Cape Verde vs The Gambia; two West African countries locked in battle for tourist dollar - part one

When one thinks of West Africa it is rarely in connection with vacations - especially beach holidays, and certainly not upmarket ones.

But the region contains two countries: one a tiny crop of mainland surrounded by another country with a small but highly attractive coastline (The Gambia), and the other a wide-ranging archipelago to the west of it in the Atlantic Ocean (Cape Verde). Both have benefitted hugely from mass tourism.

They both register 20%-25% of their GDP arising from that tourism. And both got started around the same time, in the late 1950s, with The Gambia initially racing ahead thanks to the foresight of a Swedish entrepreneur.

Cape Verde was slower out of the blocks but has clawed its way back, and then ahead, in the past two and a half decades, to become one of Africa's leading vacation destinations.

There are numerous factors that have influenced the rise and fall of both, including particularly the performance of the national carrier and that of foreign airlines serving them. Also, latterly, the decision in one case to let the private sector run its airports, while in the other it is still the responsibility of a government department.

Right now it is hard to argue against Cape Verde having the upper hand, but both countries rely on visitors from First World countries that face ever tougher economic challenges ahead and the vagaries of political relations.

Indeed, as if to underline how hard it can be to estimate demand, as this report was written The Gambia achieved 46% tourist growth in Jul-2025 - by far the highest figure in the whole of Africa.

This is part one of a two-part report.

Summary

- Few West African countries can offer the beach holiday that western vacationers have come to expect.

- The Gambia was fast out of the blocks with a tourist offer, thanks to a Swedish entrepreneur and his wife.

- Tourists were attracted to a narrow Atlantic coastline that provided most of the attributes that European sun seekers covet.

- Visitor numbers peaked at 236,000 in 2019, to what has become acknowledged as an affordable destination.

- Tourism accounts for 20% of GDP, but has experienced downturns recently.

- The UK is still the #1 visitor supplier.

- The government is trying to diversify the sector.

- Tourism remains closely linked to the economic health of advanced economies.

- Banjul’s Airport has seen some famous airlines on its apron, but today is mainly connected to West Africa capitals.

- Around half a million passengers handled this year... but a distinct absence of LCCs.

Few West African countries can offer the beach holiday that western vacationers have come to expect

There are few countries in West Africa that can be considered suitable for mass tourism from First World countries, meaning those that seek guaranteed sunshine throughout the year as they attempt to escape their own grey, overcast, miserable climate - especially in Northern Europe - and who are really only concerned with finding a beach to lie on.

For half the year, at least, they can find those beaches in southern Europe or North Africa, but even they can become cold and unwelcoming in the northern hemisphere winter; even Spain's Canary Islands, which are off the coast of North Africa, and the Portuguese islands (the Azores, Madeira).

Those West African countries can all offer sunshine, and in most cases year-round, too.

But several of them are woefully undeveloped in that tourism respect, having more concern for the day-to-day wellbeing of their indigenous inhabitants.

West Africa

Source: Wikimedia Commons.

Either that, or they are earmarked by national governments in Europe and elsewhere as being inadvisable to travel to and within; usually because of lawlessness or political tensions, although it can also be the prevalence of severe illnesses such as viral hemorrhagic fevers (Ebola, Lassa, Marburg etc.) that appear every few years, not to mention the ever-present danger of malaria.

Or the problem might be simply the lack of any sort of tourist infrastructure beyond 'basic'.

There are really only two countries with a definable tourism offer: namely The Gambia and Cape Verde.

The Gambia was fast out of the blocks with a tourist offer, thanks to a Swedish entrepreneur and his wife

The simple fact of the matter is that the further south one travels from Europe the better the weather, down to the equator and beyond. On the other hand, one may not wish to travel much more than four hours of flight time; the same as a journey to the Greek islands, for example.

And it is for that reason that The Gambia (the smallest mainland country in Africa, and almost entirely surrounded by Senegal) became an international tourist haven from 1965, when a party of 300 Swedish tourists arrived in the country. The pioneering trip having been organised by a Swedish entrepreneur in collaboration with the tour operator Vingresor, which still exists today as Ving, the country's largest such company.

That is unlike the UK's Thomas Cook, a travel and vacation giant which did not survive, and whose demise contributed to a collapse in The Gambia's tourist numbers (see later).

