Delta and United welcome improved US demand trends, after a choppy 1H2025

Two bellwethers of the US airline industry - Delta Air Lines and United Airlines - believe that an inflection in demand has occurred, after 1H2025 was mired in political and economic uncertainty.

Many factors are driving the improvement, including growing consumer confidence and a rational supply-demand environment in the US market.

For now, those airlines don't see any signs of a return to stability waning.

Perhaps US consumers have decided the potential for wild swings in diplomatic and economic policy are now just a fact of life, and are opting not to put travel plans on hold.

Summary

- Delta Air Lines and United Airlines see a positive inflection on demand trends.

- Softening US domestic demand is showing signs of improvement.

- The more favourable environment is driven, in part, by rational capacity deployment.

- Consumer confidence appears to be improving.

- But have consumers decided that uncertainty is the new norm?

Delta and United conclude that some uncertainty in US policy is clearing up for businesses and consumers

Management at both Delta and United recently drew similar conclusions about improving demand, and the factors driving upward trends.

"The recent passage of the reconciliation package creates certainty around tax policy, and with continued progress on trade negotiations, we expect both consumer, and corporate confidence to improve in the second half of the year, creating the environment for travel demand to accelerate," said Delta CEO Ed Bastian.

United's CEO Scott Kirby explained that weak demand for the last five months had been due to high levels of uncertainty for both businesses and consumers. "But in the past few weeks, the level of uncertainty has declined," he stated.

Drawing similar conclusions to Mr Bastian, United's CEO said: "The tax situation is settled…the geopolitical situation in the Middle East appears to have stabilised. And while tariffs are not yet certain…most businesses have a much better read on how they'll manage in a narrow array of outcomes".

Each airline cites favourable booking trends in the domestic market

United's CEO believes a higher level of certainty has translated into "a meaningful inflection in demand".

The airline's chief commercial officer Andrew Nocella explained that recent United and industry sales data had confirmed "a demand environment that has inflected positively in recent weeks due to less macroeconomic uncertainty".

He cited a positive six-point swing in "sales-to-date in Jul-2025 versus the second quarter…" (Mr Nocella offered that assessment during a 17-Jul-2025 earnings discussion.)

He also stated that domestic ticket sales were now showing positive year-over-year yields, "reflecting this improved demand environment for the first time since Feb-2025".

Most of the weakening demand in the US occurred among leisure customers travelling in economy class.

But Mr Nocella also cautioned that recent booking strength did not change the fact that 50% of United's 3Q2025 sales were sold as of 1-Jul-2025, along with effects of temporary lower demand at its Newark hub on sales.

During 2Q2025 United faced some unique obstacles in Newark, due to equipment outages, air traffic controller staffing issues, and runway construction.

See related CAPA - Centre for Aviation report: US global network airlines appear to remain bullish on international trends - 2Q should offer clues

Delta's President Glen Hauenstein explained that the company hoped that domestic revenues were going to "inflate back to positive here ... all forward booking trends indicate that it is moving in the right direction," adding: "...sometime this fall, I would believe that we would inflect back into positive."

He refrained from offering a specific date for that inflection, but said, "I think we have a good shot of it becoming at least neutral by the third quarter or fourth quarter of this year [2025]". During 2Q2025 Delta's main cabin ticket revenue fell 5%.

Rational US airline capacity deployment in 2H2025 also bolsters improvement in demand

Both Delta and United also believe that the reining in of industry capacity is also helping to lift demand.

In Apr-2025 domestic seats were up approximately 3%, Mr Hauenstein said.

From the period spanning May-2025 to Sep-2025, "it appears as though the industry has taken four points of capacity out, and by the time we hit September, domestic seats are actually down close to 1%," he said, adding that the reduction in off-peak capacity "is even greater than that".

"I've never really seen that amount of capacity come out in a non-recessionary environment ... I think this is a really good indication that the industry is doing what it needs to do to restore profitability," Delta's president concluded. He said that there were probably more adjustments that needed to occur from Oct-2025 to Dec-2025.

