BlackRock’s takeover of GIP potentially creates a colossal global force in the airport sector

The sale of Sydney Airport two years ago should have reinvigorated the airport business, but the long drawn out COVID pandemic, followed by the Ukraine war and a host of knock-on economic and financial implications, put paid to that. Now the world’s premier asset management company, BlackRock, has announced a takeover of one of the world’s principal investors into airports: Global Infrastructure Partners (GIP). GIP will lead the infrastructure platform for the entity. Together, the two can offer a formidable partnership, allying an experienced airport operator (albeit one that has reduced its portfolio in recent years) with a parent that seems suddenly to have ‘found’ infrastructure. And that financial, administrative and innovative muscle is just what the doctor ordered for a still ailing sector suffering from an M&A version of Long COVID. As a side issue, but an important one, the transaction comes just as BlackRock, which has been criticised for posturing on the enforcement of ESG principles in organisations it invests in, admits that it will henceforth rate financial resilience far more highly. It is not only the airport sector that will be watching where that goes with close attention.

Summary

- The global multi-sector asset manager BlackRock to acquire Global Infrastructure Partners; deal to be rubber-stamped in 3Q2024.

- The latter (GIP) has had an extensive airport portfolio, but it has diminished in recent years.

- The former is suddenly attracted to the infrastructure development it expects to kick-start a global economic revival – and a USD1 trillion market – for the organisation.

- GIP will lead the infrastructure platform for the entity, with the new organisation providing much-needed financial muscle in the airports business.

- GIP may focus on its US home base where airports are concerned, where public-private partnerships are thriving.

- To ESG or not to ESG? That is the question as BlackRock’s enthusiasm for the environment is overtaken by the need for financial resilience.

Global multi-sector asset manager BlackRock to acquire Global Infrastructure Partners

On 12-Jan-2024 the investment funds that make up Global Infrastructure Partners (GIP) and BlackRock Alternative Investors entered into an agreement for BlackRock to acquire GIP for a cash consideration of USD3 billion and approximately 12 million shares of BlackRock common stock, to a total of USD12.5 billion.

The transaction is expected to close in 3Q2024, subject to customary regulatory approvals and other closing conditions.

Both firms are active in the airport sector to varying degrees, with GIP once having been a major player; it holds a listing in the CAPA - Centre for Aviation Global Airport Investors Database (GAID) as a ‘Major Global Investor’, a select group of organisations numbering less than 70.

One of the world's largest asset management firms, and pre-eminent, with USD10 trillion under management

Founded in 1988 by current CEO and Chairman Larry Fink and seven partners, and subsequently spun off from the original Blackstone Group, BlackRock is one of the world's largest asset management firms, and pre-eminent, with USD9.42 trillion in assets as of Jun-2023.

BlackRock is a leading provider of investment management. The company operates as a single business segment and derives most of its revenue from investment advisory and administration fees – it is known as ’the World’s largest shadow bank’.

It is publicly owned, with its shares held by various shareholders, including institutional investors like Vanguard Group and State Street Corporation, as well as individuals.

Together, these organisations are known as the 'Big Three' asset management firms, with more than USD15 trillion in combined global assets under management – an amount equivalent to almost three-quarters of the US gross domestic product in 2023.

And BlackRock manages the majority of that – over USD10 trillion.

BlackRock under ‘ESG’ scrutiny from both sides of the Town Hall

In recent years BlackRock has passively courted some controversy, being accused, along with Vanguard, State Street and others. The accusation was of exercising undue levels of influence and control over ESG (environment, social and governance) practices in the many corporations, worldwide, in which BlackRock has a holding – at the top tier, these include companies such as Apple, Microsoft, Meta, Amazon, Alphabet and Tesla, (which it denies).

One former executive has claimed that financial institutions like BlackRock are motivated to engage in ESG investing because ESG products have higher fees, which in turn increase company profits.

At the same time, it has attracted some criticism in the past for investing in companies that are involved in fossil fuels, which indirectly involves the air transport sector.

For example, in 2018 BlackRock was the world's largest investor in coal-fired power stations. However, since then it has shifted its investment policy towards environmental sustainability, saying that would be a key goal for investment decisions.

GIP is the biggest of its 13 M&A transactions since 2006, and one that boosts the standing of infrastructure generally

This is the 13th known M&A transaction that BlackRock has been involved with since 2006, all but two of them with US-registered corporations, and at a total (known) price of USD38.05 billion – and the biggest.

Announcing the deal, Larry Fink (CEO and Chairman of BlackRock) gave a boost to the infrastructure sector generally, which has reeled from the combined and successive onslaught of the COVID-19 pandemic, the Ukraine war, high interest rates and attendant slow economic growth.

