession agreement, becoming the first privatised major airport in the US and its unincorporated territories, such as Puerto Rico.

The German company AviAlliance (which itself is owned by Canada's PSP Investments) has had a 40% stake in Aerostar since May-2017, making it the only European operator/investor to hold a stake in a US airport as a whole, while several other entities (airlines) from Europe and elsewhere are counted among participants in P3s that operate individual terminals there.

The other 60% of Aerostar is held by Mexico's Grupo Aeroportuario del Sureste (ASUR). AviAlliance and ASUR, in their role as industrial investors, actively support the airport's development.

'The terminal was a confusing jumble of dim corridors'...

In the Winter 2017 edition of 'City Journal', a conservative US urban policy magazine which, it must be said, is highly supportive of privatisation and the dismantling of unwieldy municipal institutions, the journalist John Tierney wrote that this airport "was run by an unwieldy bureaucracy, the Puerto Rico Ports Authority, which neglected the airport while running up bills on its other unprofitable projects ...the terminal was a confusing jumble of dim corridors, the stores were tacky and the restaurants greasy spoons, often rented at bargain prices to politicians' friends or relatives".

It still is owned by the Ports Authority, if not actually "run" by it.

That job goes to Aerostar. And it should be pointed out that under the 2018 AIPP income from airport operations could still, in theory, be diverted to "other unprofitable projects".

...'The duty-free shop now looks like an upscale department store'

Nevertheless, it is generally held that circumstances have changed since the Port Authority was required by the legislature to lease the airport in 2013.

Mr Tierney went on to report that, "Three years later, the result is an airport that nobody can call Third World. The redesigned concourses are sleek and airy and easy to navigate...The duty-free shop now looks like an upscale department store, and revenue from the new shops and restaurants has more than doubled".

(His reference to the Third World probably arose from the terminology Mr Trump used to describe New York LaGuardia and other US airports during his 2016 presidential campaign).

How many men does it need to change a light bulb?

M Tierney continued:

"On rainy days, the ceilings leaked; on hot days, the air conditioning faltered. The floors of the boarding bridges from the gates to the planes were riddled with holes. The bathrooms were grimy, and it often took days or weeks to repair a broken toilet. Because of union work rules, changing a light bulb required four workers, sometimes five - if there was a new bulb available. Some crucial tasks didn't get done at all, such as maintaining the instrument landing system, while pilots had to land their planes visually, without positional guidance from radio signals, because the system's antennae were blocked by trees and no one in the bureaucracy wanted to take responsibility for cutting them down."

Airlines, unsurprisingly, switched operations to other Caribbean hubs, leaving the airport without the revenue to pay bills - much less make capital improvements. There was no hope of rescue from the Puerto Rican government, which was in terrible financial shape during the island's long-running economic crisis.

By all accounts LMMIA's privatisation came in the nick of time.

In Jul-2022 CAPA - Centre for Aviation published a report on LMMIA that backed the claims that Mr Tierney had made.

The upshot was:

- The privatisation of the airport has led to significant investments, increased passenger and cargo traffic, and improved infrastructure;

- Almost USD1 billion has been invested in an airport which "looked like something out of the 1950s", and with more to come;

- There has been a +230% increase in passengers and cargo combined since 2013;

- The success of the privatisation has de-politicised the airport and allowed it to operate more efficiently;

- The Puerto Rico airport could serve as a model for other municipal operators considering whole-airport leases and demonstrates that privatisation can benefit airlines, passengers, and the overall airport business.

For the full report, see: San Juan - the US's single airport privatisation success in 26 years.

