LATAM Airlines Group's financials continue to shine against macroeconomic unpredictability

LATAM Airlines Group's impressive second quarter performance was against a backdrop of significant macroeconomic uncertainty, and occurred in what is typically a weak seasonal period for the company.

Some of the momentum is driven by an increase in passengers opting for premium products, and there is less seasonality among that customer base. LATAM also has one of the most diverse networks across Latin America, and beyond, that provides a buffer against seasonality.

It's not clear whether a permanent shift is under way from historical second quarter trends, but LATAM appears to be laying the groundwork to withstand more challenging periods of the year.

Summary

- LATAM’s financial momentum continues into 2Q2025.

- Premium revenues remain strong, and LATAM is working on product investments for that customer segment.

- Expansion of premium traffic is helping to offset headwinds triggered by seasonality.

- LATAM’s unit costs remain close to pre-pandemic (COVID-19) levels.

- Five years after entering bankruptcy protection, LATAM remains laser-focused on costs and growth opportunities.

LATAM ups its guidance in some financial metrics as macroeconomic uncertainty remains in place

As many other airlines worldwide yanked their yearly guidance in 1Q2025, due largely to unpredictable US trade policy, LATAM upped its guidance for its adjusted operating margin for 2025 - from 12%-13.5% to 13%-15%.

After posting a 66% jump year over year in net income for 2Q2025, to USD242 million, and recording a 12.9% operating margin, LATAM has upped its guidance again.

Its projected operating margin for 2025 is now 14%-15%.

"These results are particularly significant when considering the context of ongoing macroeconomic volatility across several of our key markets," said the LATAM CEO Roberto Alvo during a recent earnings discussion.

"Looking ahead, current booking trends remain solid across both domestic and international markets," he stated.

LATAM has domestic franchises in Brazil, Chile, Colombia, Ecuador and Peru, and it also has a strong intra-regional network in Latin America, operating numerous intercontinental routes.

LATAM's NPS among premium passengers grows as it expands upscale offerings

LATAM has been working to broaden its premium offerings, and those efforts are bearing fruit.

During 2Q2025 LATAM's total passenger revenues increased 8.5%, to USD2.6 billion, and revenue from premium passengers increased 12%.

The company has several initiatives under way to increase its share of premium passengers, including modernising its widebody fleet with the installation of new premium business class cabins - LATAM stated that it had completed reconfigurations on 64% of its widebody fleet.

