Rwanda invests USD500 million more in Bugesera Airport as it promotes an African sporting nirvana

Rwanda's new Bugesera International Airport is a teenager already - and it hasn't even been built yet. The government has been forced into a further USD500 million cash injection in it for this fiscal year, supported by a Development Bank loan, and that is putting immense pressure on the national debt.

The Qatari government, through Qatar Airways, is a silent partner so far, as part of its drive to build its presence in the African continent - but may have to step up to the plate. If, and when, the airport is finished (2027 or 2028 depending on who you believe), it will then face the challenge of pitching for regional business and influence against the likes of Addis Ababa (which will get a brand new airport of its own eventually) and Nairobi.

At least some of its peers also have challenges of their own, to level the playing field a little.

And RwandAir doesn't have an actual or anticipated fleet to be thinking about large scale expansion.

Moreover, political tribal issues are once again in evidence in the region; no one really wants to go there again.

One way the government is looking at putting the new and existing airports - and the country - on the map is by attracting global sporting events to Rwanda, in a smaller scale imitation of what Gulf countries (Qatar, Saudi Arabia etc) have been doing, starting with hosting a Formula 1 Grand Prix annually.

Some may say well 'Good Luck with that', but it could work.

But then, could even this new infrastructure handle it if Rwanda suddenly became Africa's leading sports venue?

Both the country and the new airport are in for some interesting times ahead.

Summary

- Rwanda has allocated another USD500 million to the new Bugesera Airport project, while the AIIB chips in with a USD200 million loan.

- Bugesera is a project that is very significant for Africa, not just Rwanda, and now set to open in 2027 or 2028.

- Qatar Airways’ 60% stake remains in place; the final cost now around USD2 billion.

- The National Debt is being pushed to the limit.

- The aim is for Bugesera to be an alternative hub to Addis Ababa.

- Other rival peer regional airports have their own problems.

- Might it become a minor hub to serve a major one?

- Sports events are high on the agenda to attract foreign visitors.

- But political tensions are raising their ugly head again.

- The current airport is small but plays a transnational role.

- It caters for around one million passengers annually.

- There are no low cost carriers, and few alliance airlines – that’s a problem in the long run.

- 'Forewarned is forearmed' – Rwanda must create the right conditions at and around the new airport that foreign visitors expect.

- There is the potential for long haul services and an expansion of hub operations, but RwandAir doesn’t have the fleet to do it.

Rwanda allocates another USD500 million to new Bugesera Airport; AIIB (Asian Infrastructure Investment Bank) chips in with a USD200 million loan

Rwanda's Government has allocated USD485.4 million for the Kigali Bugesera International Airport construction project in its 2025/26 budget.

The project will also be supported by a USD200 concessional loan from the Beijing-based Asian Infrastructure Investment Bank.

A project very significant for Africa, not just Rwanda, now set to open in 2027 or 2028

The airport - a significant one not only for Rwanda, but for the African continent as one of few being built or managed there with foreign investment - is being built in cooperation with Qatar's Government, and will be equipped with a 130,000 square metre terminal, with initial capacity to handle seven or eight million passengers per annum (the figure varies between news reports).

It will also include a 3,750 metre runway, a presidential terminal (VIP), office buildings for stakeholders, and "all necessary infrastructures".

The new airport will also see a dedicated cargo terminal, capable of accommodating 150,000 tonnes of cargo a year.

It is approximately 23km to the southeast of Kigali City, situated within the Rilima and Juru sectors of the Bugesera District in the Eastern Province of Rwanda.

Bugesera, Rwanda: airport location

Source: Google Maps.

The second phase is expected to be completed by 2032, and to double its capacity to 14 million passengers a year.

Completion of first phase construction is expected in 2027 (or "a firm commitment to complete the airport by 2028" according to the Minister of Finance and Economic Planning, Yusuf Murangwa), having been put back from 2025 due to delays in delivery of construction materials.

It is now almost 10 years since the country first sought out international investment for the project.

