Canadian airlines plot major expansion to Latin America during the northern winter season

One prominent theme emerging from Canada's airline sector in 2025 is a push by the country's airlines into Latin America during the northern hemisphere's winter season.

The pivot towards Latin America is largely in response to dampened demand from Canada to US leisure destinations, resulting from trade policy and geopolitical tensions.

It is not clear that the wave of new service could spur over capacity in some markets, or if the latest US tariff adjustments will trigger more economic uncertainty. But for now, Canadian airlines are moving full steam ahead to bolster their presence in Latin America.

Summary

- Seats for the northern winter period from Canada to Latin America and the Caribbean chart solid growth.

- Porter Airlines marks a milestone during the northern winter, with its first flights to Mexico, the Bahamas and Costa Rica.

- Air Canada foresees opportunities in some secondary markets, and possible expansion of sixth freedom traffic from Latin America.

- Could overcapacity and a softening of demand be a risk for Canadian airlines expanding into Latin America?

- Is the pivot away from US sun markets to Latin America a permanent shift?

Canada charts double digit seat growth to Latin America and the Caribbean during the northern winter period

As demand softened among Canadians travelling to warm weather US destinations early in 2025, Canada's airlines redeployed capacity elsewhere - largely to leisure destinations in the Caribbean and Latin America.

That expansion has continued into the northern winter time frame.

Data from CAPA - Centre for Aviation and OAG show that for the week of 29-Dec-2025, planned two-way seats between Canada and the Caribbean are up by 13% year-over-year.

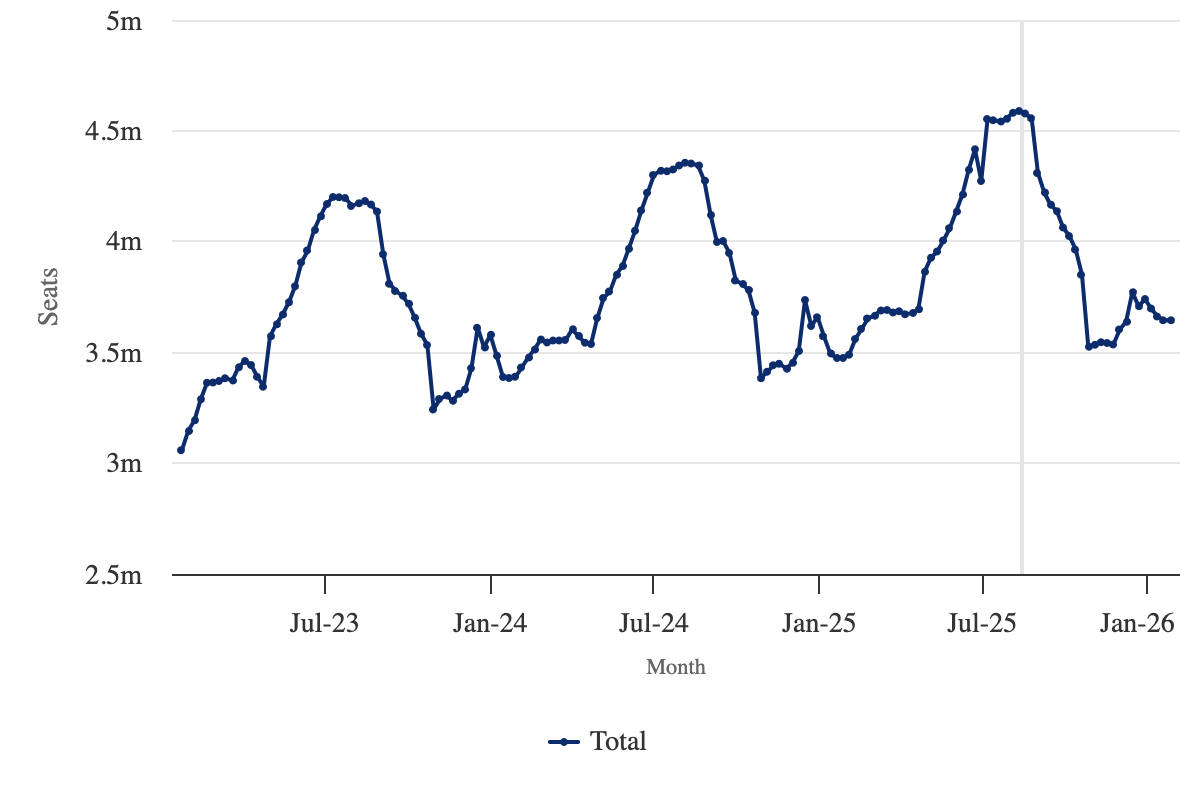

Weekly two-way seats from Canada to Latin America, from late Jan-2023 to late Jan-2026

Source: CAPA - Centre for Aviation and OAG.

