Megahubs 2025 – Asia Pacific is the region to watch for growing connectivity

The latest iteration of OAG's Global Megahubs report points to the Asia Pacific region being the one still to watch in respect of connectivity. It dominates the two main 2025 tables (global all business models and LCC only) that are published and critiqued here; Kuala Lumpur's main airport remains the one with the greatest connectivity in the region, the #1 anywhere for low-cost travel, and joint fourth in the global table, the highest ranking one from its region.

Asia Pacific doesn't have it all its own way though.

London Heathrow continues to fly the flag for the old world order as #1 for connectivity globally, and if its third runway ever sees the light of day it may never lose that title. Heathrow's strength is not so much in the number of destinations on offer as the frequencies on those routes.

Istanbul scores highly on routes - the highest number anywhere.

Other European airports do not fare so well though, with airports such as Frankfurt and Amsterdam further down the table on account of a greater influence on them by flight restrictions - especially over Russia.

While only one of the Middle East 'Big 3' airports makes much impact in these tables, Dubai is more notable for its position in the LCC table (5th) than it is for the 'global all business' models table (13th)!

Meanwhile, two Latin American airports fly the flag for a region that is otherwise devoid of representation.

Summary

- OAG 2025 Megahub report identifies the world’s most connected airports.

- There has been a little more movement than one might expect since 2024.

- Heathrow retains its 'Top Megahub' title as the classic old school representative.

- Istanbul offers the greatest number of destinations.

- Kuala Lumpur falls a little down the list, but remains the highest-ranking Asian airport in the Top 10.

- Chicago O’Hare heads the US contingent.

- Munich climbs, but Manila falls.

- The Middle East’s ‘Big 3’ are not very evident.

- Bogotá and Panama airports fly the flag for Latin America.

- Surprise package – Kuala Lumpur tops the 2025 LCC Airport Megahubs table; Asia Pacific dominates it and remains the region to watch.

- Strong LCC presence influences the table position of Dubai and Riyadh airports.

- Dublin – more questions than answers.

- Heathrow is not typical of Europe – other main hubs there have been influenced more greatly by loss of airspace routes.

OAG 2025 Megahub report identifies the world's most connected airports

The global air transport data platform OAG has released it 2025 'Megahubs' report, ranking the most internationally connected airports and other such data.

The survey is a comprehensive collection of data on:

- The Top 50 Most Connected Airports;

- The Top 25 Most Connected Low-Cost Carrier (LCC) Airports;

- The Top 25 Most Connected US Domestic Airports;

- The Top 10 Most Connected Airports by region: EMEA, North America, Latin America, Asia Pacific, Europe, the Middle East, and Africa.

For the purposes of this report, only the top two categories are considered here.

The methodology for the calculations may be found at the end of the report.

A little more movement than one might expect

In the Top 50 'Most Connected Airports' (globally) list there is no great change at the top as might be expected.

Airports do not acquire this status rapidly, nor do they relinquish it easily.

But there is a little more movement than one might ordinarily expect as the various world regions get to grips with both their own regional issues and wider global ones, which can impact in different ways on the complex calculations employed to compile the lists.

