Aircraft Interiors industry development summary: May/Jun-2025 - A320 Family business class insight

This regular CAPA - Centre for Aviation report provides a summary of major developments in the aircraft interiors sector, supported by data from the CAPA Aircraft Interiors Database and CAPA News.

This edition covers May-2025 and Jun-2025 and features:

The past decade and what lies ahead for A320 family business class;

Overview of A320 family business class seat suppliers;

A region-by-region view of A320 family business class developments;

+ Latest global interior updates.

Summary

- This regular CAPA - Centre for Aviation report provides a summary of major developments in the aircraft interiors sector, supported by data from the CAPA Aircraft Interiors Database and CAPA News.

- This edition covers May-2025 and Jun-2025 and features:

- The past decade, and what lies ahead for A320 family business class.

- Overview of A320 family business class seat suppliers.

- A region-by-region view of A320 family business class developments.

- Latest global interior updates.

A320-family business class: the past decade and what lies ahead

Etihad Airways recently unveiled full cabin interiors for its upcoming A321LR.

At the front of the cabin are STELIA Opera NA seats, featuring sliding doors, flat beds, a 20-inch 4K Inflight entertainment screen with bluetooth audio pairing, and wireless charging.

The Abu Dhabi-based airline joined the Business Plus trend by not only having a differentiated row 1 offering, but also by going as far as calling it 'First Suites'.

While JetBlue Airways was the first to bring the Business Plus concept to the A320 family, Etihad is the first to have marketed it as first class. This marks the latest development in the increasingly premium and dynamic role played by the four-decade-old A320 family.

Until the recent decade, the A320 family was rarely treated as a platform to feature premium products such as lie-flat seats. Only American Airlines, British Airways, JetBlue, Qatar Airways and Gulf Air operated small fleets of premium narrowbodies (part of the British Airways premium sub-fleet came via its merger with bmi - British Midland International).

This changed with the introduction of the A321neo.

