6 +1 questions for the US-Athens market performance

1. Is the attractiveness of Athens in the US market continuing strong , following years with dynamic growth ?

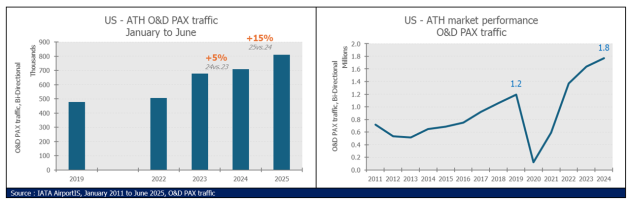

YES. O&D Passenger traffic between the USA and Athens is growing further by a spectacular 15% growth during the 1st half of 2025 when compared to 2024.

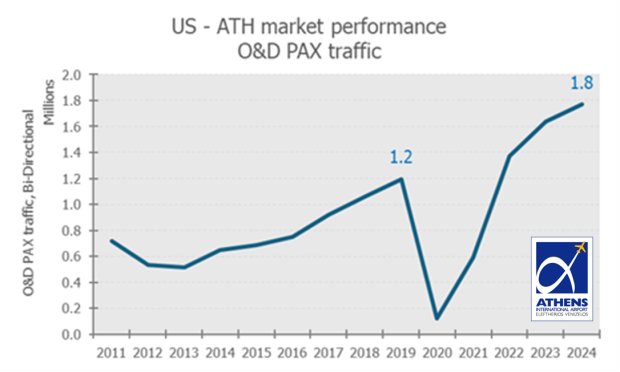

Based on IATA AirportIS figures, O&D traffic between US and Athens reached 1.8 million round-trip passengers in 2024, recording an 8% growth vs2023, reaching the highest point (so far). O&D PAX traffic grew by 5% in the period January to June 2024, when compared to 2023 and this growth is accelerated during the same period in 2025 with 15% vs2024. This strong growth resulted in Athens welcoming over 800 thousand round-trip O&D PAX in the first 6 months of the year. June 2025 is the strongest month ever with almost 300 thousand round-trip O&D PAX, when June 2024 reached 261 thousand and pre-pandemic June (2019) at 186 thousand round trip PAX.

In terms of Direct traffic, ATH-US market increased by 19% in the first half of 2025 when compared to the same period last year.

2. How is Athens performing, compared to the rest of Europe ?

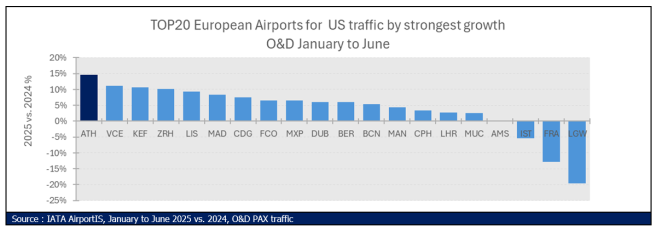

For the first half of the year, Athens achieved a spectacular 15% growth, with over 800 thousand round-trip O&D PAX, recording the TOP growth amongst the 20 strongest European airports in US traffic.

Earlier in the year, it was not clear if and at what extent travel to and from the US will be affected with uncertainty around tariffs, economic impact in the local US market and with geopolitics in different parts of the world. However, when a benchmark analysis is conducted for US market performance in TOP European airports, it is revealed that Athens achieved the strongest growth among the TOP20 European airports in O&D PAX volumes.

Most impressively, in 2025 Athens gained 2 positions in ranking surpassing ZRH and LIS in PAX volumes, due to the growing demand for travel to Athens from the US market.

3. Following the robust growth in direct US connectivity for Athens, how are Load Factors performing ?

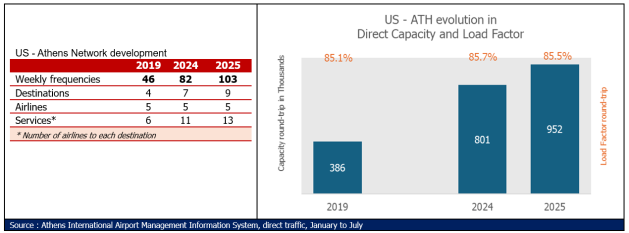

They are performing strong! The average Load Factor on Direct traffic between US and Athens for the period January to July amounted to 85.5% in 2025 when compared to same period last year, despite the addition of 151 thousand seats.

