European airline margin rankings 2024: Pegasus and IAG at the top; outlook for 2025 favourable

This report presents CAPA - Centre for Aviation's annual operating margin ranking for 16 of Europe's leading airline groups for 2024.

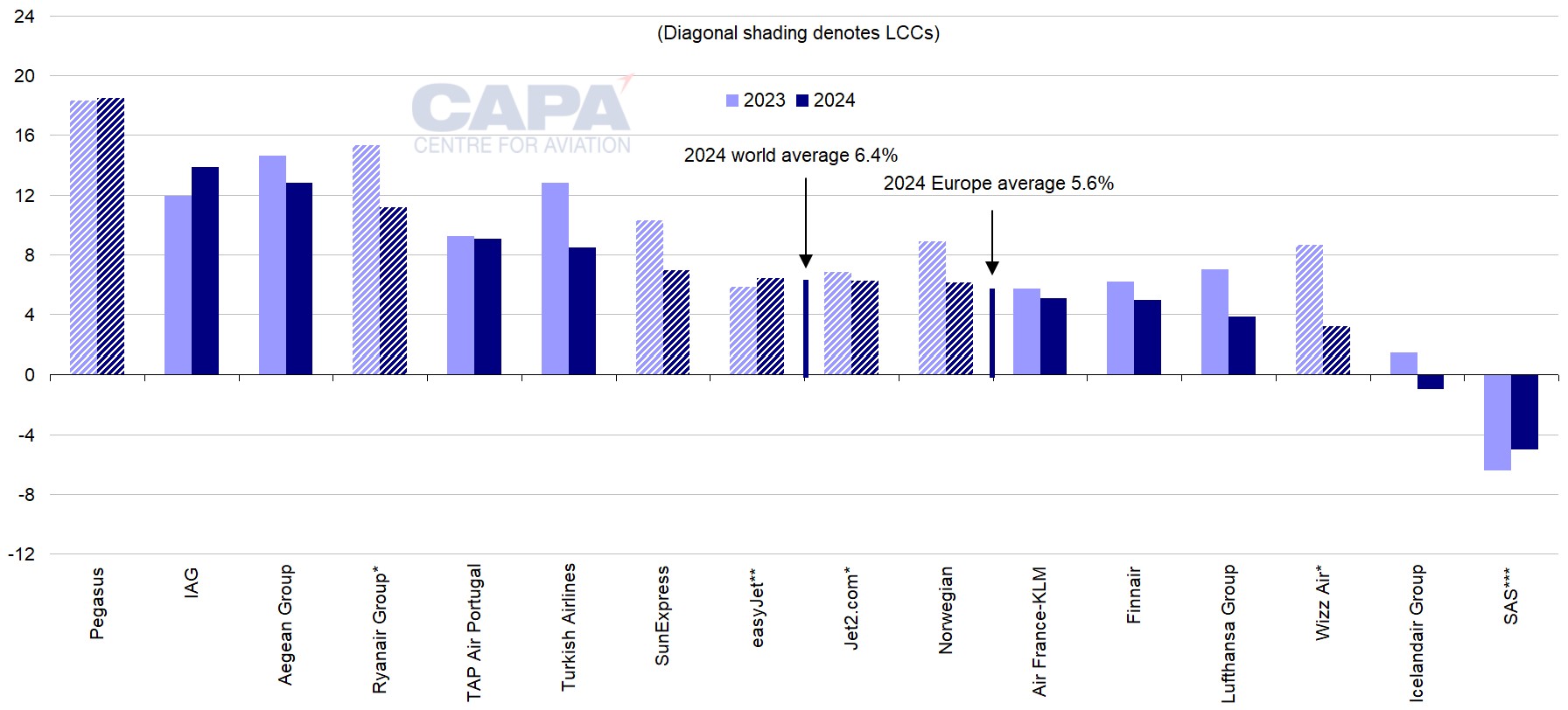

Pegasus Airlines, Türkiye's ultra-low cost airline, topped the ranking for the third year running, the best of four groups with a double digit operating margin (down from six groups in 2023). SAS again reported the lowest margin, one of two with an operating loss (whereas it had the only negative result in 2023).

The majority of the 16 groups (12 of them) had lower margins in 2024 than in 2023. However, on the whole, they outperformed other European airlines: 10 of them beat IATA's estimate of the average European airline margin in 2024.

The current expectation among forecasters is that European margins will improve a little in 2025 versus 2024, although the factors driving profits are complex - as ever - and a decline in margins is also a possibility.

Either way, Europe's largest airline groups are likely to continue to fare better than the sector as a whole.

Summary

- Pegasus and IAG ranked first and second among 16 leading European groups by operating margin in 2024.

- 12 of the 16 had lower margins in 2024 than in 2023. 10 of the 16 beat IATA's estimate of the average European airline margin in 2024 (but not the average world margin).

