Widebody LCC update - part two. Asia Pacific surge contrasts with slowdown in Europe & North America

The trend of LCCs adding widebody aircraft to their fleet mix is gaining more momentum in the Asia Pacific region, although this business model is still struggling to gain traction in Europe and North America.

Part one of this analysis examined fleet data to compare widebody numbers in service and on order in different regions.

In addition to these broader aspects, it also discussed widebody fleet plans for the LCCs IndiGo, Vietjet and T'Way, which have made notable moves on this front.

Part two will outline other Asia Pacific widebody LCC operations, as well as those in other regions.

Summary

- Transpacific operations to the US account for 44% of Zipair’s Boeing 787 capacity.

- Scoot and AirAsia X are the largest widebody operators among Asia Pacific LCCs.

- Two Middle Eastern LCCs – Flynas and Flydubai – account for 45 widebody orders.

- LCC widebody sector has shrunk in Europe, but orders could be on the horizon for IAG’s LEVEL.

- Westjet is the main widebody LCC operator in the US, and has kept 787 numbers stable.

Zipair has a major role to play in JAL's strategy to take advantage of strong international inbound demand

Japan Airlines (JAL) has big plans for its widebody LCC Zipair, which it launched in 2020.

Zipair now has eight Boeing 787-8s, and is due to take delivery of another two 787-8s in 2026.

The JAL Group announced in March that it planned to transfer 10 787-9s to Zipair, with the first set to join Zipair in 2027, and the remainder by the early 2030s.

Those aircraft will come from the JAL full service carrier fleet, and will be modified to Zipair specifications. Cabin configuration of the 787-9s has not been revealed yet.

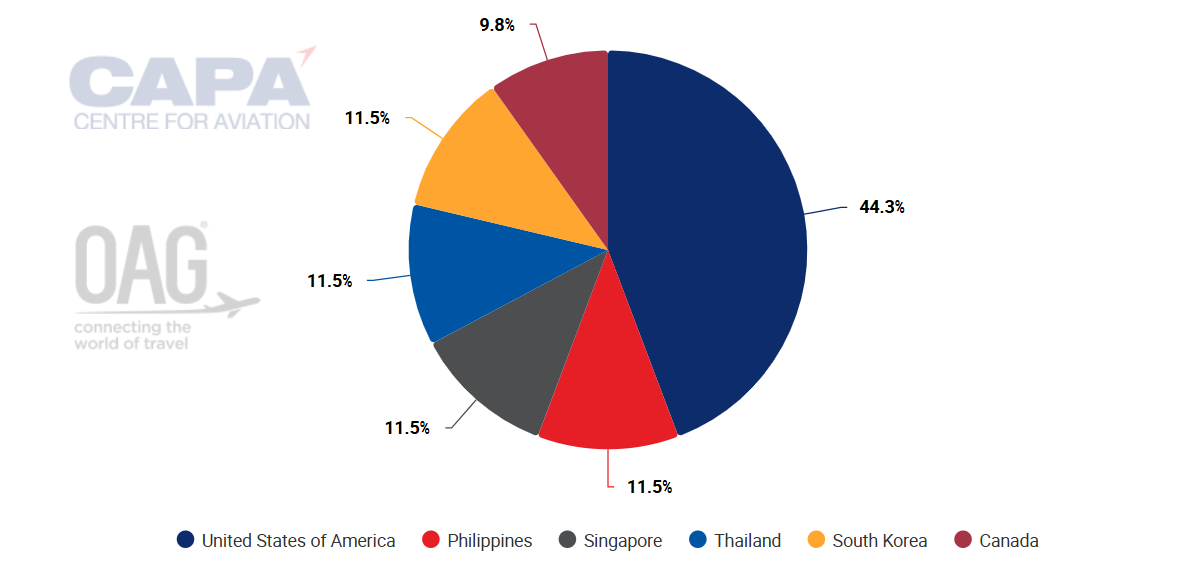

Zipair has some Asian routes, but most of its capacity is allocated to its six US and Canadian destinations, primarily targeting strong inbound demand to Japan.

The airline flies to Houston, Los Angeles, San Francisco, San Jose, Vancouver and Honolulu. The US routes account for 44% of its seat capacity, representing its largest country market by far.

Zipair: international markets, measured in departing seats for the week of 07-Jul-2025

Source: CAPA - Centre for Aviation and OAG.

As with many LCC subsidiaries, Zipair's capacity has grown faster than that of its full service sibling, with its weekly seats up 14% year-on-year for the week of 07-Jul-2025.

All Nippon Airways (ANA) is also pursuing the widebody LCC concept, having launched AirJapan in early 2024.