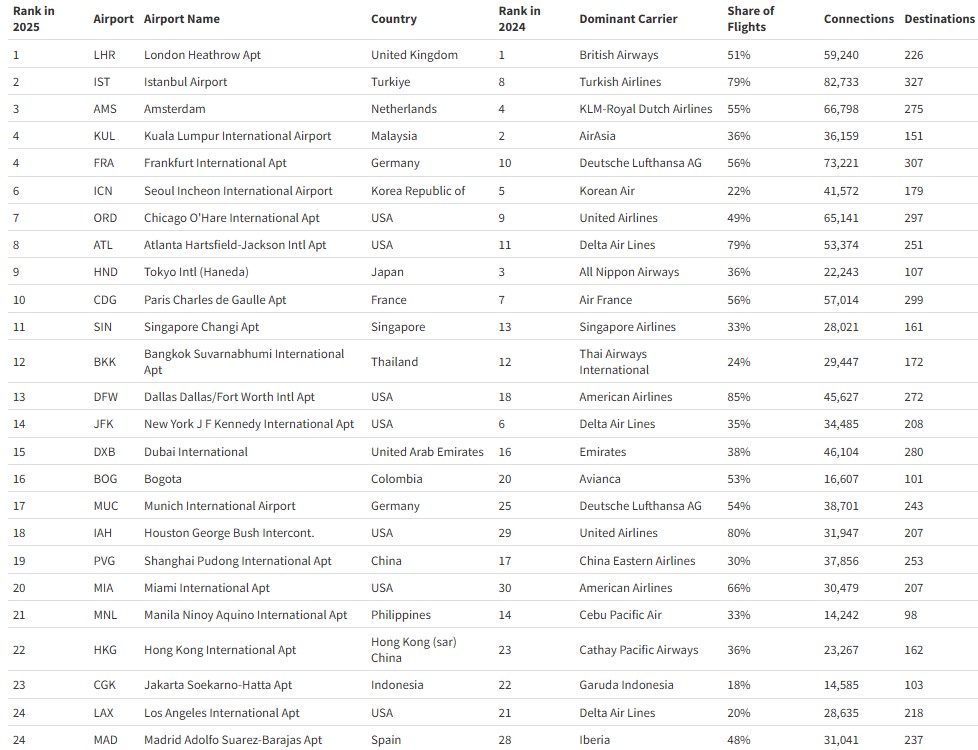

Top 25 Most Connected Airports globally

Source: OAG.

Heathrow retains its 'Top Megahub' title as the classic old school representative

London Heathrow Airport (LHR) is the world's top Megahub - indeed, for the third consecutive year.

The number of international destinations served at Heathrow grew 24% over the past decade. Despite the long established drift in scheduled services and connections away from Europe and towards the Middle East, the 'old school' London Airport retains this title owing to a mélange of factors such as the international diversity of its population, status as a global financial centre, and lingering tourist appeal; as well as its physical position and historical role between North America and the Middle East, and with respect to north/south European connections.

While the number of destinations and connections at Heathrow is lower in almost every case compared to its European rivals - Amsterdam, Frankfurt and Paris Charles de Gaulle - Heathrow scores highly on frequencies, especially trans Atlantic and to/from the Middle East, which boosts its connectivity credentials.

Istanbul offers the greatest number of destinations

Istanbul Airport (IST) consistently vies with Heathrow across several metrics, and rose by six places in 2025 compared to the previous year to the number 2 position for connectivity, and did so despite the consistently strong opposition from Istanbul Sabiha Gökçen International Airport (SAW), which is at position number 28 in the table.

The number of potential connections on the busiest day of 2025 was 25% greater than in 2024.

Istanbul offers more destinations than any other Megahub - 327 in total - and the vast majority of them on Turkish Airlines, which has 79% of flights (movements) and 81% of capacity. (The second airline by capacity is Aeroflot, with 1.1%.)

Only Frankfurt (FRA) is in the same league as Istanbul in offering over 300 destinations in their network. Frankfurt has seen a significant shift in rankings, climbing from 10th position last year to joint 4th, driven by a 21% increase in potential connections year-on-year.

Amsterdam Schiphol (AMS) climbed to 3rd place, up from number 4 in 2024 - possibly a surprising result, given the movements restrictions there. The annual flight cap has been reduced from 500,000 to 478,000 movements since the end of 2024, representing a reduction of 22,000 flights per year.