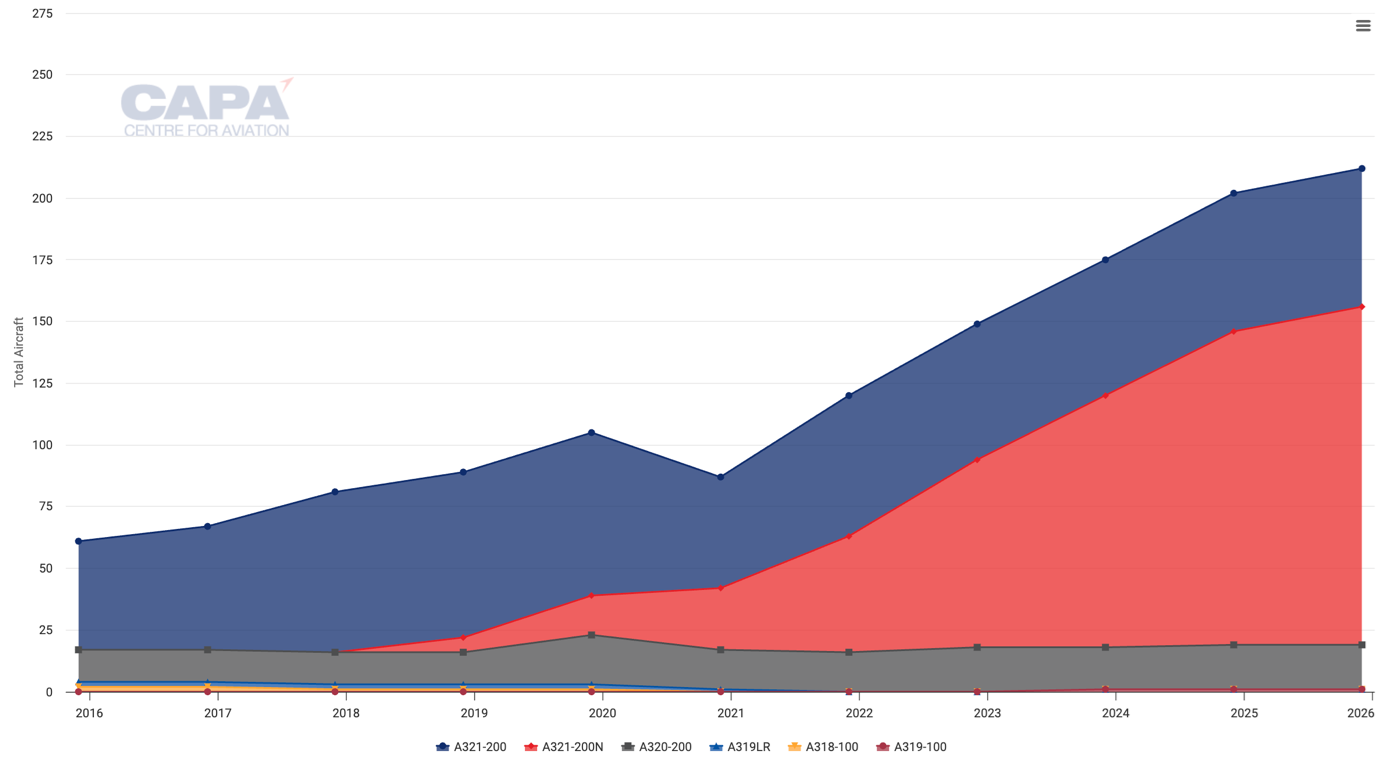

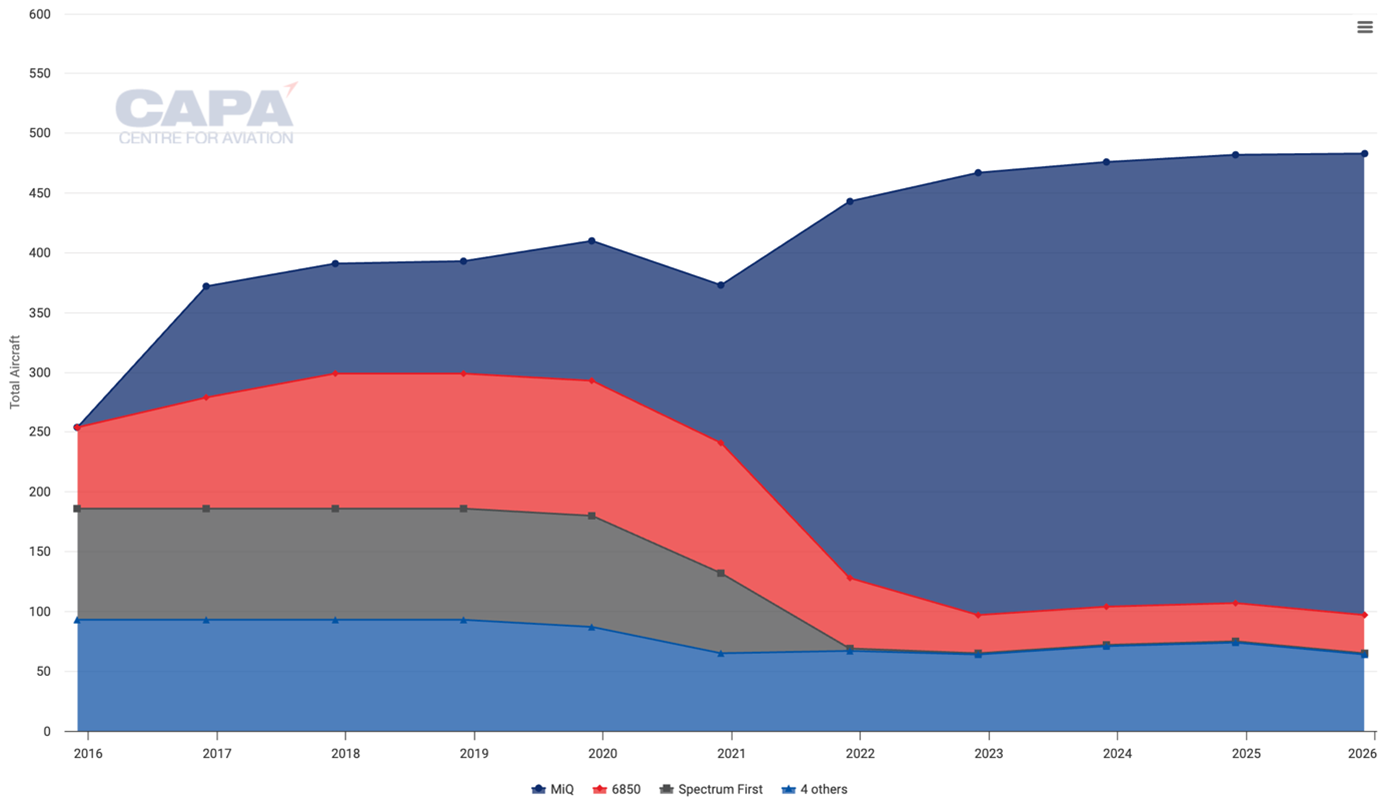

The graph below shows that the number of A320-family aircraft featuring lie-flat products only truly took off when the A321neo (bright red) entered service in 2018.