He said: “Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts reshape the global economy … Policymakers are only just beginning to implement once-in-a-generation financial incentives for new infrastructure technologies and projects”.

GIP invests across sectors too, but its exposure to airports is greater than BlackRock’s

Founded in 2006, GIP, the largest independent infrastructure manager by assets under management globally, is involved in a whole lot more than just the airport sector – in ports, oil & gas and utilities for example.

GIP's over 40 portfolio companies generate over USD75 billion in annual revenue and employ approximately 115,000 people around the world.

Among GIP’s investments, apart from airports, are CyrusOne (data centres), Suez (water and waste), Pacific National and Italo (rail), Peel Ports (part of a holding group that is also an airports operator) and Port of Melbourne, and several major renewables platforms, including Clearway, Vena, Atlas and Eolian.

Its performance has been driven by proprietary origination, operational improvements, and timely exits – and those exits have been most notable in the airport sector.

Its own airport asset base has been declining in recent years, which will be highlighted later.

But BlackRock does have a limited asset portfolio of its own in airports, which include a small investment into the partially privatised Spanish operator AENA (as does Vanguard), and more substantively, into Beijing Capital International Airport (8% of the equity) at one end of the scale, and also La Florida de la Serena Airport, located on Chile’s coast on the other.

So BlackRock’s exposure to the airport sector is a relatively small one, considering its size and influence.

GIP, in comparison, has been a significant player in the sector for many years, both as a bidder on airport assets, uniquely or within consortia and as actual – although sometimes as a ‘hands off’ operator, even if it has been divesting some of its interests latterly.

Those airports still in GIP's portfolio include London Gatwick (current minority shareholder with 49.99% inclusive of the holdings of other minority equity holders – the majority of the equity in the holding company there was sold to VINCI in Mar-2019 following Gatwick’s failure to get government support for a second runway; GIP’s own holding had been 42%) and Edinburgh Airport (81%) in the UK.

There has been recent speculation about a potential sale of Edinburgh Airport, and not for the first time, as was discussed in the recent CAPA - Centre for Aviation report: Two Scottish airports to change hands? Part one: Edinburgh sale in the spotlight.

In Mar-2022 GIP became a minority investor in Sydney’s Kingsford Smith International Airport by way of its participation in a consortium that bought it (the Sydney Aviation Alliance), of which the primary and lead partner is Australia’s Industry Funds Management (IFM). It was GIP’s first new investment in primary airport assets for some time.

Again, at the other end of the scale so to speak, GIP entered into an agreement with the Washington State Investment Board to manage its investment in the Everett Paine Field Airport near Seattle in Washington State – one of the fastest-growing regions in the US and one operated under a PPP agreement with Propeller Airports. Unusually for the airports business, – GIP is managing the investment by the public sector in what is a part-privatised facility.

