Is Canada's domestic market still stable after US demand softens? 2H2025 could be pivotal

A by-product of the drop in Canada-US transborder demand, after shifts in US trade policy, was the decision by Canadian airlines to redeploy some capacity back into the domestic market.

A lingering question from the reallocation of capacity is whether there's a danger of a supply-demand imbalance occurring in Canada's domestic market.

For now, Canadian airlines seem optimistic that a rational marketplace will ensue, as they navigate the northern summer high season.

Summary

- Air Canada foresees a stable domestic environment in 2Q2025 and 3Q2025.

- Porter Airlines sees a shift among Canadians – to local travel.

- Flair Airlines believes that shifts by Canadian airlines from US transborder routes will remain in place for the near future.

- WestJet cancels some transborder routes, and uses new domestic flights to feed its European network.

- Canadian operators are waiting to see if transborder demand changes are going to be permanent.

Air Canada foresees a stable domestic market as its network diversification provides competitive shield

Canada's airlines had to quickly reorient some US transborder capacity into domestic and other warm-weather markets during 1Q2025, after tariff threats by the US and discussions about Canada becoming the 51st state dampened demand for Canadian point-of-sale.

Air Canada executives told analysts and investors in May-2025 that it was experiencing booking declines on point-to-point transborder routes in the low teens, on average, for the next six months.

See the related CAPA - Centre for Aviation report: Air Canada's network diversification efforts create a buffer against falling US demand

But the company's management also reported that Canada's domestic market looked stable in terms of passenger growth for the second and third quarters of 2025, and Air Canada's own domestic capacity growth would remain in the single digits.

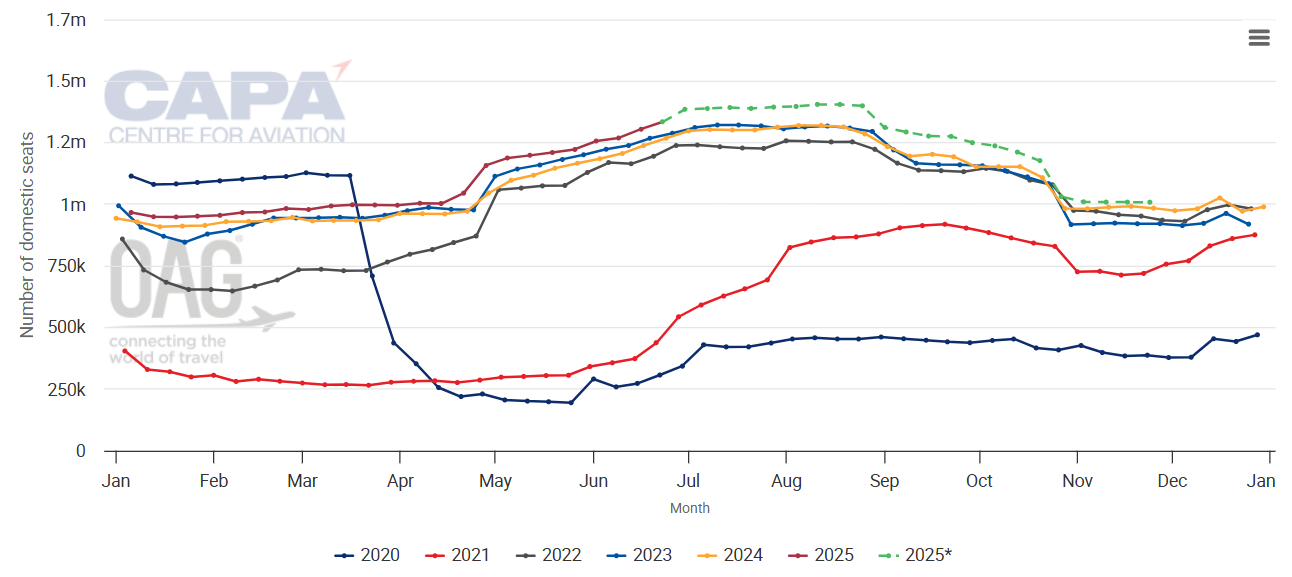

Data from CAPA - Centre for Aviation and OAG show that Canada's overall domestic seats are forecast to grow 7% year-over-year for the week of 21-Jul-2025.

