Japanese airlines base international strategies on inbound demand boom

Japan's major airlines expect that continued strong growth in inbound demand will support ambitious international expansion plans, while lagging outbound demand is showing welcome recovery momentum.

All Nippon Airways (ANA) forecasts that its international capacity will be 1.4 times current levels by early 2031, and Japan Airlines (JAL) is targeting a major increase in revenue from international passengers over the next three years.

Both airlines have sizeable widebody orders to enable their growth goals, as they aim to expand their full service and LCC operations.

International tourism to Japan has been a real bright spot for ANA and Japan Airlines (JAL) in the years after the COVID-19 pandemic, offsetting weaker outbound trends. They predict that the inbound flow will continue to be the main driver for international demand, in the medium term at least.

This dynamic has influenced the airlines' network and marketing strategies, since they now carry a greater mix of overseas-originating customers.

Promising signs in the outbound market underline confidence that it will eventually provide more balance to international demand.

Challenges are present in some of JAL and ANA's major market regions - airspace restrictions are affecting routes to Europe, and the airlines are watching for any demand repercussions from geopolitical disputes.

Senior executives from ANA and JAL discussed their views on the state of international market with Aviation Week Network during the IATA annual general meeting in Delhi on 1-3-Jun-2025.

Summary

- Japan’s visitor numbers are up more than 20% year-on-year, and 30% versus 2019.

- ANA aims for 23% rise in European capacity in FY2025, despite airspace restrictions.

- JAL and ANA target major international growth in the medium term.

- Chinese visitors to Japan exceeded 2019 levels in Apr-2025 and May-2025.

- Japan’s inbound demand is at 65%-70% of 2019 levels, but up 15%-20% over 2024, JAL says.

Japan's inbound tourism surge is going from strength to strength

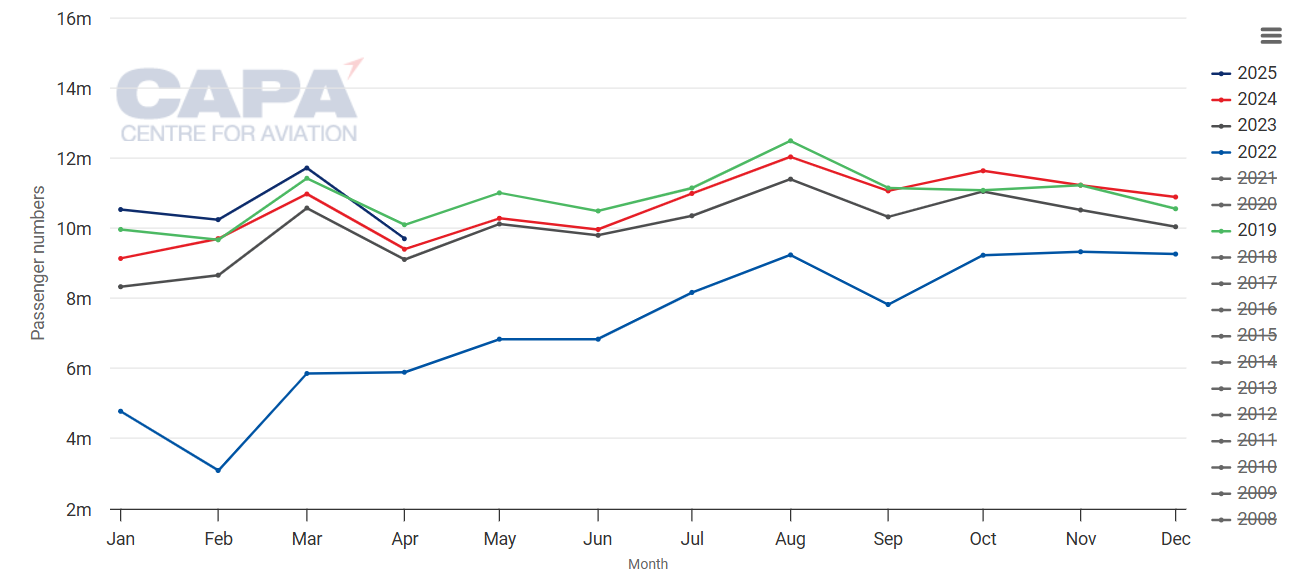

Japan's inbound tourist numbers were up by 21.5% year-on-year in May-2025, and 28.5% in Apr-2025, and were more than 30% higher than 2019 levels in both months, according to data from CAPA - Centre for Aviation and the Japan National Tourism Organization.

This growth rate far surpasses the increases before the COVID-19 pandemic. In 2019, monthly year-on-year increases were generally in the single digits, and in some months there were declines.

