Lebanese government to seek private sector support for new national-level airport

A couple of years ago Ireland's proactive daa International was set to operate a new government-built terminal building at Beirut Airport - but it suddenly fell through when the construction project collapsed.

It was a miracle that daa, or anyone else from the west, was there at all. Lebanon's problems are many, and they span four decades, including a bloody 15-year civil war, the present for finally extracting itself from that being a virtual takeover by the political and paramilitary group: Hezbollah.

With that group being decimated in the past six months, the government is turning its attention to long-abandoned projects, one of them being a new commercial airport to be built out of a military airfield in the north of the country. Lebanon only has one of them - in Beirut.

A 2012 report that a previous government commissioned wrote off the prospect as risible, but the Rene Mouawad Airport already had the hallmarks of a low-cost facility, something that would only be recognised by those conversant with the concept.

Now the government is revisiting the notion, and a 'master plan' will be revealed shortly. It would probably build it itself, just as the Beirut terminal would have been, but is already dangling the prospect of private investment into it.

The question is: who in his right mind would commit to such a project? Quite apart from Lebanon's lingering issues the 'new' airport is only 5km from the Syrian border.

Summary

- A master plan for a new commercial airport in Lebanon is to be presented soon.

- Lebanon is a single commercial airport country.

- A 2012 investigation of the Rene Mouawad Airport was damning…

- …but it still had the hallmarks of a low cost facility even then.

- A price tag of USD200 million to make it presentable.

- Logistical obstacles lay in the way.

- Hezbollah’s influence has been minimised.

- The Beirut airport has found the going hard.

- Daa International’s bold terminal management bid fell through.

- The Middle East as a whole is a no-go area for western airport investors.

Master plan for a new commercial airport in Lebanon to be presented soon

According to Lebanon's Prime Minister Nawaf Salam, speaking at the end of May-2025, the master plan for the new Rene Mouawad Airport "will be presented in the coming weeks - in less than a month".

He went on, "We've started work on this quickly, and the project will be open to investment. We haven't yet finalised the exact model, whether it will be a tender or not, but it has significant potential". He suggested that the new airport "could serve cargo operations and low cost aviation".

The Rene Mouawad Airport - formerly, and still sometimes known as, Qoleiat air base, and also as Kleyate Airport - is situated on Lebanon's northern shoreline, around 7 km from the border with Syria, 25 km from Tripoli, and 100 km from the capital of Lebanon, Beirut.

Location of the Rene Mouawad Airport, Lebanon

Source: Google Maps.

The Iraq Petroleum Company (IPC) established it in 1934 to facilitate the operations of the company's small aircraft, and carry employees across the Arab world (meaning between Lebanon and Iraq).

In 1966 the Lebanese Army took charge of the airport and turned it into a military base, accommodating the Mirage fighters that Lebanon had bought from France.

Lebanon is a single commercial airport country

What is causing so much excitement is that Lebanon, a country of 5.4 million in an area of 10,452 square km (4,036 square miles), so bigger than, say, Ireland, does not have a second civil airport in operation after Beirut's Rafic Hariri International.

At least Rene Mouawad does have ICAO and IATA identifiers (OLKA/KYE), the only airport outside Beirut to have both.

During the Lebanese civil war, the Lebanese armed forces set up the Barbara checkpoint, which blocked the linking road between Beirut and Tripoli.

This convinced Premier Rashid Karami to push to use the airport as an internal transport hub, and Middle East Airlines (MEA) started operating flights from Beirut to the airport between 1988 and 1990.

The airport also signifies an important event in the history of Lebanon - parliament convened on 05-Nov- 1989 in one of its halls to re-elect Hussein Al-Husseini as Speaker, and approve the Taef Agreement (which was designed to end the 15 year-long Lebanese Civil War), as well as electing Rene Mouawad as president of the Republic.

The airport was named after President Mouawad following his assassination on 22-Nov-1989.

The 2012 investigation of the Rene Mouawad Airport was damning...

