Ryanair: ‘UK’s biggest passenger airline’ with ‘double BA’s traffic’?

In its 27-Aug-2025 announcement of its UK winter schedule, Ryanair said that it expected 60 million passengers in the UK this year, making it the UK's biggest passenger airline.

It also claimed that it would carry almost double British Airways' traffic volume to/from the UK this year.

These claims need some fact checking, but the broader truth is that Ryanair, and low cost airlines in general, have outpaced British Airways' growth in the UK over the past decade and more.

The ultra-LCC is seeking to present its very significant credentials in Europe's biggest aviation market, thereby amplifying the core message to the UK government: scrap air passenger duty and reform air traffic control, or we will slow our growth in the UK.

Summary

- Is Ryanair the UK’s biggest passenger airline? Analysis of capacity/load factor data indicates this claim is credible.

- Will Ryanair carry almost double British Airways’ UK traffic? No, but maybe 1.5 times.

- Ryanair and easyJet have outpaced British Airways’ UK growth over the past decade, as have Jet2.com and Wizz Air.

- Aggregate LCC seat share has increased in the UK over the past decade.

Is Ryanair the UK's biggest passenger airline?

Ryanair's two claims need some unpicking.

First, is Ryanair the UK's biggest passenger airline (i.e. more UK passengers than any other airline in 2025)?

It is tricky to answer this from publicly available traffic data…

Unfortunately, with the exception of British Airways, it is difficult to break out passenger statistics for traffic carried by major airlines in the UK alone. The passenger data reported by the UK's Civil Aviation Authority (CAA) only record the traffic of UK-registered airlines.

Whereas British Airways and its two airline subsidiaries (BA Cityflyer and BA Euroflyer) are UK-registered, only parts of the Ryanair and easyJet groups are UK-registered.

CAA data show that, in the UK, British Airways carried 45.7 million passengers in 2024 (this includes BA Cityflyer and BA Euroflyer).

EasyJet UK carried 42.4 million, but this is only part of the easyJet group (albeit, by far the group's most significant operating company in the UK).

Ryanair UK carried 4.9 million passengers in 2024, whereas the vast majority of Ryanair Group's UK passengers are carried by the Irish-registered Ryanair DAC, for which no statistics are available for its traffic in the UK alone.

…but analysis of capacity/load factor data indicates this claim is credible

The next best approach is to consider scheduled seat capacity for these airlines/groups in the UK.

According to data from CAPA - Centre for Aviation/OAG, Ryanair (including Ryanair UK) is projected to operate 65.3 million seats in/to/from the UK in 2025.

If it were to achieve the same 94% group-wide load factor in 2025 as it reported for its last financial year (to Mar-2025) in the UK in 2025, this would translate into 61.4 million passengers.

This is considerably more than British Airways' UK passenger count of 2024, and will also be much higher than British Airways' likely passenger traffic in 2025. British Airways' total passenger numbers fell by 0.8% in 1H2025, to 21.9 million.

EasyJet is scheduled to offer 68.5 million UK seats in 2025, which is more than Ryanair. However, at easyJet's 89% group-wide load factor in its last financial year (to Sep-2024), this would translate into 61.0 million passengers, which is just below Ryanair's possible total of 61.4 million.

Ryanair has said it expects 60 million UK passengers in 2025, which is in the same ballpark as the above estimates.

All this lends credibility to Ryanair's expectation that it will be the UK's biggest airline by passenger numbers in 2025.

Will Ryanair carry almost double British Airways' UK traffic? No - but maybe 1.5 times

What about Ryanair's claim that it will carry almost double British Airways' traffic volume to/from the UK in 2025?

Based on total UK passenger numbers for each airline, this looks impossible.

If Ryanair carries in the region of 60 million UK passengers and British Airways carries somewhere in the vicinity of last year's 45.7 million, the ultra-LCC's total will be far from double British Airways' total.

Ryanair may be focusing only on international traffic (implied by its phrase "to/from the UK").

Subtracting British Airways' 5.6 million domestic passengers from its 2024 total of 45.7 million leaves 40.1 million international passengers.

Ryanair's expected 60 million, and even the estimated total of 61.4 million, is significantly higher than this British Airways total - but still much less than 'double' it.

To recap, Ryanair may well be the UK's biggest airline by passenger numbers in 2025, but with only a little more UK traffic than easyJet, and certainly not double British Airways' UK passenger numbers.

Ryanair and easyJet have outpaced British Airways' UK growth over the past decade…

The broader picture is that both low cost airlines - Ryanair in particular - have outpaced British Airways' capacity growth in the UK over the past decade.

