Virgin Australia’s IPO prospects are helped by its heavy focus on a strong domestic market

Virgin Australia's move to launch an initial public offering (IPO) highlights the airline's substantial footprint in a booming domestic market, and the debut of new international services via its partnership with Qatar Airways.

The airline is offering about 30% of its shares through the IPO, and intends to relist on the Australian stock exchange on 24-Jun-2025. The airline's majority owner Bain Capital will see its stake reduced to 40%, with Qatar Airways retaining a 23.4% holding, and the remainder held by management and staff.

Virgin Australia has been signalling for several months that it has been preparing for an IPO, and the airline and its advisors have now judged that conditions are in its favour. According to Bloomberg, this is poised to be the largest airline IPO in the Asia Pacific region in a decade.

There appears to be strong appetite for the offering; institutional investors have already committed to participate, and will likely take up most of the available shares.

Summary

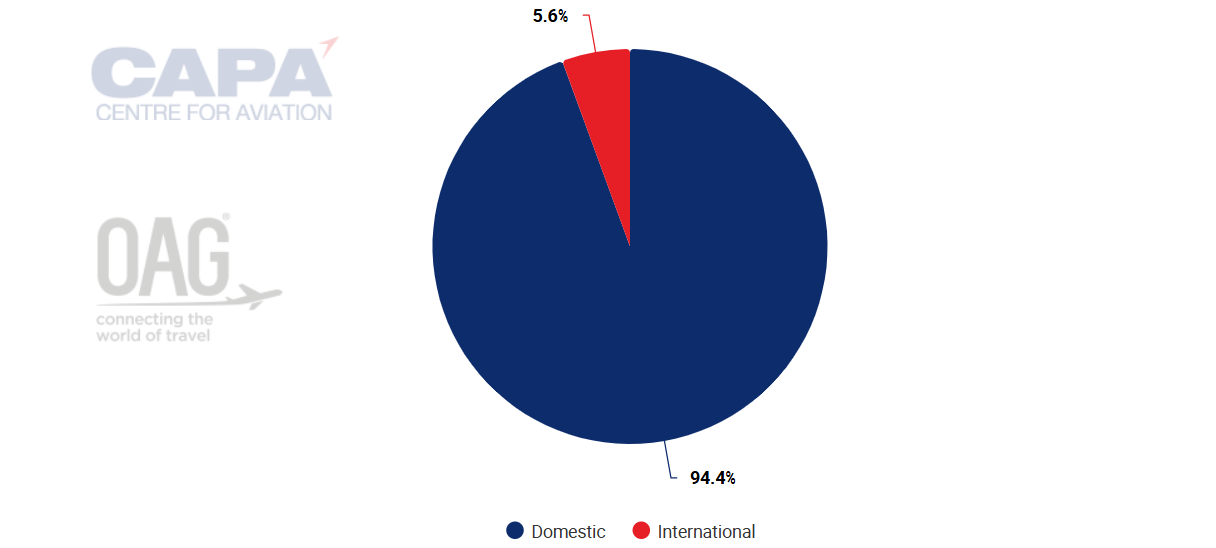

- Domestic operations account for nearly 95% of Virgin Australia’s overall business.

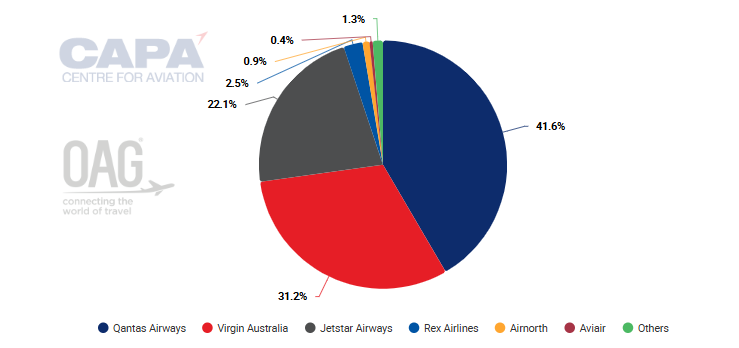

- Virgin Australia had a 31.2% share of domestic seats for the week of 9-Jun-2025.

- The airline’s share is higher on Australia’s 'Golden Triangle' routes.

- Qantas shifts more capacity to Australia, highlighting strong market.

- Virgin Australia has begun rolling out its wet-leased long haul services to Doha.

Domestic demand has been the main driver for Virgin Australia's profits

Virgin Australia is solidly profitable, and its primary focus on the domestic market has helped its sales pitch. Domestic demand is strong and stable, and Virgin Australia has little exposure to international markets that can be lucrative, but also carry higher risk from external forces.

According to data from CAPA - Centre for Aviation and OAG, domestic operations represented 94.4% of Virgin Australia's seats for the week of 9-Jun-2025.

Virgin Australia, international versus domestic seat split, week commencing 09-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

Its only international operations are targeted at a handful of short haul routes to Southeast Asian, Pacific Island, and New Zealand leisure destinations.