WestJet's significant jump in seat share is driven by the completion of integrating Sunwing into its operations, and the introduction of new routes.

Air Canada's share has also grown, whereas Air Transit's has slightly diminished.

Porter, which is launching its first international flights beyond the US to Latin America and the Caribbean this summer, represents a 2% seat share.

Two-way seat share by airline from Canada to Latin America for the week of 29-Dec-2025 versus the year prior

| Airline | Seat share 2025 (w/c 29-Dec-2025) | Seat share 2024 (w/c 30-Dec-2024) |

| Air Canada | 27.8% | 24.3% |

| Air Transat | 25.7% | 27.6% |

| Porter | 2.0% | N/A |

| WestJet | 39.4% | 13.5% |

Source: CAPA - Centre for Aviation and OAG.

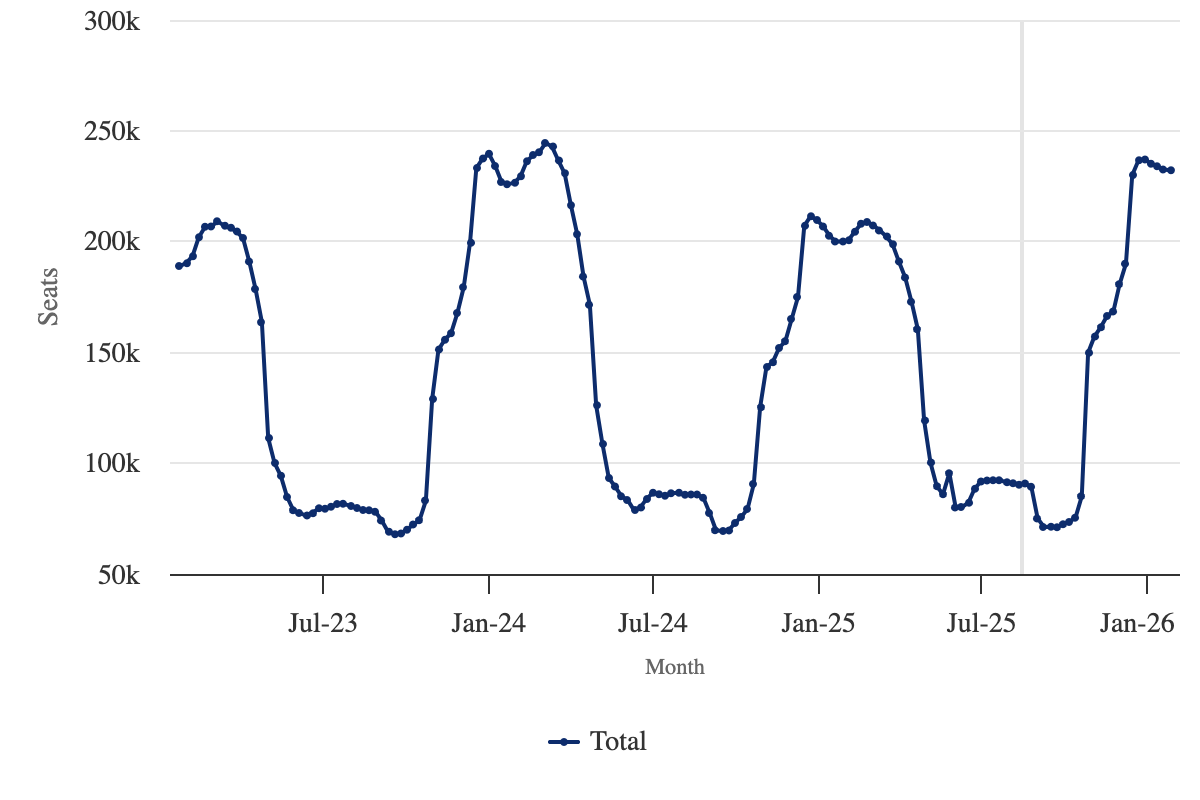

From Canada to the Caribbean, seats are growing 12% for the same period.

Weekly two-way seats from Canada to the Caribbean, from late Jan-2023 to late Jan-2026

Source: CAPA - Centre for Aviation and OAG.

Again, WestJet's seat share growth is outsized (due to the absorption of Sunwing), while Air Canada has also charted growth.

Canada's national airline has previously stated that it plans to offer 16% more capacity year-over-year during the winter season to the Caribbean and Latin America.

Two-way seat share, by airline, from Canada to the Caribbean for the week commencing 29-Dec-2025 versus the year prior

| airline | Seat share 2025 (w/c 29-Dec-2025) | Seat share 2024 (w/c 30-Dec-2024) |

| Air Canada | 27.8% | 25.0% |

| Air Transat | 18.7% | 19.6% |

| Porter | 2.1% | N/A |

| WestJet | 41.2% | 22.5% |

Source: CAPA - Centre for Aviation and OAG.