Canada's weekly total domestic seats, from 2020 to late Nov-2025

Source: CAPA - Centre for Aviation and OAG.

*These values are at least partly predictive up to 6 months from 16-Jun-2025 and may be subject to change.

Porter sees strong domestic demand in Canada for busy northern summer period

Before the US trade upheaval, the US transborder market played a key role in Porter Airlines' expansion with its growing Embraer 195-E2 fleet.

But the airline joined its Canadian counterparts in opting to reallocate some of its US capacity back into Canada.

Earlier in 2025 Porter explained that domestic operations during the peak summer season in the northern hemisphere would represent 80% of its network, versus previous plans of 75%. However, the airline did state that its presence in the US market should still be 25% larger year-over-year for the northern summer time frame.

"We're allocating quite a bit more of that capacity in Canada...we feel the summer season is already the strongest domestically, and we feel this summer will be even stronger as a result of Canadians wanting to travel locally", Porter CFO Robert Palmer told CAPA TV during the CAPA Airline Leader Summit Americas in Apr-2025.

Porter Airlines, EVP & CFO, Rob Palmer, at the CAPA Airline Leader Summit Americas 2025

Source: CAPA TV.

He added that those travellers now prefer to travel cross-country to visit destinations that include Vancouver and Halifax, "instead of going someplace in the US".

Porter has recently launched a slew of new routes in Canada, including Hamilton to Vancouver and Halifax. It's the lone airline on the Hamilton-Halifax and Ottawa to Victoria route pairings.

WestJet has pulled out of some of Porter's new routes, including Hamilton-Halifax and Toronto-Deer Lake, as it places more emphasis on its hub in Calgary.

Competitor two-way seats on some of Porter Airlines' new domestic routes, as of mid-Jun-2025

| Route | Airline seat share |

| Toronto-Deer Lake |

Air Canada 73.9% Porter 26% |

| Toronto-Charlottetown |

Air Canada 75.5% Flair 12% Porter 12% |

| Hamilton-Halifax | Porter 100% |

| Hamilton-Vancouver | Porter 100% |

| Ottawa-Victoria | Porter 100% |

| Toronto-Kelowna |

Air Canada 66% Porter 16.8% WestJet 17.1% |

Source: CAPA - Centre for Aviation and OAG.