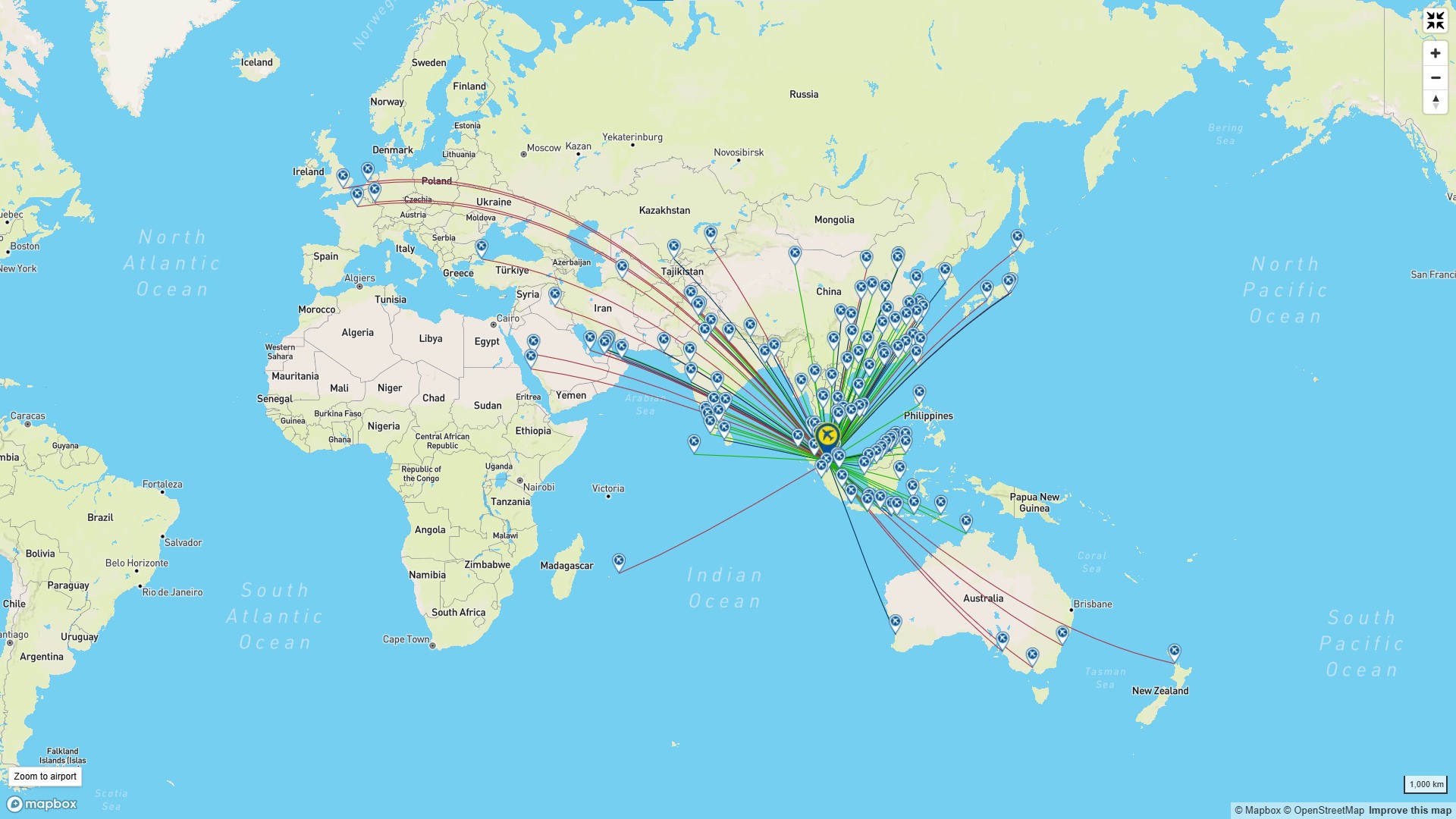

Kuala Lumpur falls a little down the list, but remains the highest-ranking Asian airport in the Top 10

Kuala Lumpur International Airport (KLIA) is the highest-ranking Asian airport in the Top 10, in joint 4th place with Frankfurt. That is actually a fall of two - it was in 2nd spot in 2024 - being an airport that punches well above its weight in this respect.

KLIA was only the 11th busiest airport in the Asia Pacific region in 2024, but it has a highly focused route network in southeast and northeast Asia and South Asia, which does wonders for its connectivity.

Kuala Lumpur International Airport: network map for the week commencing 29-Sep-2025

Source: CAPA - Centre for Aviation and OAG.

KLIA, Seoul Incheon International Airport (ICN), Tokyo Haneda Airport (HND), Singapore Changi Airport (SIN) and Bangkok Suvarnabhumi International Airport (BKK) are the most internationally connected airports in Asia Pacific.

Tokyo Haneda dropped down in this year's rankings, from 3rd in 2024 to 9th in 2025, reflecting a 10% decline in connections.