At the request of the Minister of Public Works and Transport, at the beginning of 2012 a committee examined the airport and concluded that:

- The road leading to the airport, starting from Tripoli, was too small and congested, and needed comprehensive rebuilding;

- The airport had a sole runway of 3,000 metres long, with an extra 250 metres run off at each end, and 45 metres wide with an extra two metres from each side. The runway was in a relatively satisfactory condition, despite the presence of cracks and grass;

- The airport housed a rest room of 200 square metres for officers. The room was unsuitable for any other use, and needed refurbishing;

- There was an air traffic control tower and a small weather station, the latter unsuitable for fulfilling the airport's civil purposes;

- There was a 'call centre';

- Parking areas were capable of accommodating 100 cars, but the parking lots were in a poor condition;

- There were five fuel containers with a capacity of 100,000 litres each;

- There was an aircraft hangar;

- The route from the entrance to the facilities was 1,800m long and was in a "deplorable" condition;

- The runway and taxiways lacked signs and lights;

- The 'Fire Control Centre' was equipped with two rescue vehicles;

- The drainage infrastructure was "terrible";

- There was a protection wall, 13.5km in length and 220m (sic) in height, which makes it sound like a high security prison or concentration camp;

- The apron was capable of accommodating only two aircraft.

…but it still had the hallmarks of a low-cost facility

That lengthy list is presented almost in full here because it immediately bears comparison with some of the military facilities that were taken over in Europe in the late 1990s and early 2000s, to be turned into civilian airports for low-cost carrier (LCC) budget operations.

All that was needed then was:

(a) a long runway like this, not for LCCs, but in case a separate business could be started to handle widebody cargo flights. European airports like Frankfurt Hahn (ex-military), Ostend, Liege, Vitoria, Zaragoza, Paris Vatry (ex-military) and Manston all benefitted, and a long runway of 3,000m or more also offer potentially offers the option of dual use (landing/take-off at the same time), where it is permitted.

(b) Additionally, any existing infrastructure on which a simple terminal building can be erected was just fine. When Coventry Airport in the UK began to be used by charter and low-cost scheduled flights in the early 2000s the terminal building initially was a couple of builders' portakabins.

(c) Parking lots can be bulldozed flat out of any land as long as there is plenty of it, and there usually is at a military facility. It is multistory car parks that cost a lot of money, and they are usually outsourced operationally to third parties.

(d) There is a working fire and emergency vehicle.

For all these reasons, that is why even in 2012 Rene Mouawad had the makings of a low-cost airport.

However, that potential might well have been lost on a country with little LCC supply or demand at the time.

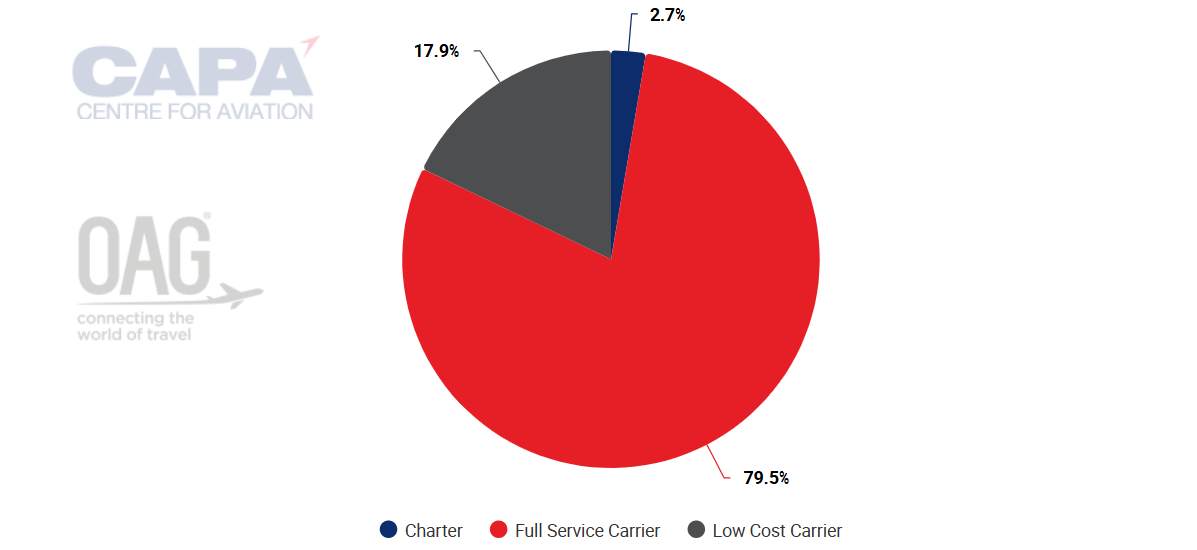

That supply, though, has increased considerably. Currently, in the country as a whole, just under one fifth (18%) of capacity is on LCCs.

Lebanon system, two-way seats by business model, week commencing 09-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

That compares with almost a third (31%) % for the Middle East as a whole, so there is still some ground to be made up.