The Gambia, a country of 2.75 million, derived its name from the Gambia River. The "The" was officially added to the name at the time of independence in 1965 to avoid confusion with the newly independent nation of Zambia in Southern Africa.

Tourists were attracted to a narrow Atlantic coastline that provided most of the attributes European sun seekers covet

And the reason that The Gambia became so popular was that it has a narrow Atlantic coastline that provides most of the attributes that sun seekers covet, and with a flight time of six hours from the UK; a little more from northern Europe and Scandinavia.

Tourists were attracted by the combination of sun, sand, beaches, and the opportunity to experience an authentic African holiday. The Gambia became unique as the first winter sunshine destinations for European package tours in sub-Saharan Africa and quickly experienced significant growth after its inception, initially going from 300 tourists in 1965/66 to 25,000 in 1976, which is an 8.3 thousand percent increase in a decade.

Visitor numbers peaked at 236,000 in 2019, to what has become acknowledged as an affordable destination

By the mid-1990s that number had increased to around 90,000. It peaked in 2019 at 236,000.

The Gambia gained its independence from Britain in the same year (1965) that international tourism began in the country, marking a significant period of transition for the nation.

Most visitors do not need a visa, and receive a passport stamp allowing a 28-day stay upon arrival, with options for extensions, which puts it at an advantage over other countries.

Although not regarded today as a budget destination, The Gambia is considered to be an affordable one for most people.

Tourism became a significant economic driver, with a subsequent focus on sustainable development, community involvement, and attracting visitors through its natural beauty, safety, and vibrant culture.

At the same time, The Gambia has latterly developed a reputation as a destination for sex tourism, with several concerning dimensions to this issue, including the onset of child sex tourism.

The Gambia is currently classified as a 'Tier 2 Watch List' country for human trafficking according to the US Department of State, indicating that while efforts are being made to address these issues, significant challenges remain.

The Gambian Tourist Board has plans to change the country's tourism focus back towards wildlife and heritage attractions. But as countries like Thailand will confirm, it is very difficult to negate this sort of tourist attraction once it is entrenched.

Tourism accounts for 20% of GDP but has experienced downturns recently

And one cannot avoid the fact that tourism accounts for about 20% of The Gambia's GDP - a very high ratio, and thus acting as a major source of foreign exchange earnings and a significant employer.

Despite that unwanted addition to the tourist inventory, tourism in The Gambia experienced significant downturns in the late 2010s and early 2020s due to the collapse of the British travel operator Thomas Cook in 2019, followed by the COVID-19 pandemic.

The failure of the major tour UK operator, which brought a significant percentage of tourists to The Gambia, caused a considerable decline in visitor numbers.

The subsequent global pandemic and related travel restrictions decimated what remained of the tourism industry, with hotels and tour operators suffering massive financial losses and hoteliers forced to seek alternatives to earn a living.

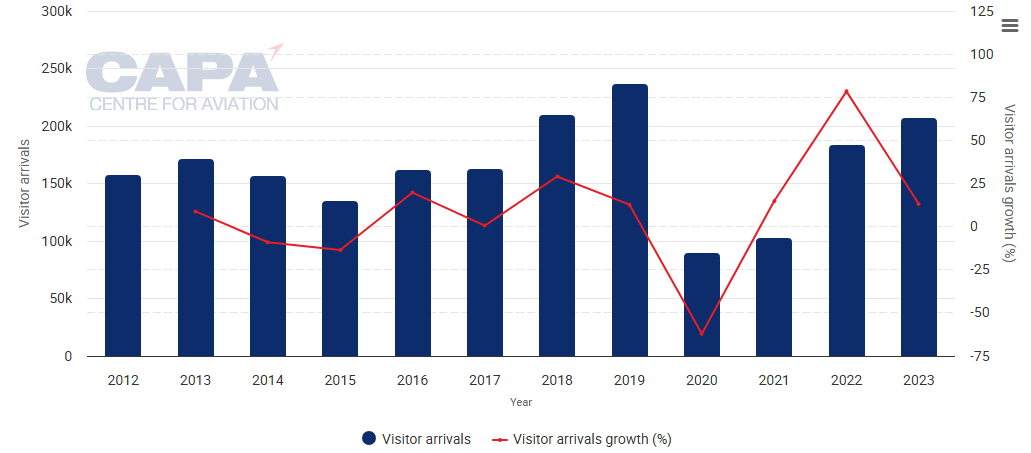

The chart of tourist numbers below shows that growth has been uneven, but had been positive in 2018 and in 2019, the year in which Thomas Cook went bust (Sep-2019) and the year before the COVID-19 pandemic.