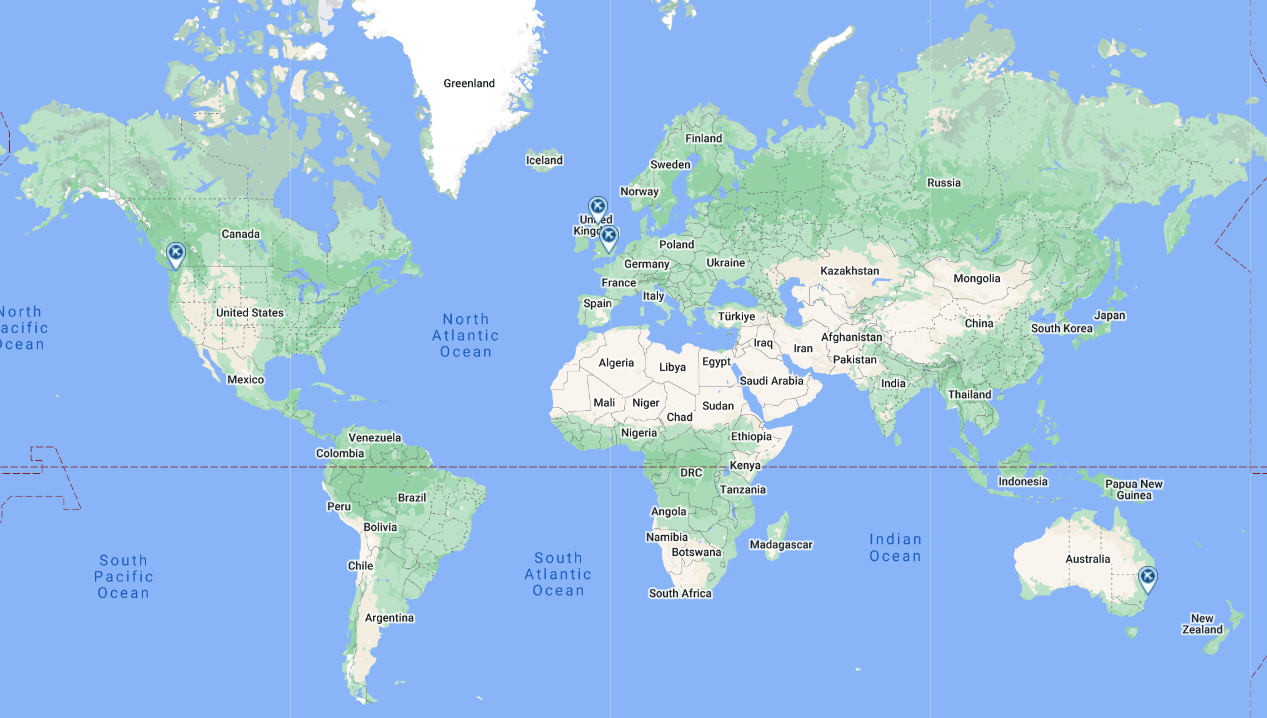

Active airports for Global Infrastructure Partners (GIP) – at the opposite ends of the world

Source: CAPA - Centre for Aviation.

The biggest disposal GIP has made apart from Gatwick is London City Airport, which it sold to a consortium led by a couple of Canadian Pension Plans, for a reputed GBP2 billion (twice the purchase price) in 2014.

GIP could have been even bigger in airports

It is only by looking back into history that the realisation dawns on how big an actor in the airport sector GIP might have been if all of its solo or consortium bids had come to fruition.

In 2012 GIP had cumulatively the largest independent funds in the world, and subsequent launches raised those funds to USD22 billion in total by 2019.

Today GIP is still the world’s largest independent infrastructure manager, with more than USD100 billion in Assets under Management (AUM).

It seemingly had money to burn in a sector with which it had become obsessed.

Those unsuccessful or lapsed bids include:

- Hochtief AirPort (now AviAlliance) (2011/13);

- AENA Madrid and Barcelona airports only (2011);

- ANA Aeroportos de Portugal (2012);

- Chicago Midway Airport, second lease attempt (2013) (Successful at RfQ stage);

- New York LaGuardia Airport Central Terminal PPP (2014);

- Japan – Osaka Kansai and Itami airports concession (2014);

- Nice Côte d'Azur Airport (2016);

- Groupe ADP (2018) (Equity sale suspended by the French government);

- Mumbai International Airport (2018);

- Six Indian airports under concession (2019);

- MAHB Malaysia (2019) (Disputed by MAHB);

- Hellenic Republic Asset Development Fund’s stake in Athens Airport (2019/20);

- St Louis Lambert International Airport (2019) (solo bid, lease sale aborted by City);

- Manila International Airport upgrade and lease project (2023) (as part of MIAC consortium).

So the Sydney and Everett Paine deals apart, GIP’s sectoral interest seemed to be waning in the last three years, although both COVID-19 and local conditions might have had an impact on that. It did acquire the FBO operator Signature Aviation, in 2021, for more than USD4 billion.

GIP will lead the infrastructure platform for the entity – a USD1 trillion market

According to BlackRock, this transaction creates “a market-leading, multi-asset class infrastructure investing platform with combined client AUM of over USD150 billion across equity, debt and solutions[,] and strengthens deal flow and co-investment opportunities”.

Interestingly, GIP’s management team will lead the “combined, highly complementary” infrastructure platform, which indicates that BlackRock is more than comfortable with retaining the existing set-up, within which GIP has acquired long experience.

BlackRock goes on to refer to infrastructure generally being a USD1 trillion market today (CAPA - Centre for Aviation identified, before the COVID-19 pandemic, an airport infrastructure business alone which totalled that amount in actual and potential investment), and one forecast to be one of the fastest growing segments of private markets in the years ahead.

It specifically referred to a number of long term structural trends supporting acceleration in infrastructure investment and highlighting “renewed investment in logistical hubs such as airports, railroads and shipping ports as supply chains are rewired”.

What it did not mention is that some of the supply chains, the maritime ones, are seriously under threat as global geo-political tensions reach a climax, prompting an even greater need for airfreight to rise to the challenge.

GIP doesn’t invest in new airports, only existing ones, and has no particular bent towards cargo-oriented airports either, but perhaps it is time to reappraise that position. Global air cargo demand has already increased by 2% year-on-year in the first two weeks of 2024, with double digit growth in demand from Asia Pacific to Europe and from the Middle East and South Asia, reflecting some modal shift to air due to disruptions to shipping in the Red Sea.

