Eurowings and SunExpress: codeshare heralds warming of Lufthansa-Turkish Airlines relationship?

Eurowings and SunExpress are launching a new codeshare agreement in the Germany-Türkiye market in early Jul-2025, in time for the peak northern summer period.

In many ways, closer commercial co-operation between the two low-cost airlines seems long overdue. Eurowings is a subsidiary of Lufthansa, while SunExpress is jointly owned by Lufthansa and Turkish Airlines.

However, the relationship between Lufthansa and Turkish Airlines is yet to recover fully from the ending of their own bilateral codeshare more than a decade ago.

Moreover, the market between Germany and Türkiye is much more important to SunExpress than it is to Eurowings.

Nevertheless, both sides should gain from the codeshare, which may also be a sign of improving relations between Lufthansa and Turkish Airlines.

Summary

- The first step in the agreement will be for Eurowings to carry the SunExpress code on five of its Germany-Türkiye routes.

- Phase two will progressively add selected SunExpress Antalya routes to the codeshare.

- SunExpress is the leading airline between Germany and Türkiye. Germany accounts for 53% of SunExpress seats in Aug-2025, while Türkiye accounts for less than 1% of Eurowings seats.

- SunExpress more than doubled its passengers between 2014 and 2024, and is Türkiye’s number three airline.

The first step will be for Eurowings to carry the SunExpress code on five of its Germany-Türkiye routes

According to a press release from SunExpress on 24-Jun-2025, the new codeshare agreement will start with Eurowings carrying the SunExpress XQ code on five routes between Germany and Türkiye from early Jul-2025.

These routes are detailed in the table below.

Three of these routes are duopolies between Eurowings and SunExpress (Cologne/Bonn-Samsun, Duesseldorf-Kütahya Zafer, and Stuttgart-Çukurova.

On Cologne/Bonn-Kayseri there is competition from Pegasus Airlines and Corendon Airlines. On Duesseldorf-Samsun, Corendon is also a competitor.

However, on both of these two routes, the combination of SunExpress and Eurowings will have more seats and weekly frequencies than the competitors.

Initial codeshare routes where Eurowings will carry the SunExpress code, week of 4-Aug-2025

|

Origin |

Destination |

Start date |

Operators on the route in seat capacity order (weekly frequency in brackets) |

|---|---|---|---|

|

4-Jul-2025 |

Eurowings (1), SunExpress (1) |

||

|

5-Jul-2025 |

Eurowings (1), SunExpress (1). (Equal capacity for each.) |

||

|

7-Jul-2025 |

Pegasus (2), SunExpress (2), Corendon Airlines (2), Eurowings (1) |

||

|

15-Jul-2025 |

SunExpress (4), Corendon Airlines (2), Eurowings (1) |

||

|

31-Jul-2025 |

SunExpress (2), Eurowings (1) |

Source: CAPA - Centre for Aviation, OAG.

Phase two will progressively add selected SunExpress Antalya routes to the codeshare

In the second phase of the agreement, a number of SunExpress routes to/from Antalya will carry the Eurowings EW code. However, the relevant routes - and when they will be added - have not yet been announced.

The aim is to give customers of both airlines an even wider selection of connections to Türkiye.

"This applies both to leisure trips to the Turkish Riviera and to guests visiting friends and family in Anatolia," said the SunExpress press release.

Jens Bischof, Chief Executive Officer and Chief Commercial Officer of Eurowings, said: "Furthermore, our goal is to gradually expand the offering on both sides, making it even more attractive for our joint customers".

According to Max Kownatzki, CEO of SunExpress, the codeshare "underscores the trusting co-operation between the two leisure airlines of the Lufthansa Group and the importance of Türkiye as a travel destination".

SunExpress is leading airline between Germany and Türkiye

SunExpress is comfortably the biggest airline by seats between Germany and Türkiye. According to data from CAPA - Centre for Aviation/OAG, it is scheduled to have 47.3% of seats in this market in the week of 4-Aug-2025.

This is more than double the seat share of second placed Turkish Airlines, which is also one of SunExpress' two shareholders.

The ultra-LCC Pegasus Airlines is third, with 11.5%, followed by Corendon, with 8.7% of seats.

Lufthansa, the other SunExpress shareholder, has 1.9% of Germany-Türkiye seats, while Eurowings (wholly owned by Lufthansa) has just 0.3%.