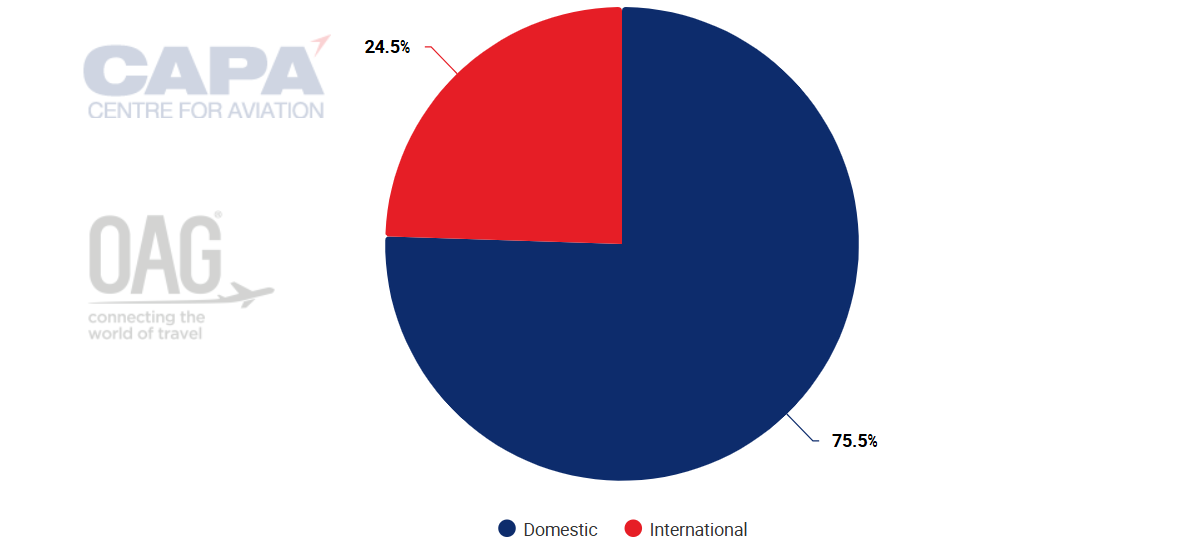

Domestic routes represented nearly 76% of Porter's departing frequencies in mid-Jun-2025, and when Mr Palmer spoke with CAPA TV in Apr-2025 he explained that Porter had recorded a reduction in bookings to popular US destinations over the previous six weeks.

Porter Airlines: domestic versus international departing frequencies, as of mid-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

The Canadian ULCC Flair caps growth for 2025, and believes transborder shifts will remain in place until 2026

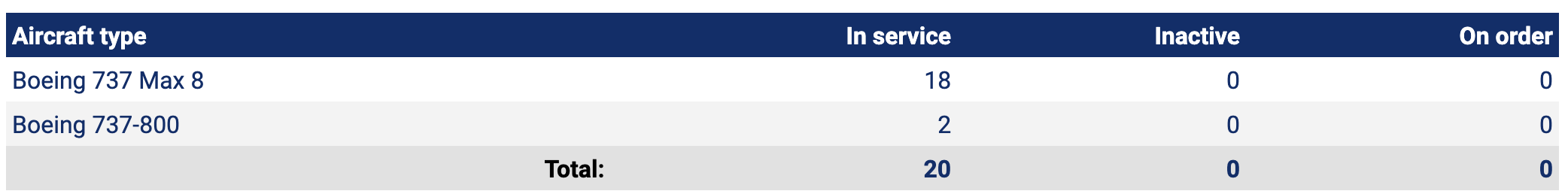

Flair Airlines' CEO Maciej Wilk told attendees at the CAPA Airline Leader Summit Americas conference in Apr-2025 that the airline had no plans to add aircraft to its fleet this year, noting "ironically, this is good news right now".

The airline operates 18 Boeing 737-8s and two 737-800s, according to the CAPA - Centre for Aviation Fleet Database.

Flair Airlines' fleet summary as of mid-Jun-2025

Source: CAPA - Centre for Aviation Fleet Database.

He also said that schedule changes implemented by Canadian airlines in the previous weeks would likely remain intact for the foreseeable future, adding that operators would likely reassess again when planning begins for summer 2026.

At the same time, Mr Wilk also struck a cautionary note, explaining that shifting transborder capacity back into Canada due to decreased demand "doesn't solve the issue[,] because everybody's doing the same".

He noted that the "...billion dollar question is whether this is something that will continue for the next 3-4 years, or emotions will cool down and the summer of 2026 will be more or less back to normal".

