Europe aviation: price inflation evaporates as capacity recovery softens

Data on growth in prices for air travel in the EU and the UK indicate that inflation in passenger fares has all but evaporated in Europe, particularly in the crucial international market. Traffic data from the International Air Transport Association (IATA) show that demand (as measured by RPKs) was approaching closer and closer to 2019 levels through 2023 – at least as far as Nov-2023 (the most recent month for which traffic results are available). However, Europe's capacity recovery trend (based on schedules filed by airlines) is softening into 1Q2024 and this could indicate a similar trend for traffic. After benefitting from the demand overhang from the pandemic, traffic may be returning to being mainly GDP-driven. And the economic outlook is lukewarm.

Summary

- Passenger air travel price inflation is following a declining trend in the EU and in the UK.

- The EU's domestic market is still in double digit inflation, but price increases have almost disappeared in the international market.

- International capacity accounts for more than three quarters of seats (and over 90% of ASKs) in Europe.

- Passenger traffic was closing in on 2019 levels through 2H2023, but capacity trends are softening a little into 1Q2024.

- After benefitting from the demand overhang from the COVID pandemic, traffic may be returning to being mainly GDP-driven, and the economic outlook is lukewarm.

Passenger air travel price inflation is following a declining trend in the EU…

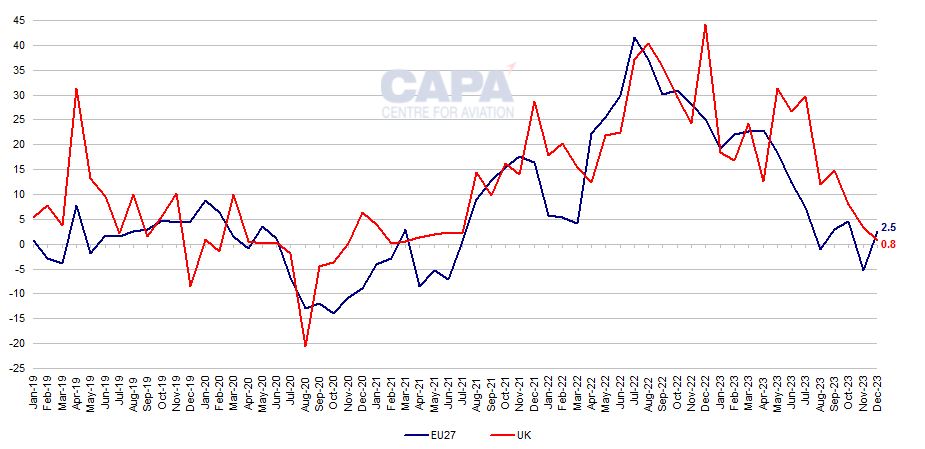

Official inflation data for the EU shows that the price of passenger air travel grew by just 2.5% year-on-year in Dec-2023.

This was the sixth month of increases that failed to reach the double digit rates that persisted for 15 months from Apr-2022 to Jun-2023. The rate peaked at 41.5% in Jul-2022, but has followed a declining trend since then.

In two of the past six months, the rate of change has been negative, including in Nov-2023, when the price of air travel fell by 5.3%.

…and in the UK

UK passenger air transport prices have followed a broadly similar pattern as for the EU.

The UK's air transport inflation was only 0.8% in Dec-2023, after falling from a peak of 44.1% in the 12 months earlier.

This was the UK's third straight month of single digit increases, after 24 consecutive months of double digit rates between Oct-2021 and Sep-2023.

EU-27 and UK: year-on-year percentage change in monthly index of prices for passenger transport by air, 2019-2023

Source: Eurostat, Office for National Statistics (UK) and CAPA - Centre for Aviation.

The EU's domestic market is still in double digit inflation…

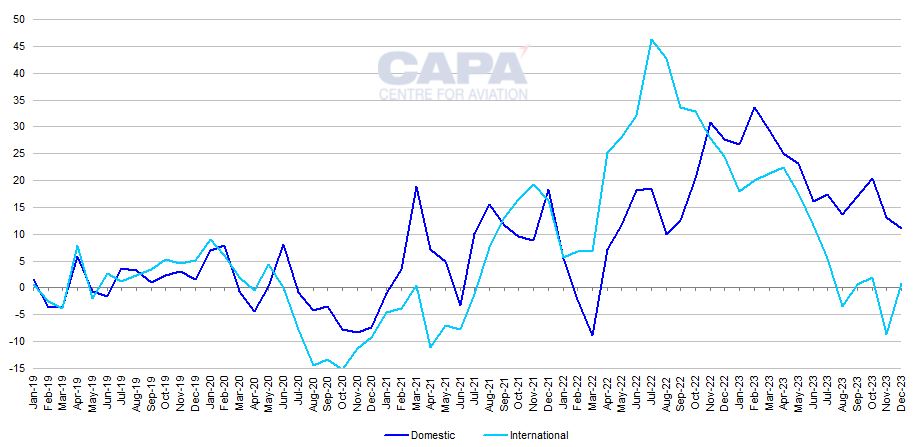

Data for the EU-27 show that price increases for domestic flights have outpaced inflation for international flights over the past year as the overall trend has fallen.

This is in contrast to much of 2022, when the overall surge in prices for air transport was driven more strongly by international flights.

The much stronger performance of the international price index in the EU-27 in summer 2022 was the result of the loosening of international travel restrictions and the unlocking of pent-up demand as Europe emerged from the COVID-19 pandemic.