Artist's rendition of terminal building

Source: CNLL Architects.

One of the major priorities for government in the forthcoming fiscal year is to advance the full-scale construction of the new international airport.

Current progress on the project stands at approximately 25% to 30%. Preparatory work on the runways, access roads, and water systems has been completed, and the project has now entered the building phase, during which it is expected to employ more than 6,000 workers.

The construction works are described locally as being "in high gear", with the authorities saying horizontal works are near complete, and have moved to the vertical - another way of saying that buildings are starting to be erected.

Qatar Airways' 60% stake remains in place; final price now around USD2 billion

In 2019 Qatar Airways partnered with the Rwandan government, securing a 60% stake in the airport project, which was then estimated to cost more than USD1.3 billion.

The final price is now thought to be USD2 billion.

The overall budget will be expanded to RWF7.032 trillion (USD4.8 billion) to help finance big-ticket infrastructural projects, which also includes the expansion of routes for the national carrier RwandAir. This meant that Rwanda's budget has risen by 21% to accommodate these projects.

National debt pushed to the limit

The International Monetary Fund (IMF) has warned that the cost of the Bugesera airport will significantly intensify Rwanda's debt service pressures and raise the country's public debt to 86.3% of GDP by 2026.

As bad as that sounds, the same debt to GDP ratio is currently 81% in the Euro Zone countries: 95.5% in the UK, and 120.8% in the US.

However, the IMF commented: "Risks of overruns on large infrastructure projects need to be vigilantly monitored." The concern must be that unable to service its debts further work could be suspended. It must be the case that the decision to allocate USD500 million from the national budget could not have been informed by the IMF warning and advisory.

Rwanda's direct financial contribution to the project remains unclear, but judging by the USD2 billion investment requirement to complete it, with a 40% stake, the Rwandan government would have to raise close to USD1 billion, taking into account other airport support infrastructure it will have to put in place.

An alternative hub to Addis Ababa

The goal is to make Kigali an alternative regional hub to Addis Ababa in Ethiopia, given the geographical position of Rwanda right in the heart of Africa, which allows centralised access to all points of the continent.

It could be argued that Kigali could become the Middle Eastern Dubai, the Asia Pacific Singapore, or the US Atlanta of Africa (albeit on a much, much smaller scale to begin with).

Location of Rwanda and its three main airports

Source: CAPA - Centre for Aviation and OAG.

Addis Ababa would be the principle rival, followed by Jomo Kenyatta (the Kenyan capital Nairobi's main airport).

Both places have featured in CAPA - Centre for Aviation reports previously: Addis Ababa in Apr-2025 for the new airport, Abusera, that is to be built there initially to supplement, but in the long term probably to replace, the existing Bole Airport; and Nairobi in Aug-2024 for the botched public-private-partnership attempt by India's Adani Airports to build a new terminal and second runway, a project that was later cancelled in Nov-2024 by the Kenyan President, Ruto.

Other rival peer airports have their own problems

Nigeria, and particularly Lagos Murtala Muhammed International Airport, is often touted as a gateway to Central as well as Western Africa, but Nigeria has long been mired in an ownership stand-off between the government and trades union-led opponents. With both TAV and a Corporación América Airports-led consortium looking to manage airports in that country, and in the latter case further afield, but with both parties thwarted so far by red tape.

The other main African air gateways are at either ends of the continent: namely Casablanca and Cairo in the northwest and northeast respectively, and Johannesburg in the south.

So on paper Rwanda, known latterly as a go-ahead, forward-looking country economically (even though it is still regarded as a poor one by many socio-economic standards), has plenty to go at in attracting visitors directly (Rwanda Tourism has a USD13 million shirt 'sleeve partnership' deal with London's Arsenal Football Club in the UK through 2025, having started in 2018 and totalled over USD40 million to date), and as a hub.

Rwanda Tourism has had a long-standing sponsorship agreement with Arsenal Football Club and other leading European teams

Source: Arsenal Football Club.

