New Zealand and Australia consider regional airline support

The financial struggles of some regional airlines in New Zealand have spurred a new round of debate about the need for government support for this sector, while the Australian government is also considering how much backing to give the country's largest independent regional airline.

Such questions are common in many countries. Regional aviation is often a hot-button political issue, as governments and opposition parties know that maintaining air services is one of the key concerns for voters in regional communities.

However, due to their smaller scale and thinner revenue streams, regional airlines have been hit particularly hard by the supply chain problems and resulting cost increases that are plaguing the airline industry.

Calls for more government support for regional airlines have been increasing in recent years, and two developments have magnified the issue further.

In New Zealand, the regional airline Sounds Air has just announced that it will sell five Pilatus PC-12 turboprops that comprise more than half its fleet, and it will also cut the routes they served.

And in Australia, the government has already taken steps to shore up Rex while it is in administration, and further support is likely to be needed.

Summary

- Sounds Air will sell its five Pilatus turboprops and retain its Cessna Caravans.

- Air Chathams calls for government concessionary loans for regional airlines.

- Others propose allocating some of the Air New Zealand dividend for regional airlines.

- Australian government has already provided aid to Rex, and may have to give more.

- RAAA has recommended a range of regional aviation funding options to the government.

Cost increases are a major factor in Sounds Air's decision to cut back its regional fleet

In New Zealand the independent regional airlines serve small niche markets, as the majority of regional flights are operated by Air New Zealand.

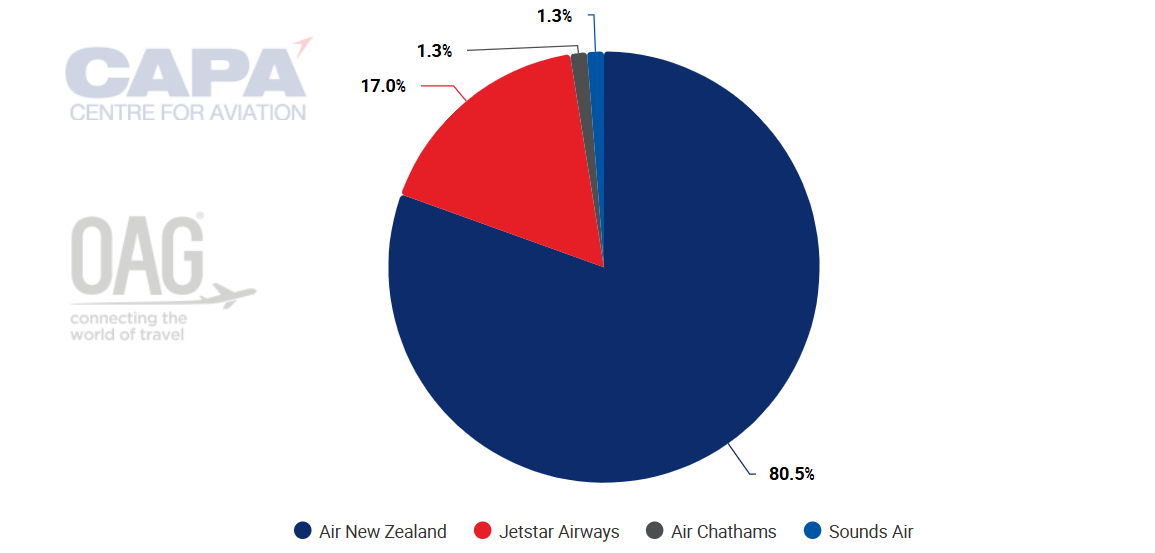

The chart below - using data from CAPA - Centre for Aviation and OAG - shows that Sounds Air and Air Chathams each have just a 1.3% share of domestic capacity.

Not depicted in the chart are other small-scale regional airlines, such as Originair and Barrier Air.

New Zealand domestic capacity by airline share, as measured in seats for the week of 28-Jul-2025

Source: CAPA - Centre for Aviation and OAG.

Sounds Air plans to sell its five Pilatus PC-12 turboprops from Sep-2025, which will leave the airline with four Cessna Caravans.

This means that it will suspend its domestic routes between Christchurch and Blenheim, and between Christchurch and Wanaka; the airline suspended two other domestic routes in Dec-2024.

