Outlook 2024: Airports spotlight – construction activities in freefall and won't recover quickly 2/3

There’s been a constant flux in the North American aviation market during 2023, with New York-based JetBlue at the centre of many developments. The airline was forced to dissolve its Northeast Alliance (NEA) with American Airlines after a court deemed the partnership to be anticompetitive. Now, as 2023 comes to a close, the fate of JetBlue’s proposed merger with Spirit Airlines lies in the hands of a judge, and the outcome is tough to predict. Just as the judge is preparing his decision, Alaska Air Group has formally started an acquisition of, and merger with, Hawaiian Airlines – as smaller US airlines work to build scale in an attempt to compete with the four airlines that control more than 70% of US domestic capacity. Spirit and its fellow ultra-low cost carrier (ULCC) Frontier Airlines have been battling a negative financial performance, and each airline will likely be under scrutiny in 2024 as they work to reverse their fortunes. Across the border, Canadian airlines continue to carve out their positions in the marketplace. The country’s major operators will continue to preserve their dominance, but the fate of the country’s smaller airlines is less certain.

Summary

- JetBlue has been at the centre of churn in the US market during 2023.

- US ULCCs in the US will come under scrutiny in 2024.

- Will proposed mergers in the US change the market dynamics?

- Air Canada and WestJet maintain their strength in the Canadian market.

- Air Transat and Porter are working to build scale through a new partnership.

- The fate of Canadian low cost start-ups is less certain.

- There are many developments unfolding in North America during 2024.

JetBlue has been mired in legal disputes for much of 2023

JetBlue Airways has been on the defensive for much of 2023 as it and American Airlines have unsuccessfully defended the merits of their Northeast Alliance (NEA) in a US court. American has officially challenged the ruling, while JetBlue has opted to focus on defending its proposed merger with Spirit in separate litigation.

Each legal challenge JetBlue has faced in 2023 has stemmed from the US Department of Justice (DOJ) – an entity under the current administration of President Joe Biden that has not looked favourably upon mergers and acquisitions.

Aside from the legal fees JetBlue has accumulated in the defence of the proposed merger, there are also significant fees associated with a judge ruling against their tie-up. If the merger fails due to antitrust reasons, JetBlue will pay Spirit a reverse break-up fee of USD70 million, and Spirit stockholders a fee of USD400 million.

If the merger does not materialise, Spirit’s long term fate appears uncertain. The Ft Lauderdale-based ultra-low cost carrier has posted eight consecutive quarterly losses; moreover, during recent testimony, the airline’s CEO Ted Christie declared: “I don’t have an estimate as to when we intend to return to profitability”.

See related CAPA - Centre for Aviation report: Are the heydays of large ultra-low cost carriers in the US market over?

Will US ULCCs have a change of fortune in 2024?

The two largest US ULCCs – Frontier and Spirit – have faced a tough operating environment in 2023. In 3Q2023 Frontier Airlines posted a net loss of USD32 million and a negative 5.1% pre-tax margin. The Denver-based airline has cited a challenging demand environment – particularly in offpeak periods.

Frontier is taking steps to reverse its fortunes, including making changes in its operating structure and improving its cost performance.

But perhaps the larger question to ask is whether the ULCC model in the US is in a precarious state? Have passenger preferences permanently shifted away from the budget airline model, now that product segmentation at the larger airlines is firmly entrenched in their business model?

Although larger airlines discounted premium offerings during and shortly after the COVID pandemic, demand for those products has remained strong, even as pricing has increased.

The upside for Frontier is if JetBlue and Spirit are allowed to merge, Frontier will be the only ultra-low cost carrier of scale in the US.

But that likely won’t decrease the level of scrutiny the ULCC model will be under in 2024.

If prospective mergers occur in the US, the country's biggest airlines will continue to dominate

A broad argument that JetBlue and Spirit are making in favour of the merger is that the combination will help the new entity compete more effectively with the US’ four biggest airlines – American, Delta, Southwest and United.

Based on data from CAPA and OAG from late Dec-2023, a combined JetBlue and Spirit would represent approximately 10% of the country’s domestic capacity, measured in available seat kilometres (ASKs).

