US global network airlines appear to remain bullish on international trends – 2Q should offer clues

Now that the busy summer season is under way in the Northern Hemisphere, travel trends in long haul markets are likely to draw heavy scrutiny - executives at many US airlines have remained bullish about demand in international markets after domestic leisure bookings have softened.

Capacity continues to grow in trans Atlantic and trans Pacific markets from the US, and strength in premium products shows no signs of waning. Yet elements that will be monitored in upcoming earnings discussions are whether point of sale from the US to long haul international markets has remained robust, and the continued robust performance of premium product revenues.

As the summer unfolds, a clearer picture should emerge regarding the health of long haul markets from the US.

But for now, executives remain optimistic on the resiliency of those markets.

Summary

- Large US airlines believe that positive demand trends in long haul international flights remain intact.

- United Airlines sees improvements in Newark, after some tough operational weeks.

- Point of sale US for international markets appears to remain solid.

- International demand, US point of sale, and premium product performance will be closely watched as 2H2025 unfolds.

Large global US airlines foresee strong international trends, as 2Q2025 comes to a close

Fallout from unpredictable trade policies adopted by the US president after he took office in Jan-2025 has affected demand among US leisure customers, those mostly travelling in economy class. Now as 2Q2025 in inching towards ending, the general consensus is that trends have stabilised - albeit at lower levels than airlines anticipated at the start of the year 2025.

Yet even as leisure demand remains softer, the outlook by large US global network airlines for long haul international travel this summer remains unchanged.

"Long haul international is doing well. Transatlantic continues to perform well. We expect positive unit revenues there in the second quarter", American Airlines CFO Devon May said in late May-2025. He also made positive comments regarding American's Latin American activity, noting that in deep South America; "...we have some markets that are just doing really, really well for us".

Back in Apr-2025 Delta Air Lines' President Glen Hauenstein said that the airline's trans Atlantic and, "...particularly the Pacific is looking very strong into Jun-2025".

He noted that China was a small part of Delta's trans Pacific operations - at that time, trade tensions between the US and China were intensifying. Data from CAPA - Centre for Aviation show that, as of mid-Jun-2025, the airline serves Shanghai from Detroit, Seattle and Los Angeles.

United Airlines' chief commercial officer Andrew Nocella said in Apr-2025 that 1Q2025 was a strong period for the company's international markets, "...and I think we'll have the same in Q2, but the year-over-year RASM [revenue per available seat mile] won't be the same, but at this point, I do expect international RASM to be positive across every single international entity…"

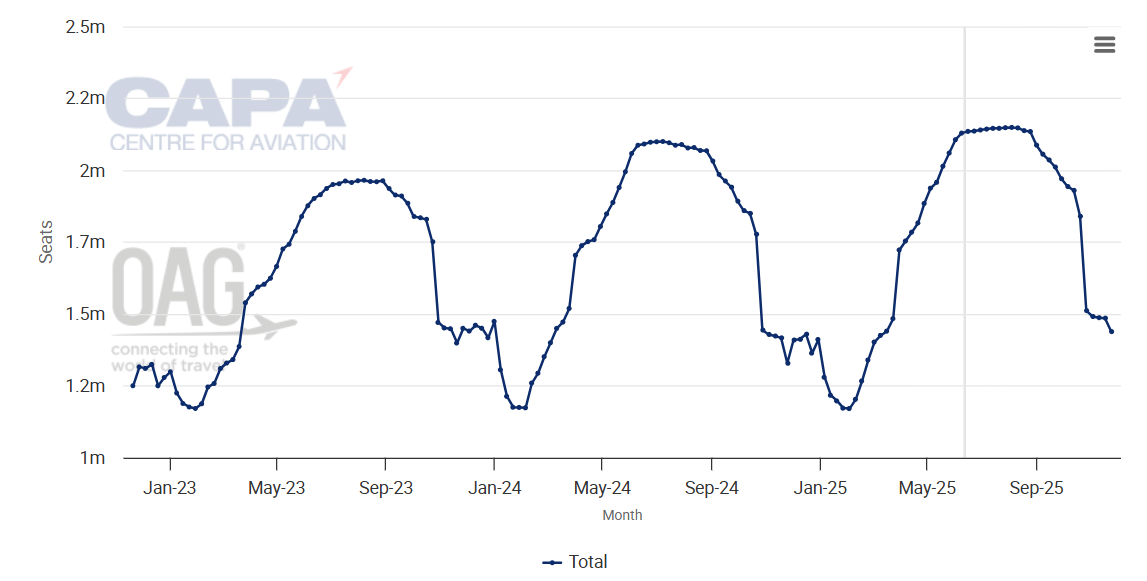

At this point, capacity growth in the trans Atlantic market seems rational, with CAPA - Centre for Aviation data showing two-way seats from the US to Western Europe growing at just 1.4% year-over-year for the week of 9-Jun-2025.

Two-way seats between the US and Western Europe, from late Nov-2022 to Nov-2025*

Source: CAPA - Centre for Aviation and OAG.