As well as Arsenal, 'Visit Rwanda' sponsors French Ligue 1 club and the current European Champions Paris Saint-Germain, and the German Bundesliga team Bayern Munich.

A minor hub to serve a major one?

Qatar Airways CEO Badr Mohammed Al Meer recently said that the Rwandan project was an important part of their model to cover Africa with a big network across countries, which will fit into another similar partnership in Southern Africa.

Tied to Qatar's 60% stake in Bugesera, which is yet to be concluded five years after being announced, is a deal to own a 49% stake in Rwanda's national carrier, RwandAir.

This development was again previously reported by CAPA - Centre for Aviation in May-2024, with the conclusion that Qatar envisages both the new airport and the airline as a means to an end - namely, for Rwanda to act as a minor hub serving a major one (Doha).

Sports high on the agenda to attract foreign visitors

One way in which Rwanda is positioning itself to extract maximum non-aeronautical revenue benefit from Bugesera is by building a permanent F1 Grand Prix circuit around the airport, after making a formal bid to host the coveted motor sport event, which has not seen an event in Africa since 1993.

It is part of a larger strategy to position the country as a global sports hub.

The F1 race is still at the bid stage, and is ranged against the Kyalami circuit in South Africa, which is being upgraded in an effort to have the African race staged there again. Kyalami was the location of that last race in Africa in 1993, having previously lost it due to political pressures.

Both of these venues have much to prove in order to host the prestigious event (again in the case of South Africa), but possibly Rwanda has a bigger task. Completing the airport rapidly is a major part of it.

The aim is to leverage Rwanda's unique hilly terrain, offering a fast and flowing layout through forests and around a picturesque lake.

If Rwanda is successful, that would open the way to hosting other sports such as athletics, and even more so football (soccer) - with international organisations keener than they have ever been to extend domestic seasons with overseas competitions.

Such tournaments could overwhelm the existing airport with visitors, and possibly Bugesera as well. Even a promotional tour by a team like Arsenal, Paris Saint-Germain or Bayern Munich could be a headache.

Political tensions raise their ugly head again

But the bigger problem is international perception of escalating tensions in the region.

Rwandan-backed M23 rebels have attacked Congolese government forces in the South Kivu province of that country this year. M23 says that its objective is to safeguard the interests of the Congolese Tutsi and other minorities, including protecting them against Hutu rebel groups who escaped to the Democratic Republic of Congo after taking part in the 1994 genocide in Rwanda that targeted Tutsis.

That hardly forms a solid base on which to generate foreign tourist visits.

The current airport is small, but plays a trans-national role

Although Bugesera will initially complement the Kigali International Airport (KIA), there is little doubt that a USD2 billion price tag is indicative of it playing a leading role in the future.

KIA opened in the 1970s, and has been a symbol of the country's renaissance since the civil war, but it has a capacity of only 1.7 mppa, which is being expanded to 4.5mppa.

Located only 5km from the city centre, it is the country's main airport; but it is also of regional importance, as it serves Congolese, Burundian and Ugandan cities.

Located at 1,491 metres above sea level, its terminal is one of the highest in the world among international airports, which (together with heat) imposes limits on aircraft operation.