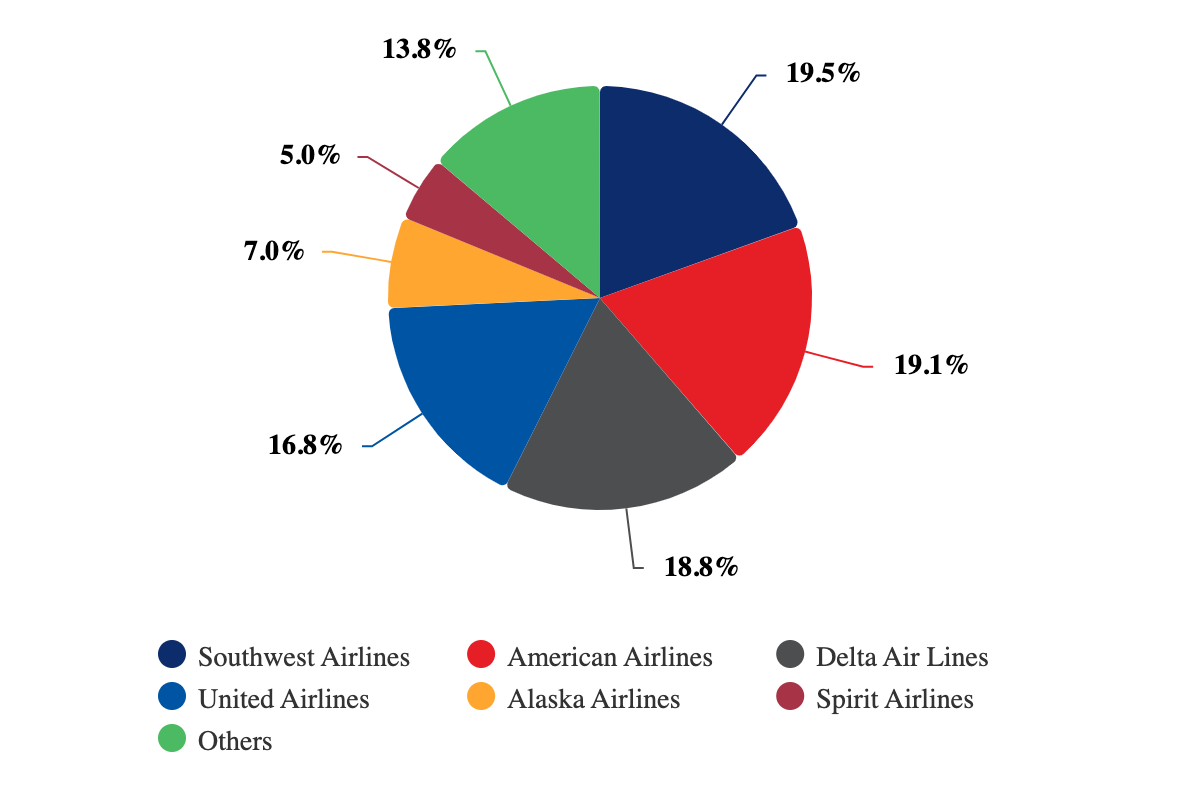

US domestic ASKs by airline, as of late Dec-2023

Source: CAPA - Centre for Aviation and OAG.

But the big four still hold 74%, and appear to have a renewed sense of competitiveness as the past four years fades away and new dynamics potentially settle into the US market.

Alaska’s pursuit of Hawaiian is also an effort to shore up scale, and faster than either airline could achieve on their own. But their combined capacity share remains at approximately 9%, based on CAPA - Centre for Aviation’s data.

If both mergers come to fruition, market dynamics could change in the US, but arguably the strength of the four largest airlines in the country won’t drastically diminish.

It is also unknown how the DOJ will view Alaska’s acquisition of Hawaiian – given the agency’s recent moves to block the NEA and the JetBlue and Spirit merger.

Air Canada and WestJet preserve their market power in Canada

Canadian airlines have also worked to pivot and strengthen their respective positions in the marketplace during 2023.

WestJet has decided to shutter its ultra-low cost subsidiary Swoop and to fold that airline's operations back into the mainline. The company, which has also acquired Sunwing, is folding Sunwing’s Boeing 737s (11 737-8s and 20 737-800s) into the WestJet brand.

WestJet has said that integrating the fleets of Sunwing and Swoop into its brand will boost its scale to enhance its operational resilience, while offering more affordable fares and vacation opportunities across its network.

The moves are part of WestJet’s plan that was launched more than a year to double-down on its low cost roots.