*The values for this year are at least partly predictive up to 6 months from 09-Jun-2025 and may be subject to change.

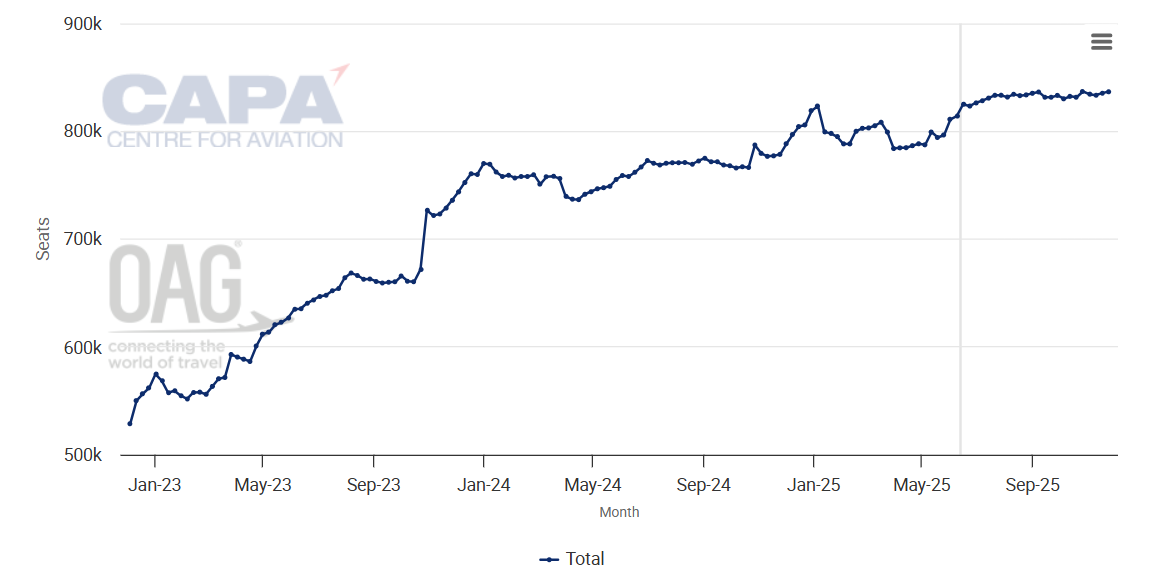

The increase is more pronounced for Asia as the recovery from the pandemic in that region was slower than in other areas of the world.

Two-way seats from the US to Asia are up 7.4% year-over-year for the same period.

Two-way seats from the US to Asia Pacific, from late Nov-2022 to Nov-2025*

Source: CAPA - Centre for Aviation and OAG.

*The values for this year are at least partly predictive up to 6 months from 09-Jun-2025 and may be subject to change.

United cites improving trends in Newark after some book-away earlier in 2Q2025

United faced some unique obstacles at its Newark Liberty International hub in 2Q2025 due to equipment outages, air traffic controller staffing issues, and runway construction. The US FAA has reduced hourly operations at the airport, but perception issues have resulted in book-away from Newark.

"At least for this summer, the prices are going to be cheaper because we took a hit to bookings - so we have more seats open to sell out of Newark", United CEO Scott Kirby stated during an investor event in May-2025.

With the reduction in operations, Mr Kirby told investors that Newark could be the most reliable of New York-area airports for the balance of the year 2025.

He recently told the Wall Street Journal for a couple of weeks that load factors in Newark had been down 15 points. But that improved to a decrease of five points in the last two weeks of May-2025, shrinking to a drop of three points for Jun-2025. The pricing adjustments are helping, Mr Kirby explained.

US point-of-sale and premium product performance remain strong, for now

Although point-of-sale for US routes from Canada and Europe has been pressured, the country's large global network airlines feel reasonably confident about US point-of-sale.

Data from Statistics Canada show that resident return trips by air to Canada from the US fell 24% year-over-year in May-2025.

Previously, United's management had concluded that for 2Q2025 international passengers originating in Europe had been down 6% year-over-year, and Canadian origin passenger volumes were slightly worse, with a decrease of 9%.

See related CAPA - Centre for Aviation report: US Aviation: how recession-proof is US international point of sale?

Both United and Delta, which each have in excess of 80% US point-of-sale for international seats, believe that US origin strength compensates for the fall-off elsewhere.

Those airlines also haven't seen any cracks in demand for premium products; Delta's premium and loyalty revenue grew 7% year-over-year in 1Q2025. United's premium cabin unit revenues increased by mid-single digits for the first three months of 2025, and unit revenues on international routes featuring its Polaris product were up 8%; international Premium Plus increased by 5%.

Will strong international and premium trends hold? Second quarter results could offer clues

To date no US airline has expressed different sentiments about international demand patterns, US point-of-sale, and premium product performance, other than those offered at the end of 1Q2025.

As 2025 continues to unfold, industry watchers will continue to see if those impressions will remain intact, and the summer high season should provide clues to whether changes will ensue.