There is no obvious reason for this other than possibly that the focus on low-cost operations at Tokyo Narita, where a new airport is being built around the old one, is paying dividends for Narita at the expense of Haneda. But then, Narita does not even figure in the Top 50 by this measure.

Chicago O'Hare heads the US contingent

Turning to the United States, both Chicago O'Hare (ORD) and Atlanta (ATL) have moved up the table since 2024, by two and three places respectively, to number 7 and number 8.

They are the highest ranked US airports for connectivity, but there are five others in the Top 25 - Dallas/Fort Worth (DFW); New York (JFK); Houston George Bush (IAH); Miami (MIA) and Los Angeles International (LAX).

Chicago O'Hare was historically the main international hub in the US, just as it was at the nucleus of the railroad lines; despite the presence of Atlanta, which is principally a domestic hub and has recouped an appropriate league position, due to a 17% growth in connections and an expanded network of 15 additional destinations.

Atlanta is the world's biggest airport by seat capacity and by passenger numbers, and it re-enters the Connectivity Top 10 this year - rising from 11th place in 2024 to 8th position in 2025 - it added eight more destinations, and has achieved a corresponding 14% increase in potential connections.

New York JFK dropped from sixth place to 14th, though. That might reflect marginally higher growth at the modernised LaGuardia Airport (LGA) instead; also movements were in decline in 2024 and into 2025.

Munich climbs but Manila falls

One very large gain was made by Munich Airport (MUC) (+8 places to number 17).

This could be connected to Lufthansa's growing reliance on Munich as an alternative hub to Frankfurt, including in the long haul segment. Munich has almost the same Lufthansa seat capacity now as does Frankfurt (49% vs. 52%), which is a slight increase in its favour compared to the same week in 2019.

Meanwhile one of the largest falls was recorded by Manila's Ninoy Aquino International Airport, down from 14th to 21st place as it shapes up ultimately to facing competition from three other airports in the not-too-distant future, and in the wake of its privatisation from the government in Sep-2024 to the New NAIA Infra Corp.

Middle East's 'Big 3' not very evident

Interestingly, only one of the 'Big 3' Middle East airports makes it into the Top 25 by this measure - namely Dubai International (DXB) (number 15, down one place from 2024), where a very broad network from the home based airline, Emirates, is negated by a comparative lack of frequency.

Doha Hamad (DOH) comes in at number 34, but Abu Dhabi (AUH) does not feature in the Top 50 at all.

Riyadh's King Khalid Airport (RUH), though, rose by 11 places in the rankings compared to 2024, and overtook Doha at number 31. Its expansion into the 'new' King Salman International will be completed by 2030, by which time it will almost certainly feature in the Top 25 rankings.