Visitor numbers declined to less than 100,000 in 2020, but have climbed back to over 200,000 in 2023.

Gambia annual tourism: visitor arrivals, from 2012 to 2023

Source: CAPA - Centre for Aviation and Gambia Tourism Board.

NOTE: Visitor arrivals are air arrivals only.

Informally, and while 2024 statistics are still awaited, the authorities expected over 200,000 tourists during the 2024-2025 tourist season, which began in Oct-2024.

The number is an expectation for the season - not a single calendar year, as tourist arrivals often come from October through April.

This season was anticipated to bring approximately 57 tourist flights per week, with new tour operators opening up fresh markets.

The UK is still the number 1 visitor supplier

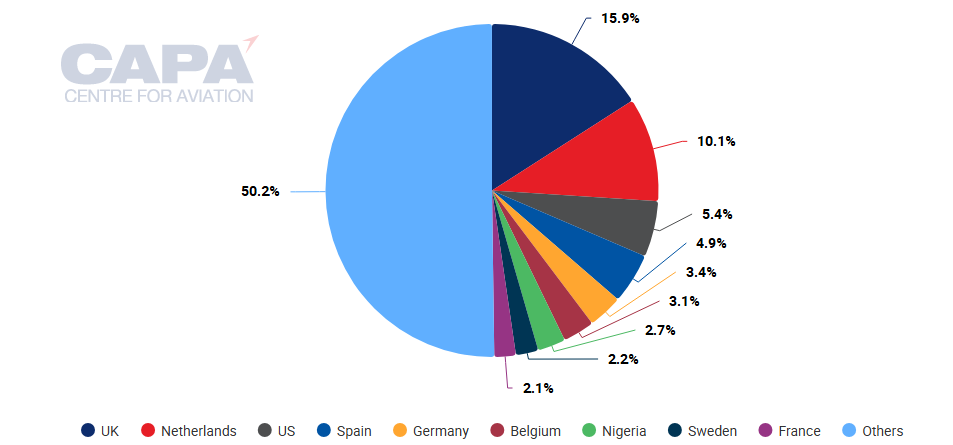

In 2023 the UK still clung to its number 1 spot as a vacationer supplier, at 16%, followed by The Netherlands and the US.

That 50% comes from 'Others' suggests that The Gambia's appeal is widespread, although there may be a degree of VFR and Diaspora traffic included; in other words not everyone is a foreign tourist.

Gambia: visitor arrivals by market for 2023

Source: CAPA - Centre for Aviation and Gambia Tourism Board.

That projection suggests the numbers will stabilise, in common with many other countries that are now perhaps seeing the end of the so-called 'revenge travel' boom.

While there have been efforts to recover and diversify the sector, including attracting regional visitors and promoting new tourism experiences, the sector faced a slow recovery from the late 2010s/early 2020s challenges, but with recent news indicating a return of some European markets and promotional efforts to inspire domestic and regional tourism in 2024 and 2025.

Those challenges had a measurable impact on the economy.

The decline in tourism led to a significant loss of tax revenue and also negatively impacted businesses like hotels, tour operators, and airlines, affecting employment and foreign exchange earnings.

The government is trying to diversify the sector

The government and the Gambia Tourism Board are actively seeking to diversify the tourism sector, as indicated previously, and crucially to promote year-round tourism, including out-of-season months to counter the previous downturn.

There is increased funding and focus on promoting the beauty of the Gambia River and other inland attractions, alongside existing beach and nature tourism, to attract more visitors.

Initiatives also include bringing Nigerian influencers and local creators to promote the country's attractions to a broader audience, as well as efforts to promote domestic and regional tourism.

There are some positive signs, with reports of the Scandinavian market re-entering the tourism mix and the welcoming of more UK tourists in late 2024, indicating a potential upswing there.

Specific tour operators like Novatos are bringing in hundreds of visitors from the Baltic countries, which is a relatively new market.

Tourism remains closely linked to the economic health of advanced economies

At the end of the day, though, the performance of the tourism sector is closely linked to the economic health of advanced economies. Particularly in Europe, those that are experiencing slower growth, potentially impacting The Gambia's tourism in 2025 and 2026.