Timeline of A320-family passenger aircraft in service with lie-flat business class seats over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Through the years - A320-family business class seat suppliers

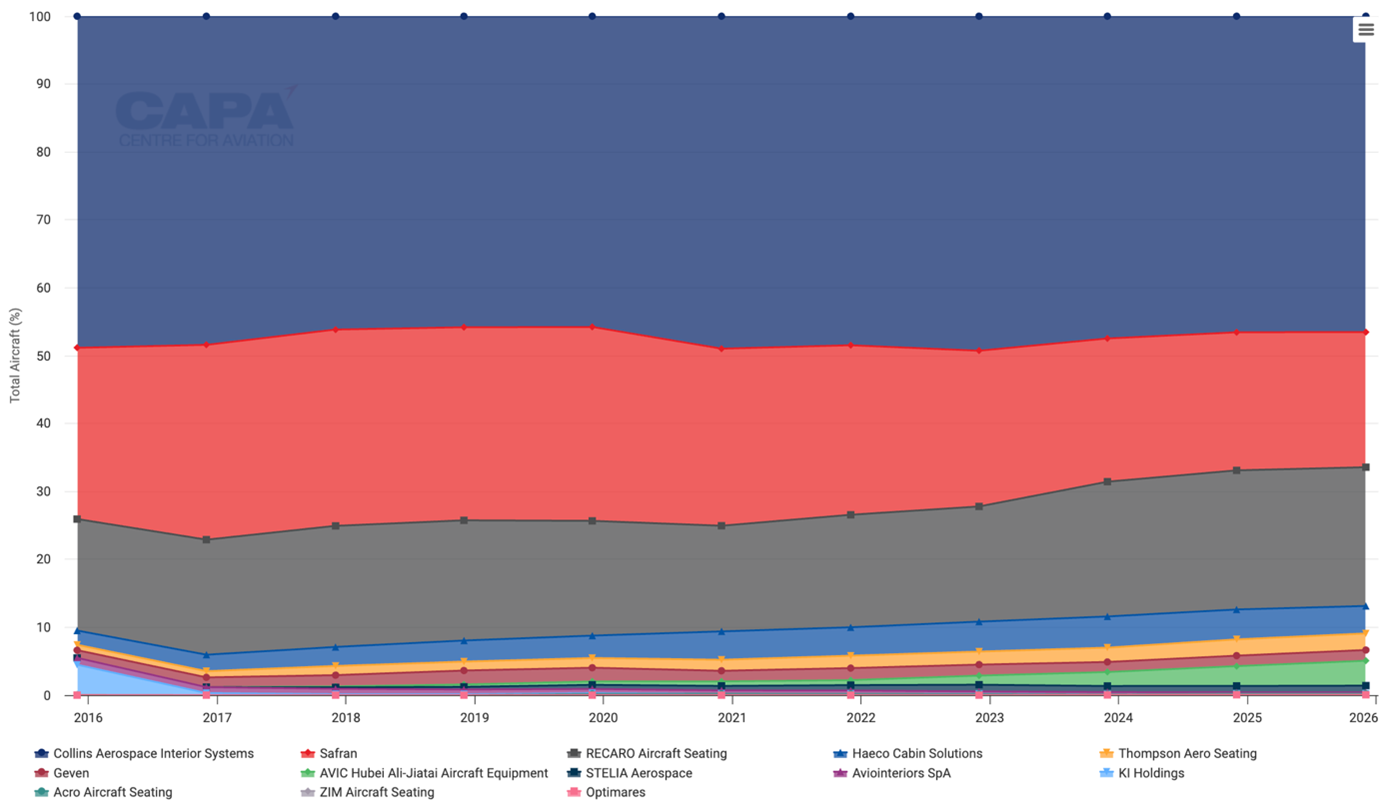

Premium seating on the A320 family has long been dominated by Collins Aerospace Interior Systems.

Almost half of the A320-family business class cabins in service feature Collins seats.

RECARO Aircraft Seating overtook Safran to become the second largest provider after the COVID-19 pandemic.