A price tag of USD200 million on developing the facility

Returning to the 2012 report, the committee underlined that the airport, in its current condition, was unsuitable for civil aviation. The report stressed that its rebuilding would require around USD200 million, let alone the cost of acquiring the land necessary for the execution of the project (around two million square metres). The estimate for completing the project was put at four years.

The committee cited the establishment of a duty-free zone, and the operation of air freight services, as the most practical investment in the airport. The committee viewed that, currently, it might be feasible to use it as an air taxi base to transfer passengers (mainly pilgrims) from the north to Rafic Hariri's International Airport, and vice versa. (This was some time before the concept of the air taxi was established).

Logistical obstacles in the way

With unanimous political agreement, which was not the case then or now, securing the funds to operate the airport could be realised easily. However, there remained two obstacles hindering the materialisation of the project:

Firstly, the airport's geographical location and wind patterns would force bigger airplanes to fly over Syrian territory before landing. That could not happen without Syria's approval, which had never been given, and which was unlikely to be given then.

In 2025 those circumstances have changed marginally in favour of such cooperation since the overthrow of the Assad regime in Dec-2024, and recognition of the interim government by the US in mid-May-2025.

Secondly, despite its hostile attitude against the political party and paramilitary group Hezbollah, and the negative comments it had voiced regarding Rafic Hariri's International Airport, it was rumoured that the US had refused the operation of the Qoleiat airport for "yet to be known reasons".

Hezbollah's influence has been minimised

There has been a sea change there.

Although Hezbollah continues to have influence in Lebanon, its losses sustained in fighting Israel means that influence has been weakened considerably.

The article that was published in the Lebanese magazine 'The Monthly' in Oct-2013, and around which this report was built, ended with a question that remains relevant today. At the time it was prompted by the demands of several pressure groups in the north of the country, and it was: 'Will Rene Mouawad's Airport replace Rafic Hariri's'?

The Beirut airport has found the going hard

At that time the Beirut airport was struggling, as it had been for years throughout the civil war, with 75% of Lebanon's population living in poverty and the national carrier shifting its fleet back and forward between Beirut and safe havens like Cyprus, depending on the ferocity of the fighting.

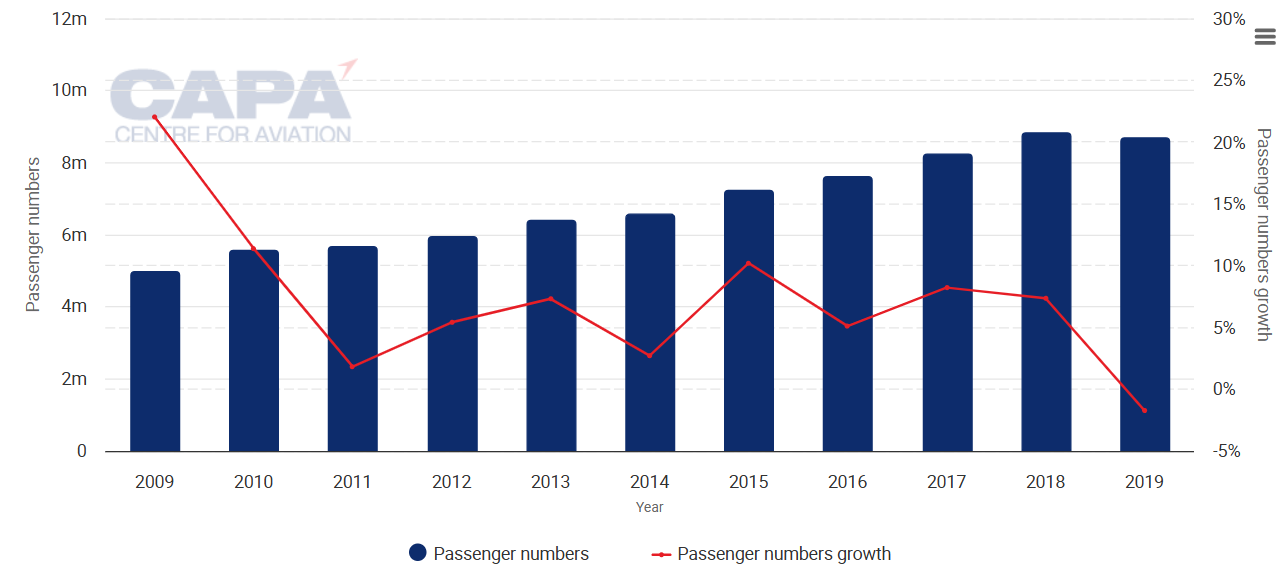

The position has somewhat improved since. The traffic chart below shows solid if slow passenger growth between 2009 and 2019, ahead of the COVID-19 pandemic years.