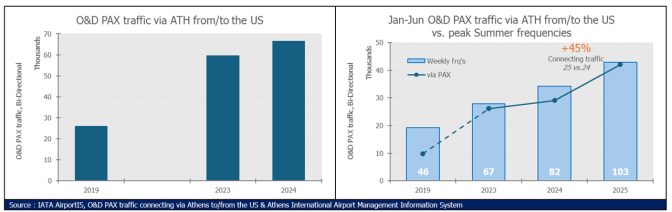

Athens is recording a very dynamic increase in direct connectivity to the US; it is worth mentioning that from 46 weekly departures (peak Summer) in 2019, Athens is now enjoying 103 weekly departures in Summer 2025. From just 4 US destinations in 2019, Athens is now connected to 9 with Los Angeles and Charlotte the newest additions.

In the peak Summer of 2025, 14.7 flights are departing every day from Athens to the US, compared to 6.6 daily pre-Pandemic (2019). Direct capacity increased by 566 thousand round-trip seats in the first 7 months of 2025 when compared to 2019, however Load Factor improved to a remarkable 85.5% from 85.1%. Obviously, in the case of the US market for ATH, Capacity is driving Demand, as Capacity for the period Jan-Jul increased by 18.9% in 2025 vs.2024 when PAX traffic increased by 18.7%.

For the first 7 months of 2025, 5 US destinations achieved Load Factors above 90% with 3 more above 80%. Charlotte achieved the TOP performance with 94.3%, followed by Los Angeles with 92.3%. Atlanta, Chicago and Boston are forming the TOP5 group. New York, which is served by 5 airlines, offering a total of half million seats in the Jan-Jul period, achieved an average Load Factor of 82%.

4. Is Travel demand between US and Athens strong throughout the year ?

Indeed, as seasonality is extended and attractiveness of Athens is increasing year on year, Winter volumes are increasing as well. Emirates is the only airline operating full year-round services between Athens and the US, with Delta significantly extending the season in recent years operating until the mid of January and resuming operations in early March. Also, United and American have expanded their season of operations.

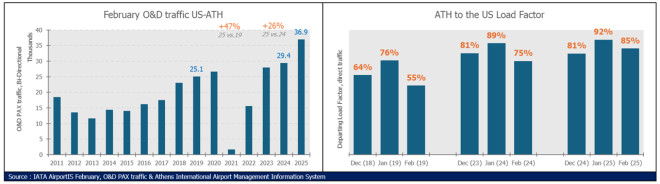

Let’s talk about February, which is the low-season month: Based on IATA AirportIS O&D traffic, it is revealed that February traffic increased by 26% 2025 vs2024 faster than the US-ATH 6 months traffic growth of 15%. Demand for Athens in February 2025 reached 36.9 thousand round-trip O&D PAX, when that number was just below 30 thousand last year or 25.1 thousand pre-Pandemic (2019). As available direct capacity in February remains stable in 2019, 2024 and in 2025, Connecting O&D traffic is increasing from 70.2% in February 2019, to 78.1% in February 2024 and even higher to 81.4% in February 2025. That is 4 in every 5 passengers traveling Indirectly. Lack of additional direct capacity for February, is restricting the true potential for February demand.

Additionally: (a) December to February Load Factors have massively improved post-Pandemic when compared to pre-Pandemic. Even February 2025 Load Factor reached a strong 85% which is similar to the 7 months 2025 average Load Factor for the market. (b) the addition of Delta direct services in December and half of January have really pushed Load Factor to record levels, like 92% for January 2025, as Delta is offering a sound connecting product via JFK in the US market.

5. What is the course of the connecting traffic, following the introduction of a direct LAX – ATH service with Norse Atlantic Airways ?

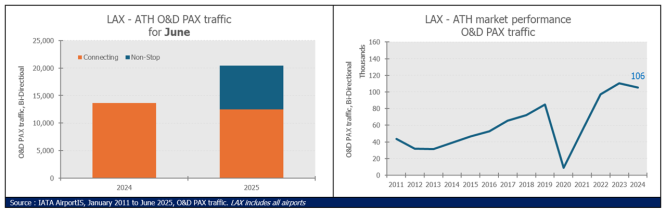

Based on IATA AirportIS figures, June 2025 alone, volume of connecting O&D traffic between LAX and ATH is continuing its positive course and remains strong, while direct service generated 8 thousand additional O&D PAX.