The combined market share of these 'Big 3' manufacturers has hovered at around 90%, and not changed significantly over the past decade.

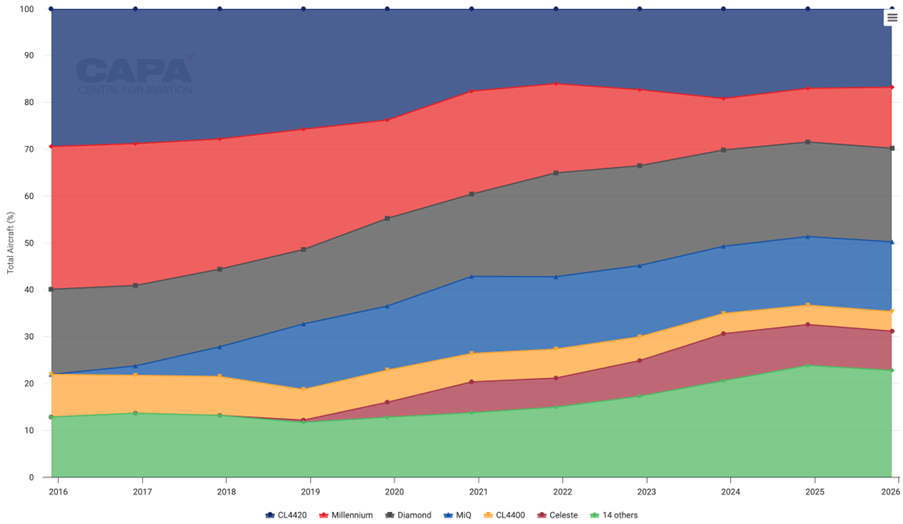

Timeline of in-service A320-family passenger aircraft business class seat manufacturer share over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Collins Aerospace has maintained its market leader position as the A320-family business class market leader over the past decade, partially due to the successful generational shift from the Millennium platform.

The MiQ began installation on A320 family aircraft in 2016, and has rapidly grown to become the second most popular seat model of the aircraft production group.

Other top models featured in the A320-family business class cabin include the CL4400 and CL4420 from RECARO, and various former Weber models, including the 6810, 6850 and 7070, now manufactured by Safran.

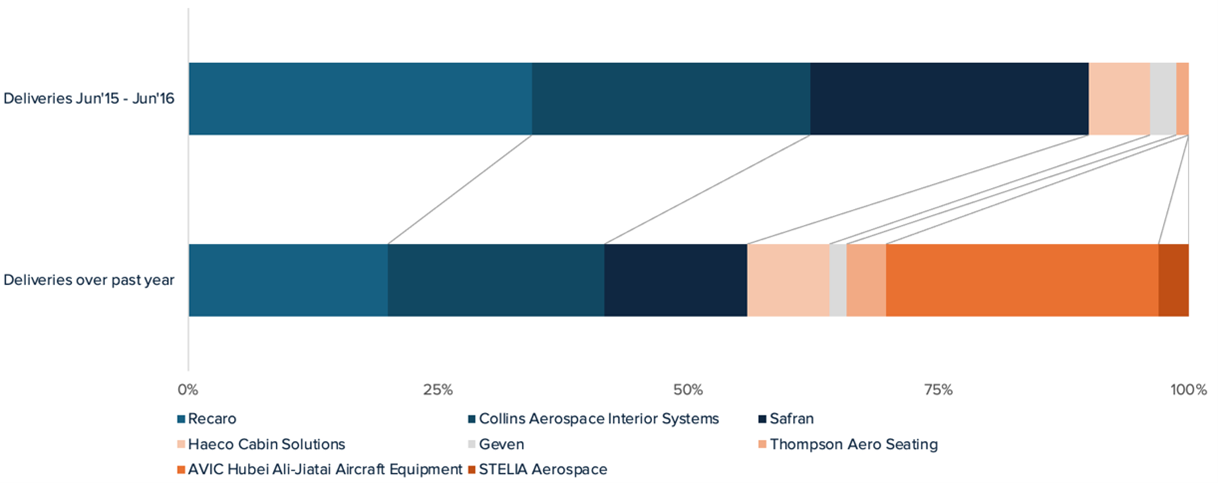

However, looking specifically at new aircraft deliveries, smaller players have been making major inroads.