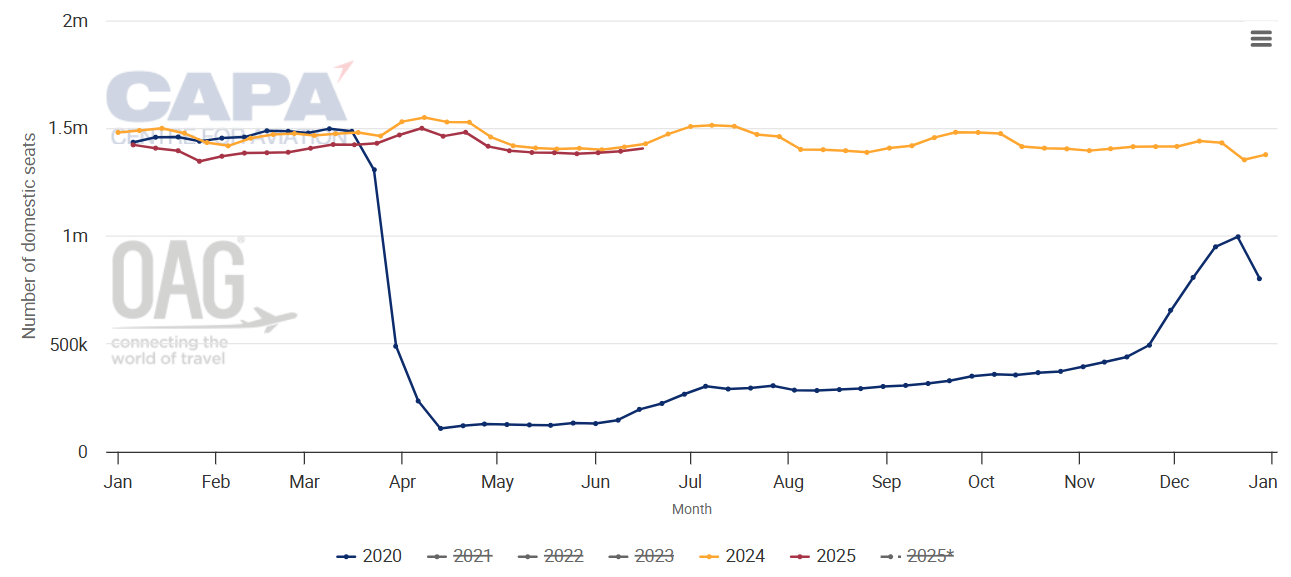

Virgin Australia's domestic capacity is tracking at similar levels as in early 2020, before the global COVID pandemic crisis began.

The Australian Competition and Consumer Commission (ACCC) noted in Feb-2025 that demand strength played a major role in healthy profits for both Virgin Australia and its rival Qantas Group in the six months through 31-Dec-2025.

While Virgin Australia does not publish half-year results, the ACCC cited comments by Virgin Australia executives that it had achieved record profits in the period, which is the first half of its 2025 financial year.

Virgin Australia reported earnings before interest and tax of AUD519 million (USD336 million) for FY2024 - the airline is projecting another underlying profit for the current full fiscal year.

Australian airlines are reaping higher returns on similar capacity levels, prompting fleet shift by Qantas

Traffic statistics underline the strong rebound of the Australian domestic market. Airservices Australia statistics cited by the ACCC show that 17-Apr-2025 - just before the Easter weekend - was the highest daily number of Australian domestic passengers in the past five years.

Overall domestic capacity is almost at early-2020 levels, and is essentially the same as in the corresponding week last year, CAPA - Centre for Aviation and OAG data indicates.

Australia, weekly total domestic seats, 2020, 2024 and 2025

Source: CAPA - Centre for Aviation and OAG.

Average fares have eased slightly since peaking last year 2024, but are still above pre-pandemic levels, the ACCC said.

Qantas' decision to close down its Singapore-based Jetstar Asia subsidiary helps highlight the appeal of the Australian market.

While financial pressure on Jetstar Asia was a major driver, the comparative strength of the Australian domestic and short haul international markets was, no doubt, also a factor.

So the Qantas decision allows the group to deploy Jetstar Asia's narrowbody aircraft in Australian domestic skies and on short haul routes, where profitability is greater - although many of the aircraft will be used for fleet replacement.

This is a positive signal regarding market health, although Virgin Australia may not have appreciated the timing of Qantas' revelation that it will be bringing more aircraft into its home market.

Virgin Australia has a significant foothold on the 'Golden Triangle' routes in particular

According to the ACCC, Virgin Australia accounted for 34.4% of domestic passengers in Mar-2025 - up from 31.3% a year earlier. The airline benefitted from Rex's withdrawal out of domestic jet operations, the Commission said in its latest report.

However, the ACCC also pointed out that Qantas estimates that for the first half of FY2025 it accounted for 80% of corporate traffic in Australia, and 54% of traffic in the small-sized, and medium-sized, enterprise segment traffic.

In terms of capacity, CAPA - Centre for Aviation and OAG data shows that Virgin Australia had a 31.2% share of domestic seats for the week of 9-Jun-2025, and a 32.7% share of ASKs.