Passenger traffic growth now higher than the US average

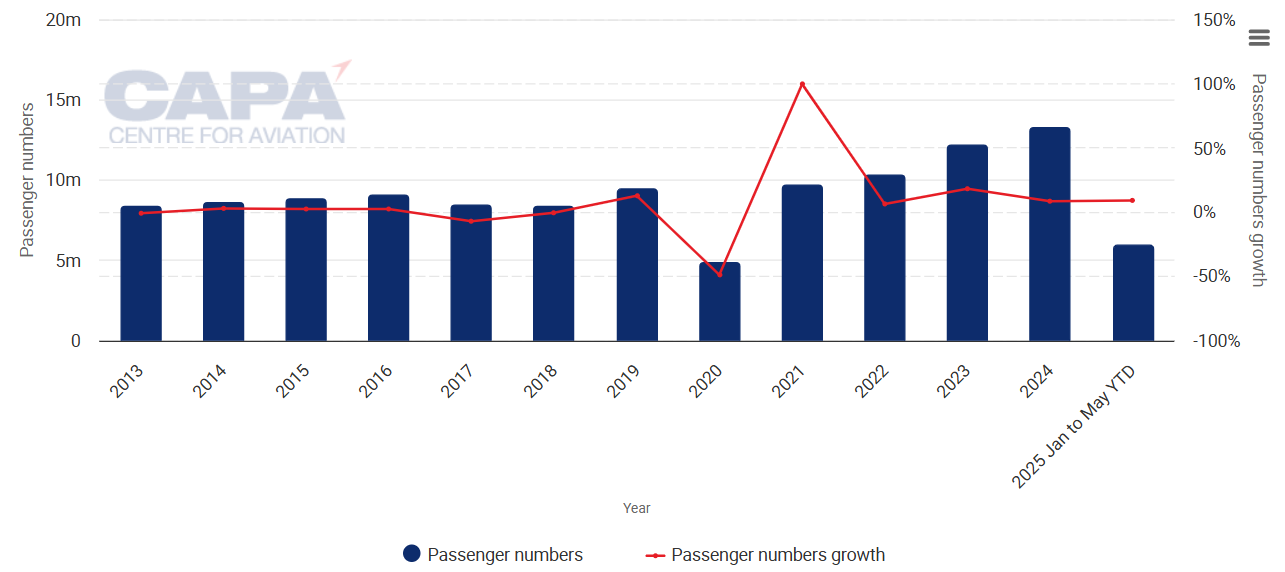

Almost three years later, and those positive trends continue.

Passenger traffic was up 18.3% in 2023, 8.6% in 2024 and in the first four months of 2025 by 11.3%.

That was higher than the US average in 2023 (12.5%), also in 2024 (5.1%), and considerably better than the early months of 2025, although US statistics (at the time of publishing) are only available for Jan-2025 and Feb-2025 (-1.1%).

Overall, the passenger traffic increase from 2013 to 2024 at LMMIA is now 158.7%.

San Juan Luis Munoz Marin International Airport (Puerto Rico): annual traffic, passenger number/growth, 2013 to 2025YTD

Source: CAPA - Centre for Aviation, ACI and Mexico ASUR.

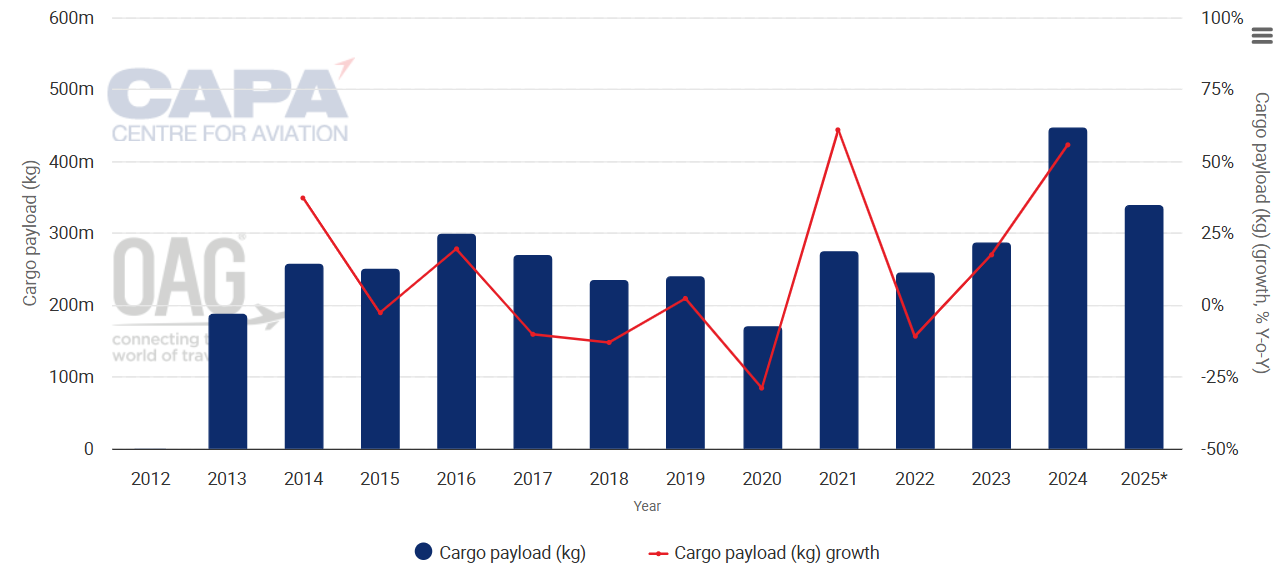

Actual flown cargo volume statistics are only available until early 2020, but available cargo volume has increased by 184% between 2013 and 2024, with +56% recorded in 2024 alone; and it appears that 2025 may be a better year still.