- British Airways and Iberia, both IAG companies, had the highest margins among the legacy group subsidiaries.

- IAG had the best margin among Europe's big six airline groups, pushing Ryanair into second place.

Pegasus and IAG ranked first and second among 16 leading European groups by operating margin in 2024

For this report, CAPA - Centre for Aviation analysed the 2024 income statements of 16 leading European airline groups and airlines, ranking them by operating margin.

This is defined as pre-exceptional operating profit, or EBIT, as a percentage of revenue.

Note that, in this analysis, 2024 includes financial year ends ranging from Sep-2024 to Mar-2025.

As with previous years, the final airline to report was Jet2 plc, which has a March year end and only announces its results in July.

The 16 companies comprise 13 that have stock market listings plus SAS, SunExpress and TAP Air Portugal.

The highest 2024 operating margin among this cohort for 2024 was achieved by Pegasus Airlines, with 18.5%.

The Turkish ultra-low cost airline has now occupied the top spot in this ranking since 2022 (when its margin was 23.8%).

IAG came second in 2024, up from fifth in 2023, with an operating margin of 13.8%, although this was some 4.7ppts behind Pegasus.

Only two others also recorded double digit operating margins in 2024: Aegean Airlines Group and Ryanair Group.

Aegean, with a 12.8% margin, held onto third place, last year's runner-up Ryanair slipped to fourth in spite of its 11.2% margin.

TAP Air Portugal (9.0%) - a privatisation candidate - was fifth (up from seventh), ahead of Turkish Airlines (8.5%).

The top 10 was completed by four low cost airlines, all with margins in the 6-7% range: SunExpress (6.9%), easyJet (6.4%), Jet2.com (6.2%) and Norwegian (6.1%).

Three of the top seven were operators from Türkiye (Pegasus, Turkish and SunExpress).

The next four all achieved operating margins in the 3-5% range: Air France-KLM (5.1%), Finnair (5.0%), Lufthansa Group (3.9%) and Wizz Air (3.2%).

Two airlines had negative margins: Icelandair (-0.9%) and SAS (-5.0%).

Pre-exceptional operating margins (% of revenue) for leading European airlines and airline groups, 2023 and 2024

Note: calendar year data are used except where noted.

*year to March of following year.

**year to September.

***year to October.

Source: CAPA - Centre for Aviation, airline company reports.

12 of the 16 groups had lower margins in 2024 than in 2023

Only four of the 16 groups reported higher margins in 2024 versus 2023: Pegasus, IAG, easyJet and SAS (although the latter remained negative).

The most significant year on year improvement in operating margin was generated by IAG, although the gain was only by 1.9ppts.

The top 10 airlines and airline groups comprised six LCCs and four legacy groups.

Among the big three legacy groups, IAG was the best performer (as it has been for many years, with the exception of the pandemic-affected 2020 and 2021).

Air France-KLM achieved a higher operating margin than Lufthansa Group for the first time since 2006 (setting aside 2021). Both fell short of Turkish Airlines' margin.

10 of the 16 beat IATA's estimate of the average European airline margin in 2024

All of the top 10 achieved a margin above IATA's estimate of the average European airline operating margin of 5.6% in 2024.

However, IATA's estimate of the average global airline operating margin of 6.4% in 2024 was beaten only by the top seven.