WestJet still has a widebody fleet of seven 787-9s that the airline is deploying strategically into certain sectors. It recently unveiled plans to introduce new long haul service between Seoul and Calgary in 2024.

Earlier in 2023 WestJet CEO Alexis von Hoensbroech told CAPA - Centre for Aviation's fellow Aviation Week Network publication Aviation Daily that the widebody operation was “a very small and opportunistic business.”

The airline operates its 787s into Europe and Japan in the northern summer, and into the Caribbean during the northern winter. Mr Von Hoensbroech said that the widebody operation had been really strong in the 1Q2023 quarter, and admitted “we were surprised” that the new service from Calgary to Tokyo Narita International Airport launched in April-2023 “was profitable from day one[,] despite point of sale Japan still being very weak”. He noted at that time “we’re filling it largely out of Canada.”

Air Canada has joined other North American global network airlines in experiencing strong trans Atlantic demand – particularly in the summer high season in the Northern Hemisphere. The airline has also entered into a partnership with Emirates to broaden its network depth, and has expanded on its own metal into the Indian market.

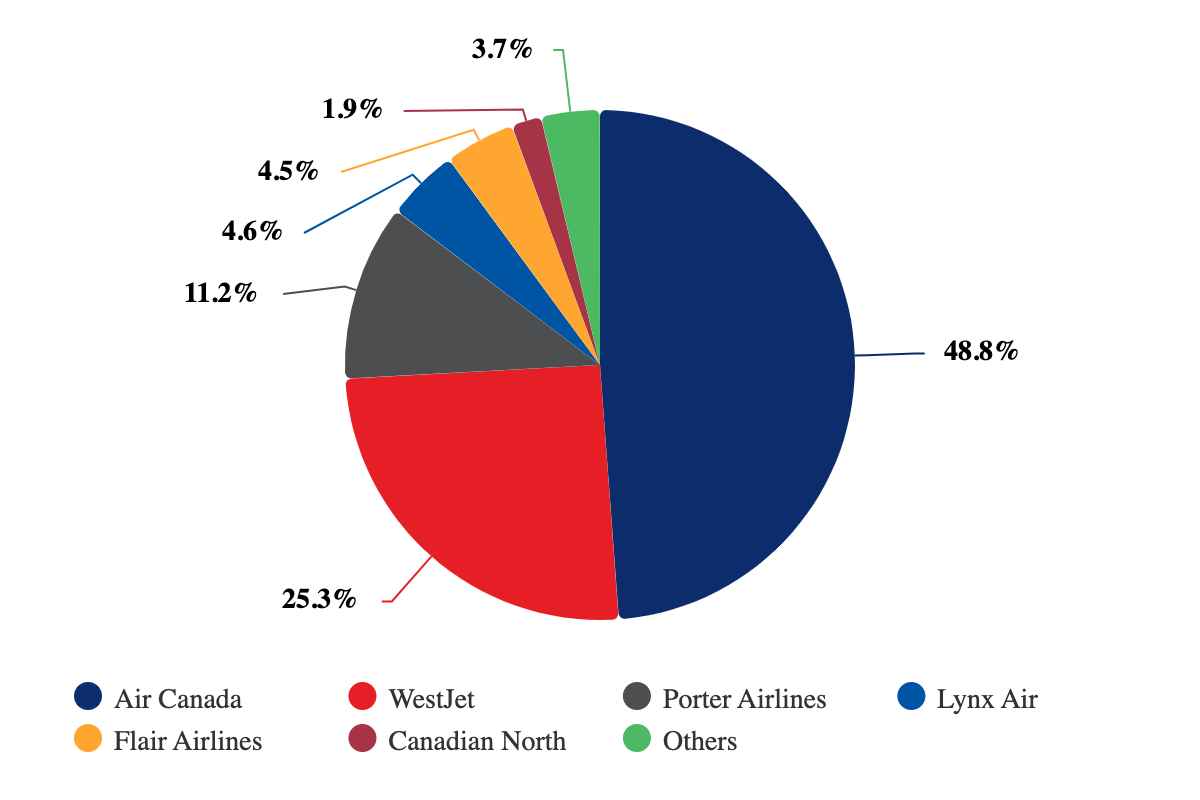

Although more competitors have entered Canada’s domestic market during the past three to four years, Air Canada and WestJet have both maintained their leading positions in Canada.

Canada domestic ASKs by airline, as of late Dec-2023

Source: CAPA - Centre for Aviation and OAG.