San Juan Luis Munoz Marin International Airport (Puerto Rico): annual cargo payload capacity, from 2012

Source: CAPA - Centre for Aviation and OAG.

* The values for this year are at least partly predictive up to 6 months from 09-Jun-2025 and may be subject to change.

Since 2013 Aerostar has invested USD300 million into the airport. Under the terms of the lease, Aerostar also made an up-front payment of USD615 million to the Puerto Rico government and agreed to annual revenue-sharing of 5% to 10% of airport revenue as ongoing lease payments.

A total of 24 airlines serve LMMIA across four terminals, and the utilisation is high. On every day currently there is almost 24/7 operation, with the exception of a single-hour block that is not occupied with arriving and/or departing capacity (0400:0500).

LMMIA is well served by low-cost carriers (LCCs) - they currently account for 64% of seats overall, although that is a 2ppts reduction compared to the Jul-2022 report.

There is a much wider range of in-terminal food & beverage concessions - 25 in all - and revenue from the new shops and restaurants has more than doubled.

Overall, the privatisation can be considered to have been a success - the only one (of two to date), after the international leaseholder walked away from New York Stewart airport more than two decades ago only seven years into a 99-year lease, the airport returning to municipal oversight.

But San Juan is not a mainland US airport. Could similar privatisation principles apply to other airports?

Hawaii's main air gateway facing similar issues

One that springs to mind is Honolulu Daniel K Inouye International Airport, previously known as Honolulu International Airport, and hereafter HNL. It serves the most populous city in the US state of Hawaii.

HNL recently figured in an article in Aviation Policy News which asked the same question.

HNL is the major international gateway to the state, handling over 20 million passengers per annum, and it plays a major role as both a transit point and holiday destination in the Pacific.

The airport is the principal hub of Hawaiian Airlines, which commands 45% of seat capacity and 42% of aircraft movements in the week commencing 09-Jun-2025.

The airport is extensively served by airlines from around the Pacific Rim and has direct connections to major cities in the Pacific region.

HNL is owned and operated by the State of Hawaii Department of Transportation.

Honolulu Daniel K Inouye International Airport: network map for the week commencing 9-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

But an article in 'Beat of Hawaii' (Apr-24) headlined, 'Hawaii Promised a World-Class Airport. Visitors Got This Instead'. The article complained about full parking garages, limited food and amenities, airlines spread over multiple terminals with slow access between them, poor disabled access, and ageing infrastructure generally.

The article goes on to claim that the airport is not run as a business. Rather, it is part of the Hawaii Department of Transportation and that "direct state control...means more bureaucracy, less flexibility, and slower response to infrastructure problems or traveller needs".

It also quotes a reader as saying, "Until the corruption stops, Hawaii will never have a quality (sic) airport. The airport needs to be privatised and have someone responsible for making it the best for flyers and employees".

Good enough for government work - the aspiration and the reality are two different things

Another said: "Always 'good e'ngh' is alive and well at the Honolulu airport", That echoes the observation made of the New York Public Prosecutors' offices in The Bronx in Tom Wolfe's seminal novel 'Bonfire of the Vanities' - that they were "good enough for government work". Civil servants around the world will recognise that sentiment.

A major complaint is that many future improvements have been announced, but they have been very slow to materialise.

The state continues to promote its plans for a revitalised HNL, complete with cultural upgrades, expanded lounges, and terminal renovations. But beyond renderings and announcements, the actual pace of progress tells another story.

Construction of a five-level garage adjacent to the Hawaiian Airlines and Alaska Airlines terminal could take up to five years - that project is not even listed in the CAPA - Centre for Aviation Airport Construction Database.

While parking gets attention, travellers describe a broader dysfunction: scattered terminals, long walks, poor signage, limited food options, and no reliable transfer system.