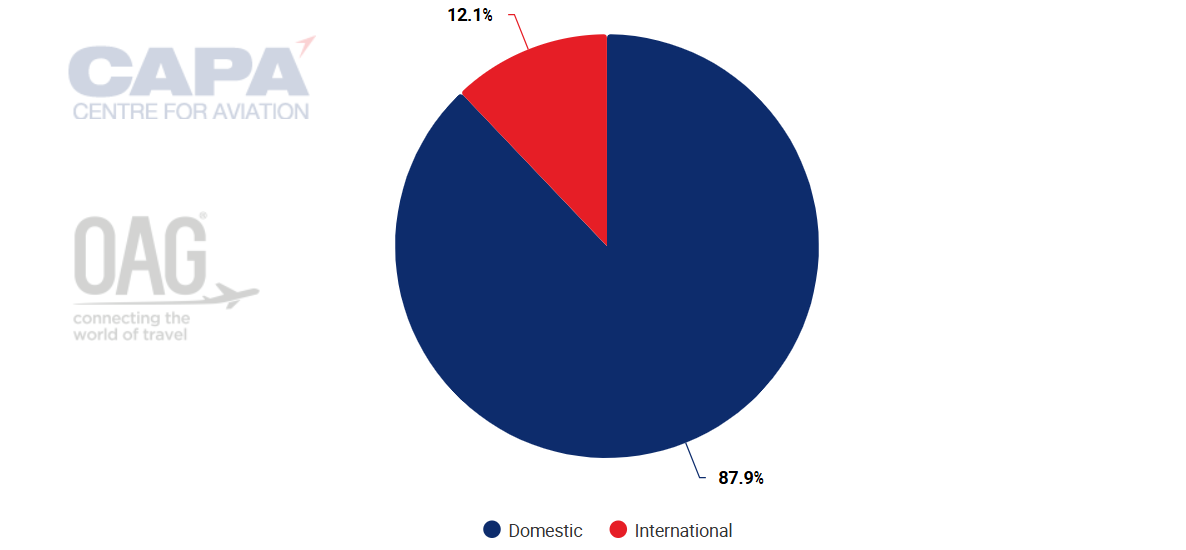

As it navigates shifting demand patterns, Flair's domestic departing frequencies are nearly 88% - the highest among Canada's airlines.

But as an ultra-low cost airline, Flair's focus is domestic and near international service.

Flair Airlines' domestic versus international departing frequencies, as of mid-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

WestJet cuts US routes and adds Canadian pairing to funnel passengers to Europe

Back in Feb-2025 WestJet CEO Alexis von Hoensbroech told CTV News that the tariff announcements had resulted in a significant drop-off in transborder sales - approximately 25%.

In May-2025 Aviation Week Network reported that the airline was suspending nine transborder routes for parts of the summer, citing declining demand for travel to the US, amid growing tensions between the neighbouring countries.

An airline spokesperson explained to the publication that WestJet had "seen an increase in demand for domestic travel, specifically between Eastern and Western Canada," and would add capacity on domestic transcontinental routes.

Some of WestJet's new domestic services set to debut in late Jun-2025 and early Jul-2025 include Winnipeg-St John's, and Halifax to Saskatoon and Regina.

