Outlook 2024: Airports spotlight – 2023 turned out to be far better than 2022 but with caveats 1/3

The airports business is in a better position than it was this time in 2022, but ‘headwinds’ remain, and the Black Swans that habitually inflict misery on the entire industry have not hibernated yet. In this first of a three-part summary of 2023 and outlook for 2024 for the sector, CAPA - Centre for Aviation looks back at the conclusions it drew for the 2022 Outlook – how most of them proved to be accurate, and how traffic, capacity and demand is returning to, or is close to, 2019 levels at the end of 2023 in the passenger segment, and how it is improving again in the cargo segment, which is the one that effectively kept the business going during the worst of the COVID-19 pandemic. It backs up these conclusions with figures from ICAO and IATA, but also takes into account an independent private sector survey report which suggests that the level of confidence among airport management about finances and recovery potential is low. It ranges over the conflicts taking place across the world, and how they are affecting and might impact further on the air transport business generally, and on how the Nov-2024 US presidential election could influence airport development and financing there. It finishes with a brief consideration of the expansion of the BRICS bloc and the implications for the airport sector in those countries.

Summary

- The year 2023 turned out to be far better than 2022, but with caveats...

- The Black Swans continued to roost and proliferate.

- Traffic, capacity and demand are returning to, or close to, 2019 levels at the end of 2023...but strong headwinds remain.

- Airfreight is out of the doldrums.

- Independent report reveals deep-seated fears among airport management about finances and recovery potential.

- Conflicts could escalate, or new ones arise that threaten trade routes.

- Elections – and one in particular – will have a direct impact on airports in that country.

- The BRICS could apply their own rules, and that would include mutual airport support.

The year 2023 turned out to be far better than 2022, but with caveats...

Look back 12 months and the 2022 version of this report began with this overview:

- The years 2020 and 2021 were terrible years for the air transport sector.

- The year 2022 has been better, but no sooner did the COVID-19 pandemic start to wane (in most places, but not Asia Pacific) than the Ukraine war set off a series of events that helped plunge much of the western world into a dystopian nightmare of power shortages, high utility prices, inflation (the dreaded stagflation in some cases), and industrial unrest.

- Against that background the sector is expected to ‘recover’ in 2023, while remaining in the grip of global ‘influencers’, for whom every rotation off a runway is another nail in the planet’s coffin. It is going to be another very difficult year, and who knows what additional problems lie in wait around the corner?

- However, there are still some bright spots, nationally, regionally and globally.

- When peace finally comes, Ukraine, its airports and tourism infrastructure will present the world with its greatest rebuilding challenge for more than 70 years.

- While it is also possible that more airports could close, many have taken the opportunity to design or redesign new terminals in ways shaped by the COVID pandemic. For the first time they will actually be in a state of preparedness for a ‘Black Swan’ event.

The Black Swans continued to roost and proliferate

As it turns out, the world got over COVID-19, or at least the worst of it, although lingering concerns remain that it is still not even close to being eradicated (Spanish flu was, in four years) and that it remains a designated pandemic. Further, that even as this is written an outbreak of a new and as yet not publicly identified pneumonic disease is sweeping parts of China, seemingly resistant to existing treatments.

That is exactly how COVID-19 began, in Dec-2019.

Peace has not yet come to Ukraine, and the way the war is shaping up it could last another year. The situation is not helped by the intransigence of certain political leaders in Eastern Europe either.

Another ‘Black Swan’ did emerge from the murky waters (as they have a habit of doing) in the shape of the Israel-Hamas conflict in Gaza.

Quite how that conflict – which has already expanded to include Hezbollah in Lebanon, and other extremist groups, and is one that could even lurch into direct conflict with Iran – will ultimately take shape is uncertain. But the implications for air transport, which has already experienced a five percentage point knock-back to its recovery in Oct-Nov-2023, are potentially grave.

Traffic, capacity and demand returning to, or close to, 2019 levels at the end of 2023...

The 2022 review made clear that there were some bright spots in 2022, and there certainly were in 2023 too. The air transport business recovered to, and in some cases surpassed, the position it held in 2019 (the only exception for the first half of 2023 being Asia Pacific, but that region has now caught up a little more).