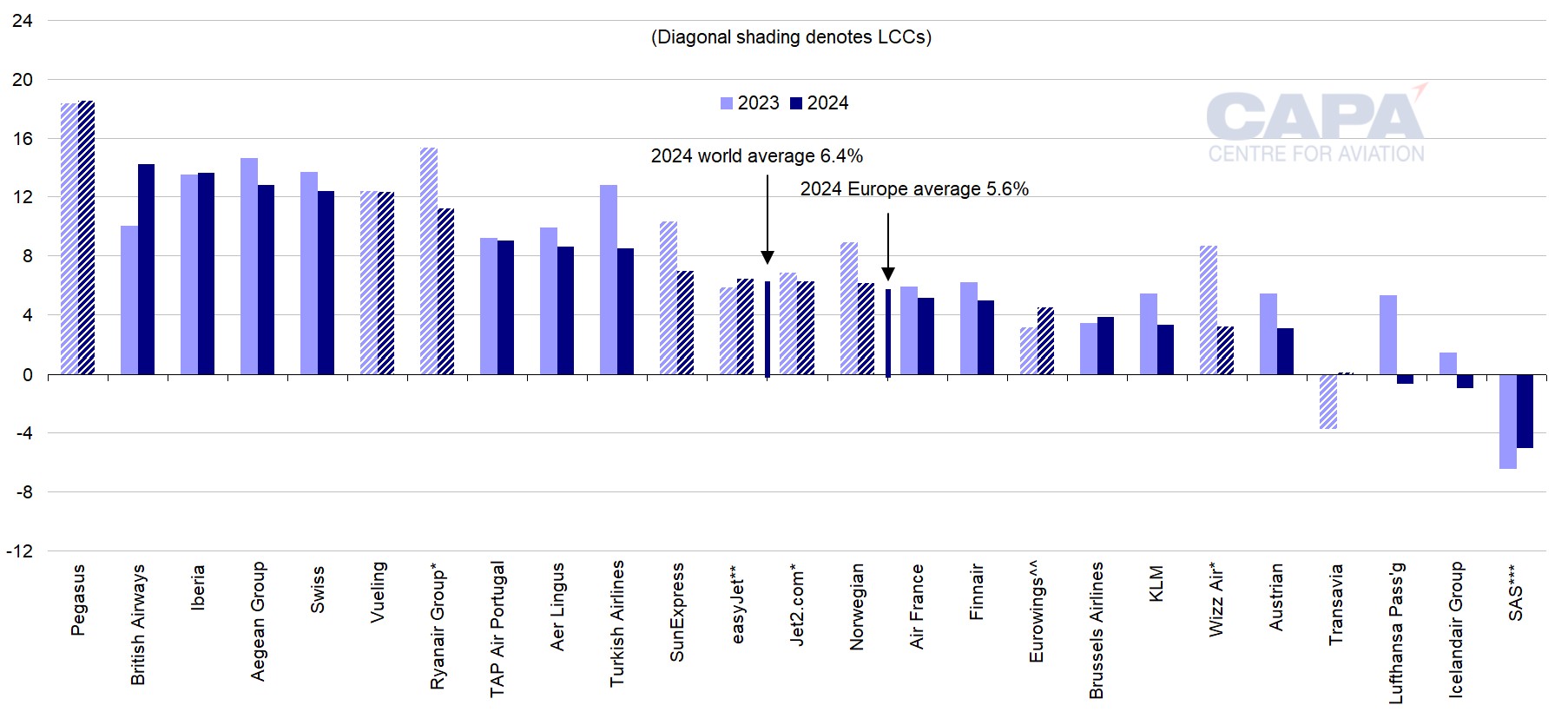

British Airways and Iberia had the highest margins among the legacy group subsidiaries

In the following chart, the operating margins of the three big European legacy groups' principal airline subsidiaries are ranked separately alongside the other airlines and airline groups.

This ranking comprises 25 leading European airline brands.

Pegasus's 18.5% margin ensured that it retained its top ranking, while two IAG subsidiaries climbed into the top three. British Airways was second, with 14.2%, and Iberia was third, with 13.6%.

Aegean slipped from third to fourth, but its 12.8% margin was higher than the 12.4% achieved by SWISS, which was the best performer in Lufthansa Group.

SWISS was only just ahead of IAG's low cost operator Vueling (12.3%), which was only the third best margin among IAG's airlines.

Ryanair, in seventh on this ranking, was the only other double digit margin, although its 11.2% was 4.1ppts below its 2023 figure.

IAG's fourth airline, Aer Lingus, reported a margin of 8.6%.

Air France-KLM's Air France reported an operating margin of 5.1%, while KLM made just 3.3%. The group's LCC brand, Transavia, only just beat break-even, with 0.1%.

Other than SWISS, Lufthansa Group's subsidiary airlines' margins were muted. Eurowings achieved the group's second highest margin, 4.5%, and its biggest improvement (+1.4ppts).

Brussels Airlines made 3.8% and Austrian Airlines 3.1%, while Lufthansa Passenger Airlines fell into losses, with an operating margin of -0.6%.

Pre-exceptional operating margins (% of revenue) for leading European airline brands, 2023 and 2024

Note: calendar year data are used except where noted.

*year to March of following year.

**year to September.

***year to October.

Source: CAPA - Centre for Aviation, airline company reports.

