Milei's liberalisation efforts bear fruit as Argentina's aviation sector expands

It's been broadly a year since Argentina's President Javier Milei introduced changes to liberalise the country's aviation sector while also forging Open Skies agreements with numerous countries.

Airlines have definitely taken advantage of opportunities stemming from the changes, which is reflected in Argentina's system seat growth.

More international growth, intra-regional and long haul, is on the horizon.

One of Mr Milei's other goals, the privatisation of the state-owned airline Aerolineas Argentinas, has not occurred. And while it is tough to see investors stepping forward in the near future, there are some signs that the airline's financial state is improving.

Summary

- Argentina’s supply grows after liberalisation is introduced in the country’s aviation sector.

- The country is also experiencing an international growth spurt, particularly to Brazil.

- Argentina’s two ultra-low cost airlines appear to be gearing up for expansion.

- Privatising Aerolineas Argentinas remains elusive for Javier Milei.

- Will Mr Milei’s policies endure if he doesn’t have a second term?

Liberalisation and open skies pacts lift Argentina's seat growth

During Jul-2024 Mr Milei's government issued a decree encompassing many changes to the country's aviation sector.

The changes in policy included authorising foreign companies to provide internal or international air transportation, and more competition in ground handling.

Over the course of his presidency Mr Milei has also forged open skies agreements with numerous countries, including Brazil, Canada, Chile, Ecuador, Peru, Uruguay, the Dominican Republic, Ethiopia, Mexico and Turkey.

Although no new airlines have entered Argentina's market, there has been a flurry of activity from airlines based in the country, and from other airline operators based in Latin America.

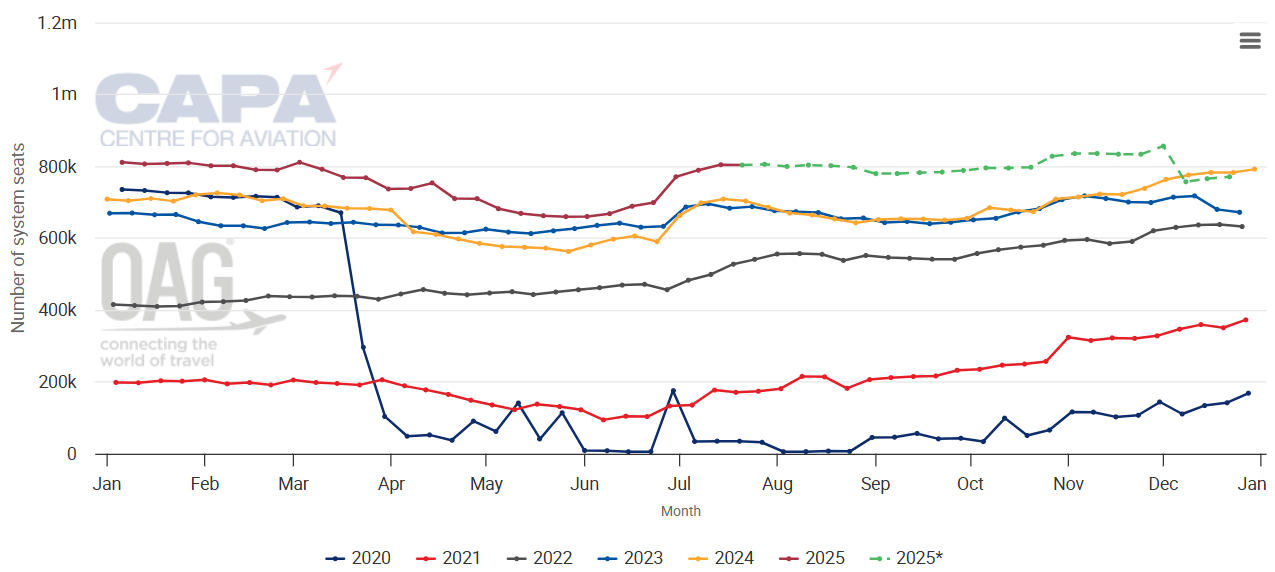

Data from CAPA - Centre for Aviation and OAG show that Argentina's system seat growth has outpaced 2024 throughout the year 2025, and projections show particularly high expected growth in the back half of the year - although there could be some schedule churn on these numbers.

