Southeast Asia airlines: part one – demand outlook spurs massive order backlog

If the Asia Pacific region is the growth engine for the global airline industry, then Southeast Asia could be considered the engine within the engine.

Southeast Asian airlines have racked up massive aircraft order backlogs to cater to rapidly rising demand in the dozen countries that comprise this subregion.

Of course, airlines here are not immune to industry headaches such as supply chain bottlenecks and delivery delays. These factors have disrupted fleet planning in Southeast Asia.

However, there are signs that deliveries and fleet renewal are slowly regaining some momentum.

LCCs are a major force in Southeast Asia, and they account for the bulk of the aircraft orders there. But full-service carriers have also placed significant orders with more in the pipeline.

Infrastructure expansion will be needed to accommodate the longer-term fleet expansion projections, and several important airport projects are underway to address that issue.

With the Singapore Airshow approaching in early Feb-2026, now is a good time to take a closer look at fleet developments in this region.

Part one of this snapshot looks at some of the fleet trends and market dynamics in the subregion, while part two will drill down to specific airlines and airport projects.

Summary

- Southeast Asia is a key driver of global airline industry growth, with airlines in the region holding significant aircraft order backlogs to meet rising demand.

- Supply chain bottlenecks and delivery delays have disrupted fleet planning, but aircraft deliveries and fleet renewal are gradually regaining momentum.

- Low-cost carriers dominate the region and account for the majority of aircraft orders, though full-service airlines are also expanding their fleets.

- The region’s airlines are scheduled to take delivery of 121 jet aircraft in 2026, with annual deliveries projected to rise to 189 in 2027, despite ongoing delivery uncertainties.

- Boeing forecasts that Southeast Asia will require about 4,900 new jet aircraft by 2044, driven by strong GDP growth, a rapidly expanding middle class, and increasing tourism.

- Infrastructure expansion, including major airport projects, will be essential to accommodate the projected fleet growth and rising passenger demand in Southeast Asia.

Airbus and Boeing deliveries are starting to increase again for Southeast Asian airlines

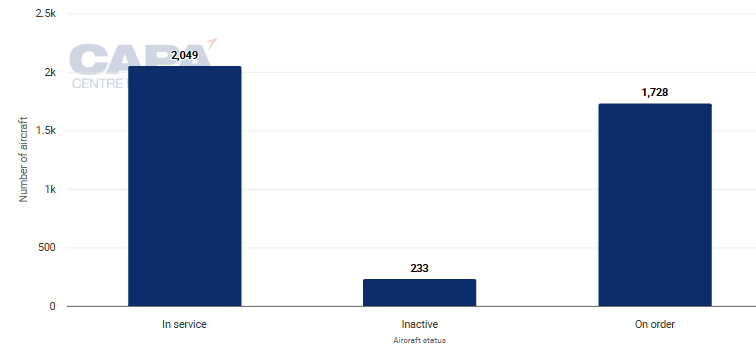

The CAPA - Centre for Aviation Fleet Database shows there are 1,728 aircraft on order in Southeast Asia, versus an active fleet of 2,049.

Southeast Asia fleet status as of 19-Jan-2026

Source: CAPA - Centre for Aviation Fleet Database.

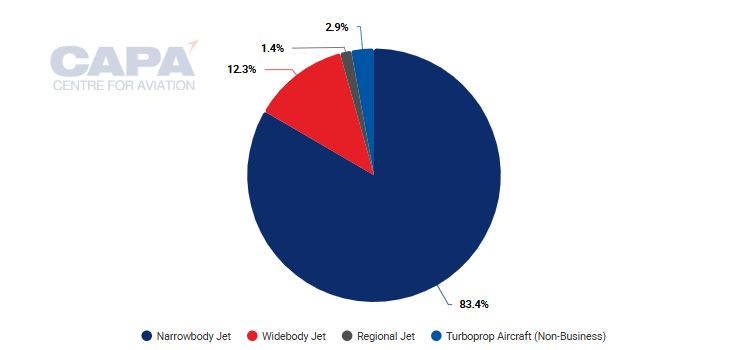

As a subset of the total, there are 1,678 commercial jet aircraft on order by Southeast Asian airlines (including narrowbodies, widebodies and regional jets), versus an operational fleet of 1,579.

By far the majority of orders - over 83% of total orders - are narrowbodies, reflecting the preponderance of low-cost carriers in this part of the world.

Southeast Asia orders by aircraft type, as of 19-Jan-2026

Source: CAPA - Centre for Aviation Fleet Database.

Many carriers in the subregion saw deliveries beginning to pick up in 2025, including the introduction of new fleet types in some cases. Delivery numbers are likely to increase again in 2026.

Airbus delivered 42 aircraft to Southeast Asian carriers in 2025, according to the manufacturer's orders and deliveries reports. These included new deliveries via lessors.

Boeing reported 15 deliveries to airlines in this subregion, not counting those to lessors.

The combined total is higher than the 38 aircraft delivered in 2024 by the two major manufacturers.

Southeast Asian airlines are scheduled to take delivery of 121 jet aircraft in 2026, according to CAPA - Centre for Aviation projections.

The annual total is due to rise again to 189 in 2027. However, it should be noted that delivery delays mean that such schedules have not proven very reliable lately.

Boeing predicts that expanding middle class and GDP growth will drive dramatic fleet growth

Over the longer term, Boeing projects that Southeast Asia will require about 4,900 jet aircraft deliveries during the 20 years through 2044, said David Schulte, Boeing commercial marketing managing director for Asia Pacific, at the Association of Asia Pacific Airlines annual meeting in Bangkok in Nov-2025.

Of the total, 1,200 will be for replacement and 3,700 for fleet growth.

This dramatic fleet expansion will be driven by surging demand. Boeing estimates that Southeast Asia's passenger demand - as measured in revenue passenger kilometres - will increase by an average of 7% per year over the forecast period.

That is the equal-fastest growth rate for any subregion in the Boeing forecast, alongside South Asia.

Rising demand is spurred by expected GDP growth of 5% per year in Southeast Asia, in conjunction with higher tourism and a rapidly expanding middle class.

The number of people classified as middle class in Southeast Asia has more than doubled over the past 25 years, Mr Schulte said. It is forecast to double again by 2044.

"This is important, because it [increases] the propensity to travel for many households, which is one of the major drivers for continued growth [in this market]", he said.

Over the past 25 years there has been a 200% increase in both monthly flights and connected city pairs in Southeast Asia, Mr Schulte said.

Tourism is vital to airlines and economies in many Southeast Asian countries. Data from national tourism authorities shows that monthly visitors are at or above 2019 levels for countries such as Malaysia, Vietnam and Indonesia.

Tourism to Thailand has dropped this year, but is expected to bounce back.

Boeing projects that 80% of deliveries to Southeast Asia through 2044 will be narrowbodies.

However, the size of those narrowbodies is increasing. The average capacity of narrowbodies in this subregion has been rising by about one seat per year as more airlines upgauge to larger models, Mr Schulte said.