American and JetBlue: Northeast Alliance appears to be heading towards a sunset

American Airlines and JetBlue are still likely recovering from the shock from the decision by a US judge ordering the airlines to dissolve their alliance. When American and JetBlue launched their Northeast Alliance (NEA) in early 2021 it was an unprecedented tie-up in the US domestic market. Indeed, in his lengthy ruling that sided with the US Department of Justice (DOJ), District Judge Leo Sorokin concluded that airlines in the US “have not historically attempted arrangements that intertwine their operations so broadly with other domestic airlines". But American has vowed to file an appeal, sticking to its belief that the alliance produces meaningful benefits. There is no easy outcome or resolution for the Northeast Alliance (NEA) now that the judge in the antitrust trial has rendered a decision. And neither airline has an alternative for the partnership as the promise to bolster their positions in a key US market is fading fast.

Summary

- American Airlines and JetBlue Airways have much to lose after a judge ruled that their alliance violates US antitrust law.

- The decision creates headwinds for both airlines whenever they unravel their agreement.

- Delta Air Lines and United Airlines stand to benefit from the decision by the court.

- Uncertainty continues to grow over the fate of the JetBlue-Spirit merger.

Both JetBlue and American have consistently cited improving financial metrics from the NEA

When American Airlines and JetBlue launched their Northeast Alliance (NEA) in early 2021 it was an unprecedented tie-up in the US domestic market.

Indeed, in his lengthy ruling that sided with the US Department of Justice (DOJ), District Judge Leo Sorokin concluded airlines in the US “have not historically attempted arrangements that intertwine their operations so broadly with other domestic airlines. This is at least partly due to a general understanding across the industry that such coordination would run afoul of antitrust law”.

Under the NEA, American and JetBlue coordinate schedules at Boston Logan and airports in the New York City metro area in a partnership designed to operate for a minimum of seven years from the initial signing.

The break-up of the partnership will be a significant setback for each airline. In early 2022 JetBlue president Joanna Geraghty noted the airline had hit an outstanding milestone with the NEA, explaining that JetBlue had reached USD100 million in codeshare revenue in the alliance’s early stages. JetBlue executives have also stated that the partnership became “measurably margin positive” in the second half of 2022.

In Apr-2023 daily departures covered under the NEA from New York JFK reached approximately 290, with JetBlue operating 190 of the flights. Their combined operations from New York LaGuardia reached 190, with JetBlue operating 52 of the daily departures.

From Boston Logan, JetBlue operated 150 of the 220 daily departures covered under the NEA in Apr-2023. There are approximately 700 daily departures covered in the agreement.

“There are so many leisure markets out of New York that we never had the ability to serve before without taking them away from something else, and we can do that now”, JetBlue CEO Robin Hayes said in early 2023.

American, which has historically struggled in the New York market, has also cited revenue upside from the partnership.

The airline's Chief Commercial Officer Vasu Raja said in May-2022 American’s unit revenue improvement in New York had grown sequentially each month of this year. “We’re starting to see signs where it is growing sequentially[,] and even sometimes at a greater rate than the rest of the system, which in our domestic system is no small shakes.”

Mr Raja also explained that he’d been examining American’s performance in New York for a long time, and “I’ve never seen New York unit revenue performance outpace the system”.

Although American CEO Robert Isom recently said the New York market only represents about 5% of the airline's non-hub flying, the NEA is critical for American to remain competitive in the region. “As we look forward, I think the benefits that we’ve proposed will ultimately prevail. But in the meantime, we’re going to have to work with the DOJ, work with JetBlue to find out exactly what we do in the interim, and we’re going to do that. It’s just a lot of work going on right now,” Mr Isom stated. JetBlue has not formally commented on an appeal.

Slots and aircraft are in play as the NEA is likely to be unwound

According to the ruling, American has leased nearly 100 of its slots at JFK and LaGuardia to JetBlue.