Argentina: weekly total system seats, from 6-Jan-2020 to 22-Dec-2025

Source: CAPA - Centre for Aviation and OAG.

System seats for the beginning of Aug-2025 are forecast to be up 19.8%%, with domestic growing 21% and international increasing 19%.

Argentina gains numerous new international flights. Brazil is a major growth market

There has been a raft of new route announcements by airlines launching or expanding service to Argentina.

Some of the more recent developments include:

- Arajet plans to launch service from Punta Cana to Córdoba in Dec-2025;

- Aerolineas Argentinas and GOL resumption of flights from São Paulo Guarulhos to Bariloche;

- JetSMART's new flights from Bariloche to Recife;

- Azul's flights from Belo Horizonte to Bariloche and service from Campinas to Bariloche.

- LATAM has launched flights from Rio de Janeiro to Buenos Aires and from São Paulo to Bariloche;

- Also, the ultra-low cost airline Flybondi plans to introduce flights from Córdoba to Florianopolis and Rio de Janeiro in Dec-2025.

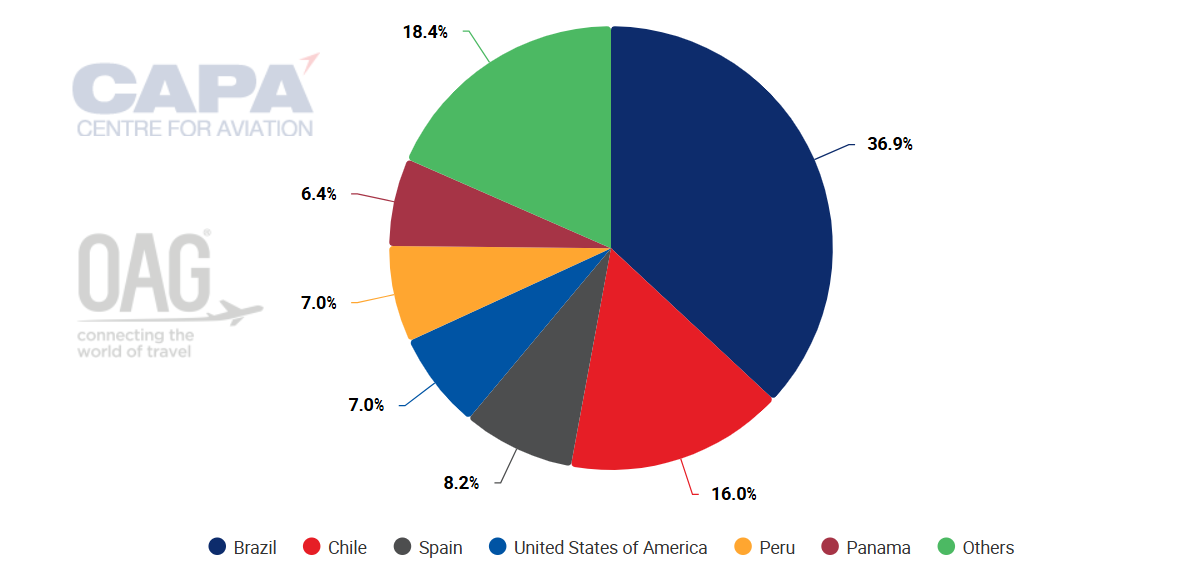

Brazil remains Argentina's largest international market, representing 37% of the country's international departing seats.

Percentage of international departing seats by country from Argentina, week commencing 14-Jul-2025

Source: CAPA - Centre for Aviation and OAG.

Two-way seats from Brazil to Argentina are up 31% as of early Jul-2025, with GOL having the largest share at 32%, compared with 24% in the prior year.

