2022 – An Exceptional Year for Curaçao International Airport

CAP reports Passenger Traffic Movements Recovery 101% vs 2019

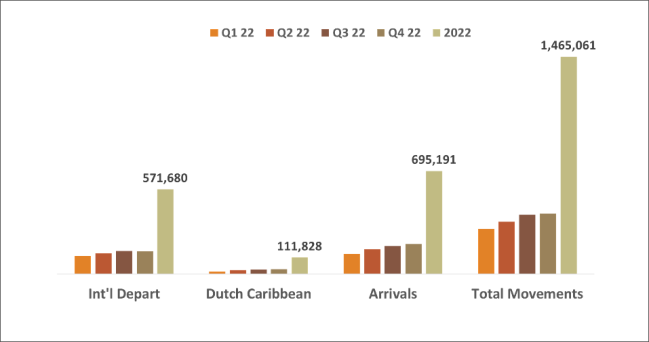

Curaçao Airport Partners (CAP) is reporting a full-year recovery of passenger traffic movements of 101% compared to 2019, the benchmark year for reaching pre-pandemic traffic figures. Total Passenger Movements (all arriving and departing passengers through the airport) were 1,465,061 YE 2022, a recovery of 101% vs. YE 2019. International departing passengers in 2022 were 578,545 a recovery of 106% vs. 2019; Dutch Caribbean departing passengers in 2022, were 106,387 passengers, a recovery of 79% vs. 2019 and there were 695,191 arriving passengers in 2022 reflecting a 104% recovery vs. 2019.

2022 Fourth Quarter Overview

Since reopening for commercial passenger traffic in July 2022, CAP has measured growth by comparing quarterly results. During Q4 2022, there were 152,961 international departing passengers, a -2% decrease compared to Q3 2022. In Q4 2022 there were 33,602 passengers departing to the Dutch Caribbean, an +8% increase compared to Q3 2022. Arriving passengers in Q4 2022 were 201,962, a +7% increase compared to Q3 2022 and total passenger movements in Q4 2022 were 408,819, a +3% increase over Q3 2022.

During Q4 2022, the reopening of the Canadian borders for commercial passenger traffic in the latter part of 2022, prompted Air Canada and WestJet to restart their winter season flight schedules from Toronto and Montreal non-stop to Curaçao. The capacity challenges and schedule adjustments from Amsterdam, impacted KLM flight schedule. US passenger traffic continued to grow in Q4, stimulated in part by the Royal Sandals Curaçao opening in June 2022. In South America, the Colombian and the Brazilian market have shown a significant recovery in 2022.

2022 Passenger Traffic Distribution per region – Diversification

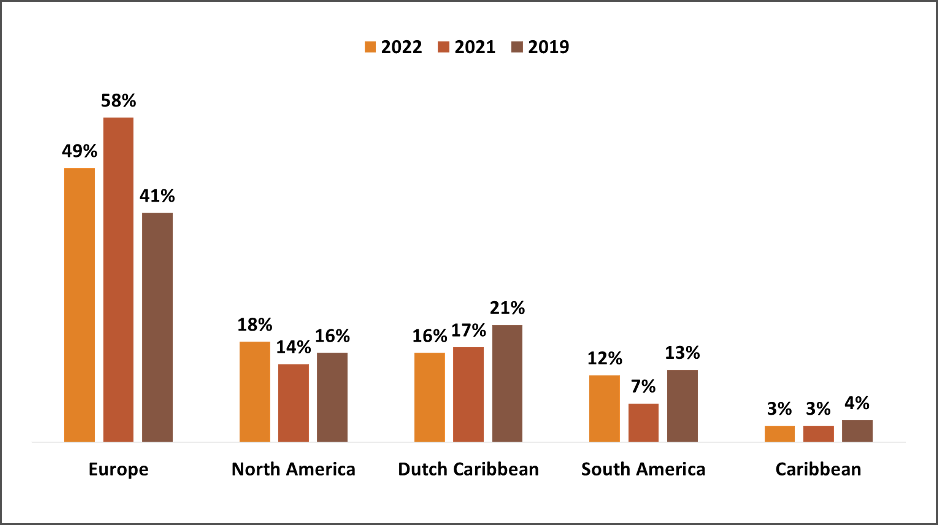

Passenger Traffic Diversification is one of CAP’s air service development principles. During the pandemic, and understandably so, our passenger traffic distribution was primary dominated by The Netherlands. With the gradual opening of other markets and restart of air service, the distribution of passenger traffic from different markets, mitigates dependency. A balanced market share distribution, that would consist of smaller share percentages and more passenger numbers avoids the risks of dependency on one major market.

In 2022, the European market share was 49%, a decrease of 9 points compared to 2021, North America, primarily the USA, a share of 18%, an increase of 4 points compared to 2021, the Dutch Caribbean 16%, a decrease of 1 point compared to 2021 and South America 12%, an increase of 5 points over 2021.