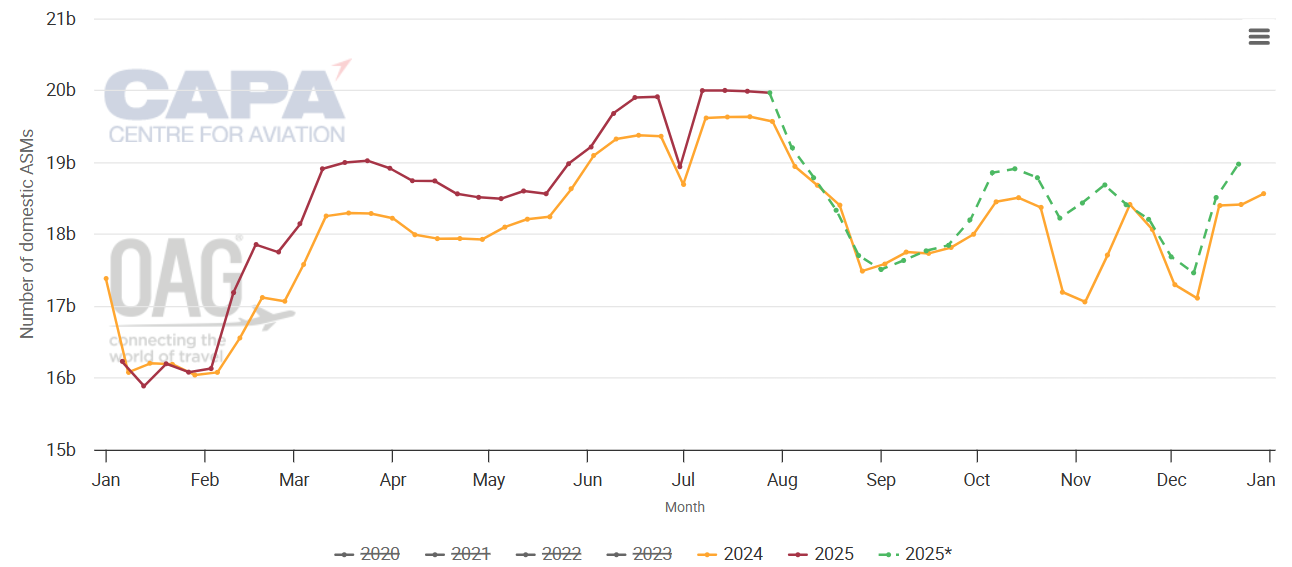

Data from CAPA - Centre for Aviation and OAG show that US domestic available seat miles are projected to be flat in Aug-Sep-2025, before creeping back up in Oct-2025.

United States of America: weekly total domestic available seat miles, from Jan-2024 to Dec-2025

Source: CAPA - Centre for Aviation and OAG.

* These values are at least partly predictive up to 6 months from 21-Jul-2025 and may be subject to change.

"Public industry domestic capacity for Aug-2025 and Sep-2025 indicates slightly less capacity year-over-year when just a few months ago, it was published at up almost 4%," said Mr Nocella.

Delta cites rising consumer confidence and strength in its 'target customer household'

It appears that US consumer confidence is also improving, which also helps in stabilising demand.

"If you look at any measure of consumer confidence, it certainly took a big dip in the early part of the year, and then again in Apr-2025, after the Liberation Day announcements were made," Mr Bastian explained. "And it's been slowly starting to climb back."

Delta's target customer is a household with USD100,000 or more of annual earnings, said Mr Bastian, "which is not, by the way an elite definition. That's 40% of all the US households. And that cohort has accumulated a significant amount of wealth in the post-COVID era".

The company was concerned earlier in 2025 "about the wealth effect, what's going on in the markets and other financial instruments, but that's corrected itself," Mr Bastian stated.

The University of Michigan's preliminary consumer sentiment index increased from 60.7 in Jun-2025 to 61.8 in Jul-2025, which was better than the market expectation of 61.5, according to Fxstreet.

Part of rising consumer confidence could be getting on with life as policy norms have changed - for now

Upward trends cited by Delta and United are encouraging after a whirlwind of uncertainty in the first half of 2025.

But there's an argument to be made that some of the rebound in consumer confidence could be an acceptance that uncertainty is the norm for the foreseeable future, and both consumers and would-be travellers have simply decided to get on with their lives.