Porter marks a milestone during the northern hemisphere winter, with first flights to Latin America

Porter plans to introduce flights during the winter season from Toronto Pearson, Ottawa and Hamilton to Cancún, Puerto Vallarta, Nassau, Grand Cayman and Liberia. Frequencies range from once a week to daily, with Toronto-Cancún and Nassau featuring daily service.

As previously reported by Aviation Week Network, the Ottawa-Liberia route, at nearly 2,500 miles (2,172nm/4,024km), pushes the limits of the Embraer 195-E2, which has a maximum range of about 2,990 miles (2,600nm/4,812km).

Currently, Porter's longest route is Montreal-Vancouver at 2,287 miles (1,987nm/3,681km) - although the now-suspended Montreal-San Francisco service, last operated in summer 2024, stretched to 2,532 miles (2,200nm/4,075km).

Porter's joint venture partner Air Transat is also adding new flights to Latin America with the launch from Toronto Pearson and Montreal to Rio de Janeiro Galeão airport, as well as Montreal-Guadalajara.

Air Canada opts for some Latin secondary markets and foresees opportunities for sixth freedom expansion in the region

Alongside new flights from Toronto Pearson and Montreal to Lima, Air Canada is introducing flights to lesser-known destinations in the winter period, including Toronto Pearson to Puerto Escondido and Vancouver to Tepic.

Puerto Escondido garnered its first international flights earlier in 2025 when United Airlines introduced service to the airport from its hub at Houston Intercontinental airport.

American Airlines plans to launch new service to Puerto Escondido from Dallas/Fort Worth in Dec-2025.

Mexico's government completed a runway and terminal expansion at Tepic in early 2024, and in addition to Air Canada's new service, WestJet has unveiled new Calgary-Tepic flights operating in northern winter 2025.

United Airlines is also launching service from Houston to Tepic during the same period.

Although all Canadian airlines are seeing weakness in US leisure markets, Air Canada's sixth freedom markets from the US remain strong, with revenues growing 12% year-over-year in 1Q2025.

The airline has previously stated that it can see opportunities to expand sixth freedom traffic in Latin markets.

One of the new routes it is launching for the northern winter period is Toronto-Guadalajara, "...which we're very excited about, not only for the local traffic," said Air Canada Chief Commercial Officer Mark Galardo earlier in 2025. "But the route is also timed extremely well for...our international network, and we think we can have a decent proposition in the Sixth Freedom play between Europe and Mexico."

He also said that Air Canada was restoring service in another promising market - from Toronto to Monterrey (which was suspended last northern winter due to fleet challenges).

"Overall, we like the Mexico market, but we also like the counter-seasonality of that market and the potential Sixth Freedom contribution; that traffic could make to Air Canada's network," Mr Galardo added.

See related CAPA - Centre for Aviation report: Air Canada's network diversification efforts create a buffer against falling US demand.

Is there a risk of over-supply from Canada to Latin America, given the rapid expansion?

While Canadian airlines are making interesting moves in the Latin American market, it does beg the question of potential overcapacity on some routes.

For example, Porter will join Flair, Air Transat, Air Canada and WestJet on service from Toronto to Cancún. Aviation Week Network has reported that Porter will face competition on 10 of its 13 new routes, including Toronto-Cancún. But the airline will be the only operator on flights from Ottawa to Grand Cayman and Liberia, and from Hamilton to Puerto Vallarta and Nassau.

Puts and takes will occur in some of the new markets introduced by Canadian airlines, but there is also a question whether the demand will hold steady. The US recently introduced raised tariffs on goods imported from Canada from 25%-35%. Broader implications from the levies on Canada's economy are not entirely clear.

As reported by the New York Times, the effect of the increased tariffs on Canada was mitigated by the US president excluding products that qualify as North American, that were covered from a trade agreement brokered with Canada and Mexico during his first term. The publication stated that the Canadian Prime Minister Mark Carney said about 85% of trade between the two countries remains tariff-free.

However, as the article pointed out, a 25% tariff on autos assembled in Canada, which is adjusted to reflect the level of American parts in specific vehicles, as well as 50% percent tariffs on steel and aluminium, are already being felt by those industries.

Will the pivot towards more Latin expansion by Canadian airlines continue?

If general economic uncertainty ensues due to US trade policy, there could be a possibility that some knock-on effect on air travel demand could emerge.

But Canadians have faced trade whiplash since the start of 2025, and perhaps are learning to manage lingering uncertainty, and are opting to travel regardless.

Whatever the outcome of ever-changing trade policy, for now Canadian airlines are making an interesting push into Latin America.

Future winter seasons could dictate if those changes are permanent.