According to data from CAPA - Centre for Aviation/OAG, Ryanair's 2025 UK capacity is projected to be 63% higher than in 2015, and easyJet's is projected 40% higher.

British Airways' UK seat count is scheduled to be up by only 7% over the past decade; the UK market as a whole will have grown by 20% over the same period.

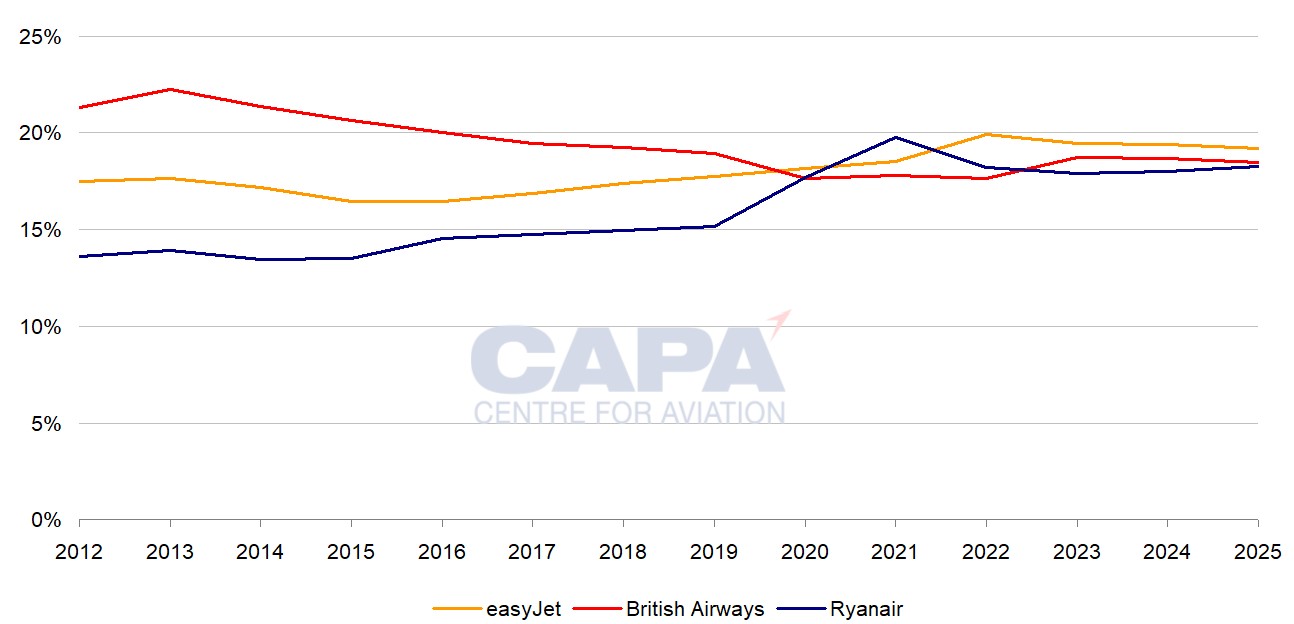

As a result, Ryanair and easyJet have gained seat share, while British Airways has lost share over this time frame.

From 2015 to 2025, Ryanair's UK seat share is projected to gain 4.8ppts to 18.3%, and easyJet's is set to be up by 2.8ppts, to 19.2%.

British Airways' share is scheduled to be down by 2.1ppts to 18.5%.

British Airways, easyJet and Ryanair: scheduled seat share in the UK, 2015 to 2025*

*2025 data are projected after 1-Sep-2025.

Source: CAPA - Centre for Aviation, OAG.

As already noted, Ryanair's superior load factor means it is likely that it has a higher passenger count than both easyJet and British Airways in 2025.

…as have Jet2.com and Wizz Air

Looking beyond the top three, the fastest-growing airlines in the UK over the past decade are Jet2.com, whose 2025 capacity is 3.8 times its 2015 level, and Wizz Air (including Wizz Air UK and Wizz Air Malta), which is 2.6 times the size it was a decade ago.

The LCCs Jet2.com and Wizz Air are the fourth and fifth-ranked airlines by seats in the UK. This means that four of the UK's top five are LCCs, and all four have outpaced market growth over the past decade.

Top five UK airlines by scheduled seat share, 2025*

|

Rank |

Airline |

Seat share |

Seat growth 2025/2015 |

|---|---|---|---|

|

1 |

19.2% |

140% |

|

|

2 |

18.5% |

107% |

|

|

3 |

18.3% |

163% |

|

|

4 |

6.5% |

379% |

|

|

5 |

3.8% |

256% |

*2025 data are projected after 1-Sep-2025.

