Latin American airlines exude confidence amid prolonged economic ambiguity

Although no region is completely shielded from ever-changing US trade policy, Latin America has arguably fared better than other areas of the world.

Traffic continues to grow at a steady pace and the region's airlines are posting solid financial results, given the persistent overhanging uncertainty that's been present throughout 2025.

LATAM Airlines Group, Copa and Avianca all have offered reasonably positive outlooks for the remainder of 2025 as each operator works to execute their respective business plans and capitalise on their strengths.

Summary

- Amid macroeconomic uncertainty, LATAM Airlines Group sees solid booking trends.

- Copa believes its cost advantage is a buffer against lower yields.

- Avianca stakes a claim in Medellin, while also redeploying capacity out of domestic Colombia.

- Latin American airlines post solid results against a backdrop of continued uncertainty.

LATAM Airlines Group challenges the norm of a weak second quarter

The latest data from IATA show that Latin America was the only region posting stronger month-to-month traffic in Jun-2025.

LATAM Airlines Group bucked historical trends during the seasonally weaker second quarter and posted a 66% jump year-over-year in net income, to USD242 million. It is forecasting an operating margin for 2025 of 14%-15%.

"These results are particularly significant when considering the context of ongoing macroeconomic volatility across several of our key markets," said LATAM CEO Roberto Alvo during a recent earnings discussion.

"Looking ahead, current booking trends remain solid across both domestic and international markets," he stated.

See related CAPA - Centre for Aviation report: LATAM Airlines Group's financials continue to shine against macroeconomic unpredictability

Copa believes it can maintain its financial edge, despite a weaker yield environment

Panama's Copa Airlines posted an operating margin of 21% for 2Q2025 and is forecasting 21%-23% margins for the full year. Its net income grew 23.8% year-over-year in the second quarter, to USD148.9 million.

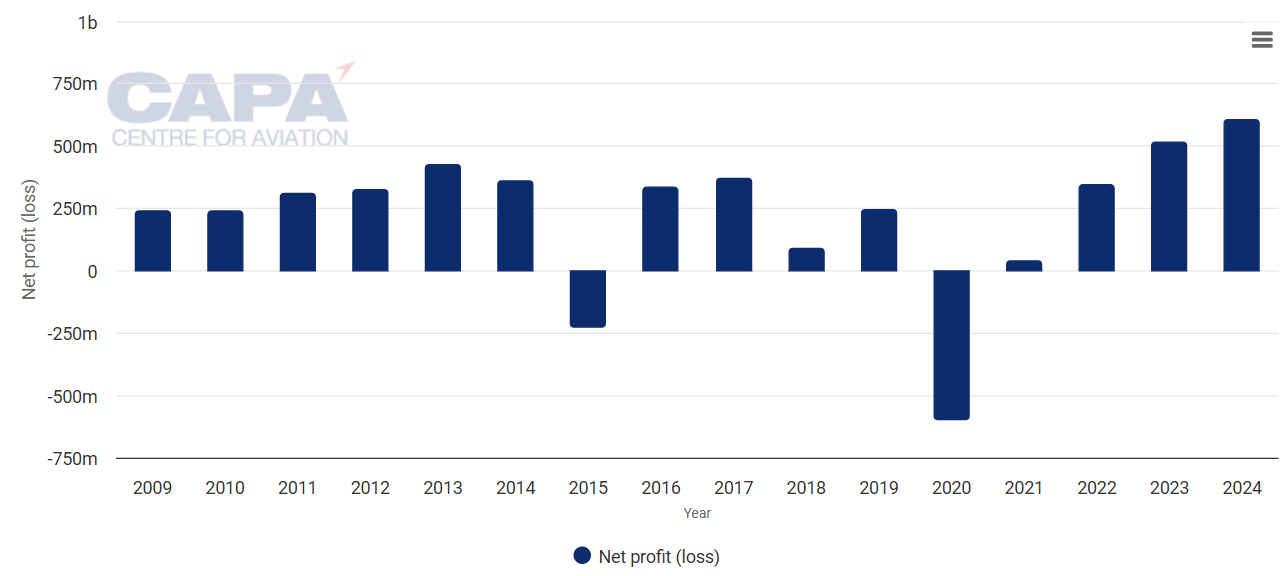

During the past 15 years Copa has posted just two annual losses - in 2015, and during the depths of the COVID-19 pandemic in 2020. Copa's profitability streak is all the more impressive given that many of its large competitors in Latin America restructured in Chapter 11 bankruptcy protection during the COVID-19 pandemic.