Turkey to Germany: airlines ranked by seats scheduled for the week of 4-Aug-2025

|

Rank |

Airline |

Seats |

Seat share |

|---|---|---|---|

|

1 |

268,312 |

47.3% |

|

|

2 |

120,368 |

21.2% |

|

|

3 |

65,408 |

11.5% |

|

|

4 |

49,424 |

8.7% |

|

|

5 |

22,836 |

4.0% |

|

|

6 |

10,708 |

1.9% |

|

|

7 |

10,613 |

1.9% |

|

|

8 |

9,292 |

1.6% |

|

|

9 |

4,136 |

0.7% |

|

|

10 |

3,480 |

0.6% |

|

|

11 |

1,818 |

0.3% |

|

|

12 |

740 |

0.1% |

|

|

13 |

370 |

0.1% |

Source: CAPA - Centre for Aviation, OAG.

Germany accounts for 53% of SunExpress seats in Aug-2025…

Just as SunExpress is the biggest Germany-Türkiye airline, so Germany is also by far SunExpress' biggest market.

Germany accounts for 53% of its total seats (and 60% of its international seats) scheduled for the week of 4-Aug-2025 (source: CAPA - Centre for Aviation/OAG).

…down from 72% 10 years ago

This share has fallen from 72% in the equivalent week ten years earlier.

This reflects the expansion of its international network to 30 countries from 13 a decade ago. In particular, the UK is now 12% of its seats, compared with less than 1% ten years ago.

SunExpress more than doubled its passengers between 2014 and 2024…

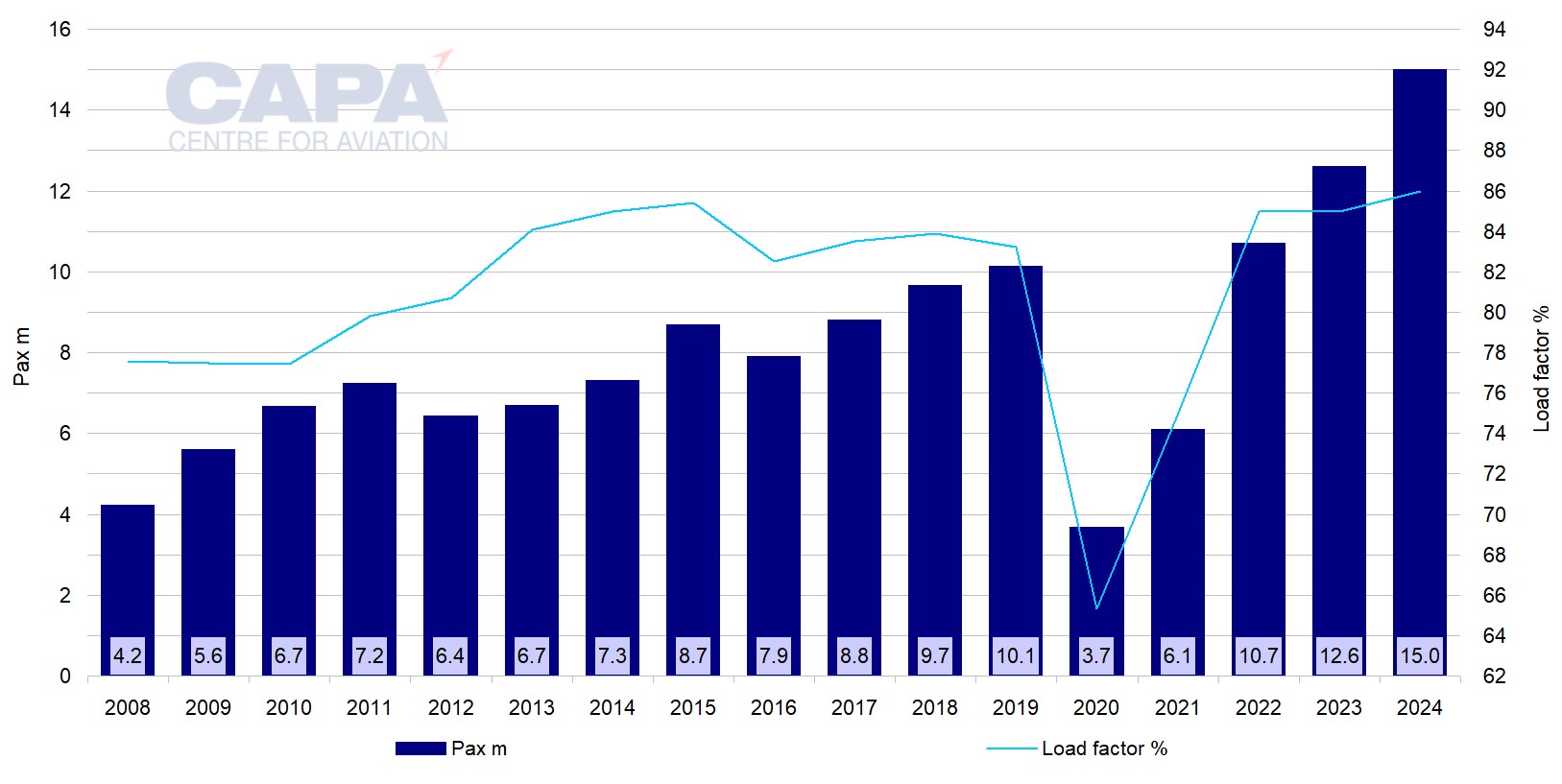

SunExpress' network expansion has driven a more than doubling of its annual passenger numbers: from 7.3 million in 2014 to 15.0 million in 2024.