The chart below shows monthly visitor arrivals in 2019 and in 2022-2025. The green line is 2019, blue is 2022, grey is 2023, red is 2024 and the top dark blue line is 2025 YTD.

Japan's monthly visitor arrivals (some years excluded for clarity), from 2019

Source: CAPA - Centre for Aviation and Japan Ministry of Land, Infrastructure, Transport and Tourism (Japan MLITT) reports.

ANA is looking to tap into demand from emerging markets, while established markets (like Europe) have been performing very well

"We anticipate the demand for our expanded international network will be driven by tourism" to Japan, said ANA CEO Shinichi Inoue during the IATA AGM.

ANA is aiming for more inbound traffic, not just from its historically strong markets such as the US, Europe and China, but also from the so-called "global south" countries with developing economies, said Mr Inoue.

Sharp GDP growth in many of these countries means that ANA is paying much more attention to them, he said.

Inbound demand from Asian and European markets has been robust recently, Mr Inoue said. Prompted by this trend, ANA has "strategically increased capacity" in these regions.

In the Asian market, demand has been particularly high to short haul destinations, such as South Korea, Taiwan and Hong Kong.

In the European market, ANA launched routes to Milan in Dec-2024, Stockholm in Jan-2025, and to Istanbul in Feb-2025.

Demand on these routes has been stronger than expected, with load factors of approximately 80%, Mr Inoue said. This is particularly noteworthy, because flying times to Europe are much longer due to the need to avoid Russian airspace.

ANA's European capacity is expected to be up by 23% year-on-year in the 2025 fiscal year, which began 1-Apr-2025. Asian international capacity is projected to rise 6%.

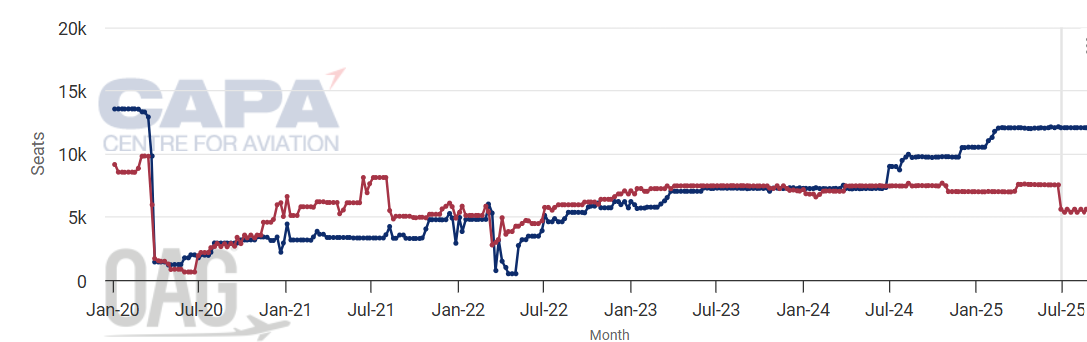

The chart below shows JAL and ANA's capacity trends in the Japan-Europe market.

ANA's European seat capacity was at 87% of 2019 levels for the week of 23-Jun-2025, following a significant rise in late 2024 and early 2025.

JAL's capacity to Europe reached 83.2% of 2019 levels for the week of 23-Jun-2025.

JAL (red) and ANA (blue) capacity between Japan and Europe, as measured in weekly one-way seats, from 2020

Source: CAPA - Centre for Aviation and OAG.

There are a total of 14 airlines flying between Europe and Japan, according to the CAPA - Centre for Aviation database. For all airlines combined, weekly seat capacity reached 75% of 2019 levels for the week of 23-Jun-2025.

This indicates that the Japanese airlines have recovered capacity more strongly than the European-based airlines.

JAL predicts strong international inbound demand trend will continue

JAL also sees scope for further growth in inbound demand. The airline projects a 70% increase in revenue from travellers from the key markets of Southeast Asia, North America and India by FY2028.

International capacity growth will support this goal, with particular emphasis on the long haul low-cost subsidiary ZipAir.

The JAL Group predicts that ZipAir's capacity will double over the next three years as it gains more Boeing 787-9s.

Like ANA, JAL has been seeing strong demand on routes to Europe, said Ross Leggett, JAL's senior vice president for route marketing, on the sidelines of the IATA AGM.

JAL has resumed flying all of the European routes it was operating before the COVID-19 pandemic, although it has not restored all of its frequencies to Helsinki.

While there are no flight sanctions in place between Japan and Russia, insurance coverage does not extend to flights over Russia - the need to divert around this airspace has added about three hours to some routes for JAL.