Around one million passengers annually

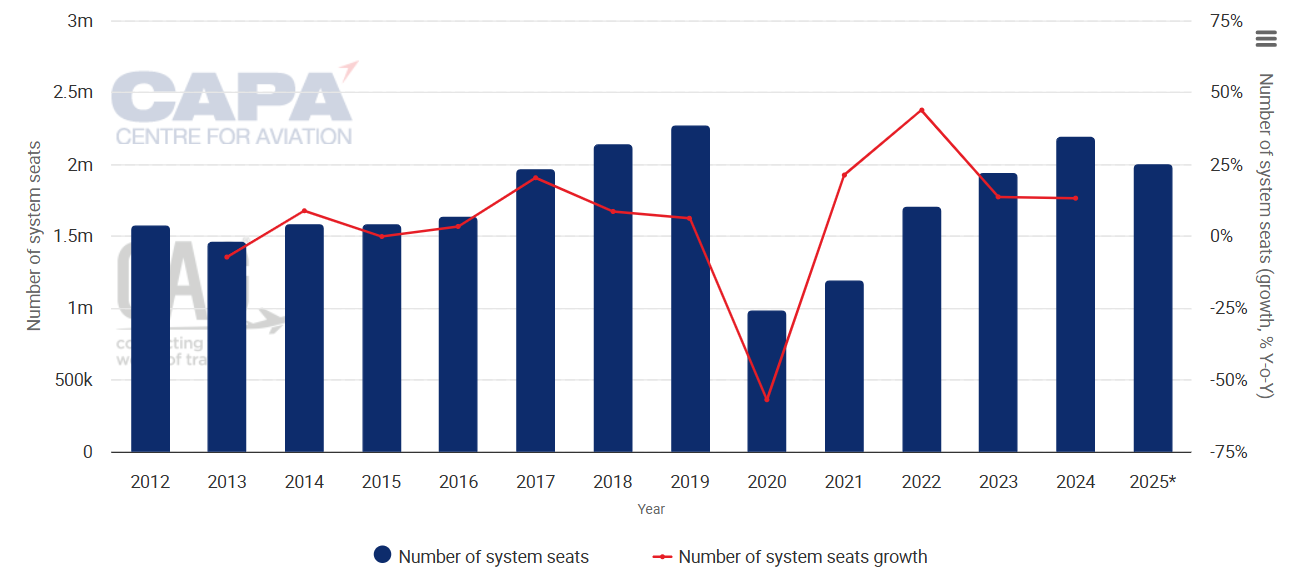

Neither the airport nor the CAA has published passenger statistics since 2016, when there were 710,000 out of 1.6 million available seats, or an average load factor of only 44%. With the intervention of the COVID-19 pandemic in 2020, it is unlikely that KIA is handling much more than one million passengers annually now.

The 2024 capacity was 2.19 million seats - an increase of 13.2% over 2023, and the 2025 total to date (week commencing 23-Jun-2025, and based on published advanced schedules for the coming six months) is 1.99 million.

Kigali International Airport, annual system seats as at w/c 23-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

*The values for this year are at least partly predictive up to 6 months from 23-Jun-2025 and may be subject to change.

Almost all the capacity is international. There are only two other airports in the country: at Kamembe and Gisenyi.