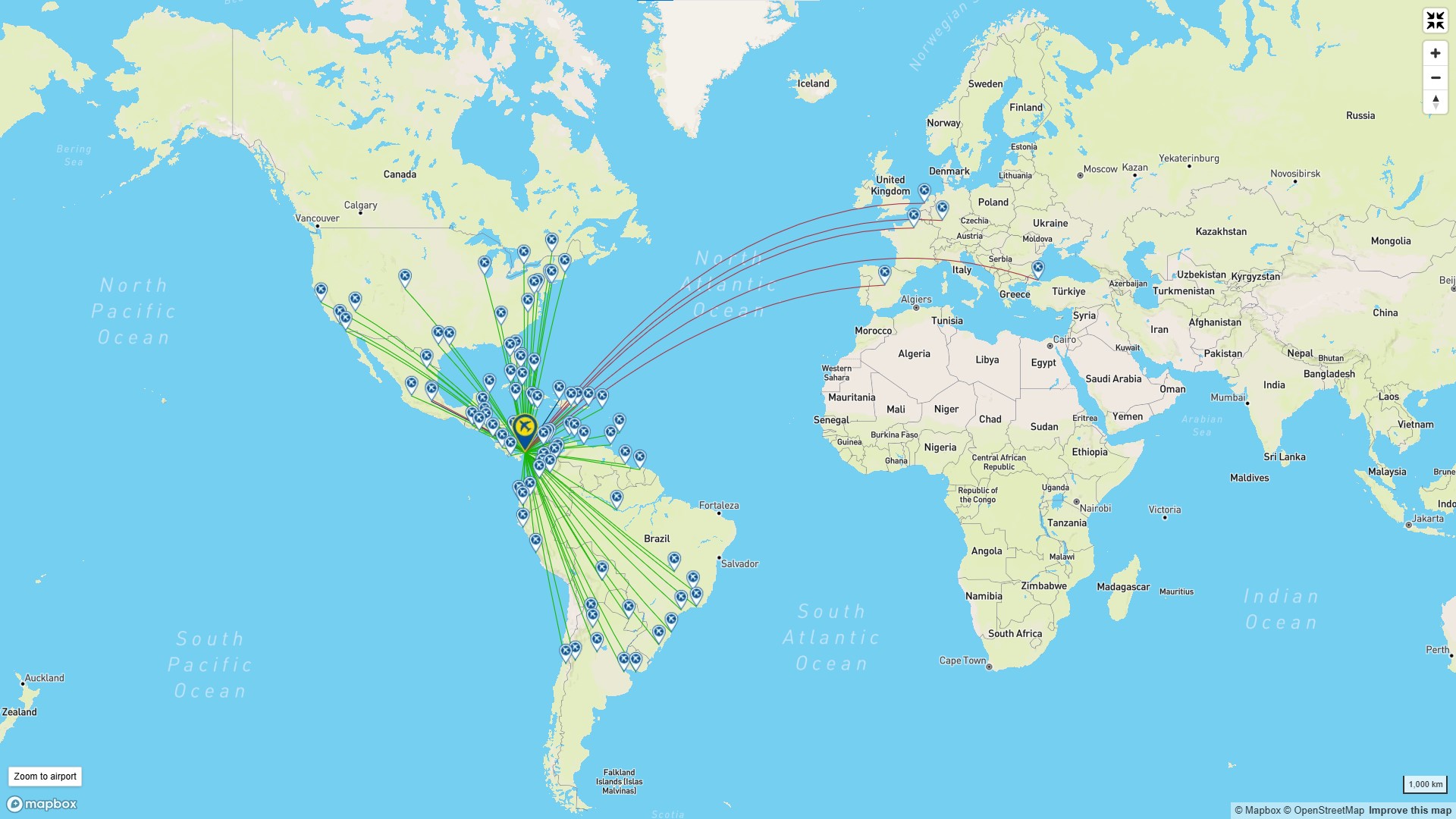

Bogotá and Panama airports fly the flag for Latin America

Finally, credit must be given to Bogotá's El Dorado Airport (BOG), which is the only Latin American airport in the Top 25 (at number 16, up four places) and one of only four in the Top 50. The others being Mexico City Juarez (MEX), Panama City Tocumen (PTY), and São Paulo Guarulhos (GRU).

This degree of connectivity in a very diverse continent economically and politically speaks volumes about these airports, and how quickly two of them in particular have come on. Bogotá El Dorado Airport was actually the busiest in the whole of Latin America in 2024, and in 8M2025 (Jan-Aug) is still hanging on to second position behind Guarulhos.

Meanwhile, Panama's Tocumen Airport - home to Copa Airlines and its highly focused hub and spoke operation - is one of the smaller airports in the Top 25/50, and has built its impressive connectivity around that hub operation almost entirely.

As Pedro Heilbron, the Copa CEO, is keen to relate, when he first took on the job 37 years ago the airline had a tiny point-to-point operation with just two aircraft, compared to the 109 now, with 34 on order.

Panama City Tocumen International Airport: network map for the week commencing 29-Sep-2025

Source: CAPA - Centre for Aviation and OAG.