Deliveries a decade ago were still dominated by the 'Big 3' manufacturers, but for recent deliveries they have lost a sizeable chunk of their share to: AVIC Hubei Ali-Jiatai Aircraft Equipment (also known simply as Jiatai), HAECO Cabin Solutions (now part of Zim), Thompson Aero Seating, and STELIA Aerospace.

Jiatai's market share increase has been nothing short of astronomical. It pushed the manufacturer to be the largest linefit supplier of A320 business class seats for deliveries over the past year.

Thompson Aero Seating and STELIA Aerospace's rise broadly correlates with deliveries of the A321neo. The two manufacturers, alongside Collins Aerospace, share the A321neo lie-flat market.

Meanwhile, HAECO Cabin Solution's rise is singlehandedly propped up by its Spirit Airlines' deliveries.

Market share of business class seats line-fitted on A320-family passenger aircraft delivered over the past year, versus 10 years prior

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Around the world - regional trends from region to region

CAPA - Centre for Aviation will now present a region-by-region view of A320-family business class developments

Asia - Chinese airlines influence supplier split

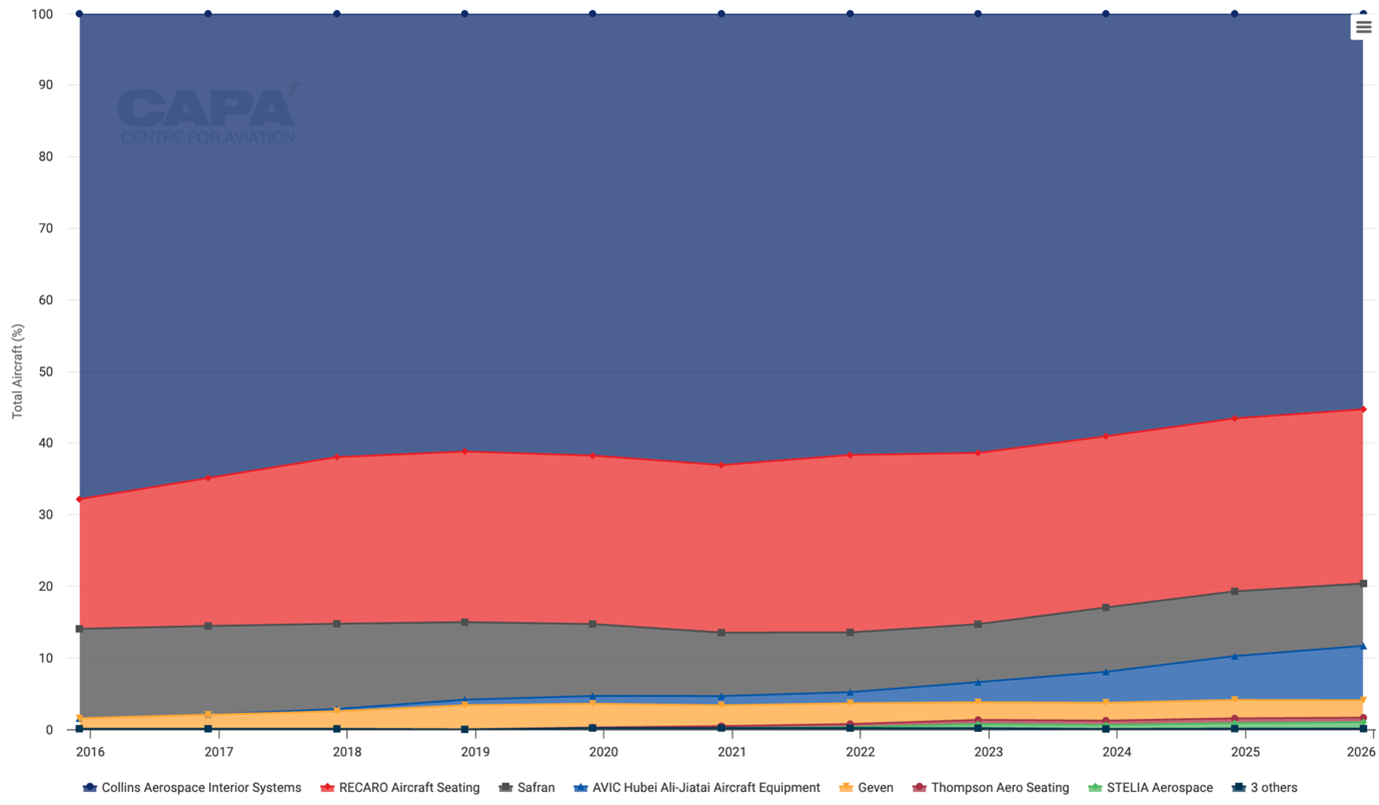

We start with Asia, the region with the largest A320-family fleet.