Should the Russian overflight issue be resolved, JAL would quickly look to boost Helsinki back to daily service, Mr Leggett said. He noted that it is a good gateway to Europe from Japan.

JAL has yet to see any negative effects on passenger demand on US routes as a result of trade disputes and geopolitical tensions, Mr Leggett said: load factors have been strong at about 85% on US routes.

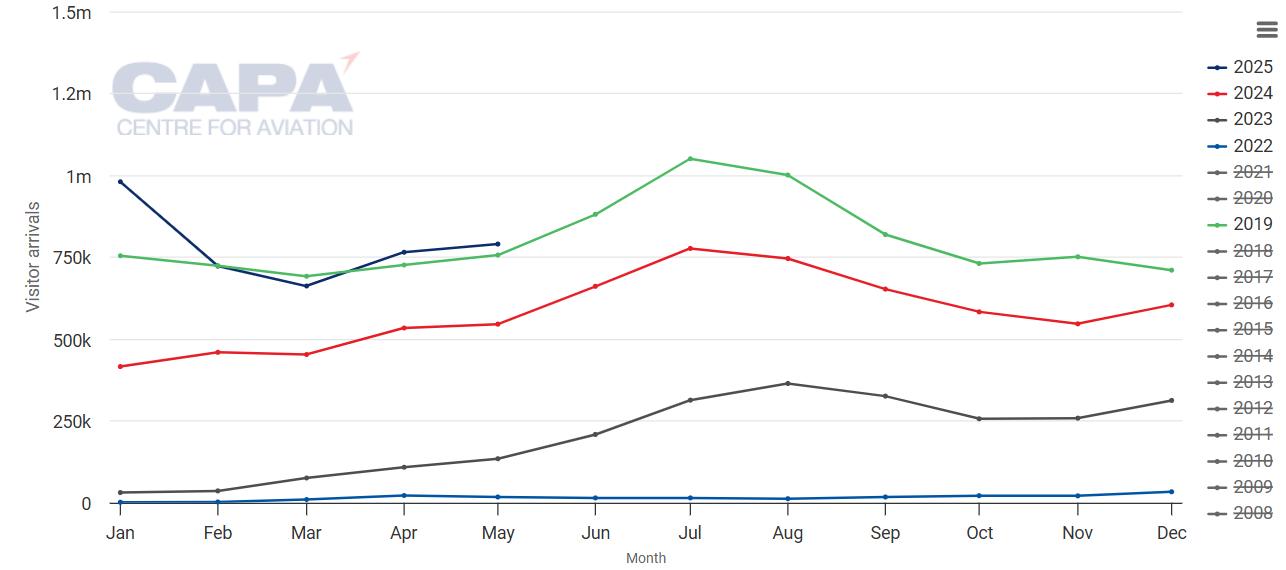

Visitor numbers from China have finally reached - and exceeded - 2019 levels

Inbound demand from mainland China to Japan was relatively slow to rebound after the COVID-19 pandemic. But this important traffic flow appears to have now fully recovered.

Travellers on Chinese passports coming to Japan have exceeded 2019 levels for the past few months, Mr Leggett said. JAL's load factors on Chinese routes have been running in the high 80%s.

JAL's subsidiary 'Spring Japan' has expanded its network to China over the past 12 months. There has been an increase in demand for "price-conscious travel" in China due to macroeconomic conditions in that market, Mr Leggett said.

The chart below shows that Chinese visitors to Japan were above 2019 levels in Apr-2025 and May-2025, with increases of more than 40% versus 2024 levels in both months.

Monthly visitors from China to Japan (some years excluded for clarity), from 2019

Japanese outbound travel is still well short of full recovery, but solid progress has been made

International outbound demand from Japan is up 15%-20% year-on-year, said Mr Leggett.

However, despite the significant year-on-year rise, outbound travel is still at 65%-70% of 2019 levels, he said: this is an improvement from the recovery rate of around 50% in Nov-2024.

"The recovery of the Japanese [outbound] market is still happening - it's going to take a while," Mr Leggett said.

ANA's Mr Inoue noted that the outbound recovery has been slow, but is occurring at a steady pace.

The three new European routes ANA launched this year 2025 will help stimulate outbound travel, and the airline is expecting Japanese demand for flights to Europe to increase in the current summer season.

Full recovery of outbound travel to pre-pandemic levels will likely depend on the Japanese yen strengthening, according to Mr Leggett.

The value of the yen against the US dollar has increased since last year 2024, and is now at about 144 yen versus the dollar. Mr Leggett estimates that a further improvement to around 130-135 yen versus the dollar would stimulate outbound travel more.