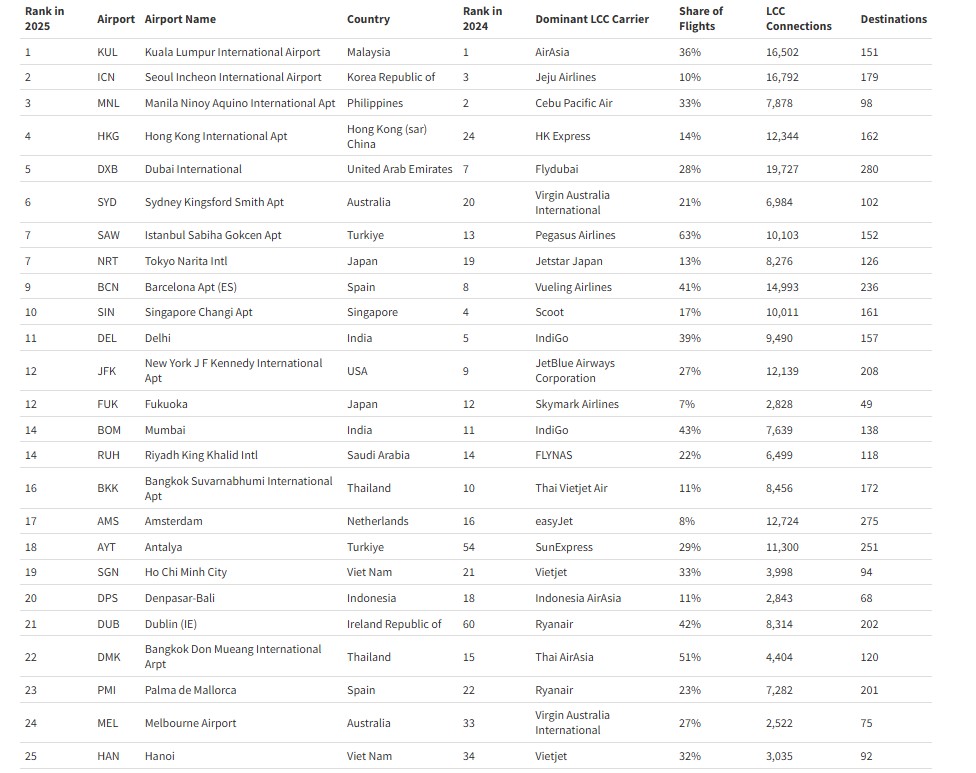

Surprise package - Kuala Lumpur tops the 2025 LCC Airport Megahubs table; Asia Pacific dominates it

Turning now to the Low Cost Carrier (LCC) list, Kuala Lumpur again figures prominently, and actually tops the 2025 list, mostly as a result of AirAsia's operations there at what its CEO once described as a 'Taj Mahal'.

Top 25 Low-Cost Carrier Airport Megahubs

Source: OAG.

Asia dominates low-cost connectivity generally.

Although Kuala Lumpur is the top airport for low-cost connections, Hong Kong International Airport (HKG) made one of the biggest jumps in the LCC list, moving up 20 places to fourth - driven by the activities of HK Express, which is the second largest airline there (with 14% of seat capacity) - while Seoul Incheon and Manila Ninoy Aquino also both figure in the Top 5.

Strong LCC presence influences the table position of Dubai and Riyadh airports

There are two Middle East airports in the list, both of them perhaps surprising inclusions.

Few people would associate Dubai International and Riyadh King Khalid airports with low cost activities.

But Dubai comes in at number 5 in the list, prompted in the main by the activities of Flydubai, which has 18% of seats and 28% of movements, making it the second largest airline there and contributing to the airport's vast total of 280 destinations.

A similar situation applies at Riyadh, where the LCCs flynas and flyadeal collectively have 37% of the capacity.

Other interesting listings include that of Tokyo Narita (number 7, up 12 places), especially when measured against Haneda Airport's fall down the main ranking and Bangkok Don Mueang's (DMK) fall, which does not appear to be related to any LCC activity at the Suvarnabhumi Airport, where it has remained constant over the last 12 months.

Dublin - more questions than answers

The most puzzling statistic is that of Dublin Airport, which jumped from number 60 to number 29 in a single year.

Because the calculations are based on a single day's activities (see below - Methodology) they might be skewed by events on that day, either positively (a major political or entertainment event for example), or negatively (continuing transport strike action, ATC issues etc.). That is perhaps a potential weakness of the survey, but it is highly unlikely that a truly significant event that had such a major impact on schedules and connectivity would take place on one day only.