Australian domestic market share, as measured in seats for the week of 9-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

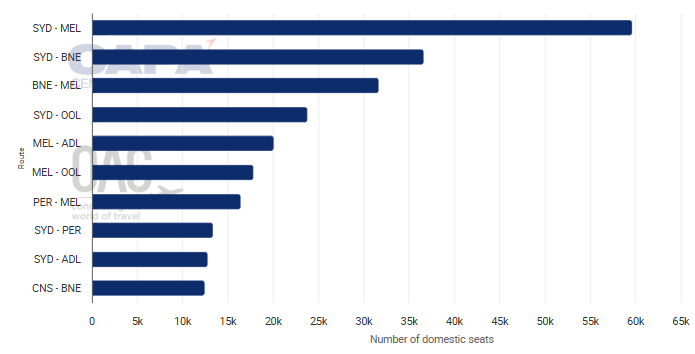

Virgin Australia's busiest route is between Sydney and Melbourne - which has been hovering between the seventh-busiest and eighth-busiest domestic city pair in the world by capacity.

The Sydney-Melbourne route accounts for 13.7% of Virgin Australia's weekly seat capacity, followed by Sydney-Brisbane with 8.4% and Brisbane-Melbourne on 7.3%. These routes represent the so-called 'Golden Triangle' in the Australian market.

Virgin Australia's top 10 domestic routes by two-way seat capacity for the week of 9-Jun-2025'

Source: CAPA - Centre for Aviation and OAG.

The airline's share of seats on the Sydney-Melbourne route is 32.9% of the market total, which is fairly similar to its overall domestic market share.

It has a higher share of 38% on Sydney-Brisbane, and 40.6% on Brisbane-Melbourne.

The IPO was launched just a week before the Virgin Australia-Qatar Airways wet-lease flights began

Another development that has lifted Virgin Australia's prospects is its partnership with its part-owner, Qatar Airways.

In a major aspect of the deal, Qatar Airways will wet-lease Boeing 777-300ERs to Virgin Australia, They will be used on flights between Australia's four largest cities and Doha.

The Doha flights began from Sydney on 12-Jun-2025; from Brisbane starting 19-Jun-2025; from Perth on 26-Jun-2025; and Melbourne 1-Dec-2025.

The deal is beneficial for both parties - it gives Qatar Airways access to more frequencies in the Australian market, and it gives Virgin Australia improved international links without committing to its own long haul aircraft.

Virgin Australia and Qatar Airways told Australian regulators that they are considering switching this to a dry-lease arrangement within three years.

However, Virgin Australia appears to have little appetite yet to order its own widebody aircraft, preferring its 'capital-light' approach of relying on its partners for international connections.

Tight focus on domestic network means there are more opportunities in short haul international

Virgin Australia is about to start the next stage of its post-administration revival, with a new CEO and new investment.

Dave Emerson took over as CEO in Mar-2025, after previous CEO Jayne Hrdlicka deemed it to be the right time for leadership transition.

The airline's game plan since its re-emergence has been to keep its focus on the domestic network, with only a handful of short haul international routes that are able to be served by its narrowbodies.

It has far fewer international routes than before administration - with international seat capacity about a third of early 2020 levels.

This strategy has paid off in terms of profitability, as the airline has taken advantage of a very strong home market.

It also means there are opportunities for growth in short haul international markets, should the airline look to expand after the IPO.

The airline's low-risk approach has also translated to the long haul international market, where it offers network coverage via partners that serve Australia.

It has modified this approach slightly through the wet-lease arrangements with Qatar Airways. This allows it to offer what is technically its own service without having to secure a sub-scale widebody fleet, and gives it the weighty backing of the Qatar Airways international network.

CAPA Airline Leader Summit Australia Pacific 2025 will take place in Cairns, Australia

CAPA - Centre for Aviation's home event, the CAPA Airline Leader Summit Australia Pacific 2025 will gather hundreds of industry leaders and decision makers from across the Asia Pacific and beyond to consider the most significant trends and opportunities of aviation events.

The 2025 agenda will dive deep into current travel sector trends and opportunities, as well as analysing the direction the industry is headed.

With the Asia Pacific headed for full recovery in 2025, the industry might be forgiven for breathing a quiet sigh of relief. Yet, nothing stands still in aviation and regional airlines face an array of new challenges. Supply chains - particularly new aircraft deliveries - remain bottlenecked and the industry remains vulnerable to shifting geopolitical dynamics. Economic factors - slower growth, persistent inflation, oil prices and currency fluctuations - are all impacting business.

Asia Pacific carriers will need to navigate these difficult waters, while continuing to manage above average demand growth, the ongoing process of consolidation among regional carriers, shifting aviation regulations and the drive towards greater travel sustainability.

The CAPA Airline Leader Summit Australia Pacific 2025 will tackle all these key issues, and much more, at a two-day event to be held in Cairns, Australia over 31-Jul/01-Aug-2025. Join us to gain insight from industry insiders, business leaders and key decision makers into the world's most dynamic aviation market.