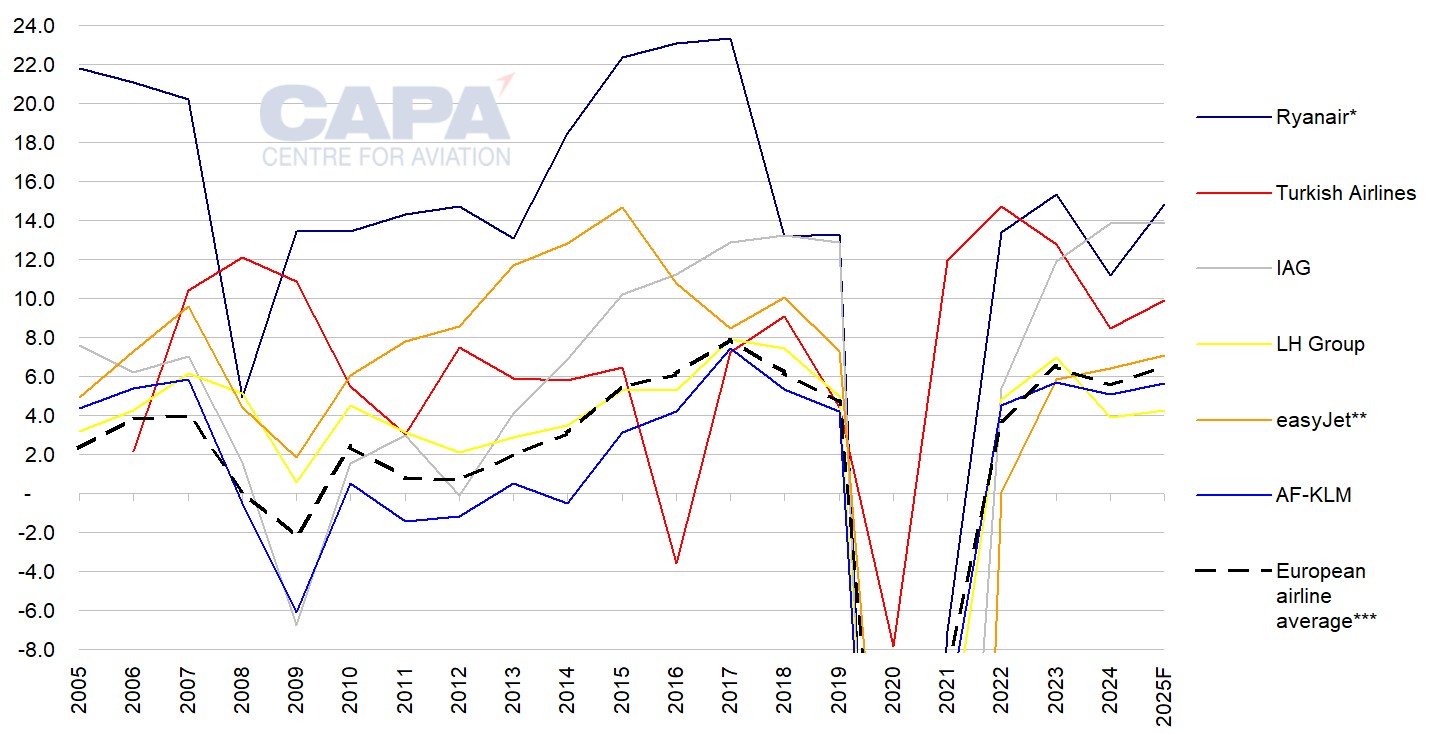

IAG had the best margin among Europe's big six airline groups, pushing Ryanair into second place

Among Europe's six biggest airline groups (ranked by 2024 passenger numbers), IAG's operating margin was the best, the first time it has achieved this.

It replaced Ryanair Group as the top performer among the big six. The Irish ultra-LCC had the second highest margin in this set of airlines.

Turkish Airlines, which had the best margin among the six in 2022, was third in 2024, but its 8.5% was still comfortably ahead of easyJet's 6.4%.

Air France-KLM's 5.1% margin was down by 0.6ppts year-on-year, but still comfortably ahead of Lufthansa Group's 3.9% margin (down by 3.2ppts).

Operating margins (% of revenue) for Ryanair, Turkish Airlines, IAG, easyJet, Lufthansa Group, Air France-KLM, 2005 to 2025F

Note: 2025F forecasts for individual groups are sourced from uk.marketscreener.com.

*year to March of following year.

**year to September.

***European average from IATA.

Source: CAPA - Centre for Aviation, airline company reports, IATA.

Although margins dipped in 2024, Europe's leading groups outperformed…

As noted above, the majority (12 out of 16) of Europe's leading airlines and airline groups reported lower margins in 2024.

Moreover, nine out of 16 also had lower margins than they achieved in 2019, the last year before the pandemic.

Nevertheless, they have outperformed the European airline sector as a whole. This is not surprising, given that they are the biggest operators in Europe and - on the whole - benefit from economies of scale.

For the leading 16 airline groups and airlines included in this CAPA - Centre for Aviation report, the straight arithmetic average margin was 7.0% in 2019, 8.5% in 2023 and 6.9% in 2024.

According to IATA, average margins for all European airlines were 4.7% in 2019, 6.6% in 2023 and 5.6% in 2024.

…and should do so again in 2025

Looking ahead to 2025, IATA's most recent forecast (published in Jun-2025) predicts that Europe's average margin will improve from 5.6% in 2024 to 6.5% for 2025.

Stock market analysts are currently also forecasting a small improvement in operating margins for the major listed European airline companies, including all of the big six (see chart above).

Again, the margins of the leading groups can be expected to outperform the rest of the European airline sector margins.