Copa Holdings: annual net profit/loss, from 2015 to 2024

Source: CAPA - Centre for Aviation and company reports.

Putting the 4.1% drop in yields year-over-year in 2Q2025 into perspective, Copa CEO Pedro Heilbron explained during a recent earnings discussion that the company's yields and unit revenue are lower this year than in 2024, and fell last year 2024, compared with 2023.

Copa has been preparing for the yield decline for years, said Mr Heilbron, noting that the company had lowered its unit costs to offset the drop in yields. Its unit costs excluding fuel did increase 3.2% in the second quarter to 5.8 cents, but the growth was largely driven by a non-recurrent benefit recorded in the second quarter of 2024 in maintenance, materials, and repairs costs associated with the return conditions of nine aircraft lease extensions.

Mr Heilbron pointed to some regions where weakness was present, including Central America to the US, a market that has undergone outsized capacity growth during the past couple of years.

"Luckily, it's not a huge market for us," he said, noting that Copa does not operate nonstop service from Central America to the US - "We connect through Panama which is a little south of Central America."

Industry capacity, including Copa, is projected to grow 9% year-over-year in the airline's markets.

"Some airlines have grown quite a bit," Mr Heilbron said. "One in particular has grown a lot in our kind of markets in the intra Latin America region ... we've dealt with that successfully."