Beirut Rafic Hariri International Airport annual traffic: passenger numbers/growth, 2009-2019

Source: CAPA - Centre for Aviation and Beirut Rafic Hariri International Airport reports.

Unofficial reports indicate a passenger total of 5.62 million in 2024 - marking a decrease of 20.8% compared to the 7.1 million passengers in 2023 (the same as in 2015).

So the post-COVID recovery period has undoubtedly been hampered by the war between Israel and Hezbollah, and the regular strikes on targets in Beirut and neighbouring towns.

Hopefully these have come to an end, or at least will be minimised, permitting some normality to return to the civilian population and a resumption of both incoming and outgoing air travel.

But Lebanon cannot be shifted from its geographical position. It will always be entwined in a complex political landscape in the entire region

Unless a way can be found of ending the various conflicts, expansion of the Beirut airport, and construction of alternatives for more distant populations, will remain no more than an ambition.

Daa International's bold terminal management bid fell through

In Mar-2023 CAPA - Centre for Aviation published a report about Ireland's daa International's successful bid to operate a new Terminal 2 at Beirut's Rafic Hariri International Airport, which would be the first new infrastructure there since 1998.

The Lebanese government would construct the USD122 million terminal.

It was to handle 3.5 million passengers annually and to be completed in four years.

Beirut Airport aimed to reach 20 million passengers by 2030, but more infrastructure will be needed to accommodate this level of growth.

It was noted that Beirut Airport primarily serves as an origin and destination (O&D) airport, with limited hub activities, which is in contrast with the amount of seat capacity across the three main airline alliances, with only 35% on unaligned airlines.