Minimal service standards are the expectation at US transport interchanges

Of course, customer comments about just about any airport in the world will be equally good and bad subjectively, but there is a distinct flavour of negativity in the US where airports have long equated with bus and rail stations in the minds of many travellers that have come to expect only minimal service standards.

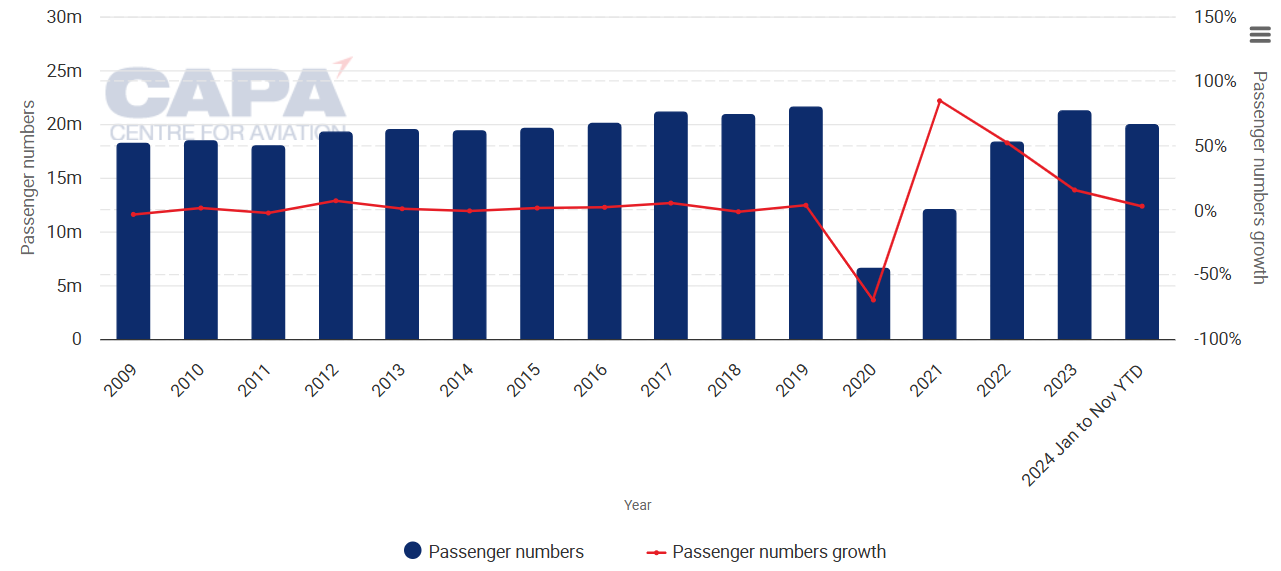

HNL has seen no discernible increase in passenger numbers.

In 2009 there were 18.2 million passengers. In Jan-Nov 2024 there were 19.9 million as post-pandemic recovery stalled to +3% growth.

Honolulu Daniel K Inouye International Airport: annual traffic, passenger numbers/growth, 2009-2024

Source: CAPA - Centre for Aviation and State of Hawaii, Department of Transportation.

The contrast with airports in Asia Pacific must be stark

A passive, acquired, image problem is that a large percentage of Hawaii visitors come from Asia Pacific countries.

In 2023 Japan was the leading source of international visitors to Hawaii, with 573,000 tourists. Canada followed with 454,000 visitors. Other contributors included Australia with 187,000 visitors, Korea with 164,000, and China with 13,000.

Passengers from these countries are used to world-class airports, many of which have been privatised, either in part or whole, such as the major airports in Australia, New Zealand, and a growing number in Japan, also Bangkok, Kuala Lumpur, and Delhi.

Visitors from Asia Pacific might be taken aback by Honolulu Airport's numerous shortcomings.

So in some ways, HNL mirrors the situation in Puerto Rico before its privatisation. Neither San Juan nor Honolulu is a mainland US airport. Could Hawaii do something like the San Juan P3 lease?

Foreign interest in US airports remains strong

A policy study in 2021 by the Reason Foundation, a US libertarian think tank, analysed 31 large and medium US hub airports, including Hawaii-owned HNL.

The study's high-value estimate, if the airport was to be leased, was USD2.7 billion. The amount paid for the lease would naturally be significantly less than that if the lease required large-scale investment by the new airport company in terminals, parking, etc.

Global infrastructure investors and large global airport companies see the United States as the last great untapped airport market - there were almost 20 solo or consortium bidders for St Louis Lambert International Airport in 2019 before the tender was axed.