Avianca pulls down domestic Colombia, but strategically expands in Medellín

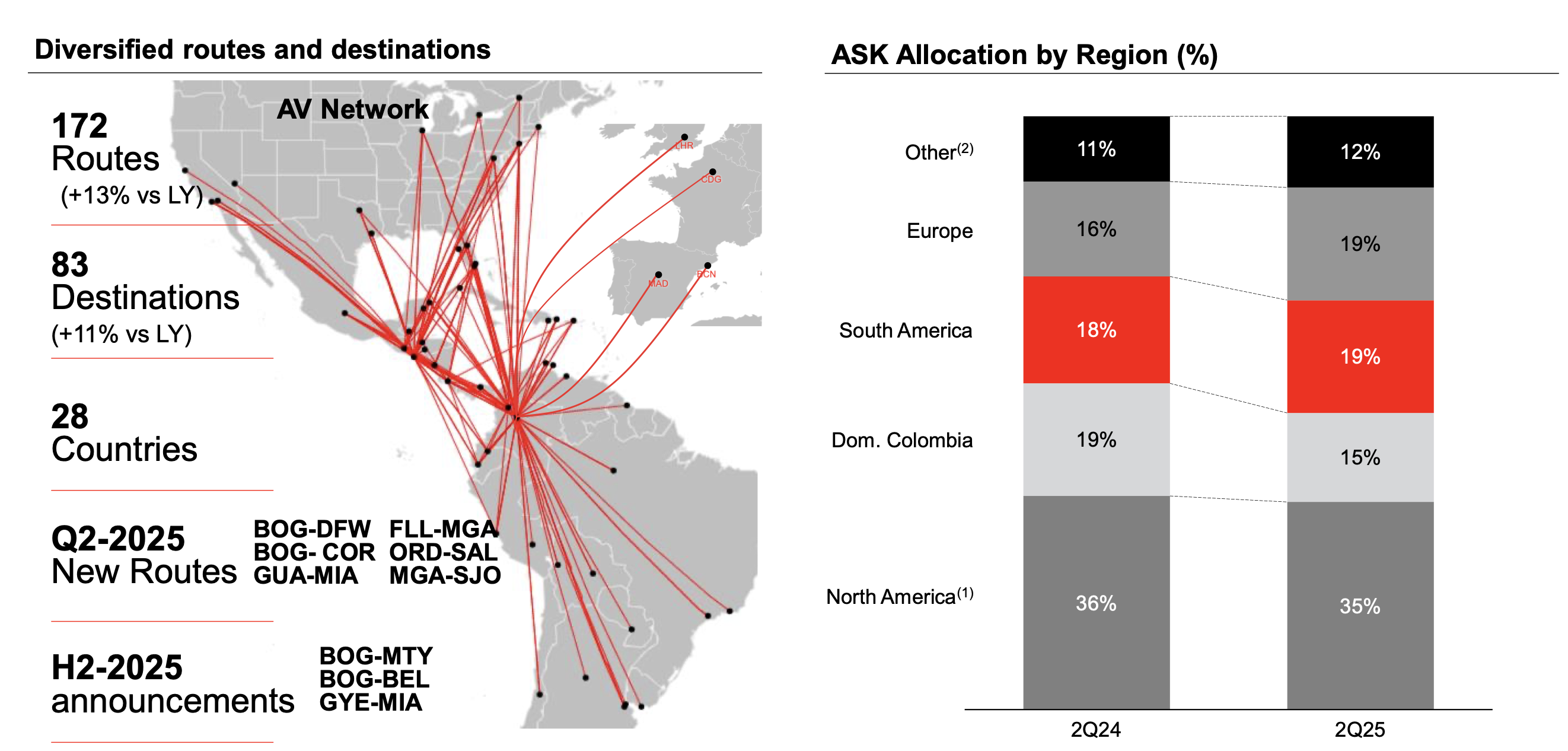

Avianca upped its available seat kilometre (ASK) allotment on routes within South America from 18% in 2Q2024 to 19% in 2Q2025.

Avianca: system capacity deployment change from 2Q2024 to 2Q2025

Source: Avianca Group.

Approximately a year ago Avianca began pulling capacity out of Colombia's domestic market and redeployed the supply to international markets. Its ASKs allotted to Colombia fell from 19% to 15% year-over-year in 2Q2025, whereas Europe's share increased from 16% to 19%.

Even with the pull-down in Colombia, Avianca continues to make strategic moves in its largest market by expanding its presence in Medellín.

Offering insight into Avianca's strategy in Colombia, Adrian Neuhauser, the CEO of the airline's parent company Abra Group, explained during a recent earnings discussion that "we have lost no slots in Bogotá. We've increased our presence in Medellín".

Mr Neuhauser says that Medellín "is behaving like a slot controlled airport now ... so we're staking out kind of our strategic position there".

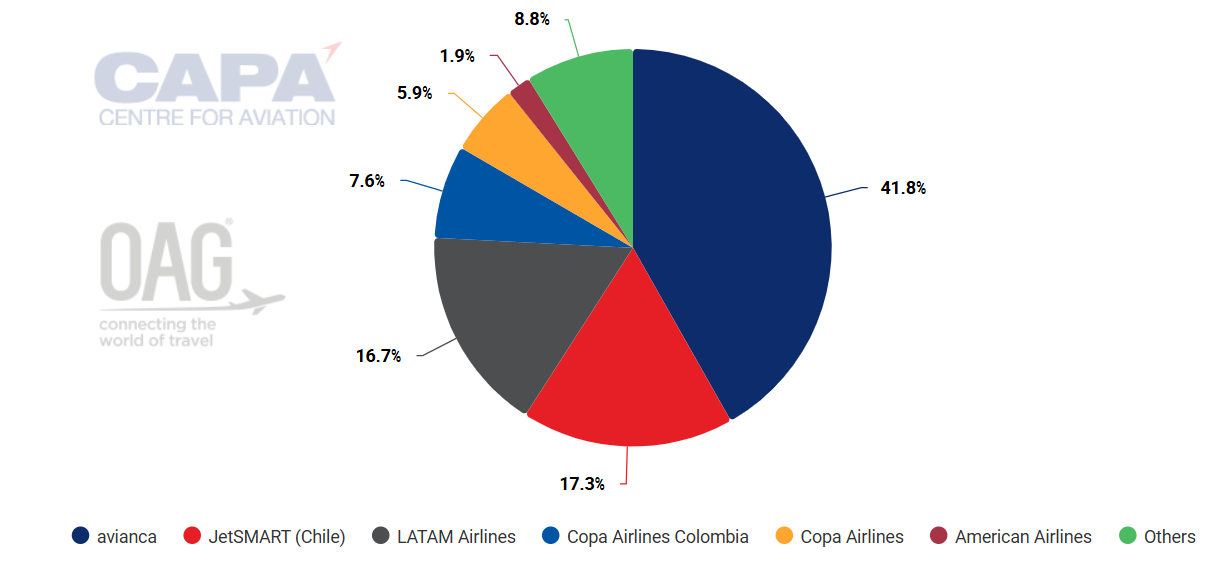

According to CAPA - Centre for Aviation and OAG data, Avianca represents 41.8% of Medellín's departing frequencies, followed by JetSmart at 17.3%, and LATAM Airlines Colombia with a 16.7% share.