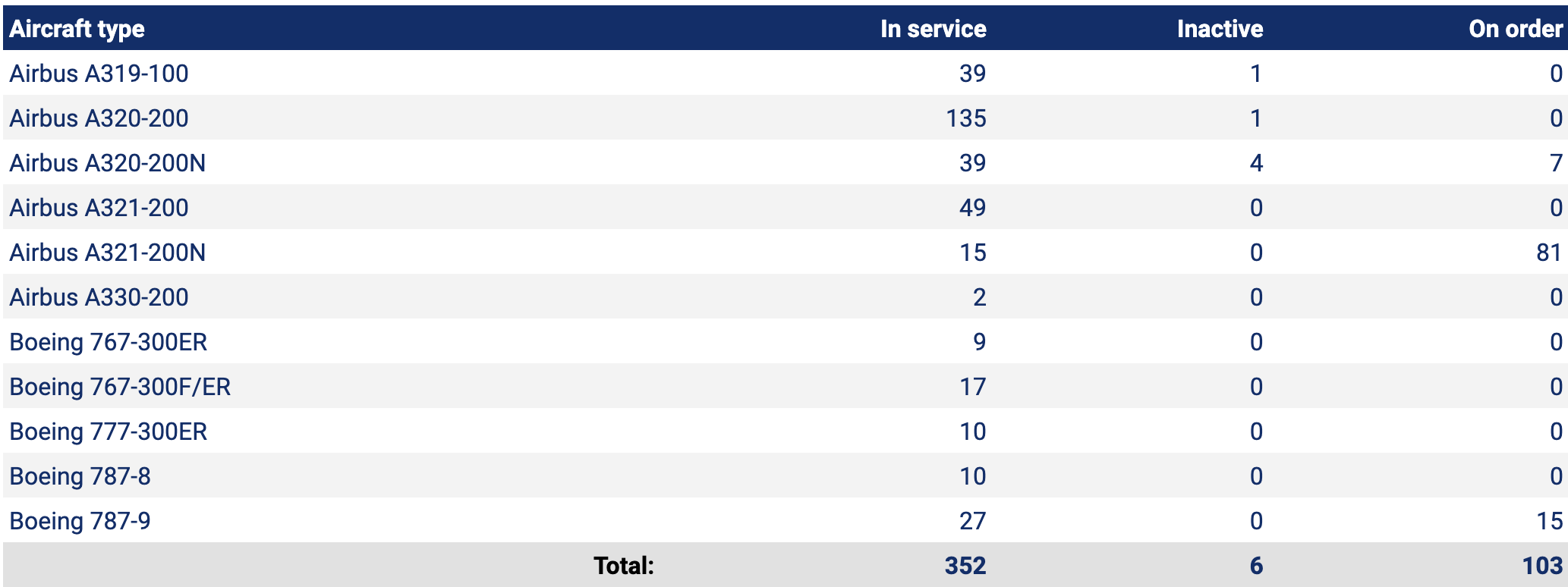

LATAM Airlines Group: fleet summary, as of early Aug-2025

Source: CAPA - Centre for Aviation Fleet Database.

Approximately 90% of LATAM's narrowbodies now feature WiFi, and connectivity should be available across its widebody fleet next year after a USD60 million investment to equip its twin-aisle jets with WiFi.

During the second quarter LATAM's net promoter score among premium customers was 60, compared with 56 in 2024 and 54 in 2023.

LATAM Airlines Group: NPS for passenger operations and premium passengers, from 2019 to 2Q2025

Source: LATAM Airlines Group.

A higher mix of premium passengers and network diversification help to weaken some seasonal headwinds for LATAM

Explaining the seasonality patterns that LATAM typically faces in the second quarter, Mr Alvo stated that "we have holidays in January, February and in July in this part of the world, and no holidays, or not important holidays, in the second quarter."

He believes that those trends will remain intact, "it's not linked to demand," Mr Alvo stated.

However, the growing premium passenger segment is less seasonal, "and our mix is changing," said Mr Alvo, which is helping to ease some of the challenges stemming from seasonality in the second quarter.

"We have been able to drive significant growth on premium traffic revenue that is less seasonal than the leisure revenue, and that is certainly helping to change a little bit the seasonality curve as well," Mr Alvo explained.

What LATAM has seen is "an untapped avenue of premium revenue that we hadn't identified in the past," he said.

"And shame on me…" Mr Alvo quipped. "I was the commercial guy…" Before assuming his role as LATAM CEO in Mar-2020, Mr Alvo was the company's chief commercial officer.

LATAM's network diversification also helps relieve some headwinds associated with seasonality in the second quarter, as Mr Alvo said that "not all countries have the same seasonality". The company's network encompasses 153 destinations to 27 countries.

LATAM keeps costs in line as it evaluates adding more aircraft to its operations

As it works to balance seasonality and grow its premium passenger numbers, LATAM remains focused on keeping costs in line.

Noting that LATAM's cost per available seat kilometre has remained at essentially the same level as before the COVID-19 pandemic, Mr Alvo said "that provides us with a good set of opportunities for growth in the upcoming years". During the second quarter LATAM's adjusted unit cost excluding fuel was USD4.8 cents, and its guidance for 2025 is USD4.65-4.75 cents.

LATAM's evaluation of growth opportunities also includes analysing the addition of more aircraft during the next two to three years. Mr Alvo said the company was examining taking the additional aircraft "from various manufacturers and lessors". That includes additions to its widebody and narrowbody fleets, "...the latter including aircraft from the A320[neo] family, as well as other similar jets from manufacturers such as Airbus and Embraer," he added.

His citing of Embraer in aircraft evaluations occurs after a report published by Reuters in 2024 quoting LATAM Airlines Brazil's CEO Jerome Cadier as saying the company was weighing the possibility of adding smaller aircraft to its fleet, such as the Embraer E2 or the Airbus A220.

LATAM's management did not offer a timeline about when any fleet decisions would be made, but it is notable that executives referenced smaller jets in the company's fleet studies.

LATAM could be laying the groundwork to combat seasonality in weaker periods of the year

Just five years ago LATAM was forced into Chapter 11 bankruptcy protection after the COVID-19 pandemic, and the associated travel restrictions, vapourised demand.

Now a few years later, Latin America's largest airline is laser-focused on cost control and expanding high value traffic.

Mr Alvo said he couldn't "...speak for the second quarter of 2026 yet", but there is little doubt that LATAM is striving for a repeat performance of 2Q2025's impressive results.