Los Angeles, was by far Athens largest Unserved route with 106 thousand Bi-Directional O&D PAX in 2024, while the 2nd unserved route followed at 72 thousand. Norse Atlantic realised this strong opportunity and following a very successful JFK-ATH service in 2024 (initial year of operations), they decided to add LAX from Athens. Norse inaugurated services on the 3rd of June 2025, operating 4 weekly frequencies. For the period January to June 2025, O&D Pax traffic between LAX and ATH is growing further by 15%, following very strong performance in 2023 and in 2024 with over 100 thousand O&D PAX each year.

In terms of Direct traffic, in just 2 months (June & July) Norse carried over 21 thousand round-trip passengers on the route. This is like “capturing” 20% of the total 2024 O&D market between LAX and ATH in just 2 months. Furthermore, Norse achieved a spectacular strong Load Factor of 92.3% in the 2 months period.

The strong performance of Norse on the route and the stimulation of the LAX-ATH market, clearly demonstrates that connecting feed to other HUBs for onward travel to Athens, will remain strong.

6. Is point-to-point traffic between USA and Athens, the only driver for this spectacular growth ?

On the contrary: via Athens traffic from/to the US is increasing, in addition to the increase of the point-to-point traffic. Based on IATA AirportIS figures, US connecting traffic via Athens increased by 155% in 2024 versus pre-Pandemic (2019) and it is increasing further by 45% in the 1st half of 2025 when compared to the same period in 2024.

The spectacular enhancement of the Athens network to the US in recent years, growing from 46 weekly departures in 2019 to 103 in 2025, resulted in greater connecting opportunities for travel via Athens, not only to the Greek domestic market but also for markets in the South-East Mediterranean region.

Last year more than 65 thousand round-trip O&D PAX travelled via Athens from/to the US, making this a new record. In addition to the Greek domestic market, Cyprus, Albania and Israel are forming the TOP markets connecting via Athens to or from the US in 2024. United Airlines was the TOP dominant Marketing and Operating airline for the via Athens traffic, followed by Emirates.

+1. Are other developmental opportunities available for Athens in the US market ?

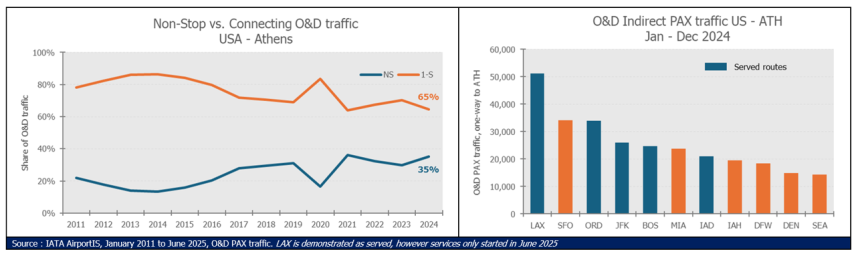

Definitely yes, as still 65% of the O&D traffic between US and Athens in 2024 travelled indirectly, based on IATA AirportIS figures. Obviously, there is spectacular enhancement of Athens connectivity to the US in recent years, but still a large volume of 1.14mio O&D PAX travelled indirectly last year, pointing to significant future opportunities in the US market for Athens.

Furthermore, it is interesting to note that even routes with existing direct services, like Chicago, New York (JFK), Boston and Washington, they still have a significant volume of indirect traffic, a fact which strongly supports deployment of additional capacity and year-round operations.

TIP: San Francisco is now the TOP unserved market in the US for Athens with over 70 thousand Bi-Directional O&D PAX last year, followed by Miami. Furthermore, Denver and Seattle are listed as TOP opportunities for a direct service to Athens.

As you will have noticed, we have not included Dallas as a TOP opportunity : this is because, American Airlines seized this spectacular developmental opportunity, announcing the Dallas-Athens direct operations as of May 2026!!!

As you will have noticed, we have not included Dallas as a TOP opportunity : this is because, American Airlines seized this spectacular developmental opportunity, announcing the Dallas-Athens direct operations as of May 2026!!!

This will be number 10 in ATH direct connections to/from the USA.