Note: Ryanair includes Ryanair UK; Wizz Air includes Wizz Air UK and Wizz Air Malta.

Source: CAPA - Centre for Aviation, OAG.

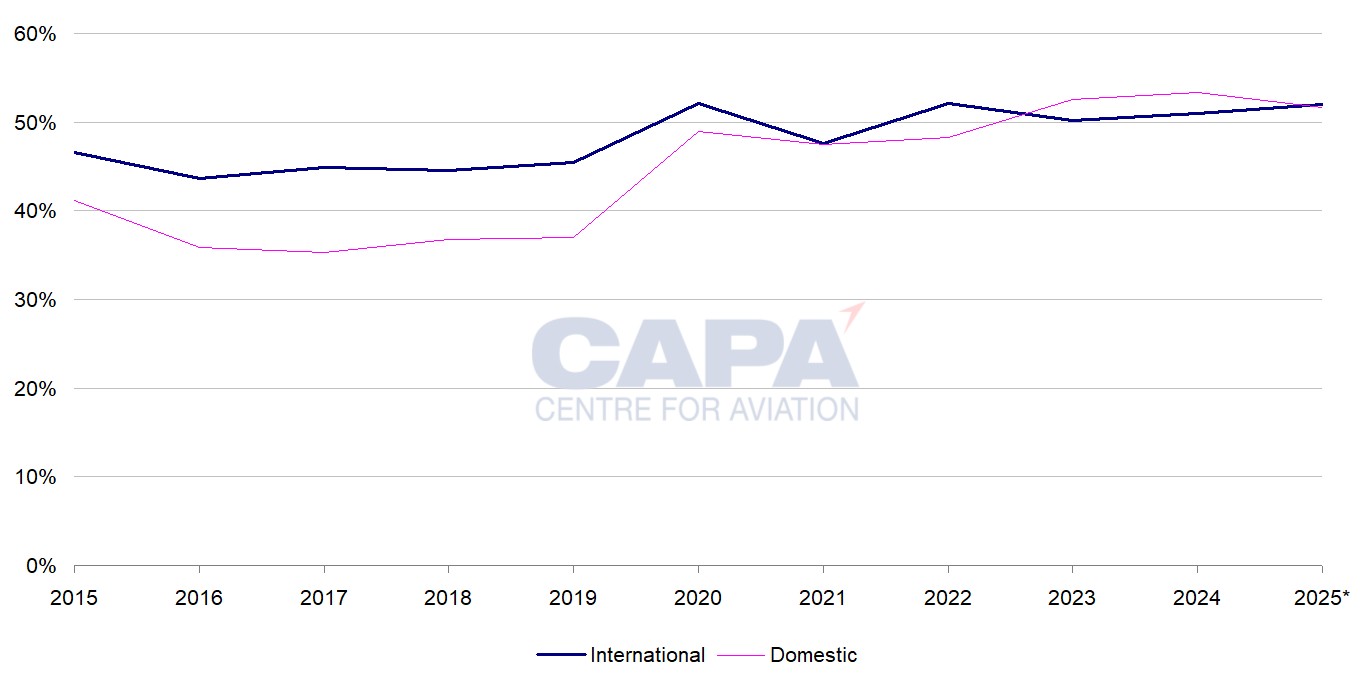

Aggregate LCC seat share has increased in the UK over the past decade

Aggregate low-cost seat share on international routes has increased from 46.6% in 2015 to 52.0% in 2025 (first nine months).

On domestic routes, LCC share has risen from 41.2% to 51.6% over the same time period.

UK LCC: seat share on international and domestic routes, 2015 to 2025*

*2025 Jan to Sep.

Source: CAPA - Centre for Aviation, OAG.

Ryanair's real message: 'scrap APD and reform ATC'

Ryanair's announcement also included a familiar call on the UK government to scrap air passenger duty and to reform NATS, which provides the nation's air traffic control services.

If the Starmer government meets these conditions, Ryanair says it will increase its UK traffic by 33%, from 60 million to 80 million, over the next five years.

Its declaration that it is the UK's biggest airline by passengers - and much bigger than the country's flag carrier, British Airways - should be seen in this context.

The UK is an island nation that, historically, has appreciated the importance of the aviation industry to its economy and cultural links with the rest of the world. This has led to its position as the biggest aviation market in Europe and the third-biggest in the world (after the US and China) by seats.

Ryanair is arguing that, as the biggest airline in this market, its voice should be heard.