In Dec-2023, prices for domestic flights in the EU increased by 11.0% year-on-year, the 16th straight month of double digit growth.

…but price increases have almost disappeared in the international market

For international flights, inflation was only 0.8% in Dec-2023, the sixth consecutive month of single digit or negative price growth (after 15 months of double digit increases before that).

EU-27: year-on-year percentage change in monthly index of prices for domestic and international flights, 2019-2023

Source: Eurostat and CAPA - Centre for Aviation.

International capacity accounts for more than three quarters of seats in Europe

The near disappearance of inflation for international flights in the EU is significant, because international capacity is much more important than domestic capacity in the European market.

Indeed, the importance of international capacity has grown since before the pandemic.

In 2019 international seats accounted for 75.7% of all capacity in Europe, whereas this grew to 77.0% in 2023.

In ASK terms, international markets represented 91% of capacity in Europe in 2023.

This reflects a trend towards the substitution of some domestic air travel by surface transport (particularly rail) and by video communication technology (especially where business travel might have been undertaken previously).

Passenger traffic was closing in on 2019 levels through 2H2023…

The period of slowing inflation for air transport in Europe coincided with passenger traffic volumes closing in on 2019 levels through the second half of 2023.

According to data from IATA, RPKs for airlines in Europe were 7.6% below 1H2019 levels in 1H2023.

This was then -5.5% in Jul-2023, -6.6% in Aug-2023, -3.6% in Sep-2023, -2.1% in Oct-2023, and -1.9% in Nov-2023.

…but capacity trends are softening a little into 1Q2024

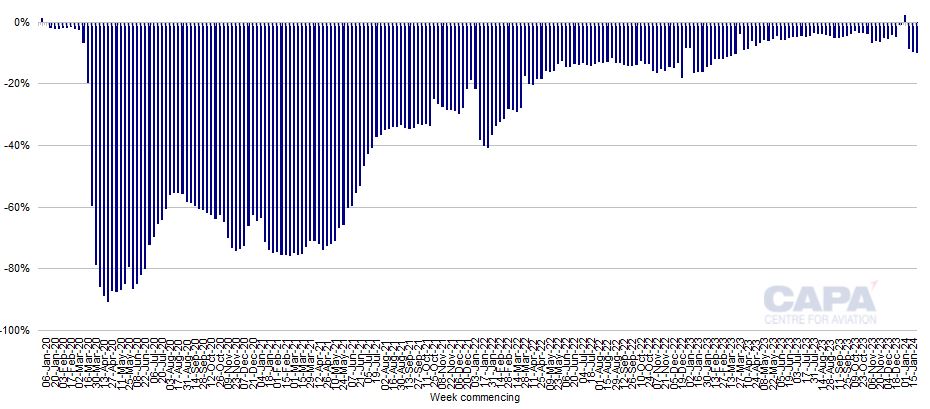

Monthly traffic data are not available for Dec-2023 or Jan-2024, but weekly capacity numbers may give some indication – at least of the direction of the trend.

According to capacity data from CAPA - Centre for Aviation and OAG, seat numbers across Europe were 6.0% below 2019 levels in Nov-2023, but this improved to 3.7% below 2019 in Dec-2023.

However, Jan-2024 seat capacity is 6.3% below Jan-2019's.

Seat capacity in 4Q2023 was 4.2% below 4Q2019, but in 1Q2024 it is scheduled to be 5.0% below 1Q2019.

It is not straightforward to extrapolate from capacity trends to traffic, but this suggests that the improving monthly trend of Europe RPKs as a percentage of 2019 volumes may not continue in the first part of 2024.

Europe: weekly seat capacity, percentage change vs the equivalent week of 2019, 2020-2024

Source: CAPA - Centre for Aviation and OAG.

Traffic may be returning to being mainly GDP-driven

Whereas air traffic since the lifting of COVID-19 restrictions has benefitted from the overhang of pent-up demand, it may be returning to its previously closer relationship with economic growth.

The outlook for GDP growth in Europe is a little cloudy.

In Nov-2023 the European Union trimmed its GDP growth forecasts for 2023 and 2024. For 2023, it expects growth of 0.6% both in the euro area and in the EU as a whole, which is a downward revision of 0.2ppts from its previous forecast in summer 2023.

For 2024, the EU forecasts GDP growth of 1.2% in the euro area and 1.3% in the EU.

These both represent improvements from 2023, but both were downward revisions of 0.1ppts. Moreover, growth at such rates is very sluggish compared with historical trend rates.

Other forecasters also expect fairly weak GDP growth in 2024, albeit at a higher rate than in 2023. The IMF forecasts 1.5% growth for the EU and 0.6% in the UK, while the OECD forecasts 0.9% in the EU and 0.7% in the UK.

According to data gathered by the UK's Office for National Statistics in Jan-2024, the median of 32 forecasts of GDP growth in 2024 is 0.4% (compared with 0.3% in 2023).

Demand may soften a little into 2024

If traffic growth is indeed becoming more GDP-driven, Europe's airlines will not be cheered by this outlook.

The fall in air fare inflation is to no small degree connected with oil and jet fuel prices falling from a peak in 1H2022. However, prices are also closely connected to the strength of demand.

Airlines in Europe will be hoping that they continue to enjoy some benefit of the overhang of demand that built up during the pandemic, and of the priority many passengers have been giving to air travel and holidays over other discretionary spending.

However, the dropping away of price inflation for passenger air travel in the EU and the UK, and the dampening of the capacity recovery trend, suggest that demand may soften a little into 2024.