For example, the International Air Transport Association (IATA) reported at the beginning of Dec-2023 that in 3Q2023, the third quarter of the year (Jul-Sep), Global Revenue Passenger Kilometres (RPKs - the total of revenue paying passengers times the distance travelled in kilometres) had increased by 28.4% year-on-year, reaching 96.3% of the 3Q2019 level.

Domestic RPKs increased by 24.7% and exceeded the pre-pandemic level by 7.4%. Major domestic markets, including Brazil, China, India and the US, have exceeded their 2019 levels.

International traffic recovered to 90.3% of the 3Q2019 level, North American airlines reaching 102.6%.

Airlines in the Middle East and Latin America were close to full recovery. Global premium (‘Business’ and ‘First’ class) traffic recovered to 95.8% of the 3Q2019 level and economy class only reached 89.9%.

Available Seat Kilometres (ASKs) or Available Seat Miles (ASMs) – a measure of the airlines’ passenger carrying capacity – increased by 25.8% and reached 96.6% of the 3Q2019 level.

Load factor (the percentage of available seating capacity that has been filled with passengers, or ‘bums on seats’) increased by 1.7 percentage points (ppts). European airlines reported the highest load factor, at 87.2%, followed by North America at 85.8%. Asia Pacific airlines recorded the largest growth, increasing by 6.6ppts to 81.4%.

Those figures continued to improve further in Oct-2023, the most recent month for which they are available as this is written, with all regions reporting solid growth and the Middle East, North America and Latin America surpassing 2019 RPK levels by more than 6%.

The one area of concern remains Asia Pacific, which remains 19.5% below the 2019 level – probably on account still of the late lifting of COVID-19 restrictions in parts of the region, as well as contemporary commercial developments and political tensions.

...but strong headwinds remain

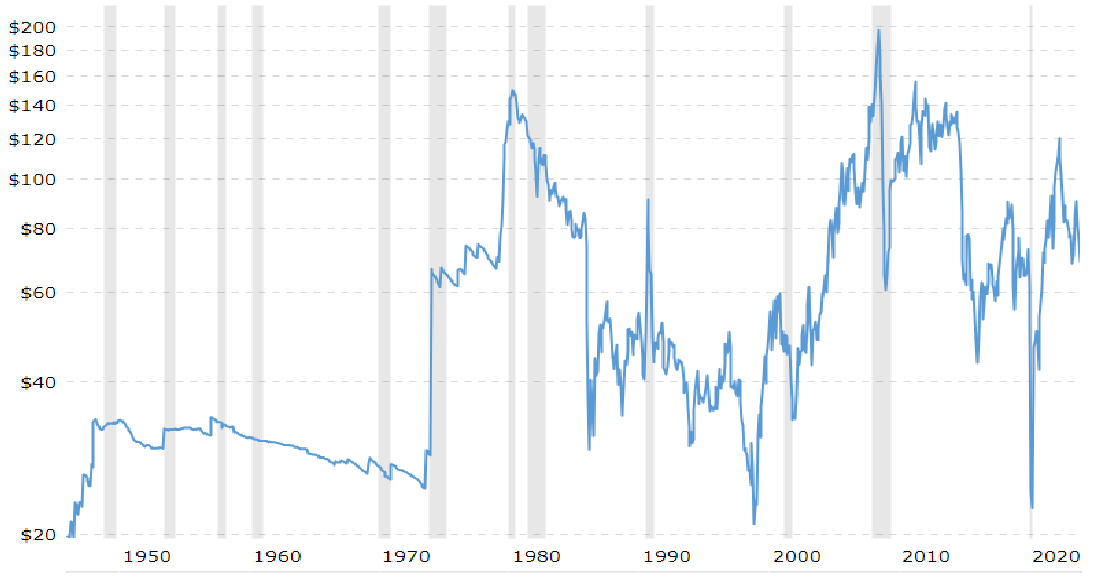

IATA did point out, though, that the recovery in global passenger traffic continued to face headwinds in 3Q2023 as jet fuel prices rose, exacerbating airlines' input and operational cost challenges. Those fuel prices could rise dramatically in the event that the current Middle East conflict spreads, with some analysts talking in terms of USD150 a barrel (a figure that has not been reached since Mar-2011; the highest ever price per barrel was almost USD200 in Jun-2008).

Crude Oil Prices in USD: 70-year historical chart from pre-1950

Source: Macrotrends.