Air Transat and Porter deepen ties to bolster their competitiveness

As a means of building up their own respective scales, current codeshare partners Porter Airlines and Air Transat are expanding their relationship into a joint venture in 2024, pending regulatory approval.

Air Transat’s parent company, the tour operator 'Transat', has calculated that codesharing with Porter generated more than 60,000 additional passengers for Air Transat in fiscal 2023. Porter and Air Transat launched their codeshare in October 2022.

The potential benefits for Porter are also significant.

The two airlines have estimated that at the 10-year deal’s full potential, Porter’s connecting flights are forecast to account for 15-18% of Transat passenger traffic, based on assumed fleet growth at both airlines.

Immediately after the JV was announced, Porter exercised options for 25 additional Embraer E195-E2 jets, bringing its total firm order for the type to 75. The airline has 25 E2s and 24 De Havilland Dash 8-400s in service, with 25 E2 purchase rights remaining.

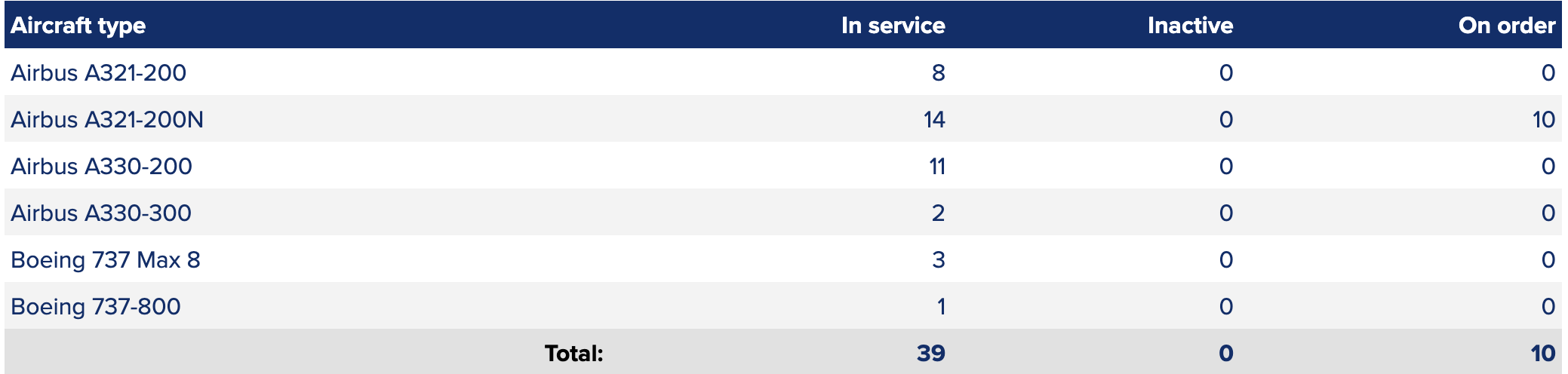

The CAPA - Centre for Aviation Fleet Database shows that Air Transat operates a fleet of primarily Airbus aircraft, with 10 A321neos on order.

Air Transat fleet summary, as of late Dec-2023

Source: CAPA - Centre for Aviation Fleet Database.

It is an interesting tie-up that shows how North American airlines are working to scale up.

But in the case of Porter and Air Transat, it is a low risk way to bolster scale, passenger numbers and ultimately – revenue.

How will ULCCs in Canada ensure that they can effectively compete?

The big question mark for Canada is whether all the start-up ultra-low cost carriers will have staying power.

Lynx Air is headquartered in WestJet’s hometown market of Calgary. It currently operates 9 Boeing 737-8s with a mix of 37 -8 models on order.

Flair Airlines, based in another WestJet stronghold of Edmonton, has a fleet of 17 Boeing 737-8s and two 737-800s, with no aircraft on order.

Both Air Canada and WestJet have feed from their own network and extensive partnerships to support their transborder, long haul and domestic operations. Porter and Air Transat are working to establish more comprehensive connectivity.

Lynx and Flair don’t have the same network depth, and although the theory that Canada is ripe for stimulation may remain intact, the reality is that: the country has a smaller population; it remains a high cost market in which to do business; and it has two entrenched leading airlines that are all too aware of increased domestic competition.

The year 2024 could be the year some airlines learn their fate

There are numerous developments to watch in the US and Canada in 2024, and the fates of certain airlines could change significantly as the year unfolds.