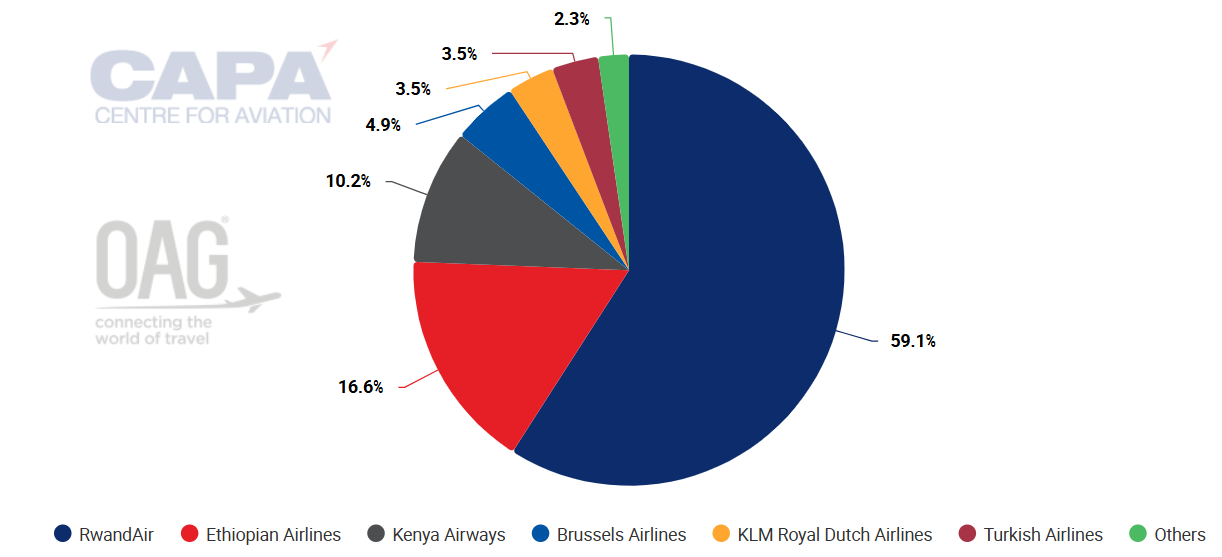

Another determinant of the low load factor is that almost 99% of seats are on full service carriers (led by RwandAir, which has 60.1% overall, and 59.1% international), while regional and charter services account for the other 1%. There is a complete absence of the low-cost carriers that bring tourists in larger numbers to many countries.

That said, a number of important long haul airlines do serve KIA, including Ethiopian Airlines, Kenya Airways, Turkish Airlines and the two European representatives, Brussels Airlines (Rwanda was a Belgian colony from 1916 to 1962, having previously been part of German East Africa) and KLM.

Qatar Airways resumed service there in 2Q2025.

Kigali International Airport: two-way seats by airline (International) in week commencing 23-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

No low cost carriers, and few alliance airlines

For all the presence of those airlines, however, it is still the case that apart from having no low cost carriers in place (East Africa as a whole now has 7.5% of its seats on LCCs, so Rwanda is not alone in this paucity), nor is there a great presence from alliance member airlines.

Unaligned seat numbers are at almost two thirds (65.6%) at KIA, compared to only 41.6% in East Africa as a whole.

'Forewarned is forearmed'

These are two critical areas that the management needs to tackle in advance of Bugesera's opening, along with the distribution of airlines and their capacity between the airports. The majority of airlines will presumably wish to use the new airport, despite its distance from the city, as long as there are no differentiated charges that penalise them by doing so.

An alternative might be to designate one of the airports (probably KIA) as a domestic and international budget airline airport, leaving Bugesera to position itself as the full service international facility.

From a passenger perspective, both local ones and visitors and whether as tourists or on business in the latter case, they will want to see rapid, frequent public transport available, and as an alternative to highly regulated taxi services.

Rwanda has the opportunity to get these features in place now, as well as immediate on-arrival accommodation for tourist visitors whose purpose is nature, wildlife and scenery, and who wish to avoid the capital altogether.