Medellín Jose Maria Cordova Airport: percentage of system weekly departing frequencies by airline, week commencing 11-Aug-2025

Source: CAPA - Centre for Aviation and OAG.

The capacity redeployment by Avianca on longer-haul routes resulted in its average stage length growing 11% year-over-year in the second quarter, with ASKs growing nearly 14%.

Avianca narrowed its losses for the seasonally weaker 2Q from USD65 million in 2024 to USD16 million in 2025. The company's EBITDAR (Earnings Before Interest, Taxes, Depreciation, Amortization, and Rent [or Restructuring costs]) of USD355 million and EBITDAR margins of 25.5% were the highest Avianca had ever achieved during the second quarter.

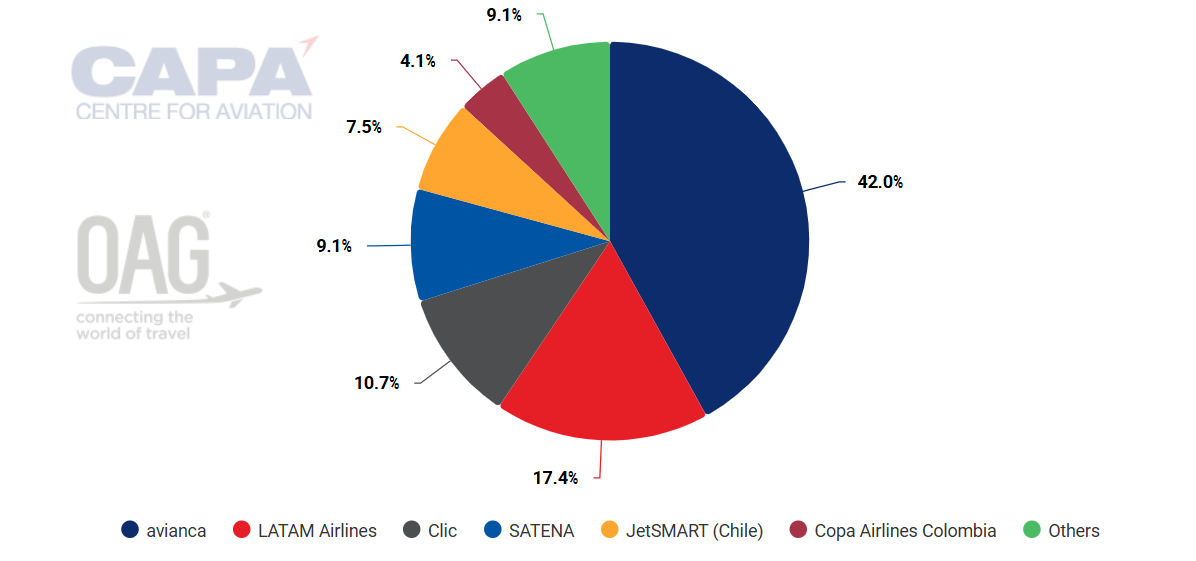

And even with a pull-down in domestic Colombia, Avianca still remains the dominant player, with an approximately 42% share of departing frequencies.

Colombia: percentage of system departing frequencies by airline, week commencing 11-Aug-2025

Source: CAPA-Centre for Aviation and OAG.

Describing Avianca's network optimisation efforts, Mr Neuhauser said that it was a critical move in "getting capacity into the right places, but also getting it out of the wrong places".

Latin American operators show confidence as uncertainty continues to loom large

This year 2025 has been eventful for airlines worldwide, and Latin America is no exception.

But the region's larger airlines continue to focus on executing their business plans while posting respectable financial results.

Not all operators around the globe find themselves in similar positions.