The second-largest operator in the market, Aerolineas Argentinas, had a 20.5% share, compared with 28.5% in 2024.

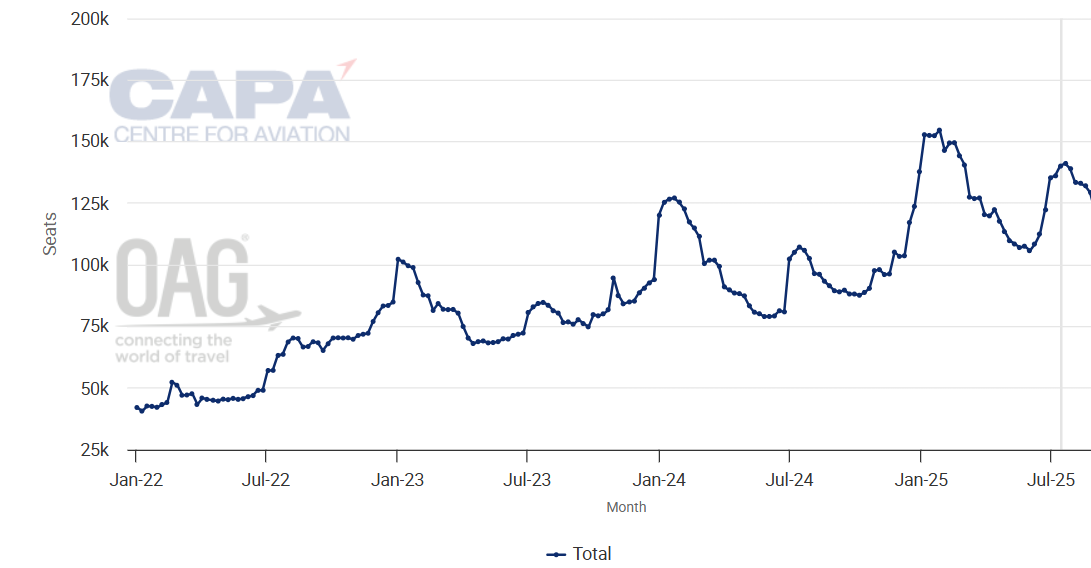

Two-way seats from Brazil to Argentina, from early Jan-2022 to Aug-2025

Source: CAPA - Centre for Aviation and OAG.

The growth by airlines between Argentina and Brazil reflects, in part, the lifting of restrictions previously in place before a more liberalised air service agreement was reached between the two countries.

Long haul operators are also expanding service to Argentina.

LEVEL is operating 11 weekly flights to Buenos Aires from Barcelona from Nov-2025 to Jan-2025.

In Dec-2025 China Eastern is launching a Shanghai-Auckland-Buenos Aires service, and the Auckland International airport CEO Carrie Hurihanganui has said that the new service would help address a 53% reduction in direct capacity between New Zealand and Latin America, lost during the COVID-19 pandemic.

Domestic ULCCs JetSMART and Flybondi eye expansion in and around Argentina

Argentina's airlines are working to position themselves to leverage opportunities in the domestic market.

During the Routes Americas 2025 conference even JetSMART executive Victor Mejia applauded the regulatory changes: "This is something we've been waiting for. Argentina is a real focus for growth for us right now".