On a high level, A320-family aircraft business class cabins in the region are also dominated by seats from the 'Big 3'.

It should be noted that Safran has a much smaller share in Asia than globally.

Timeline of Asian in-service A320-family passenger aircraft business class seat manufacturer share over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

The Collins Aerospace Millennium platform is also the market leader in Asia, thanks to its historical popularity among Chinese airlines.

Approximately 85% of Millennium seats in service on A320s are operated by Chinese airlines: China Southern Airlines, Air China and China Eastern Airlines are all Millennium users.

Millennium's successor, the MiQ, also proved popular among airlines from China. However, in recent years Chinese airlines have made a hard pivot to Jiatai, and its 'made in China' solutions for linefit and retrofit activities.

From 2021 China Eastern Airlines and Sichuan Airlines took delivery of A320neos linefitted with AVIC seats. The Xiamen Airlines' A321neo, China Eastern Airlines' A321neo, China Southern Airlines' A321neo and Hainan Airlines' A320neo followed suit.

This started initially with the Jiatai Kky131/140, and the airlines eventually all shifted towards the JT220B. Over 70% of Chinese A320-family deliveries over the past year feature Jiatai seats.

Collins Aerospace and RECARO dominate installation activities for other parts of Asia.

In India, the Collins Aerospace MiQ platform was selected by Air India as part of its USD400 million aircraft retrofit programme.

The CAPA Aircraft Interiors Database currently tracks 20 legacy Air India A320neos retrofitted. This allows Air India to align its offering better with legacy Vistara aircraft, which also feature the MiQ

In early 2024 Thai Airways International announced an intention to retrofit its narrowbody aircraft. The CAPA Aircraft Interiors Database tracks that 19 A320s have now added 12 RECARO R5 business seats.

North America - Collins Aerospace and Safran lead the way

In the North American market there has been Collins Aerospace and Safran broadly splitting 80% of the market. Both have maintained their respective shares in the region over the past decade.

Collins Aerospace is primarily used by American Airlines and Air Canada; Safran is primarily used by Delta Air Lines and United Airlines.

While Collins Aerospace has maintained its most important North American customers, there is a clear shift in its most popular seat model that marks the supplier's generational shift

The 'Spectrum First' and 'Millennium' seat were introduced on A320s at a similar time (1990s). The North American market saw the Spectrum First being Collins Aerospace's most popular offering. Since 2016, when the MiQ was introduced to the market, MiQ started gaining market share at the expense of Spectrum First.

This was driven by American Airlines retrofitting its A320-family aircraft. In 2019 American Airlines started retrofitting its A321s with 'Project Oasis'. The Collins Aerospace MiQ replaced older models from Safran, RECARO, and its own equipment.

Timeline of American Airlines in-service A320-family aircraft business class seat manufacturer share over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

According to the CAPA Aircraft Interiors Database, the Collins Aerospace MiQ is currently featured on 80% of American Airlines' A320-family aircraft. This is also contributed to by the airline selecting MiQ for most new A320-family deliveries.

Air Canada also embarked on a similar programme from 4Q2023. The CAPA Aircraft Interiors Database tracks that 11 Airbus A321s have now completed retrofit to MiQ, and were re-entered into service.

Europe - Eurobusiness dominates across the region

When it comes to narrowbody business class seat design, the European airlines generally had a completely different approach.

'Eurobusiness Class', offered by British Airways, Lufthansa and Iberia, among others, has the same seat as economy class but with a blocked middle seat.

But some airlines are returning to offer true business class to provide more comfort for their premium passengers.

In May-2025 Eurowings announced a plan to introduce a new business class product on its medium haul routes. The 'Geven Comoda' seat will feature on the airline's A320neo from Nov-2025.

For more details, refer to previous CAPA - Centre for Aviation analysis: Eurowings gets new premium seat before other Lufthansa Group airlines.

It is worth noting that Luxair was the first European airlines to reintroduce a business class seat on a narrowbody aircraft in recent years.

In Dec-2022 the airline retrofitted one of its all-economy Boeing 737s by adding 12 reclining business seats, and another 737 MAX 8 was also retrofitted with a dual-class configuration in 2024.

