Despite filing for Chapter 11, Azul's has introduced air travel to millions of Brazilians

It's fair to conclude that Azul tried extremely hard to avoid Chapter 11 bankruptcy protection. But despite two major out-of-court restructurings of its balance sheet over the course of the last two years, Azul now has encountered the same fate as LATAM and GOL.

Unlike some airlines elsewhere around the globe that have recently sought Chapter 11, Azul doesn't have a flawed business model. Using a diversified fleet, the airline has introduced air travel to millions of Brazilians by opening up new markets unavailable to its competitors.

Azul's decision to restructure, in some ways, reflects the inherent paradox of doing business in Brazil - opportunities abound, but challenges are just as abundant.

Summary

- Despite significant out-of-court balance sheet overhauls, Azul is forced into Chapter 11.

- AerCap, American Airlines, and United Airlines are all offering support for Azul’s restructuring.

- Azul’s business model has arguably ushered in a new era for air travel for many Brazilians...

- ...But the country’s airlines face challenges, even as opportunities for air travel growth remain ripe.

- Perhaps once Azul completes its restructuring, it can reap the rewards of growing air travel in Brazil.

Major balance sheet overhauls during the past two years couldn't shield Azul from Chapter 11

A lack of government assistance during the COVID-19 pandemic left Brazilian airlines to fend for themselves - and post-crisis currency headwinds, supply chain disruptions and aircraft delivery delays and groundings created more challenges, including access to capital.

"As we've discussed before, as the currency devalued, the local capital markets froze, further restricting our ability to raise local capital," Azul CEO John Rodgerson said in 2024.

But later that year, Azul did forge an agreement to eliminate BRL3.1 billion in obligations to 98% of its lessors and manufacturers. Yet despite that progress, Azul's net debt jumped by 50% year-over-year in the first quarter of 2025.

The agreement Azul reached with stakeholders in late 2024 followed another pact it had forged with the majority of its lessors in 2023 to cut lease payments by BRL5.4 billion during over a four-and-a-half year period.

Azul gets support from key industry players as it starts restructuring

By now, the major aspects of Azul's restructuring are well known.

The airline has gained support from key industry players in its Chapter 11 restructuring, including an up-to-USD300 million exit equity investment from United Airlines and American Airlines - subject to certain conditions.

Azul has reached an agreement with its largest aircraft lessor AerCap that will produce total annual cash flow savings of USD334 million from 2025 to 2030. The company also estimates that the cumulative contribution from lessors and manufacturers to its restructuring should average USD275 million from 2025-2029.

Azul has secured a commitment for debtor-in-possession (DIP) financing for USD1.6 billion from financing partners to repay some of its existing debt and supply the company with approximately USD670 million of new capital.

In total, Azul expects to gain USD950 million of equity investments when it emerges from Chapter 11, and is targeting an exit date of Feb-2026.

The airline's restructuring plan includes a 35% shell count reduction in Azul's future fleet. The airline's estimated fleet count for 2025 will drop from 201 to 170 aircraft, and for 2027 - from 218 to 172 aircraft. Azul's annual capacity growth for the period spanning 2025 to 2029 will drop from 11% to 3.8%.

Azul believes slowing growth should reduce overall risk, currency exposure and leverage.

Over the course of 17 years, Azul has introduced air travel to millions of Brazilians

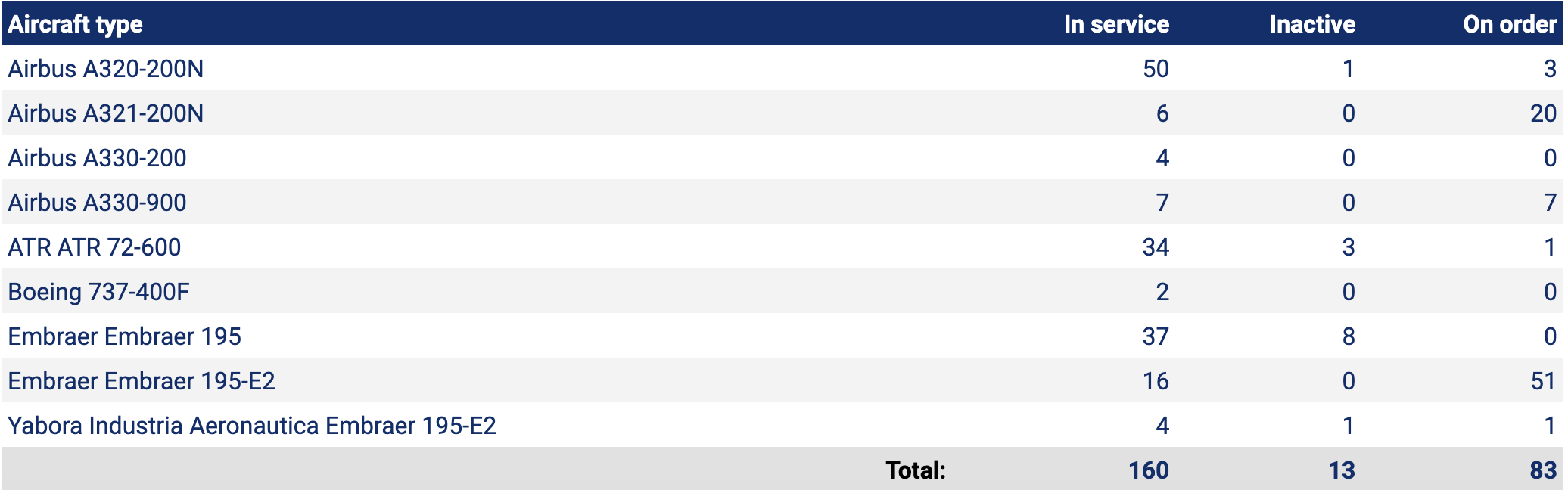

Azul's model is unique, in that it operates a range of fleet types - spanning Cessna Caravans flown by its Azul Conecta subsidiary to Airbus A330 widebodies.

