Colombian aviation: a stabilising domestic market and abundant international opportunities

Colombia's domestic aviation market has entered into a period of stabilisation after experiencing overcapacity, in the wake of two ULCCs ceasing operations in 2023 and the launch of the ultra-low cost carrier JetSMART Colombia.

Now the market has settled into three major players: Avianca, LATAM and JetSMART.

And as those airlines continue to observe positive trends domestically, a number of Colombian airlines are looking to expand their international footprints into new markets.

Summary

- Large Colombian airlines cite a stable domestic market.

- Those operators continue to see opportunities to increase air traffic growth.

- Colombia’s international seats continue a solid growth trajectory.

- While it could take some time for infrastructure improvements to materialise, Colombian airlines are not resting on their laurels.

Colombia's largest airlines cite a stable domestic market place

After the ULCCs Viva and Ultra Air exited the market in early 2023, the incumbents Avianca and LATAM Airlines Colombia worked to backfill capacity within the country.

JetSMART Colombia made its debut in early 2024; and LATAM in August of that year cited overcapacity in the domestic market.

"I would say the only market where we see today an imbalance that is visible between capacity and demand is Colombia," LATAM's Chief Commercial Officer Ramiro Alfonsín said in early Aug-2024. "Clearly the entrance of JetSMART to the market added a number of incremental flights that were not there a few months ago."

But almost a year later, both LATAM and Avianca have cited improving trends in the market.

Supply "for the whole industry has been negative in terms of growth in the past months, and therefore the market is in a slightly more healthy position than it was in the previous six months," LATAM Airlines Group CEO Roberto Alvo said in May-2025.

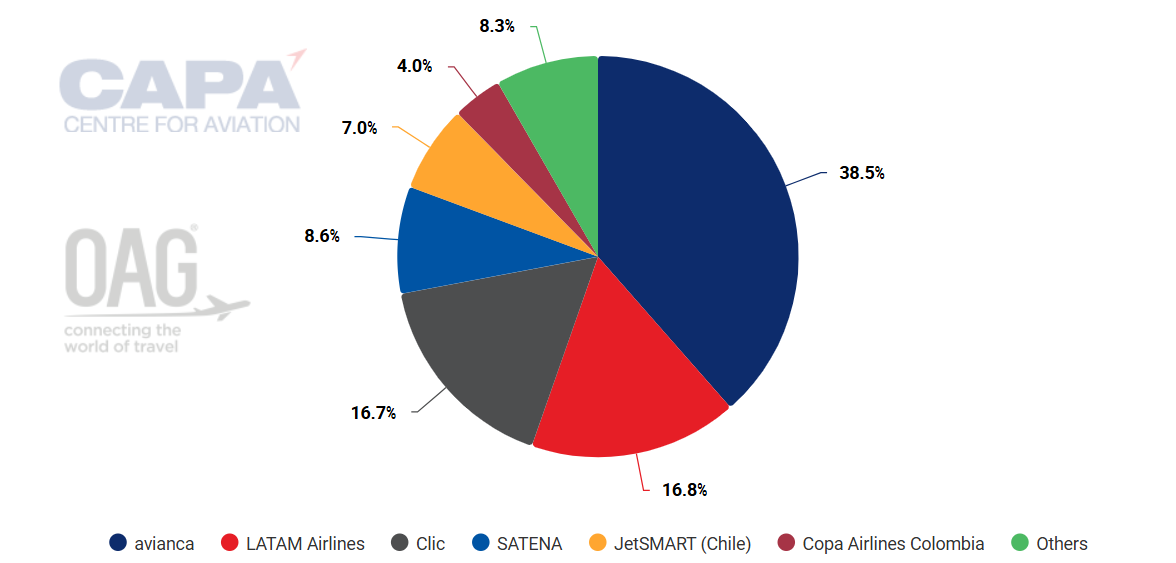

Colombia: percentage of system departing frequencies by airline, week commencing 07Jul-2025

Source: CAPA - Centre for Aviation and OAG.

LATAM Airlines Colombia is the country's second largest airline, and executives at the market leader Avianca drew similar conclusions. After removing some excess capacity from the domestic market in 2024, Avianca's network within Colombia "is in a much better situation," its CEO Frederico Pedreira explained in May-2025.