However, the CAPA Aircraft Interiors Database records that the first retrofitted 737 has quietly switched back to single-class configuration recently - it is unsure whether the airline will continue the retrofitting programme.

Middle East - living with a premium reputation

Middle Eastern airlines have long enjoyed a premium reputation.

As previously mentioned, Gulf Air and Qatar Airways were among the early adapters of narrowbodies with lie-flat seats.

Gulf Air first introduced a lie-flat bed seat on its A321 in 2012, and over the years the Bahrain-based airline has opted to maintain its sub-fleet of premium narrowbodies.

Recent A321LR deliveries resulted in the Collins 'Aerospace Diamond' seat being installed, while denser aircraft feature the 'Stelia Celeste'.

Qatar Airways followed suit in 2014, becoming one of the first to install the Collins Aerospace Diamond on a narrowbody.

While the Diamond platform is currently the most popular A320-family business class seat model in the region, Middle Eastern A320-family aircraft still mostly feature more conventional recliner business class seats.

The CL4420 and Millenium seats dominated the market until 2019: the subsequent decline in market share is due to a combination of new fleet decisions (for example - Etihad Airways), and/or seat replacement (for example - Saudia).

Timeline of Middle Eastern in-service A320-family aircraft business class seat model share over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Lie-flat seats and the future trend