Azul fleet summary, as of Jun-2025

Source: CAPA - Centre for Aviation Fleet Database.

The bet on a diversified fleet has allowed Azul to broaden the reach of air travel in Brazil. The airline currently serves approximately 160 destinations, and is the only operator on 82% of its routes.

Azul's President, Abhi Shah, told Aviation Week Network in 2024 that when the airline entered the market in 2008, Brazilian airlines transported approximately 50 million passengers. Over the past 16 years that has grown to 100 million, and Azul was responsible for 60% of the growth, flying approximately 30 million passengers, he explained.

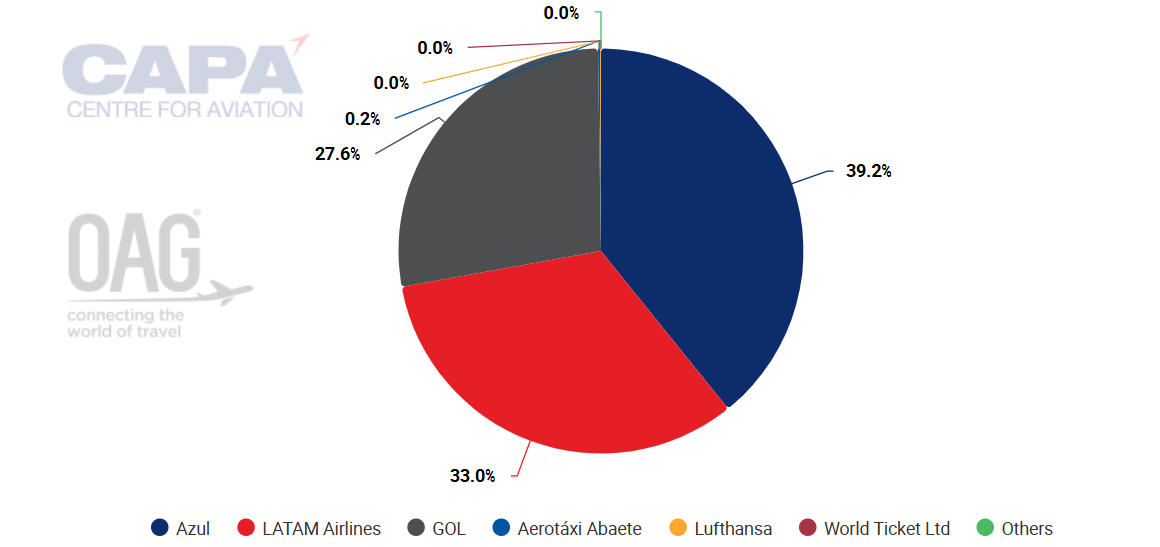

Data from CAPA - Centre for Aviation and OAG show that Azul is the domestic leader in Brazil measured by departing frequencies, representing a nearly 40% share.

Brazil: domestic departing frequencies by airline, w/c 02-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

And although Azul has been bogged down in balance sheet challenges during the past couple of years, its revenue has grown at a steady pace, increasing 15% year-over-year in 1Q2205.

Its network diversification, compared with some its peers, arguably offers Azul some pricing power not available to its competitors. Additionally, reports frequently surface that its competitors are considering evaluating Embraer jets,

Brazil's airlines face ripe opportunities and tough business conditions

But just as Brazil is ripe with opportunities - in late 2024 Azul stated that trips per capita in the country in 2022 were just 0.5 - there are also challenges unique to the market. The cost of jet fuel is higher than in other countries, and airlines also face unique litigation challenges.

In 2024 IATA calculated that Brazil's three largest airlines - LATAM Airlines Brasil, Azul and GOL - averaged one lawsuit for every 227 passengers, giving it the distinction as the world leader in claims. At that point the association calculated that the increase it litigation was costing the country a collection of USD200 million per year.

"Airlines in Brazil are a target of trying to get money out", Mr Shah said at the CAPA Airline Leader Summit Americas in Grand Cayman in Apr-2025.

Yet at the same time, Azul also sees a big part of its responsibility "as developing Brazil," Mr Shah explained, adding that when the airline introduces flights to a city that's never had air service: "you've changed people's lives" in terms of education, opportunity and health care.

If residents in the country's Amazon region want to get medical treatment they can opt for a 45-minute Azul flight, or take a days-long boat ride.

Once Azul fleshes out its restructuring, it can focus on its core strengths

Although Azul's merger talks will likely hit pause as it enters Chapter 11, and GOL exits its formal restructuring in Jun-2025, Azul's business model remains intact. Aside from slower growth, no deviation in its strategy seems imminent.

Perhaps once Azul overhauls its balance sheet for good in bankruptcy, it can focus fully on executing its plan to continue transforming connectivity in Brazil.