Go First dispute spurs improvements in India’s lessor protections

While the Indian government’s move to solidify lessors’ rights could cause headaches for the bankrupt airline Go First, in the longer term it should help second-tier Indian airlines secure aircraft lease deals. The ruling by India’s Ministry of Corporate Affairs (MCA) reinforces the ability of lessors to reclaim their aircraft when an airline declares insolvency. This step was spurred by a court’s decision to place a moratorium on the repossession of Go First’s leased aircraft during its bankruptcy restructuring. Go First’s lessors have been challenging the earlier court decision, and the latest MCA edict will give them new leverage. Meanwhile, some other Indian airlines have applauded the MCA’s clarification, as it will give lessors greater confidence in sending aircraft to India.

Summary:

- Indian Ministry’s notification means that insolvency protections will not supersede Cape Town Convention.

- Aviation Working Group upgrades India’s outlook and compliance scores after MCA ruling.

- SpiceJet says MCA move will enhance the health of the Indian aviation sector and promote growth.

- Go First is seeking new investors in order to relaunch with a smaller aircraft fleet.

Lessor concerns over treatment of aircraft in bankruptcy would have affected Indian lease negotiations

The dispute over Go First’s aircraft began when the airline filed for court-led insolvency in May-2023.

India’s National Company Law Tribunal (NCLT) subsequently approved Go First’s request for the moratorium on repossession of the airline’s leased fleet.

Lessors argued that such a step contravened the Cape Town Convention which, among other things, protects the rights of lessors to reclaim aircraft from bankrupt companies. The NCLT has so far rejected the lessors’ appeals, although they did gain the right to inspect their aircraft.

One consequence of the moratorium was that the Aviation Working Group (AWG) – which represents lessors’ interests – issued a negative watchlist notice for India. The AWG also downgraded India’s score on its Cape Town Convention compliance index.

The warning note and downgrade would have likely made lessors more wary of placing aircraft in the Indian market, making any such deals more expensive for airlines.

This development was a concern for Indian airlines, as the country’s low cost carriers, in particular, are heavily reliant on leased aircraft to fuel their growth.

Industry group and other Indian airlines have applauded government’s clarification of Cape Town Convention primacy

It was against this backdrop that the MCA published its notification on 3-Oct-2023.

The ministry stated that when protections under the insolvency and bankruptcy code are exercised for an airline, they will not apply to “transactions, arrangements or agreements … relating to aircraft, aircraft engines, airframes and helicopters.”

The AWG welcomed the MCA ruling. The ministry’s notification would potentially address “a significant gap” in how aircraft repossession can be handled “in a manner compliant with India’s obligations under the [Cape Town Convention]”, the AWG said.

Due to the notification, the AWG issued India a positive outlook and indicated that it would upgrade the country’s compliance score. However, the group noted that legislation is still needed to ensure the primacy of the Cape Town Convention over all potentially conflicting national laws.

Some airlines also praised the MCA announcement.

“This is a much-needed and positive development that will significantly boost lessor confidence in the Indian aviation sector,” said a spokesman for Indian airline SpiceJet. “It not only reinforces the stability and credibility of the industry, but also reaffirms India's commitment to fostering a conducive environment for aviation stakeholders.”

“This move will undoubtedly enhance the overall health of the Indian aviation sector and contribute to its sustained growth”, the spokesman added.

However, a court ruling may still be required to determine whether the MCA notice applies to the Go First moratorium that had already been granted.

Go First will likely have a much smaller fleet if it manages to relaunch with a new investor

If the lessors prevail in reclaiming their aircraft, it would decimate the airline’s operational fleet. Go First has 54 Airbus narrowbody aircraft, of which 38 are leased, according to the CAPA - Centre for Aviation Fleet Database.

New investors are being sought for Go First through the court-led bankruptcy process. The airline has called for expressions of interest.

The Times of India reports that there have been responses from multiple companies, including a foreign airline. Reuters reports that the power generation company Jindal Power has submitted an expression of interest.

Go First has repeatedly said that it intends to resume operations after the bankruptcy process has been completed.

In Jul-2023 India’s Directorate General of Civil Aviation (DGCA) granted conditional approval for Go First to relaunch flights with a pared-down fleet and network. But the DGCA said this was subject to the outcome of the various legal challenges against the airline.

The DGCA also set other conditions for the airline, including submitting its proposed schedule to the agency for approval. The schedule must align with the available airworthy aircraft and workforce numbers, and the airline must have interim funding in place, the DGCA said.