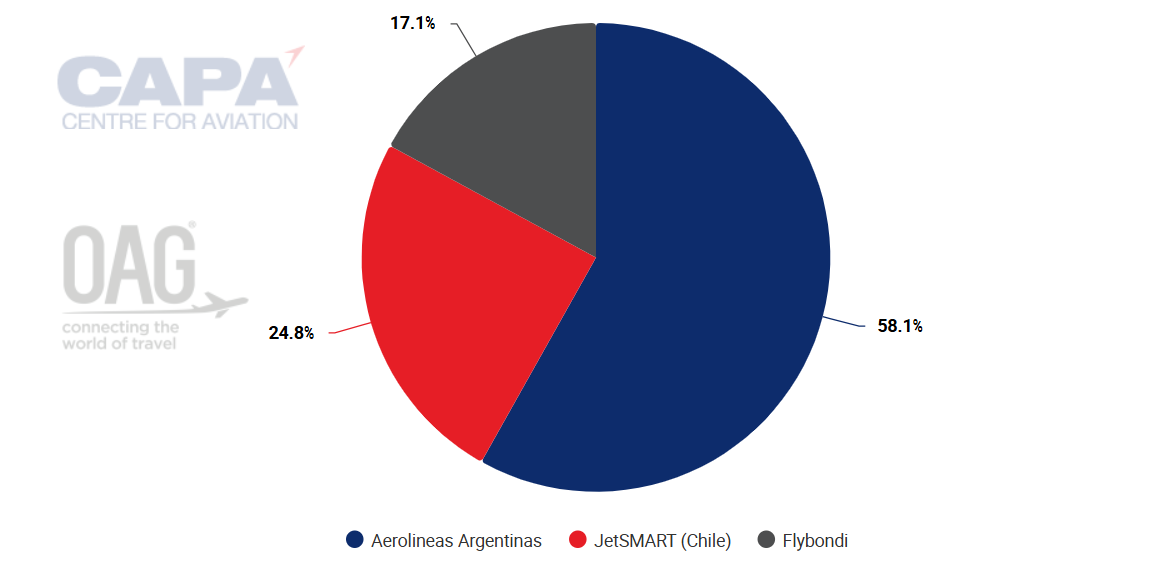

JetSMART has a 25% share of domestic departing seats in Argentina, as of mid-Jul-2025, compared with 13.5% in the year prior.

Argentina: percentage of domestic departing seats by airline, week commencing 19-Jul-2025

Source: CAPA - Centre for Aviation and OAG.

Flybondi's share has fallen from 21.6% to 17.1%.

Aviation Week Network has reported that the decrease has followed a period of operational disruption at the airline; that included a spike in flight cancellations and reduced fleet availability, contributing to its shrinking market share.

In Nov-2024, according to the publication, Argentina's government ordered the airline to submit a corrective operational plan after it had cancelled 20% of scheduled flights in that month. The disruptions were attributed to maintenance delays and a lack of spare parts, which left several aircraft grounded.

But COC Global Enterprise recently became the lead investor in Flybondi, and has said that it has plans to consolidate the airline's operations, improving service and strengthening finances.

The plan includes adding aircraft and route expansion. The CAPA - Centre for Aviation Fleet Database shows that Flybondi has 12 Boeing 737-800s in operation and two aircraft inactive.

"We have great plans for this new stage", said Flybondi CEO Mauricio Sana.

Nearly two years into Mr Milei's term, a buyer for Aerolineas Argentinas has yet to emerge

One of Mr Milei's major goals when he became president nearly two years ago was the privatisation of the beleaguered flag airline Aerolineas Argentinas.

But finding a would-be owner has proven elusive. Even with the reforms to the aviation sector and an improving economy during Mr Milei's time in office, politics in Argentina can undertake wild swings, and a re-election is never guaranteed.

The airline also faces increasing competition from JetSMART and Flybondi, each of which continues to keep growing in the market.

Still, while Aerolineas Argentinas continues to face challenges and strike threats by employees, it has stated that it would not require subsidies in 2025, and it posted a USD140.14 million profit in 1Q2025 São - its best result since the first quarter of 2018.

That's likely not enough positive change to attract investors, but it is probably safe to assume that Mr Milei won't give up on his pursuit to offload Aerolineas Argentinas.

Can Mr Milei's aviation sector reforms survive is he is not re-elected?

As liberalisation in Argentina continues to take hold, the market should be one of the most interesting to watch this year and beyond.

But the lingering question that remains is: will Mr Milei's reforms remain intact if he doesn't have another presidential term after the 2027 elections?