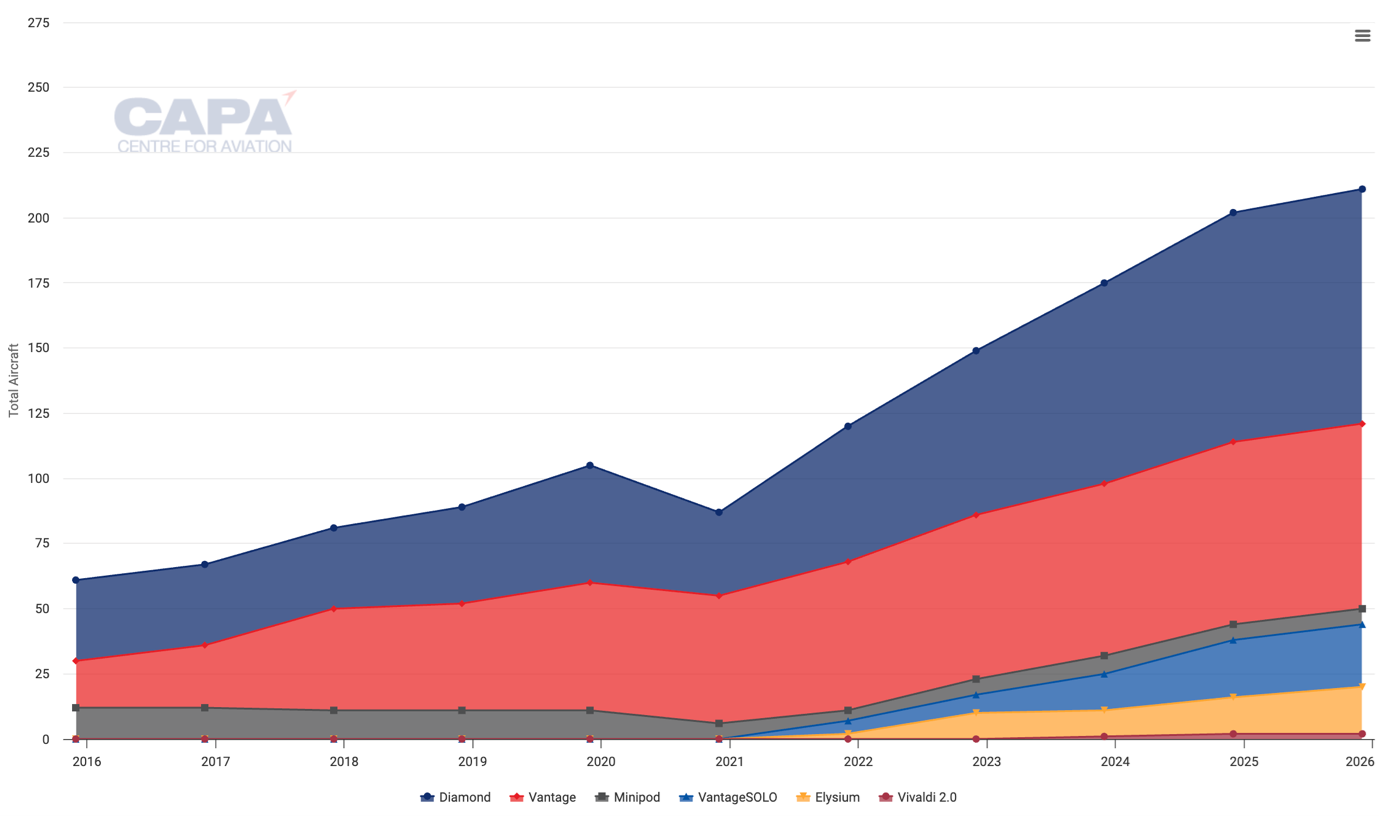

The number of A320 fleets with lie-flat seats has tripled over the past decade.

However, among all A320-family aircraft with reclining business class seats installed, only 6% of the aircraft are equipped with lie-flat seats currently.

Collins 'Aerospace Diamond' and Thompson 'Vantage' are the most popular models, followed by Vantage 'SOLO' and 'Stelia Elysium'.

Timeline of in-service A320-family aircraft lie-flat business class seat model share over the past 10 years

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Although lie-flat seats currently only have a small market share, this is a trend CAPA expects to continue rising.

In Apr-2024 Aegean Airlines announced that four of its upcoming A321neos would feature lie-flat business class seats, to serve the non-EU market.

Riyadh Air in Nov-2024 confirmed that its upcoming A321neo would feature Collins Aerospace APEX seats, and the same lie-flat seat model can be found on the airline's current 787-9 aircraft.

China Southern Airlines announced that its future A321neo business class cabin would feature the Collins Aerospace Diamond seat.

In Mar-2025 Thai Airways International announced that its A321neos on order would be delivered with Thompson Aero Seating Vantage lie-flat business class seats.

In May-2025 Kuwait Airways took delivery of its first of nine A321neo aircraft, featuring 2-2 Stelia Elysium lie-flat seats.

A321XLR arrival will unlock more premium products to support longer missions

Meanwhile, the late-2024 service entry of the A321XLR is expected to further unlock more premium products on the A320 family.

A321XLR launch customers, Iberia and Aer Lingus, both opted for Thompson Aero Seating lie-flat seats, likely as part of the larger IAG decision.

Both Air Canada and Saudia confirmed that 1-1 lie-flat seats would be installed on their forthcoming A321XLRs.

As the third A321XLR operator, American Airlines rolled out more configuration details for its aircraft in Mar-2025: its A321XLRs will not only feature 20 Collins Aerospace Aurora lie-flat seats with privacy doors, but also 12 reclining premium economy seats; the latter are what other airlines are treating as standard business class seats.

Other latest global interior news

OEM

- Greenerwave and Safran partner to develop new Ka-band terminal.

Asia Pacific

- Air New Zealand to retrofit its 777 fleet.

- Air New Zealand begins Starlink trial on an A320.

- Air Tahiti Opts for ATR HighLine All-Business Class Cabin.

- All Nippon Airways iterates on 'The Room' with 'The Room FX' for upcoming 787-9 deliveries.

- EVA Air to offer free WiFi to premium passengers and free messaging for loyalty members in economy class.

- Royal Brunei Airlines selects Intelsat multi-orbit IFC for A320neo fleet.

Americas

- Air Canada, Air Canada Rouge and Air Canada Express now offer free WiFi in North America.

- Air Canada Express (Jazz) to retrofit new seats and power for E175 and CRJ900 fleets.

- JSX to begin ATR Operations with ATR HighLine All-Business Class Cabin.

- LATAM's Boeing 787 with RECARO R7 Business Class suites enters service.

- LATAM Group to implement Viasat Amara IFC on widebody aircraft for long haul flights.

- Spirit Airlines announces 'Go Comfy' extra legroom product.

- United Airlines unveils new Polaris business seats, and includes Polaris Studio.

Europe, Middle East and Africa

- Eurowings to trial reclining business class seats on A320s.

- Ethiopian Airlines taps Panasonic Astrova IFE for its 777Xs.

- Flynas signs MoU with Safran to equip 60 A320neo with Z200 seats.

- FlySafair selects Acro Series 9 seats.

- Lufthansa now offers free inflight messaging worldwide.

- Luxair picks RECARO R2 from Embraer SFE catalogue.

- Qatar Airways selects Panasonic Converix system for 60 777Xs.