Recovery of 2022 passenger traffic per region compared to 2019 was Europe at 120%, The USA 103%, South America 93%, Canada 81%, and the Dutch Caribbean 79%.

2022 Airline Partners Performance

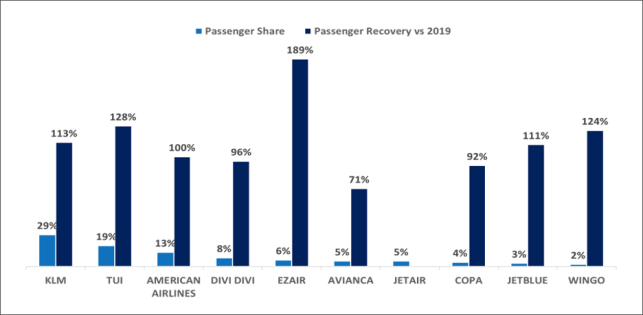

CAP is pleased with the overall performance of the airline partners servicing Curaçao throughout 2022. The following are the top producing airline partners based on passenger share and recovery vs 2019.

The overall average load factor (percentage of occupied seats per flight) in 2022 was 81%, a 1-point increase over the average load factor of 2019. According to Cirium data, there were a total of 20,478 scheduled flights arriving and departing from Curaçao, and a total capacity of 1,882,048 seats. Recovery of flights and seat capacity compared to 2019 were 92% and 99% respectively.

2022 Overview – Passenger Traffic Movements Recovered

CAP is pleased by the overall 2022 traffic figures as total passenger movements of 1,465,061 have surpassed 2019, a 101% recovery. In 2022 there were 571,680 international departing passengers an increase of +5% compared to 2019 and a recovery of 105%. 111,828 passengers departed to the Dutch Caribbean, a decrease of -21% compared to 2019 and a 79% recovery. There were 695,191 arriving passengers 2022, an increase of +4% compared to 2019 and a 104% recovery.

CAP remained with cautious optimism due to several uncertainties that could have impacted travel more aggressively. The lingering pandemic, the war in Ukraine, inflation, recessions, weakening value of the euro, US airline pilot and crew shortages and airport staffing challenges, that underlined the volatility of the economy and travel.

The containment of the Omicron virus impact on island made the impact minimal due to the efforts of the destination. Opening of borders and the restart of flight schedules by various airline partners and an increase in demand, contributed to the exceptional year end traffic results. The addition of 30% capacity to existing hotel room inventory further stimulated demand during the second semester of 2022.

2023 Outlook

IATA, International Air Transport Association, in its initial economic 2023 outlook indicates that ‘most of the headwinds from 2022 are likely to remain with us in 2023, though on the whole they may be unlikely to intensify.’ In addition, IATA cautions that ‘passenger price sensitivity has been low so far since travel has again been possible, though this can be expected to rise as economies slow and unemployment rates climb again.’ What could result in an upside in economic activity and air transportation, IATA believes would be an end to the war in Ukraine and an end to all travel restrictions.

ACI, Airports Council International, in its latest quarterly assessment analyzing the impact of the COVID-19 pandemic, its effects on airports, and the path to recovery, indicates that ‘uncertainty still surrounds the recovery of the aviation industry, especially in the medium-term. Projecting the path to recovery at this point is still an exercise requiring prudence. The potential for an economic downturn and possible recession continues to increase in probability. Those risks could dampen or delay the recovery.

According to ACI, despite several headwinds, the baseline projections indicate that the industry will recover to 2019 levels by the end of 2023 or in early 2024. International travel is forecast to recover by 2024. ACI predicts that North, South and The Caribbean will be the first regions to reach full recovery compared to 2019 by the end of 2023. Global passenger traffic is expected to reach 2019 levels in late 2023 with the full-year recovery to 2019 levels in 2024.

Despite all the challenges, CAP is pleased that Curaçao has reached traffic recovery ahead of what both IATA and ACI are forecasting.

CAP is realistically optimistic in 2023, as the challenges in 2022 continue to be of concern and underscore the volatility of the economy and aviation industry. However, the addition of room inventory announced for 2023 including among others, the opening of a brand-new Marriott Courtyard and the second tower of Mangrove Beach Corendon Curaçao All-Inclusive Resort, Curio by Hilton are indications of further traffic growth in 2023. According to Cirium, subject to change, currently there are 24,240 scheduled flights filed (arriving and departing) in 2023, an increase of +18% over 2022. This translates into a total of 2,155,551 seat capacity in 2023, an increase of +15% over 2022.

CAP, in close partnership with the Curaçao Tourism Board and the Curaçao Hospitality and Tourism Association, continues to ensure the retention, growth, and diversification of Curaçao’s route network.