Strong domestic competition and pilot shortages present major challenges for smaller Indian airlines

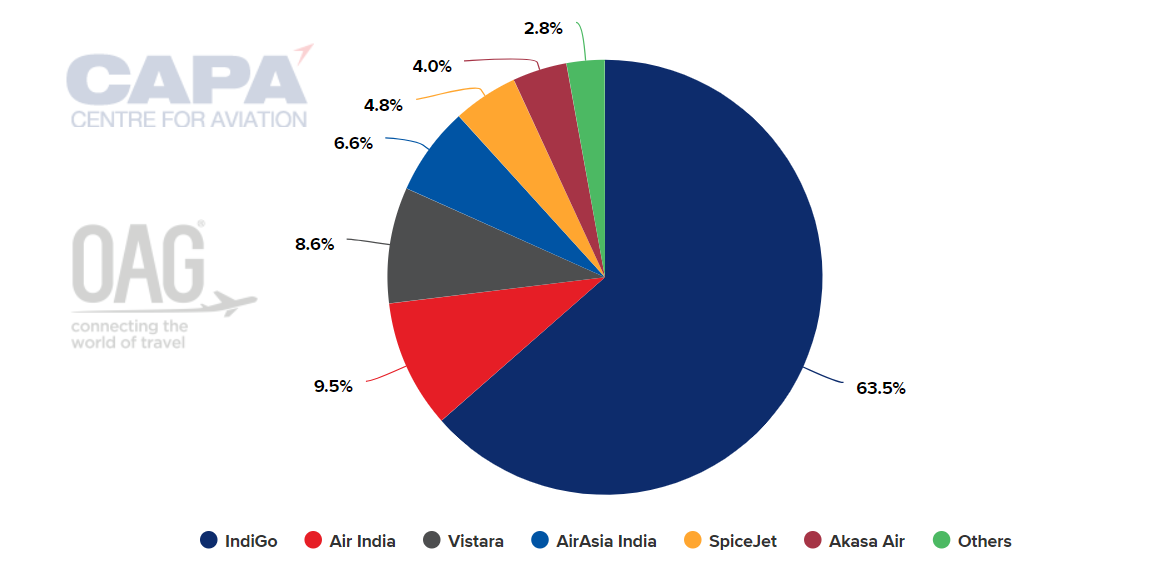

Even if it somehow manages to clear all of its hurdles and resume flights, Go First will face a difficult operating environment. Competition is fierce in the Indian domestic market, which is dominated by IndiGo. A revitalised and expanded Air India is also a growing force.

The chart below shows that IndiGo and the combined Tata Group airlines account for 88.2% of Indian domestic market capacity.

India’s domestic seats: by airline, for week of 9-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Another bankrupt Indian airline that is attempting to relaunch operations is Jet Airways.

New owners were selected by creditors in 2020, but disputes over payments to creditors have stalled its progress. The airline is now aiming to resume flights in 2024.

Securing and retaining pilots is one of the major problems facing Indian start-ups and airlines trying to relaunch. With demand high at the major airlines, the smaller airlines with less certain outlooks are having a hard time keeping enough pilots on their books and attracting new hires.

A significant proportion of Go First’s pilots are believed to have left the airline, and the newcomer Akasa Air had to cancel many flights between Jul-2023 and Sep-2023 due to a spike in pilot resignations. Akasa Air has taken legal action against some of these pilots, alleging they did not provide the correct notice period.

Reaffirming lessor rights under Cape Town Convention will help grow airlines – and competition – in the Indian market

Affirming the primacy of the Cape Town Convention was obviously the right step for India to take. The lessor community had been heavily critical of the NCLT after it allowed Go First to freeze aircraft repossessions.

It seemed inevitable that the NCLT’s application of insolvency laws in the case of Go First would not be viable in the long term. Industry pressure to uphold the Cape Town Convention would only have increased.

Another telling factor was that other Indian airlines that rely on leased aircraft were in favour of protecting lessor rights.

It will now be a matter for the courts to decide if the MCA notification should be applied to Go First.

Even absent of the recent MCA clarification, it is clear that the moratorium will expire at some point. So if Go First does manage to relaunch, it will have a much smaller fleet.

The airline’s tentative plans are for a restart with about 15 aircraft, so Go First obviously recognises this. If it is to start growing again and build up to an optimum fleet size, it will likely have to negotiate with lessors again.

Of course all of this is moot if Go First cannot attract sufficient new investment to relaunch. And even after that, Jet Airways is a prime example of the many challenges that confront an attempted airline resurrection.