The Acid Test will be reaching 250,000 annual visitors - which was in sight in 2019 - and when that will be achieved.

The Gambia only has one international airport, the Banjul Yundum International Airport (BJL), which serves as the sole commercial airport in the country and handles all scheduled passenger flights.

The pre-war (WW2) airport, which has a 3,600m runway, was rebuilt in 1963, and a modern terminal was opened in 1997.

Banjul's Airport has seen some famous airlines on its apron, but today it is mainly connected to West Africa capitals

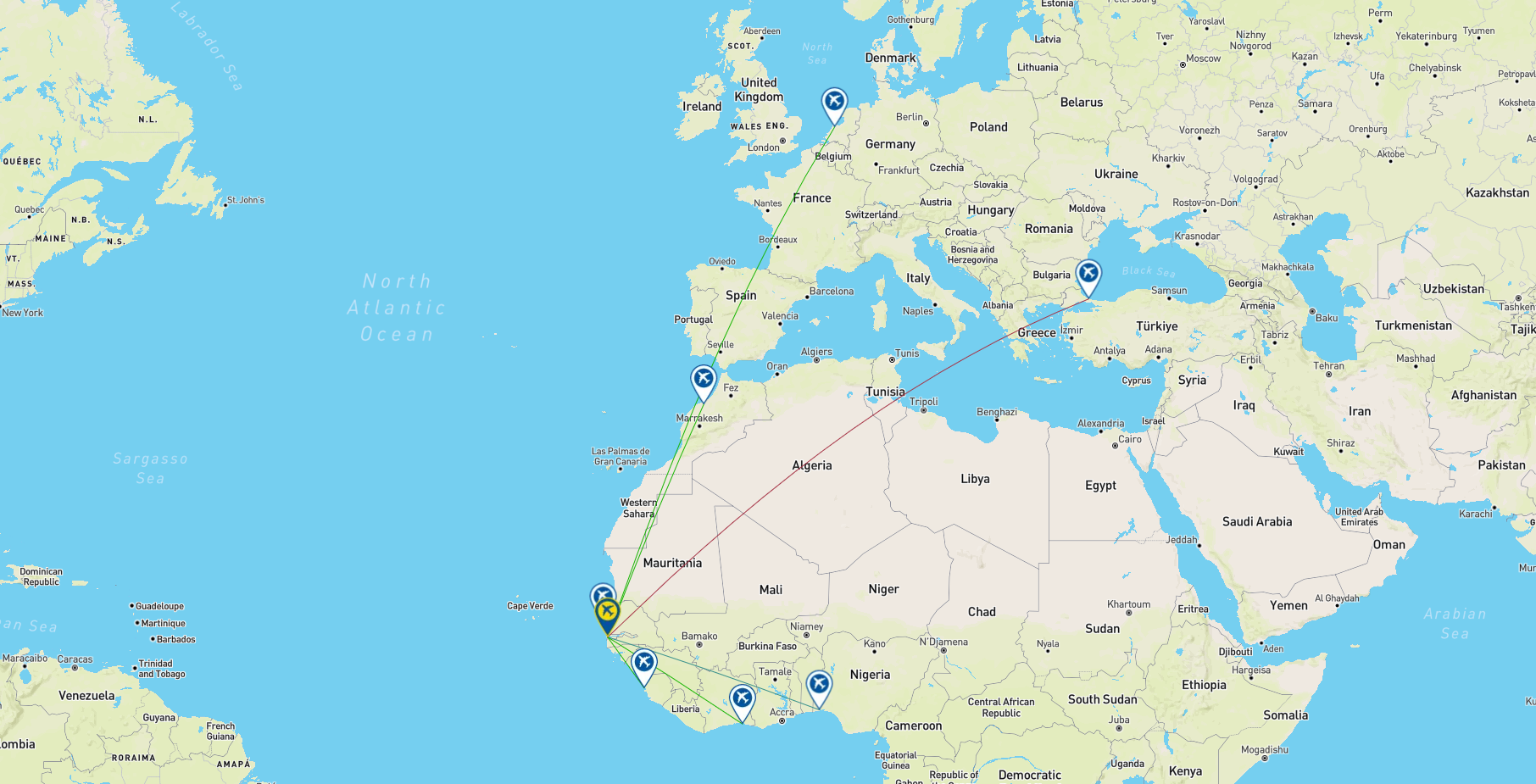

Yundum International Airport has, in its time, seen airlines such as British South American Airways and the British Overseas Airways Corporation (BOAC) operating services there, but the position today is quite different, as evidenced by the route map below.