Sounds Air will now focus on its shorter routes connecting cities on either side of Cook Strait, between North and South Islands. It uses the Cessna Caravans for these services, and will look to expand the Caravan fleet.

The airline will reduce its staff numbers as a result of the fleet and network cuts.

Sounds Air stressed that escalating costs, compounded by a weak New Zealand dollar, "has threatened the viability of all regional airlines and the routes that they serve". Another factor is the Civil Aviation Authority's recent move to lift the passenger service levy by 145%.

While demand is strong at the moment, air travel is very price-sensitive, and demand would suffer if the airline tried to pass all of the cost increases to customers, Sounds Air has said.

"Having exhausted all other options to restore the viability of the business, we seem to have reached a deadlock - government appears to believe that private capital markets will step in to sort this out, while on the other hand, private capital markets believe that [the] government should step in to level the playing field like they do in other parts of the world, in order to maintain essential regional air services," the airline said.

Managing Director Andrew Crawford notes that while nearly 40 countries have government support for regional flights, New Zealand does not offer significant support.

Regional airlines and communities propose funding options, and the government is considering its response

Another regional airline, Air Chathams, has been urging the New Zealand government to play a larger role in supporting regional air services. The airline's CEO Duane Emeny has called for concessionary loans - which are typically at below-market rates - from the government for regional airlines.

The mayor of Whakatane - a town served by Air Chathams - has suggested that a portion of the dividend paid by Air New Zealand to the government should be allocated to regional airlines.

Air Chathams has asked the Whakatane council to contribute more to make its flight between Whakatane and Auckland viable, but the council has said the government should provide support.

The government appears to be aware of the plight of the regional airlines. Associate Transport Minister James Meager has said that he has been holding meetings with regional airlines and airports to discuss their challenges and support options.

"The Government is actively considering several options to address regional connectivity concerns and improve competition in our aviation sector," Mr Meager said in a statement. He noted that the government will soon release an aviation action plan.

Rex financial woes are forcing the Australian government to intervene

In Australia federal and state governments provide support for regional airline services on certain routes to small or remote communities. However, this has not prevented the regional airline Rex Airlines from entering voluntary administration.

Rex is the country's largest independent regional airline, operating a fleet of 33 Saab 340Bs, with another 24 inactive, according to the CAPA - Centre for Aviation Fleet Database.

While rising costs have not helped, other factors have also played a major role in Rex's financial predicament, most notably Rex's now-abandoned attempt to enter domestic trunk markets with narrowbody jets.

Allowing Rex to disappear would be politically untenable, so the Australian government has taken an active role in helping the airline financially since it entered administration.

For example, the government took over about AUD50 million (USD33 million) of Rex's debt from the airline's largest creditor.

The preferred outcome is for an appropriate investor to purchase Rex, potentially with government support.

A federal court granted the administrators' request to extend the deadline to find a buyer until Dec-2025. If the airline cannot be sold, the government has indicated that it will consider acquiring the airline.

Ageing regional fleets are also a concern. The Regional Aviation Association of Australia has called for a financial support package from the government to give regional airlines confidence to invest in fleet renewal.

In a policy submission in Mar-2025 the RAAA said such a package could include direct financial investment, loan underwriting, loan guarantees, concessional financing, grants or tax incentives.

The Australian government issued an aviation white paper last year 2024 that acknowledges the importance of regional aviation.

But while the white paper highlighted existing initiatives - mainly for funding regional airport improvements - it did not articulate new funding concepts for regional airlines themselves.

Striking the right balance in regional airline support is a difficult exercise for governments

If we start from the premise that having a healthy regional airline sector is of immense public (and political) value, then providing financial support is a logical step.

The question for policy-makers will be what form this support should take. In New Zealand, the government's thinking on this issue should soon become clearer.

Governments taking over airlines is generally not a desirable outcome, as it can distort markets.

But in some cases it can be the only option left, and this may be the unpalatable last resort facing the Australian government.

Air New Zealand is majority government-owned as a result of a past bailout effort, but the government takes a very hands-off approach and gains healthy dividends from its shareholding.

So the arrangement has paid off for the New Zealand government, and it may actually help provide a funding avenue for the support needed by the country's smaller airlines.

Such a win-win outcome cannot be guaranteed for all state-owed airlines, and it is hard to imagine that a struggling regional airline would become a cash cow for any government.