Raymond James analyst Savi Syth stated in a report that while American would likely regain those slots leased to JetBlue, “...it will now have to rebuild JFK and LaGuardia at likely lower profitability[,] given its reliance on regional jets and with the lack of feed from JetBlue.”

In 2021 JetBlue decided to delay the retirement of its Embraer E190 fleet to support the NEA. Mr Syth noted that investments made in the partnership, including extending its E190 operations, would unlikely be recouped.

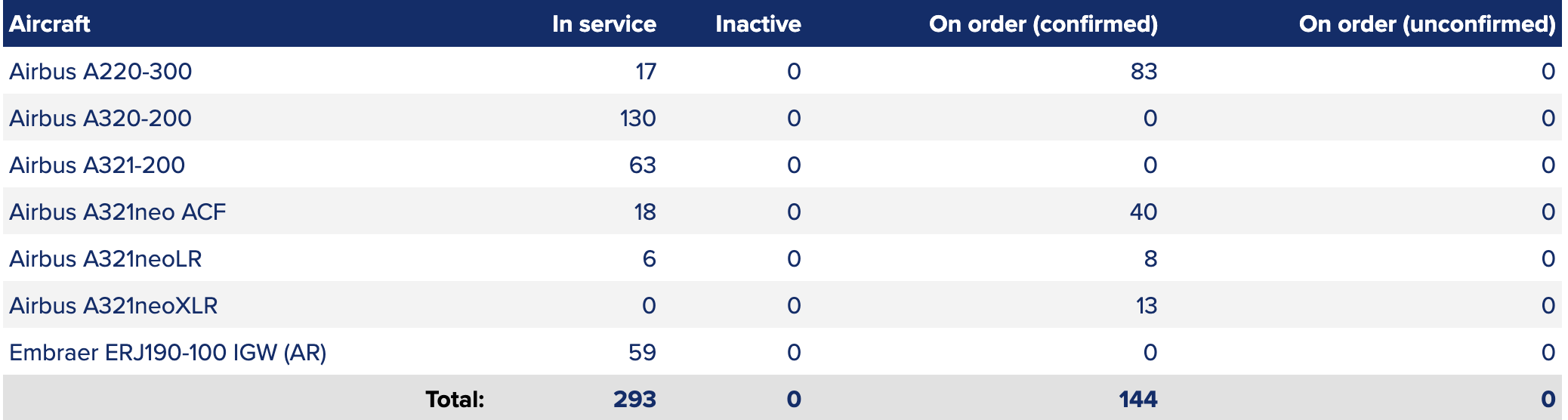

The CAPA Fleet Database shows that JetBlue has 59 Embraer E190s in service and, so far, it is undetermined how the airline would deploy those aircraft before the last aircraft exits its fleet in 2026.

JetBlue: fleet summary, as of mid-May-2023

Source: CAPA - Centre for Aviation and OAG

American and JetBlue's rivals stand to gain the most from the end of their alliance

Outmanoeuvring Delta was a significant motive behind the alliance in the first place, the ruling notes: “The record establishes that a primary goal – and a significant concern – motivating both American and JetBlue to pursue a partnership was a mutual desire to address the competitive threat they each perceived Delta presented in markets they deemed important”, the judge said.

But Delta, which has hubs in JFK and LaGuardia, will now be beneficiary of the unravelling of the NEA.

In a research report TD Cowen analyst Helane Becker stated, “American and JetBlue would need to order significant amounts of equipment in order to compete effectively, and Delta would have to stand still to allow others to catch up”.