But municipal authorities plow on regardless with traditional methods of funding and management, which embraces passenger fee funded federal government controlled airport improvement grants, public bond issues and public service (too often 'good enough' for government work) attitudes to customer satisfaction needs.

Hawaiian legislators could do worse than looking into this option for HNL.

And that must raise the question of whether other airports might benefit, too.

P3 needed urgently at Newark Airport

New York is a case in point.

The city-region's three main airports are owned by the cities of New York (JFK, LaGuardia) and Newark (Liberty) and are operated by the Port Authority of New York and New Jersey (PANYNJ), under a public sector concession.

Mayor Rudy Giuliani attempted to privatise the two New York airports at the start of his tenure from 1994 to 2001, when lease renewal negotiations with PANYNJ broke down, but he eventually dropped the idea.

More recently there has been a great deal of P3 activity at JFK and LaGuardia, the latter having been rebuilt and revamped by that method, while a similar procedure is potentially waiting in the wings at Newark for its rehabilitation/expansion project.

Collectively, they make New York the most privatised in the US in the airport sector, and by a margin.

But Newark consistently ranks low due to delays, congestion, and traffic issues, and has been in the news in 2025 for all the wrong reasons.

The FAA issued an interim order reducing the flight arrival and departure rate on 20-May-2025 following recent local air traffic control system failures, chronic understaffing, and a runway closure for rehabilitation.

The FAA demanded, inter alia, the addition of new, high-bandwidth telecommunications connections to provide more speed, reliability and redundancy, and the replacement of copper telecommunications connections with updated fibre optic technology (which also features greater bandwidth and speed).

US Department of Transportation (DoT) Secretary Sean Duffy stated on 28-May-2025 that capacity reductions at Newark Liberty are likely to remain until at least Oct-2025.

It is a moot question as to whether fully privatised operation of Newark, and preferably all the PANYNJ airports, would have made any difference to this evolving scenario, but the chances are that it would have. 'ATC system failures' broadly approximates to the trees that hampered LMIAA's efficacy.

What is likely is that Newark's 'Vision Plan for a World Class EWR', which might yet attract private sector investment into new and/or improved terminals - that has yet to be decided - would carry more gravitas still if not only was there one or more freestanding P3s to deliver it, but a fully privatised operation to see though the turnkey project, raising debt and/or equity financing from a broader range of sources.

And if one airport was to be fully privatised, then why not the whole of the Port Authority?

It isn't as if it hasn't been considered before now, and by arguably New York's most successful mayor.

Challenged airports according to popular sentiment have no private sector involvement

Some airports may be challenging for specific reasons, while others might be overall less enjoyable for travellers.

Those that seem to crop up regularly in surveys for the wrong reasons, apart from Newark, include:

- San Francisco International Airport;

- Las Vegas Harry Reid International Airport;

- Denver International Airport;

- Fort Lauderdale International Airport;

- Miami International Airport.

CAPA - Centre for Aviation is not aware of any P3 project at any of the airports.

There was one at Denver - the Great Hall (Jeppesen Terminal) Rehabilitation project, which originally went to Ferrovial for USD650 million - but it was cancelled and replaced by one primarily funded by revenue generated at the airport, and costing USD2 billion.

...but then again neither have some of the most highly regarded

It is also worth bearing in mind that an airport classified positively might not be a privately managed one either.

CAPA - Centre for Aviation has reported on Ontario Airport in California, where traffic has grown dramatically, and one that is now regarded as an 'economic engine' for Southern California since it separated from Los Angeles World Airports in 2016.

But Ontario is not privately run; it is owned and managed by a joint powers authority formed between the City of Ontario and San Bernardino County.

But overall, there are tangible benefits from privatisation that have been proven consistently across continents over the last four decades. (There have also been DIS-benefits revealed of course!)

The ball is in the president's court

The US is still waiting for the US administration to enact an airports policy that goes further and faster than the one in his first presidential term, and it will do eventually. There remain many other things on the agenda, still.

There is every chance that it will be an even more private sector-oriented policy than previously, with greater incentives for municipalities to co-operate with private investors on airport developments - including full leasing - and air traffic control functions.

Related articles...

Tierney article, 2017: Making New York's Airports Great Again

Beat of Hawaii article: Hawaii Promised A World-Class Airport. Visitors Got This Instead