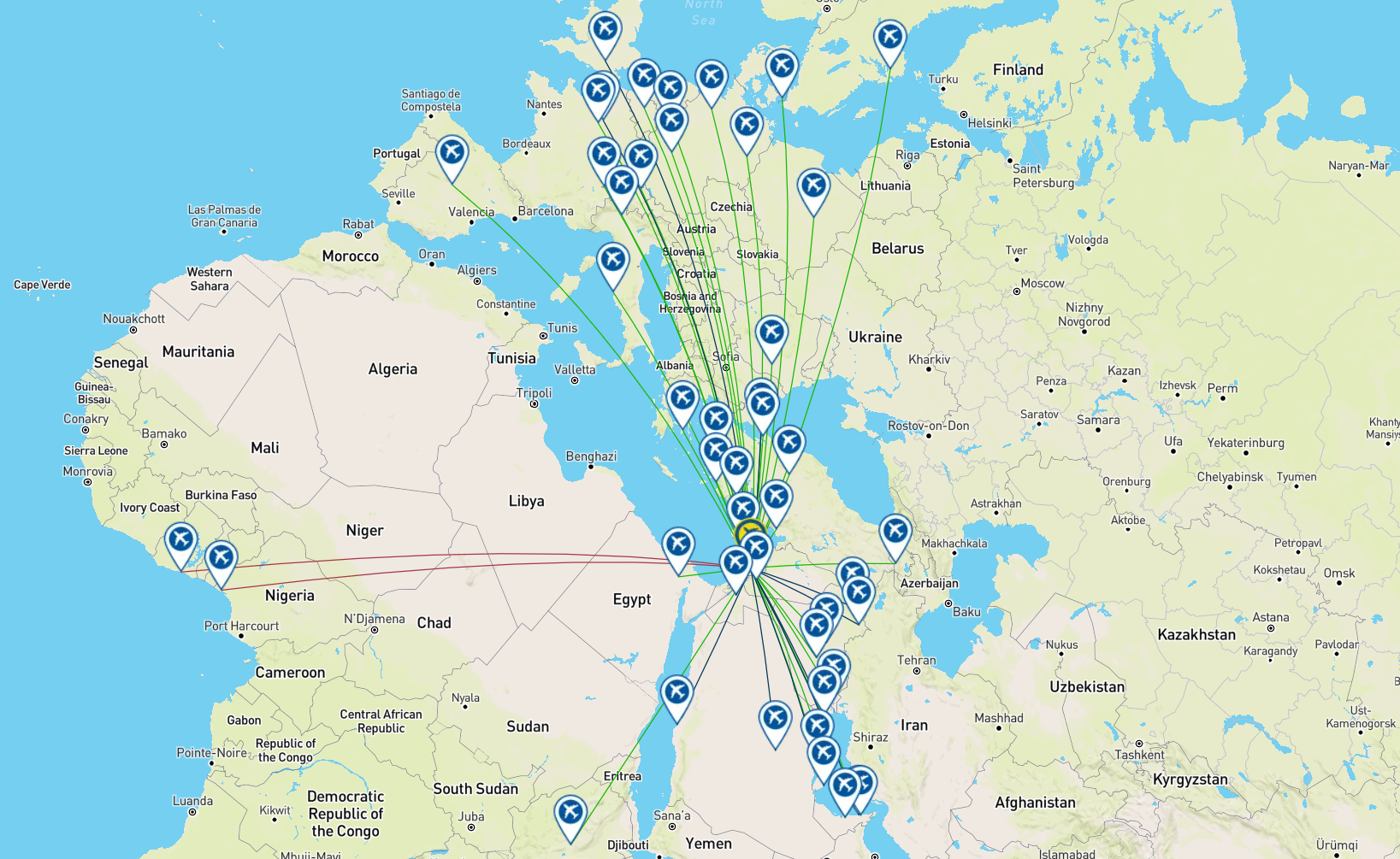

Beirut Rafic Hariri International Airport: network map for the week commencing 09-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

As the above route map shows, it acts only as a potential hub between the Middle East and Europe, with four destinations in Africa. Most of the services are operated my Middle East Airlines (MEA), which has 40.5% of capacity and 63.5% of movements.

Before the civil war Beirut had occupied the position of the Middle East's leading 'playground', its broad Corniche being home to the nightclubs and casinos that were not permitted in most Arab countries.

That status has now been lost, probably forever. Tourists will not be heading back there anytime soon.

Nevertheless, the airport had grown to become a regional hub: thanks to limited competition from neighbours at the time and fast and steady growth by the country's four airlines - as well as numerous other foreign airlines.

The caretaker prime minister, Najib Mikati, said that "the project opens more horizons for air travel between Lebanon and the world".

So, what can be easily understood is the attraction of that airport to the Irish operator; one that already had experience in the Middle East, especially in the development of bespoke retailing through daa's 'Aer Rianta' branch.

Interestingly, Terminal 2 was earmarked for LCCs and charter flights (the latter currently total 3% of seats).

But the venture fell through on 30-Mar-2024, when Lebanon's Minister of Transport and Public Works Ali Hamié announced that the government was no longer going ahead with plans to construct a new passenger terminal at Beirut Airport. Mr Hamié attributed the project cancellation to ongoing "legal controversy" amid the nation's economic crisis.

In light of the circumstances that have emerged since then, with an air assault on Beirut which prompted the airport's frequent closure (along with many others throughout the region) - daa might consider itself lucky to have been spared the impact on its operations.

The Middle East, as a whole, is a no-go area for western airport investors

The entire Middle East, with the very recent exception of Saudi Arabia, is something of a no-go area for western investors in airports. Partly because they aren't needed; partly because business models don't fit the norm there (including financing options), and partly because they are nervous about potential outcomes arising from circumstances beyond their control.

That is why daa is to be applauded at least for giving it a go.

But if a new terminal is not to be constructed at the nation's primary airport, even though the funding was to come from the government, what chance that the major renovation at Rene Mouawad Airport will go ahead?

Even if the government was to put right all the faults and present a basic, but modern, new airport for LCCs as a fait accompli to a potential investor to build on, that with a PPP or BOT deal for further modernisation (derivatives of the latter are still common in the region), who would take that chance in an area that hasn't had a working commercial airport for decades (so the level of demand is unknown)?

Realistically, the area is too far from Beirut for Rene Mouawad to trade as a Beirut budget airport, even if Ryanair was to operate there and offer free trips to and from the capital.

Actually, it is slightly closer to Homs, once a major industrial city in Syria and the third most populous, but one which has been devastated by the Siege of Homs during the Syrian civil war.

And the very fact that it is around 5km from the Syrian border would be a turn-off for investors from outside the region. Syria might have come out of its civil war shell in the past six months, but it has a long way to go before western governments will have confidence in its future.

So potential investors from outside the region would be turned off by Rene Mouawad for now, leaving the field open to those from within it, especially Saudi Arabia, to rise to the challenge of any forthcoming tender.