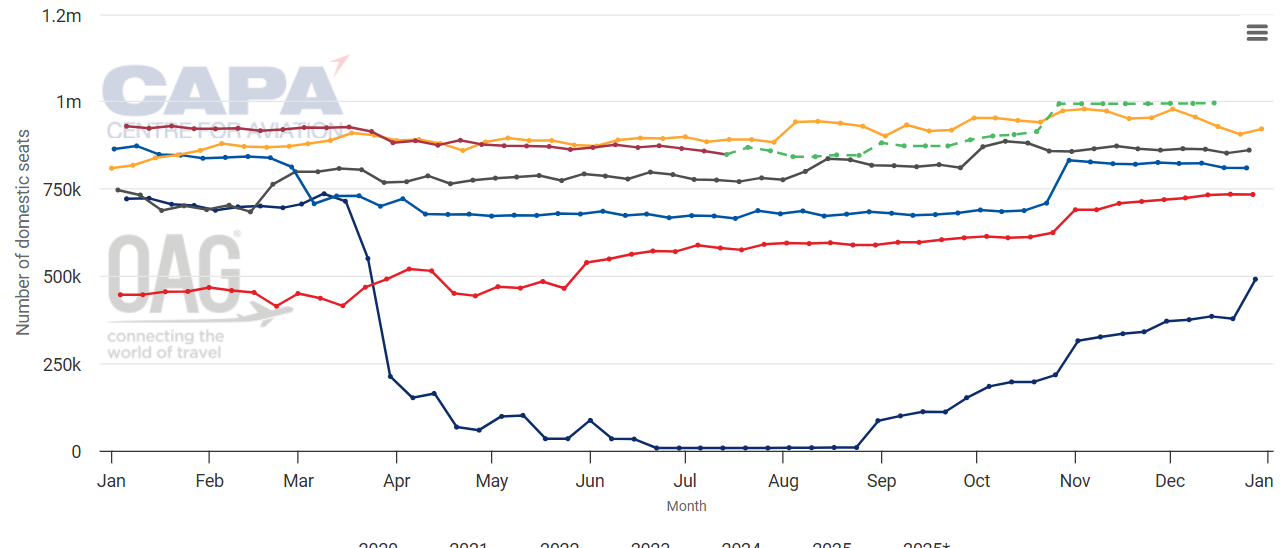

Data from CAPA - Centre for Aviation and OAG show that domestic seats in Colombia's market in mid-Jul-2025 are projected to decrease 6.3% year-over-year, before growing later in the year.

Colombia: domestic seats from Jan-2020 to late Nov-2025

Source: CAPA - Centre for Aviation and OAG.

* These values are at least partly predictive up to 6 months from 07-Jul-2025 and may be subject to change.

Colombia's domestic market holds significant growth potential - now and in the future

The rational behaviour exhibited by airlines in Colombia's domestic market is a welcome sign, and offers the operators an opportunity to target a large swath of still untapped demand.

Data from Colombia's Aerocivil compiled by CAPA - Centre for Aviation show that the country's total passenger numbers increased 14% year-over-year in 2024, to nearly 57 million, with domestic growth of 12%.

Earlier in 2025 Aviation Week Network reported that Mr Pedreira (president and CEO of Avianca) had said that Colombia's market had strong growth potential, reflected in 14% of the airline's domestic passengers in 2024 were customers flying for the first time.

He added that Avianca's basic economy product was quite popular with domestic passengers, enabling the Bogotá-based airline to offer a low-fare option for price-sensitive travellers.

"In Colombia, because of its geography, people have to fly. It's a must to keep the country connected, with short sectors [of about 300 to 370 miles]. You say, well, why would people fly those sectors? Because there's a mountain chain in the middle of the country [that makes it difficult to travel via ground transportation]. It's a country that's made for the ULCC model. You have very short sectors and a lot of frequencies," said JetSMART CCO Victor Mejia at the Routes Americas conference in Nassau & Paradise Island, Bahamas in Feb-2025.

He added that, "...we're looking to continuing to serve this domestic market, which is one of the biggest in South America."

Airlines in Colombia continue to flesh out their international networks

The international outlook for Colombia's aviation market also looks promising.

In May-2025 Mr Pedreira explained that the company was still seeing strong demand and booking curves to North America from Colombia and Ecuador, but also from the "Deep South [America]."