Potential for long haul services and an expansion of hub operations

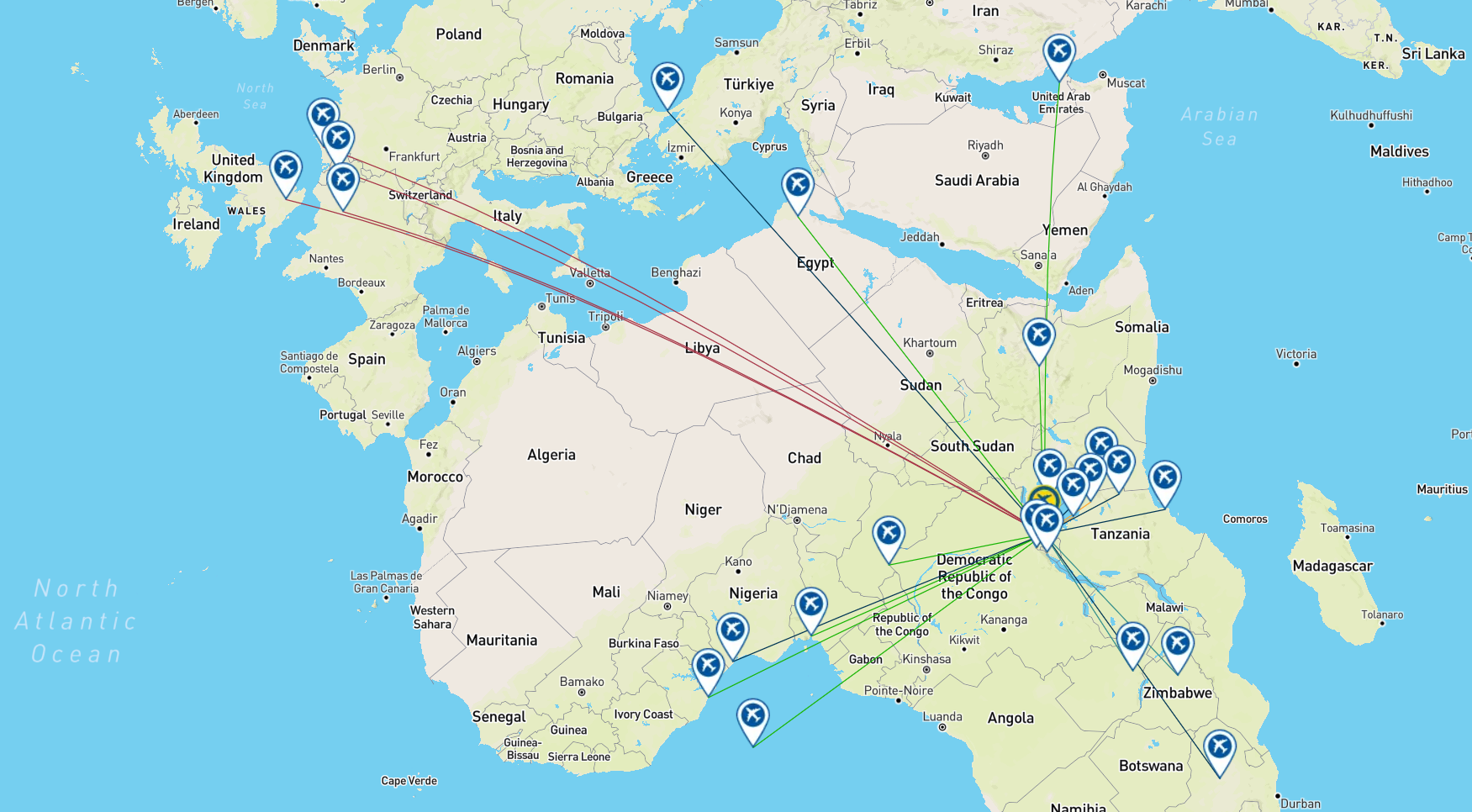

Looking at KIA's current network map, it is clearly a localised hub for travel between East and Central Africa, West Africa and South/Southern Africa.

While there may be some mileage in merely seeking to increase the scope of connections within that area, there is greater promise in attracting new services from the Middle East and Asia Pacific, particularly Southeast Asia, areas which are poorly represented if at all, while a single service from the United States (for example Delta Air Lines, which serves five African cities but none in East Africa) would do wonders for its reputation.

Kigali International Airport: network map for the week commencing 23-Jun-2025

Source: CAPA - Centre for Aviation and OAG.

A modern terminal building, facilities, a long runway (bearing in mind the height and heat), and guaranteed fuel supplies can appear highly attractive to any long haul airline, especially one that has already committed to the continent.

The problem is that RwandAir has only three designated long haul aircraft in its fleet - all of them Airbus A330s. According to Aviation Week Network RwandAir will add a fourth A330 to its widebody fleet this summer to give it greater operational resilience on its European routes.

Yvonne Manzi Makolo, CEO of the Rwandan flag carrier told African Aerospace the aircraft will arrive from an unnamed lessor in late Jun-2025 or early Jul-2025 and will operate mainly on its daily London Heathrow service but will also bolster its Lagos route.

While RwandAir is expanding, it appears Bugesera would have to rely on foreign airlines to expand long haul networks.