The International Civil Aviation Organisation (ICAO) concurs with IATA’s findings.

ICAO stated that it expected global ASKs and RPKs to reach the pre-COVID-19 level in 4Q2023, and that the pace of growth would continue.

ICAO added that cargo Available Freight Tonne Kilometres (AFTKs) and Freight Tonne Kilometres (FTKs – the cargo version of ASKs) remained marginally higher than the pre-COVID-19 level, but the pace of growth was expected to decline in the remaining months of 2023.

Airfreight out of the doldrums

Looking more closely at airfreight: IATA, in its Quarterly Air Transport Chartbook for 3Q2023, reported that Global CTKs (the measure of tonnes of revenue load carried one kilometre including unaccompanied baggage) had increased by 0.6% year-on-year in 3Q2023.

International demand registered its first growth since the end of 2021. Airlines in Asia Pacific, the Middle East and Latin America recorded the highest annual growth.

ACTKs (available cargo tonne kilometres, the capacity measure) increased by 12.8% and exceeded the baseline 3Q2019 level by 3.3%. IATA stated that the rapid growth in ACTKs largely reflected the restoration of belly hold capacity.

International capacity increased by 10.9%, primarily driven by returning belly hold capacity, which increased by 31.1%. Capacity on dedicated freighters fell by 0.14%.

Load factor reached 49%. Load factors on major trade lanes showed an upward trend by the end of 3Q2023.

Air cargo demand growth surpassed that of global goods trade for the first time since Dec-2021.

Growth in world merchandise trade is anticipated to slow to 0.8% in the full year 2023, down from 3% in 2022. IATA stated that the decline could be attributed to persistent inflation, conflict in Europe and the Middle East, geopolitical tensions, and supply chain issues. In other words – much the same as for passenger traffic.

In a brief summary: the passenger side of the business will return to pre-pandemic levels of capacity and utilisation by the end of 2023, despite the world’s problems, while the cargo side, having kept the business going during 2020 and 2021, is also growing again following a lull in 2022.

On the other hand, ‘growth’ in seat and belly hold capacity does not necessarily equate to a return of the good times for airports.

Independent report reveals deep-seated fears among airport management about finances and recovery potential

In a report published in Nov-2023 a UK company, Aerocloud, published the results of an independent survey that it had undertaken with 200 airports; the report provided a more worrying outlook.

Inter alia the results were:

- 48% of airports have not recovered revenue to the pre-pandemic level;

- 52% of airports have not been able to restore all routes served before the pandemic;

- 52% of airport leaders remain worried about their financial stability, and 37% report that they are still in debt;

- 62% worry that their passenger numbers will not recover to pre-COVID-19 levels;

- 69% fear the impact of disruptive events outside their control, and 74% reported flight cancellations are negatively affecting their reputation with passengers.

The survey concluded that the overall outlook for the aviation industry was stronger, after what has been a difficult few years.

But not all airports are benefitting from this bounce back yet. Many are still struggling with the impact of staffing issues and flight disruption on their operations, as well as their ability to boost their revenue.

That independent, and subjective, qualitative survey on confidence in the airport sector stands in stark contrast to the objective, quantitative conclusions of number crunching reports from industry regulatory and airline representation bodies, and it suggests that many airports, especially smaller regional ones, will continue to face an uphill struggle in 2024, even if there is not a worsening of the global economic-political situation.

Conflicts could escalate, or new ones arise that threaten trade routes

It is important to consider the economic-political scenarios for 2024 and their effects on the air transport sector.

The two major conflicts in the world presently are in Ukraine and the Middle East (Israel/Gaza), although there is also one brewing in Latin America – Venezuela, a mid-ranking oil producer, covets land in neighbouring Guyana.

The Ukraine war looks likely to last longer than was anticipated at the beginning of 2023, unless pressure from the US and Europe prompt an unsatisfactory ceasefire and land partition arrangements. It will, for the foreseeable future, prevent the reopening and rebuilding of the airport network in Kyiv and other important commercial and tourist cities – which the Ukrainian has been preparing for.

Ultimately – whenever that is – the job is likely to fall in the main to US-based private equity, along with the rest of the country’s infrastructure.