The airline, so far, has two Boeing 787-8s deployed on medium haul and short haul routes in Asia - such as Singapore, Bangkok and Seoul - all from Tokyo Narita.

AirAsia X, Scoot and Cebu Pacific all have well established widebody operations

Malaysia-based AirAsia X was among the pioneers of widebody LCC operations.

It now operates 18 Airbus A330s, after adding a leased aircraft in Mar-2025, and it has another parked aircraft due to return to service soon. The affiliate Thai AirAsia X has a fleet of 10 A330s.

AirAsia X has orders for 14 Airbus A330neos. It had a much larger commitment for A330neos before the COVID pandemic, but cut about 60 aircraft from its order in 2021 as part of its restructuring.

Founder Tony Fernandes has signalled that the airline is evaluating the future of the remaining orders.

AirAsia X operates flights to several Asia Pacific markets. It has one route outside the region to Nairobi, but plans to cancel this service in Sep-2025.

Scoot, a subsidiary of Singapore Airlines Group, has the largest widebody fleet of any LCC in the region.

The airline operates 22 Boeing 787s, with two more slated for delivery during the fiscal year that began 1-Apr-2025.

Scoot uses its 787s on routes to Australia, North Asia, and on some shorter Asia Pacific routes.

Scoot is also one of the few Asian LCCs with long haul routes to Europe.

It operates to Athens, and started service to Vienna on 3-Jun-2025. However, it suspended its Athens-Berlin leg in Mar-2025.

Cebu Pacific has completed the replacement of all of its A330s with 11 A330neos, and has five more remaining on order. It operates the widebodies on both international and domestic routes.

Cebu's remarkable growth rate was discussed in this May-2025 CAPA - Centre for Aviation analysis.

Other Asia Pacific LCCs with widebodies in their fleets include Lion Air, with five A330s and eight A330neos; Jetstar, with 11 787-8s; Beijing Capital Airlines, with 12 A330s; and Jin Air, with four 777-200ERs.

There is also potential for widebody LCC operations to grow in the Middle East

The Middle East is emerging as a significant market for LCC widebody orders.

Saudi Arabia's Flynas has eight A330s in its fleet, and it has orders for 15 A330neos. Flydubai has 30 Boeing 787-9s on order.

Very little near-term growth is expected for European LCC widebody fleets

In Europe, widebody operations occupy a much smaller niche in the low cost market than in Asia.

France's 'French bee' operates a fleet of four A350-900s and two A350-1000s.

The sister airline of Air Caraïbes, French bee serves destinations that include New York, Miami, San Francisco and Los Angeles in the US; Punta Cana in the Dominican Republic; the French overseas department Réunion Island; and Papeete in French Polynesia. Its latest destination, added last year, is Montreal.

Before the COVID-19 pandemic, Norwegian Air Shuttle was a major low cost trans Atlantic operator of Boeing 787s.

But the airline was forced to rethink its strategy after a brush with bankruptcy, and in Jan-2021 it announced a shift to focus on short haul routes in Europe, operating an all-narrowbody fleet.

The new start-up Norse Atlantic moved into the trans Atlantic space vacated by Norwegian, taking on its former fleet and launching services in 2022.

Norse has 12 Boeing 787s, but six of these will be allocated to IndiGo under their damp-lease agreement, which will significantly reduce Norse's own scheduled services.

"We believe this represents a good balance between securing year-round fixed revenue from [damp leases] and maximising the possibilities in our scheduled network", Norse said in a recent update.

LEVEL is the only LCC widebody operator in Europe that is part of a major group, as its parent is the International Airlines Group (IAG).

LEVEL could benefit from a group order for 21 A330neos that IAG placed in May-2025.

These aircraft are set for delivery between 2028 and 2033, and will be deployed with Aer Lingus, Iberia or LEVEL. In LEVEL's case they would replace short term leases, IAG said.

The LCC currently operates seven A330s, and expects to have eight by the end of 2026. It serves routes between its Barcelona base and destinations in the US and Latin America.

Canada's WestJet operates widebodies, but this business model has not taken hold in North America

In North America the main widebody LCC operator is Canada's WestJet, which has seven 787-9s in its fleet.

WestJet made the decision in late 2022 to base all of its widebodies in Calgary, as part of its strategy to de-emphasise Eastern Canada and reduce costs.

The airline currently operates Boeing 787 routes to Tokyo, Seoul, Paris, Dublin, Reykjavik, Rome, Barcelona and London.

Last year WestJet told Aviation Week Network that it was evaluating the 787 operation to determine if an increase in fleet size was warranted. However, the airline has not added any more widebodies since then.