All the capacity on those international services, including new routes to Argentina, Brazil and Chile, has been feeding Avianca's hub in Bogotá, with passengers transferring to US and Caribbean markets. He remarked that bookings in those markets were pretty solid.

Some of the more recent route launches from Colombia include Aeromexico's service from Mexico City to Cali, which features no competition. Avianca has introduced service from Bogotá to Córdoba, where it is the lone operator, and has squared off with American Airlines on flights from Bogotá to Dallas.

In Dec-2025 LATAM Airlines Colombia plans to launch flights from Bogotá to Aruba and Curaçao. It will compete with the Copa subsidiary Wingo and Avianca on service to Aruba, and will be the only airline operating to Curaçao, according to CAPA - Centre for Aviation and OAG.

Mr Mejia said that Colombia's geographic position opened up a wide variety of markets for JetSMART, noting that the airline would be actively flying internationally from Colombia in the upcoming years. JetSMART has domestic operations in Chile, Argentina, Colombia and Peru.

The JetSMART Group has Airbus A321XLRs on order, which could be used as a springboard for some international service from Colombia.

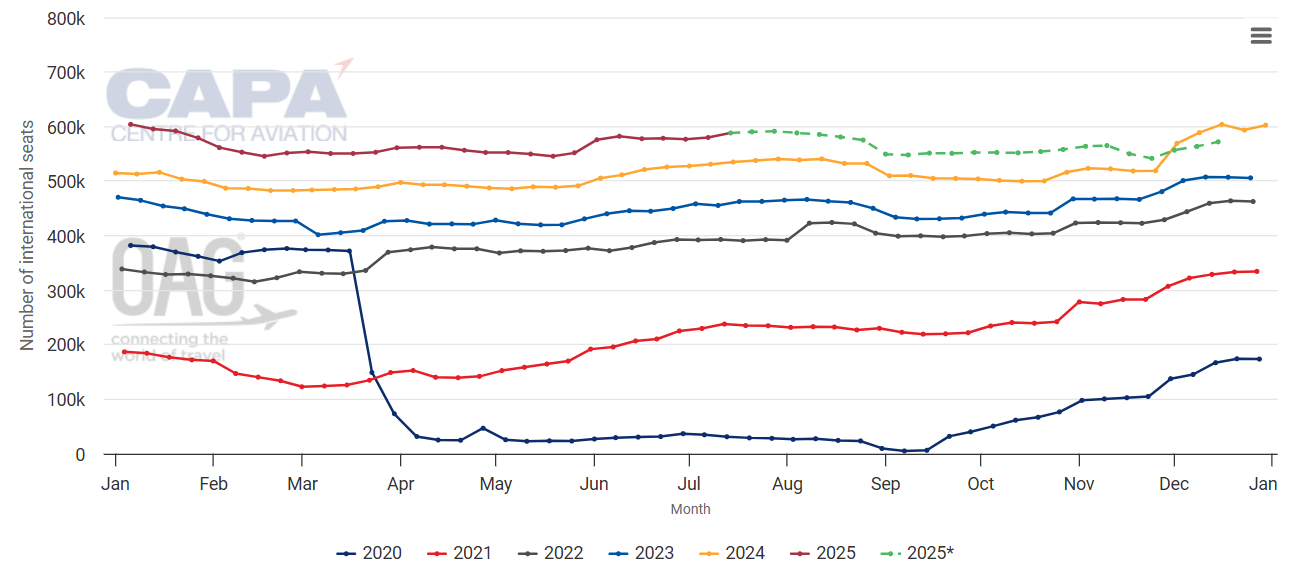

Colombia: international seats, from Jan-2020 to late Nov-2025

Source: CAPA - Centre for Aviation and OAG.

* These values are at least partly predictive up to 6 months from 07-Jul-2025 and may be subject to change.

Colombia's international seats are projected to rise 10% year-over-year in mid-Jul-2025, and remain above 2024 levels through late Nov-2025.

For now, it seems that Latin America overall seems somewhat shielded from shifts in US trade policies and other geopolitical events - but that's always subject to change.

There is no shortage of growth opportunities in the Colombian market

Colombia remains one of Latin America's dynamic markets, and the potential for market growth remains strong.

While it could take some time to address infrastructure constraints, the country's airlines see numerous opportunities to grow the market.