The Israeli invasion of Gaza as a result of the terrorist atrocity on 07-Oct-2023, along with military action in the West Bank and on the border with Lebanon, is growing in intensity and unlikely to stop irrespective of any declaration by western governments or by the United Nations. It is already being seen as potentially a two-year war, with the propensity to spread much more widely.

Apart from a deteriorating level of economic confidence in the region as a whole, and in the prospects for airport development projects, the concern must be that an escalation could lead to a huge rise in oil prices, as mentioned earlier.

Also, that shipping through the Red Sea could be badly affected, with a knock-on effect on aviation – 12% of all shipping and 30% of container trade passes through the region.

The likelihood of an invasion of Taiwan by China in 2024 has grown. Such an invasion would really upset the apple cart. Again, world shipping lanes and air transport would immediately be exposed to the conflict, with dire repercussions for the air transport industry as a whole and with probably worse consequences than during the COVID-19 pandemic.

If the west as a whole, and particularly the US, did not intervene, then its standing in Southeast Asia in particular – and notably with other countries that feel directly threatened by China, such as The Philippines and Vietnam – would evaporate, and that includes investment there in all sectors, including airports.

The worst-case scenario is all three of the above conflicts escalating and coinciding at once, but the repercussions of that transcend any impact on the airport sector.

Elections – and one in particular – will have a direct impact on airports in that country

There are numerous significant elections coming up in 2024, in Europe and in the United States, where gubernatorial (state governors), House, Senate and presidential elections all take place on 05-Nov-2024.

The most significant impact on the air transport sector, and on airports especially, would arise out of a Donald Trump presidential victory, which would probably see a further expansion of the airport privatisation process with matched government funding that was first introduced partway through Mr Trump's first term, though never fully implemented.

In the event of a Democrat victory, be it by Joe Biden or another individual, it might be expected that the status quo would be maintained – no further incentives for airport privatisation, and their support continuing to come from the government by way of existing or new schemes, such as the CARES Act, the American Rescue Plan Act, the Infrastructure Investment and Jobs Act, and the Airport Coronavirus Response Grant Programme.

Apart from “closing the border” Mr Trump stated in a recent television interview that his other priority “on day one” would be to “drill, drill, drill”, signifying the removal of prohibitions on new oil and gas fields and probably the reopening of the preparations for the final stage of the Keystone XL Pipeline from Canada, which was curtailed by President Biden on his first day in office, even though the original developer has now pulled out.

In other words, the intention would be to reinstate the US as the primary source of extracted oil in the world and the impact of that, in theory and apart from the national self-sufficiency that Mr Trump craves, should be considerably increased domestic and international supply and, ergo, competition in oil markets, thus potentially dragging down prices to the benefit of the air transport industry generally.

The downside would naturally be ramped up opposition by environmentalists and, as is often the case, directed at airports.

The BRICS could apply their own rules and that would include mutual support

Both China’s Xi Jinping and Russia’s Vladimir Putin are now effectively 'President for Life' in their respective countries (Mr Putin’s re-election in Mar-2024 is pretty much guaranteed, despite the ongoing war in Ukraine).

That brings into the frame the impact of the expanded BRICS (previously BRICs) economic-political block, which has grown to 11 countries if recent invitations are all accepted, and which is led by China and Russia, the 'R' and 'C' in the BRIC wall.

In Aug-2023 CAPA - Centre for Aviation published a comprehensive two-part report on this development – The expanded BRICS – what implications does it have for aviation? Part one, Part two .

It concluded, inter alia:

- The BRICS bloc posits itself as an alternative to the G7 – the B11;

- Member countries are already talking extensively to each other about initiating or increasing flights between them, with Brazil-South Africa and Saudi-China services at the forefront;

- Discussions have also begun on better cooperation across passenger connectivity; creating a cargo strategy; infrastructure development; and sustainability;

- Exchanges could take place where financial support for airport construction is offered as a quid pro quo for construction expertise in the other direction;

- Well over one third of the world’s population was located in BRICS countries, even before the expansion by another 400 million people; there is every possibility they could collectively break away from western-dominated organisations like IATA, ACI and even ICAO, forming their own such bodies, applying their own open skies agreements, and even replacing the US dollar as the reserve and fare calculation currency;

- The most likely projects will probably be initially in route development and airport building and financing projects, and may well be seen as early as 2024.