BlackRock did zero in, though, on the increasing need for the mobilisation of capital through public-private partnerships to counter large government deficits at all levels (applying to central, regional and local governments). As a US company, it must by now be anticipating a new government, which could shake up the public/private financing scenario in that country where infrastructure is concerned to an even greater degree than it did first time around.

'The world’s premier infrastructure investment firm'

It argues that the combination of GIP with BlackRock’s “highly complementary infrastructure offerings” creates “a comprehensive global infrastructure franchise with differentiated origination and asset management capabilities”.

The GIP management team, led by Bayo Ogunlesi and four of its founding partners, will lead the combined infrastructure platform. The integration with BlackRock’s broader platform is expected to generate greater opportunities. BlackRock has also agreed to appoint Mr Ogunlesi, GIP Founding Partner, Chairman and Chief Executive Officer, to the Board following the closing of the transaction.

BlackRock and GIP are singing from the same hymn sheet when they insist that – as global corporates turn to private infrastructure as a fast innovator and a more commercially agile owner of infrastructure assets that aren’t core to their commercial businesses – the combined platform “is set to be the preeminent, one-stop infrastructure solutions provider both for them and the public sector, mobilising long-term private capital through long-standing firm relationships”.

In short, “We are convinced that together we can create the world’s premier infrastructure investment firm”.

BlackRock also points to business improvement as a key pillar of GIP’s infrastructure approach, with a dedicated team delivering deep operational enhancements.

GIP has executed successful exits across multiple channels.

Terms of the Transaction and its funding, in detail

Under the terms of the transaction, BlackRock will acquire 100% of the business and assets of GIP for a total consideration of USD3 billion in cash and approximately 12 million shares of BlackRock common stock.

Approximately 30% of the total consideration, all in stock, will be deferred, and it is expected to be issued in approximately five years, subject to the satisfaction of certain post-closing events.

BlackRock intends to fund the cash consideration through USD3 billion of additional debt. BlackRock is currently credit agency-rated AA- with S&P and Aa3 with Moody’s, and this transaction is not expected to change its leverage profile meaningfully, according to BlackRock.

The deal is expected to be modestly gradual to BlackRock’s as-adjusted earnings per share and operating margin in the first full year post-close.

The transaction is expected to close in the third quarter of 2024, subject to customary regulatory approvals and other closing conditions.

So what can be taken so far from this deal and its implications for the airport sector?

The new organisation can provide much needed financial muscle in the airports business

When GIP completed its takeover of Sydney Airport as a minor participant in the IFM consortium takeover two years ago, CAPA - Centre for Aviation was confident that it would kick start M&A activity in the sector – but that largely failed to happen, on account of factors which included high interest rates.

Those rates remain high, and will probably not come down much in 2024 across the world, but this takeover marries two organisations that have: (a) a history of investment in infrastructure including airports, with (b) one that is suddenly enamoured of infrastructure, believing that investment in it is a way out of the financial doldrums, that it is going to be in big demand worldwide, and that a number of long term structural trends support an acceleration in infrastructure investment – including airports.

Thus they can potentially provide financial muscle in this business segment that hasn’t been seen since the days when the Australian bank Macquarie and its numerous subsidiaries ruled the airport investment world. BlackRock could, in time, become a serious rival to companies like VINCI and Corporación America Airports.

Furthermore BlackRock is enamoured with the principle of public-private co-operation, with the mobilisation of capital through it, and with the private sector taking on the larger part of the investment.

The GIP subsidiary will probably be more US-focused, and possibly so on smaller airports that have scale-ability potential

GIP can be expected to focus more on the US in anticipation of a change of government – it was already doing that anyway.

Within the airport sector it might start to take an interest in smaller airports, having gained experience of their milieu in Washington State and the Signature Aviation takeover and in anticipation of more public-private partnership deals at that level.

Scale-ability will remain critical in the decision making process however.

To ESG or not to ESG – that is the question

Given BlackRock’s track record, the emphasis at GIP-owned airports might be expected to shift more in the direction of ESG (Environmental, Social, and Governance) than they were previously.

However, there is a change in the air on the ESG level.

As this report was being prepared, BlackRock made company calls to shareholders about its engagement policies for the year on 18-Jan-2024 in which it stressed “financial resilience” in its talks with companies this year as it puts less emphasis on climate concerns amid a growing political backlash to environmental, social and governance investing generally.

As indicated earlier, until now Larry Fink has been vocal about the use of ESG factors when making investment decisions. On the other hand, ESG investing still offers a big and growing pot of money and will not go away any time soon.

Whatever actions BlackRock takes, it has suddenly become the focus of attention in the sector, and it will be watched and assessed by operators and investors everywhere.