Since reaching 10.7 million passengers in 2022, and thereby exceeding its 2019 (pre-pandemic) traffic of 10.1 million, it has enjoyed two successive years of annual growth in the 18%-19% region.

In 2025 it expects passenger numbers to increase by 12%, to reach 16.8 million.

SunExpress*: passenger numbers (million) and load factor (percentage), 2008 to 2024

*Combines SunExpress and SunExpress Germany for the period 2011 to 2020.

Source: CAPA - Centre for Aviation, Turkish Airlines.

…and is Türkiye's number three airline

Although SunExpress has expanded its network, its core business continues to focus on leisure passengers travelling between Germany and Türkiye.

This market niche has provided it with a platform to becoming the third largest airline by seats in Türkiye, with a seat share of 11.8% in the week of 4-Aug-2025 (source: CAPA - Centre for Aviation/OAG).

This places SunExpress behind only Turkish Airlines (seat share 40.7%) and Pegasus Airlines (12.5%). It is just ahead of Turkish Airlines' low-cost subsidiary AJet, which has 10.2% of seats.

Turkey: top 10 airlines ranked by seats scheduled for the week of 4-Aug-2025

|

Rank |

Airline |

Seats |

Seat share |

|---|---|---|---|

| 1 | Turkish Airlines | 1,731,112 | 40.7% |

| 2 | Pegasus Airlines | 533,828 | 12.5% |

| 3 | SunExpress | 504,230 | 11.8% |

| 4 | AJet | 433,104 | 10.2% |

| 5 | Corendon Airlines | 124,008 | 2.9% |

| 6 | Jet2.com | 85,498 | 2.0% |

| 7 | easyJet | 60,560 | 1.4% |

| 8 | Southwind | 36,782 | 0.9% |

| 9 | TUI Airways | 29,514 | 0.7% |

| 10 | flynas | 28,536 | 0.7% |

Source: CAPA - Centre for Aviation, OAG.

SunExpress has strong leisure focus and highly seasonal schedule

SunExpress' network has a strong leisure focus. This is evident in its low frequency schedule and its highly summer-skewed capacity profile.

Almost three quarters (73%) of SunExpress' 199 summer routes from Türkiye are served less than once daily, while 57% have a weekly frequency of only once or twice (week of 4-Aug-2025, source: CAPA - Centre for Aviation/OAG).

SunExpress' seat capacity in the second week of Dec-2025 is scheduled to be only 36% of its capacity scheduled for the first full week of Aug-2025.

This northern summer capacity bias is much stronger than it is for Türkiye's aviation market as a whole, where capacity in early Dec-2025 is projected to be 64% of weekly capacity in early Aug-2025.

In spite of an apparent imbalance, both sides will gain from the codeshare…

Given SunExpress' considerably larger presence than Eurowings on Germany-Türkiye routes, the new codeshare agreement between them could be seen as somewhat out of balance.

SunExpress is scheduled to operate 103 routes in this market in the week of 4-Aug-2025. This compares with Eurowings' five routes, all of which will be part of the first phase of the new codeshare before SunExpress routes are selectively added.

While Germany-Türkiye is 53% of SunExpress seats, it is considerably less than 1% of Eurowings seats (week of 4-Aug-2025, source: CAPA - Centre for Aviation/OAG).

Nevertheless, even if SunExpress will operate much more capacity in the partnership, it will benefit from Eurowings' ability to provide it with an additional sales channel on routes where it carries the EW code.

Both sides will benefit from being able to offer their passengers a wider range of destinations - whichever one operates the capacity.

…which may also signal warmer relations between Lufthansa and Turkish Airlines

Moreover, the new codeshare can also be seen in the wider context of the relationship between Turkish Airlines Group and Lufthansa Group.

The airlines at the head of these two groups are both leading members of the Star Alliance.

However, they have not codeshared with each other since 2013, since when the relationship between the two giants of European aviation has been somewhat cool.

The jointly owned SunExpress is the most visible expression in practice of co-operation between Lufthansa and Turkish Airlines. The airline already has codeshares with Lufthansa and its subsidiaries Austrian Airlines, SWISS and Brussels Airlines.

It may be reading too much into the new commercial partnership between SunExpress and Eurowings to see it as a signal of a warming of relations between Turkish Airlines and Lufthansa.

Or it may not.