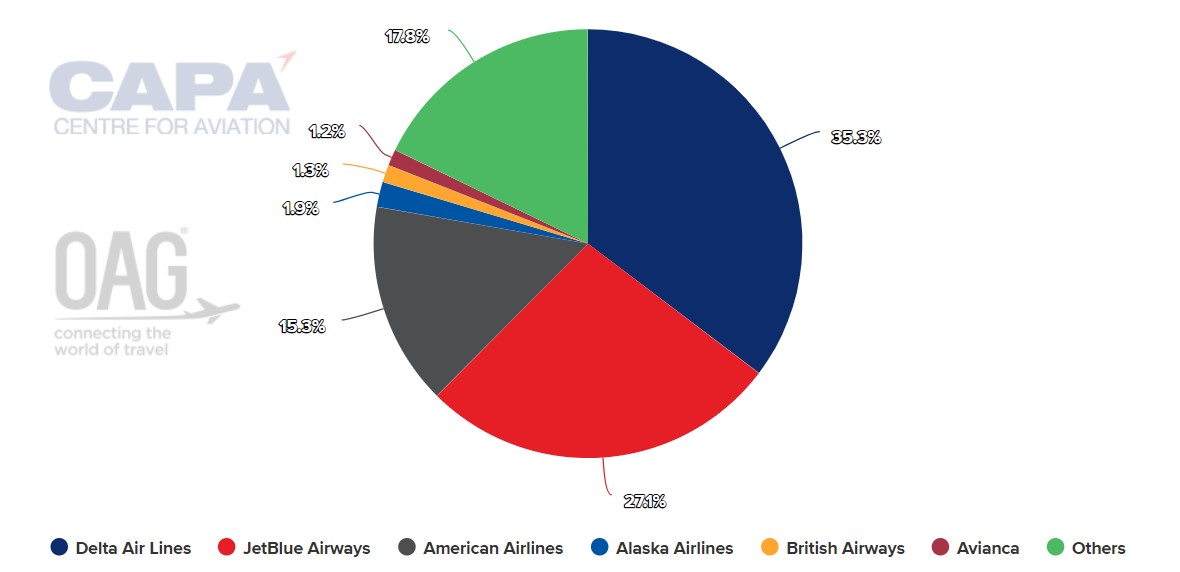

In late May-2023, Delta held a 35% share of JFK’s departing frequencies.

New York John F. Kennedy International: system departing frequencies by airline, as of late May-2023

Source: CAPA - Centre for Aviation and OAG

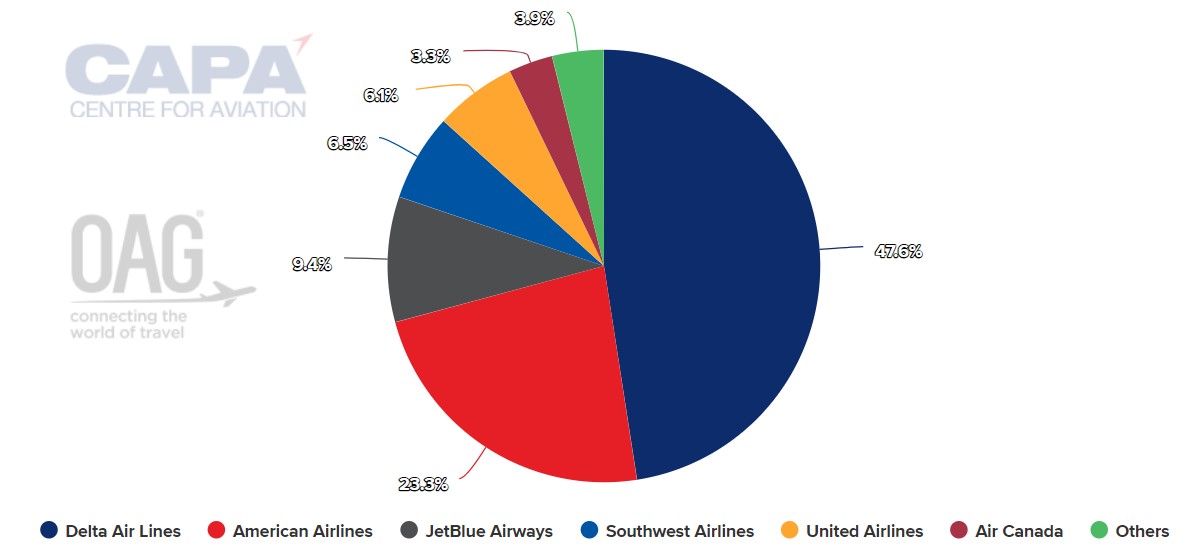

Delta's share at LaGuardia was approximately 48%.