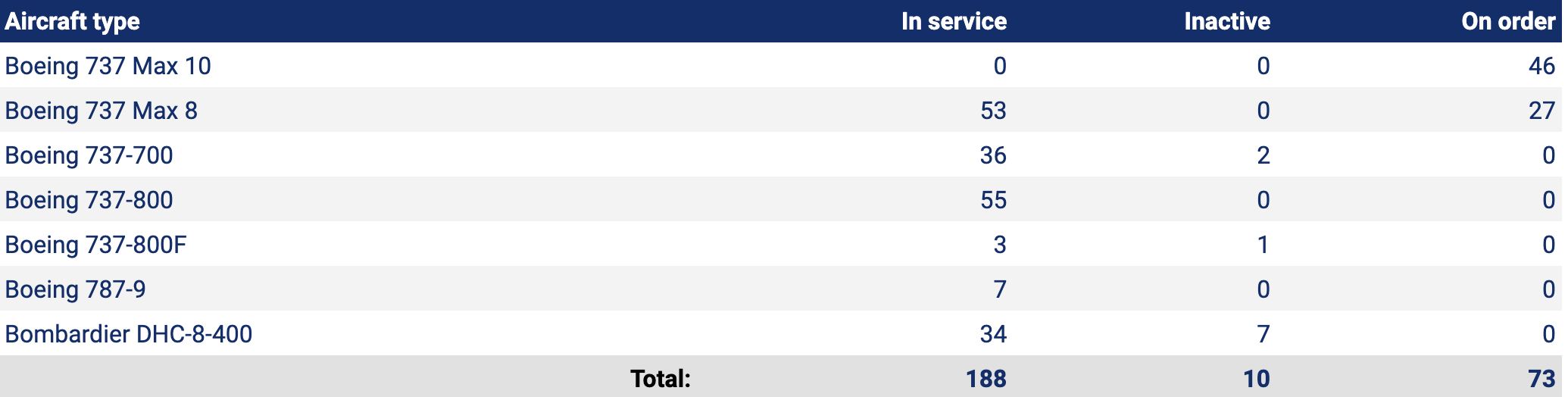

WestJet concluded that those routes would offer connections to its European network from Canada's east coast; the airline operates Boeing 737-8s from St John's to Dublin, London Gatwick and Paris and from Halifax to Amsterdam and Dublin.

Additionally, WestJet bases its seven 787-9s at its Calgary hub, operating flights to Tokyo Narita, Seoul, Barcelona, Dublin, Edinburgh and Paris.

WestJet Group: fleet summary, as of mid-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

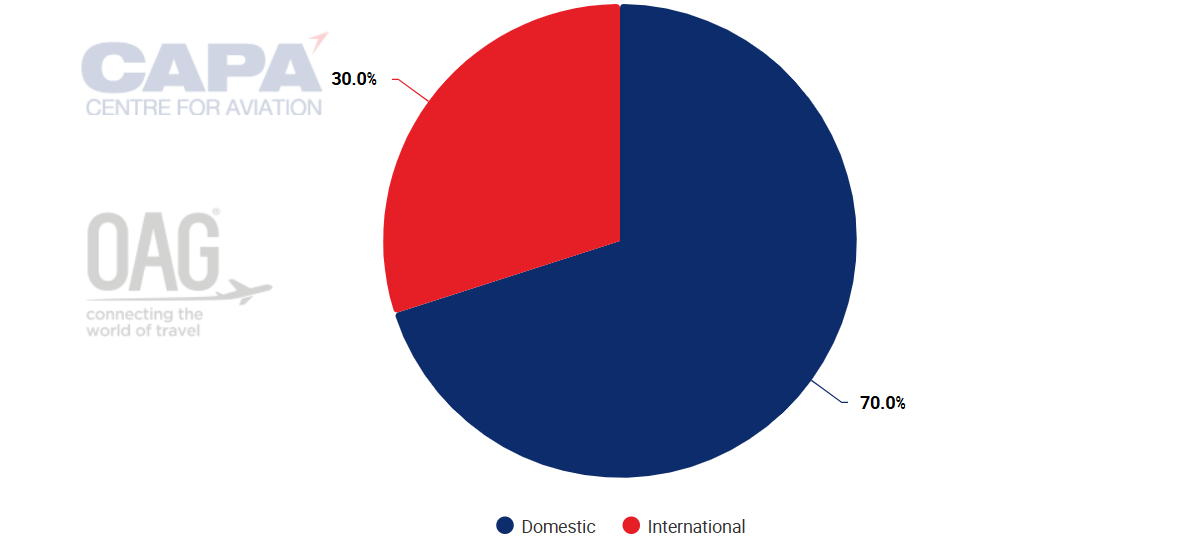

WestJet's long haul flights also provide the airline some additional network flex, as its domestic/international departing frequency split is 70%-30%.

WestJet: domestic versus international departing frequencies as of mid-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

What does the future hold for US-Canada dynamics in 2026 and beyond?

Canada's airlines arguably moved quickly to disperse capacity slated for US transborder routes elsewhere.

For now, it seems as if the addition of some capacity back into the domestic Canadian market is not creating an irrational marketplace; but more clarity should emerge as the busy summer season unfolds.

All of Canada's airlines are waiting to see if this is a permanent shift, or if a return to normal trends is in store for 2026.