Banjul Yundum International Airport: network map for the week commencing 15-Sep-2025

Source: CAPA - Centre for Aviation and OAG.

Banjul is connected to key capitals in West Africa, but otherwise its scheduled long haul operations, in week commencing 15-Sep-2025, are limited to Amsterdam and Istanbul, although those airports offer many connections.

Otherwise, key destinations are operated mainly by charter services, often by TUI divisions and by a Danish charter operator.

Brussels Airlines, the consummate Africa services operator from Europe, has served Banjul in the past, but does not do so presently.

Around half a million passengers handled this year...

There is no official figure for passengers at BJL in 2024, but in 2023 the airport handled a total of 418,807 passengers (210,482 disembarked and 208,325 embarked).

In 2019 there were 477,512 passengers, and the recovery direction post-COVID has been positive since 2022, suggesting that the 2024 figure may have touched 500,000.

Togo-based Asky Airlines and Royal Air Maroc are the two main airlines by passengers carried.

... but there is a distinct absence of LCCs

In the analysis week there were no low-cost carriers operating there. All were full service (95% of capacity) or virtual. There is a small presence from LCCs, among them Vueling offering winter connections to Banjul from Barcelona..

There is a presence from alliance airlines, with 30.1% of seat capacity on oneworld and 15.8% on Star Alliance, but the routes served are highly concentrated.

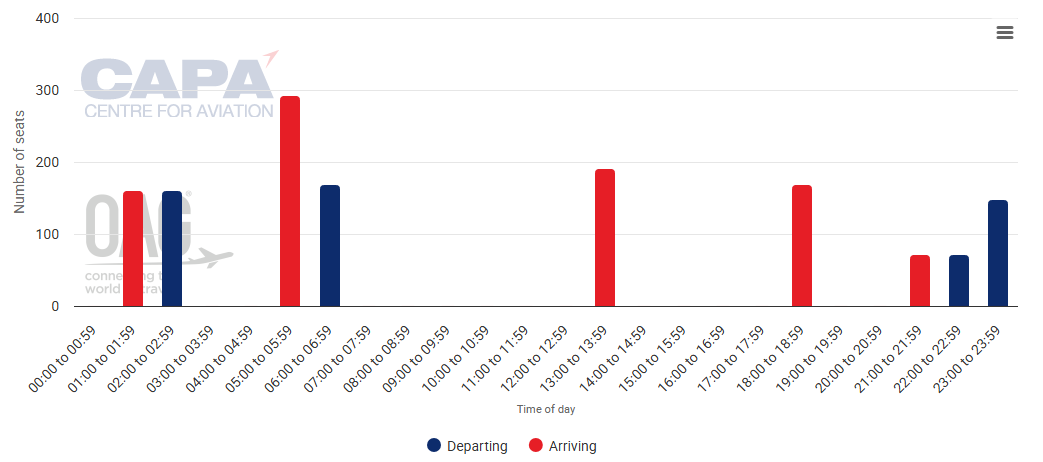

The airport's utilisation is very patchy. The chart below is of arriving and departing capacity on Wednesday 17-Sep-2025.

Banjul Yundum International Airport: total system seats for 17-Sep-2025

Source: CAPA - Centre for Aviation and OAG.

The Gambia has a problem attracting low-cost carriers.

They remain in short supply throughout Africa generally, and are not appropriate to short haul services around West Africa anyway. Moreover, flight lengths are too long for many European operators, in the way they impact on crew rostering, in particular.

The main hope lies in a change of philosophy by European airlines.

While airlines such as Ryanair and Wizz Air would probably not consider Banjul, easyJet for example already flies to Cape Verde, which is a similar distance from most of its European bases, and in its northern winter season for 2026 the airline will offer beach package holidays there.

If easyJet could be attracted to Banjul it would augment the TUI offers from Europe considerably, but the airline would certainly want to see official figures confirming that The Gambia is solidly back on track in the tourist stakes over a period.

There seems to be little prospect of other mid to long haul services emerging, and in that sense, much will depend for the time being on what networks can be built out of the existing alliance airlines.

So much will depend on what progress can be made in building tourist numbers in what are likely to be tough years ahead.