There is no evidence of any of those, apart from a Dublin bus strike that would not have impacted on connectivity in the air, and definitely not positively.

The largest airline at Dublin (44.5% of capacity) is Ryanair, a point-to-point LCC, but it has not noticeably increased its capacity there over the year. Nor has it suddenly begun interlining with other airlines.

The connectivity increase therefore presumably came from other airlines increasing frequencies and/or launching new routes.

Even then, that does explain such a huge ranking jump this year. The second runway has been open for three years, so did not directly play a part on the 2025 table.

Asia Pacific remains the region to watch

So, in summary, Kuala Lumpur leads the pack overall as Asia Pacific's most connected airport in the OAG Megahubs rankings, lying joint fourth in the main table, first in the LCC table and topping a separate Asia Pacific table (not shown).

Already, in 2025, the Kuala Lumpur-Singapore Changi route was identified as the busiest international route by seat capacity. These developments reflect significant connectivity and capacity growth in the Asia Pacific region, particularly in Kuala Lumpur.

Comparing today's leaders with 2015, when 'Megahubs' was first published, Kuala Lumpur has risen from fifth to fourth, with a 22% increase in destinations served.

The growing strength of Asia Pacific's aviation sector is highlighted by it having three airports in the global Top 10.

Seoul Incheon stands out as one of the biggest movers of the decade overall, climbing from 10th to sixth place in the global league and recording a 58% increase in potential connections on the busiest day of the year.

Asia Pacific dominates in low-cost aviation as well, as home to 16 of the world's Top 25 LCC Megahubs, and can reasonably claim to balance world ranking full-service hubs with dynamic low-cost connectivity.

Southeast Asia, in particular, continues to lead LCC connectivity, with three of the world's top five LCC hubs located in the region. LCCs account for 61% of all available seats there.

Heathrow is not typical of Europe - other main hubs have been influenced more greatly by loss of airspace routes

Then again, one cannot overlook the claims of long-established global hubs like London Heathrow, which doesn't appear in the LCC table. It never has done, and probably never will do, but it dominates the global mixed business model one.

(So Heathrow tops one list, but is nowhere on the other. LCC capacity is negligible, and that has always been the case; only the third runway will change that - if it is ever built).

Heathrow offers 61,356 possible connections across 227 destinations, with the flag carrier British Airways operating half of all flights at the airport.

In contrast, some major European hubs, including Amsterdam Schiphol and Frankfurt, slipped in the rankings, mainly due to reduced frequencies on Asia routes, which was driven in part by restrictions on overflying Russian airspace.

While it offers up some anomalies that are hard to understand without serious digging, the 2025 rankings help to underscore the balance between established gateways and ambitious challengers worldwide.

METHODOLOGY

Briefly, OAG Megahubs is based on flight data from the 100 largest and 100 largest international airports, measured by total scheduled seats for the year.

Rankings use data from the busiest day in global aviation between Sep-2024 and Aug-2025, which was Friday, 01-Aug-2025.

In more detail:

Using OAG flight data from the 100 largest airports and the 100 largest international airports in the world, based on total scheduled seats for an entire year (01-Sep-2024 to 31-Aug- 2025), data is extracted from the busiest day for global aviation in the past year (Sep-2024 to Aug-2025), which was Friday 01-Aug-2025.

The total number of all possible connections is calculated between inbound and outbound flights within a six-hour window, considering those where either the inbound, outbound, or both flights are international.

In addition, the following criteria were chosen for all operating flights:

Single connections *1 only to/from the chosen airports

Maximum circuity *2 of 150

Minimum Connection Time (MCT) varies by individual airport. OAG holds the MCT information for every commercial airport in operation

Maximum connection window of six hours

The Top 25 Most Connected Low-Cost Carrier (LCC) Airports (International) uses the same methodology but the restriction rule is limited to low-cost flights only.

*1 A single connecting routing could include a domestic to international connection, an international to domestic connection, or an international to international connection.

*2 In aviation, circuity refers to the extra distance or detour an aircraft must fly compared to the most direct route. For example, a maximum circuity of 150 typically means that the actual route is allowed to be up to 150% of the great-circle distance. It is similar to the additional mileage calculation in multi-sector air fares.