New York LaGuardia: system departing frequencies by airline as of late May-2023

Source: CAPA - Centre for Aviation and OAG

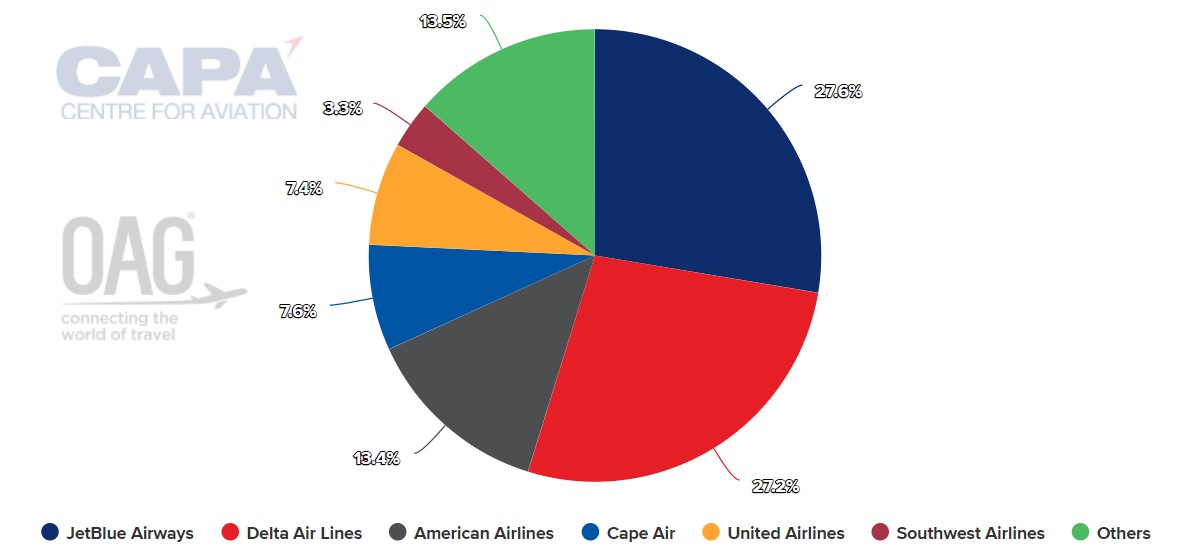

American and JetBlue also use the NEA to be more competitive in Boston, where Delta’s share of departing frequencies was nearly equal to JetBlue’s, as of late May-2023.

Boston Logan International: system departing frequencies by airline, as of late May-2023

Source: CAPA - Centre for Aviation and OAG

Will JetBlue prevail in its next legal challenge? The outcome is tough to predict

Judge Sorokin’s decision is now also spurring questions regarding the fate of JetBlue’s merger with Spirit.

The DOJ will attempt to score another antitrust victory in the US airline sector when the agency squares off against JetBlue and Spirit in court, beginning in Oct-2023.

When the second DOJ suit was announced JetBlue remained bullish in its outlook for the merger, which it had called “absolutely complementary” to the alliance. After the trial date was set for the fall, the airline appeared unsurprised by another legal battle, stating, “We have always accounted for a DOJ lawsuit in our timeline to close the transaction in the first half of 2024, and our integration team continues to work according to this timeline”.

Now, as it awaits the start of another antitrust case, one of JetBlue’s key strategies for remaining competitive in the US market has been upended, with no clear path to resurrect the NEA.